best supply and demand indicator in forex trading

Supply and Demand Indicator in Forex Trading:

1. Supply and Demand Zones:

2. Volume Profile:

3. Fibonacci Retracement:

4. Moving Averages:

5. Price Action Analysis:

6. Relative Strength Index (RSI):

7. Ichimoku Cloud:

8. Bollinger Bands:

9. MACD (Moving Average Convergence Divergence):

10. Stochastic Oscillator:

Supply and Demand Zones:

2. Volume Profile:

3. Fibonacci Retracement:

4. Moving Averages:

5. Price Action Analysis:

Supply and Demand Indicator in Forex Trading:

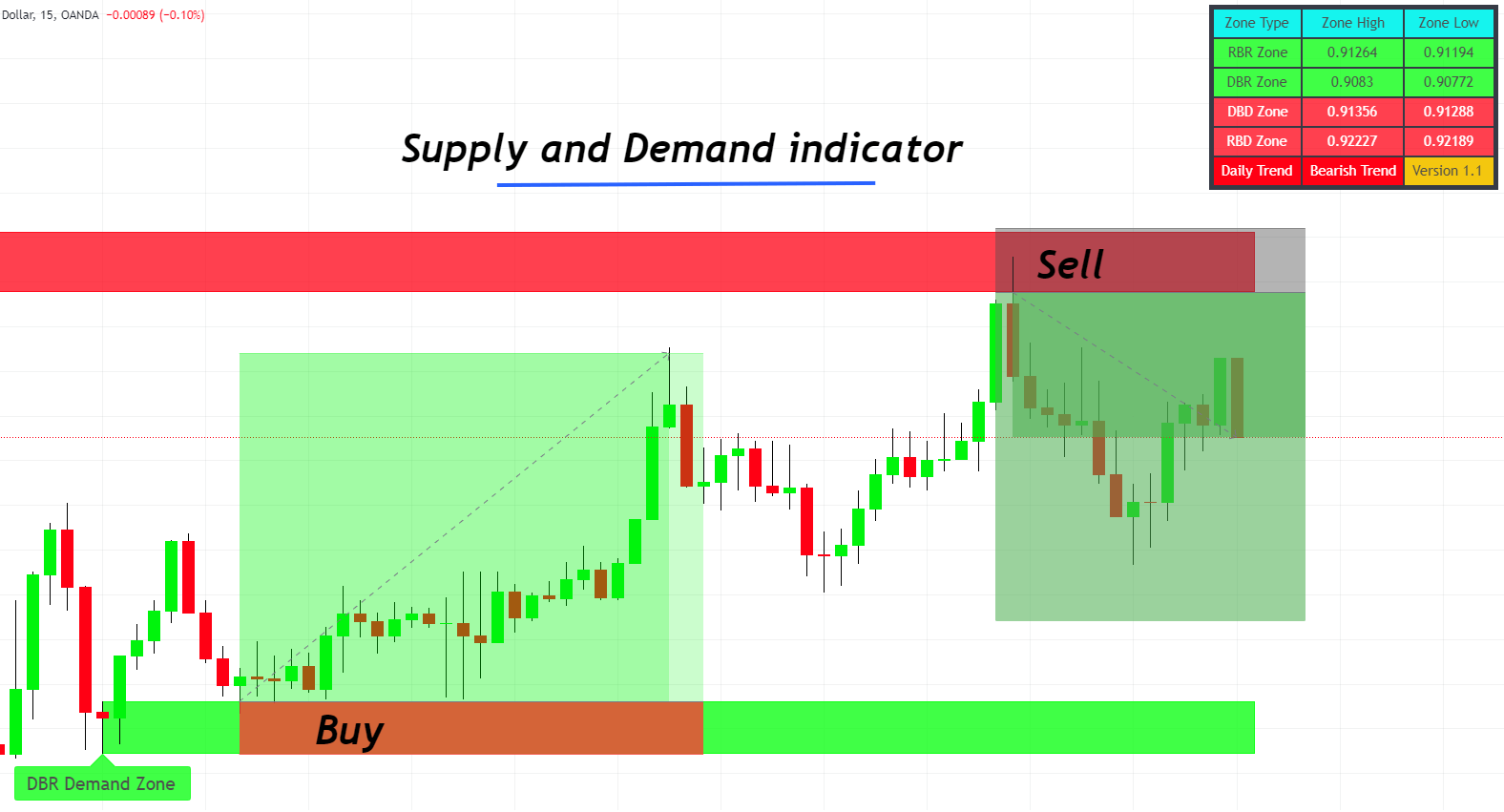

1. Supply and Demand Zones:

- Tajziya ki Ahmiyat: Supply aur demand zones ka tajziya karna market ki trend aur price action ko samajhne mein madadgar hai.

- Kaise Pehchanein: Supply zones woh areas hote hain jahan sellers ka interest hota hai aur price girne ki sambhavna hoti hai. Demand zones woh areas hote hain jahan buyers ka interest hota hai aur price badhne ki sambhavna hoti hai.

2. Volume Profile:

- Tijarat ki Raqamiat: Volume profile ka istemal karte hue traders market mein kitni raqamiat maujood hain, yeh maloom karte hain.

- Kaise Kaam Karta Hai: Jab price kisi specific area par jaata hai aur volume bhi izafa hota hai, to yeh indicate karta hai ke wahan supply ya demand ka level hai.

3. Fibonacci Retracement:

- Nisbatan Wapas Aaegi: Fibonacci retracement levels ko istemal karke traders price ki movements ka andaza lagate hain.

- Kaise Istemal Karein: Fibonacci retracement levels ko use karke traders woh areas identify karte hain jahan price mein wapas aane ki sambhavna hoti hai, jo supply aur demand levels ko darust karne mein madad karta hai.

4. Moving Averages:

- Harekatein Aam Karte Hue: Moving averages ki madad se traders market ke trend aur momentum ko samajhte hain.

- Kaise Samjhein: Agar price moving average ko cross karti hai, toh yeh indicate karta hai ke supply aur demand dynamics mein tabdili hone ki sambhavna hai.

5. Price Action Analysis:

- Qeemat ki Harkat: Price action analysis ke zariye traders price ke patterns aur behavior ko samajhte hain.

- Kaise Kaam Karein: Price action ki roshni mein, traders supply aur demand ke levels ko samajhte hain aur inke hisab se trade karte hain.

6. Relative Strength Index (RSI):

- Mawazna Shakti Ke Nisbat: RSI indicator market mein mojooda tawanai ko samajhne mein madadgar hota hai.

- Kaise Istemal Karein: Jab RSI ek specific level ko chhoota hai ya usse guzarta hai, toh yeh supply aur demand ki shakti ka pata lagane mein madad karta hai.

7. Ichimoku Cloud:

- Badalne Wale Mausam: Ichimoku Cloud indicator trend direction aur potential reversals ko identify karne mein istemal hota hai.

- Kaise Samjhein: Jab price Ichimoku Cloud se cross hoti hai, toh yeh indicate karta hai ke supply aur demand ke dynamics mein tabdili hone ki sambhavna hai.

8. Bollinger Bands:

- Range Ka Pata: Bollinger Bands market volatility aur price range ko samajhne mein madad karta hai.

- Kaise Pehchanein: Jab price Bollinger Bands ke borders ko cross karti hai, toh yeh supply aur demand levels ko identify karne mein madadgar hota hai.

9. MACD (Moving Average Convergence Divergence):

- Harekat Ka Tajziya: MACD trend ke changes aur momentum ko detect karne mein istemal hota hai.

- Kaise Kaam Karein: Jab MACD ki lines ek doosre ko cross karte hain, toh yeh supply aur demand ke shifts ko darust karne mein madad karta hai.

10. Stochastic Oscillator:

- Taqat Ka Jaiza: Stochastic Oscillator market mein oversold aur overbought levels ko pehchanne mein madad deta hai.

- Kaise Samjhein: Jab Stochastic Oscillator extreme levels ko touch karta hai, toh yeh supply aur demand ke imkani levels ko darust karta hai.

Supply and Demand Zones:

- Tajziya ki Ahmiyat: Supply aur demand zones ka tajziya karna market ki trend aur price action ko samajhne mein madadgar hai.

- Kaise Pehchanein: Supply zones woh areas hote hain jahan sellers ka interest hota hai aur price girne ki sambhavna hoti hai. Demand zones woh areas hote hain jahan buyers ka interest hota hai aur price badhne ki sambhavna hoti hai.

2. Volume Profile:

- Tijarat ki Raqamiat: Volume profile ka istemal karte hue traders market mein kitni raqamiat maujood hain, yeh maloom karte hain.

- Kaise Kaam Karta Hai: Jab price kisi specific area par jaata hai aur volume bhi izafa hota hai, to yeh indicate karta hai ke wahan supply ya demand ka level hai.

3. Fibonacci Retracement:

- Nisbatan Wapas Aaegi: Fibonacci retracement levels ko istemal karke traders price ki movements ka andaza lagate hain.

- Kaise Istemal Karein: Fibonacci retracement levels ko use karke traders woh areas identify karte hain jahan price mein wapas aane ki sambhavna hoti hai, jo supply aur demand levels ko darust karne mein madad karta hai.

4. Moving Averages:

- Harekatein Aam Karte Hue: Moving averages ki madad se traders market ke trend aur momentum ko samajhte hain.

- Kaise Samjhein: Agar price moving average ko cross karti hai, toh yeh indicate karta hai ke supply aur demand dynamics mein tabdili hone ki sambhavna hai.

5. Price Action Analysis:

- Qeemat ki Harkat: Price action analysis ke zariye traders price ke patterns aur behavior ko samajhte hain.

- Kaise Kaam Karein: Price action ki roshni mein, traders supply aur demand ke levels ko samajhte hain aur inke hisab se trad kartay Hain.

تبصرہ

Расширенный режим Обычный режим