What is Overbought and Oversold in forex:

Forex market mein, Overbought aur Oversold ke halaat ke usool sarmaya karon ke liye ahem hain ke woh bakhabar tijarti intikhab karne ki koshish mein samjhain. yeh halaat mukammal tor par is khayaal par mabni hain ke currency ke jore ki sharah ko mukhtasir muddat mein shadeed darjay tak pohanchaya ja sakta hai, jis ki wajah se salahiyat mein tabdeeli ya islahat ho sakti hain. Overbought ke halaat is waqt hotay hain jab fees mein taizi se izafah sun-hwa hai aur yeh pal back ki wajah se ho sakta hai, isi waqt jab Oversold honay walay halaat peda hotay hain jab ke fees mein taizi se kami waqay hoti hai aur yeh rebound ke liye tayyar ho sakta hai.

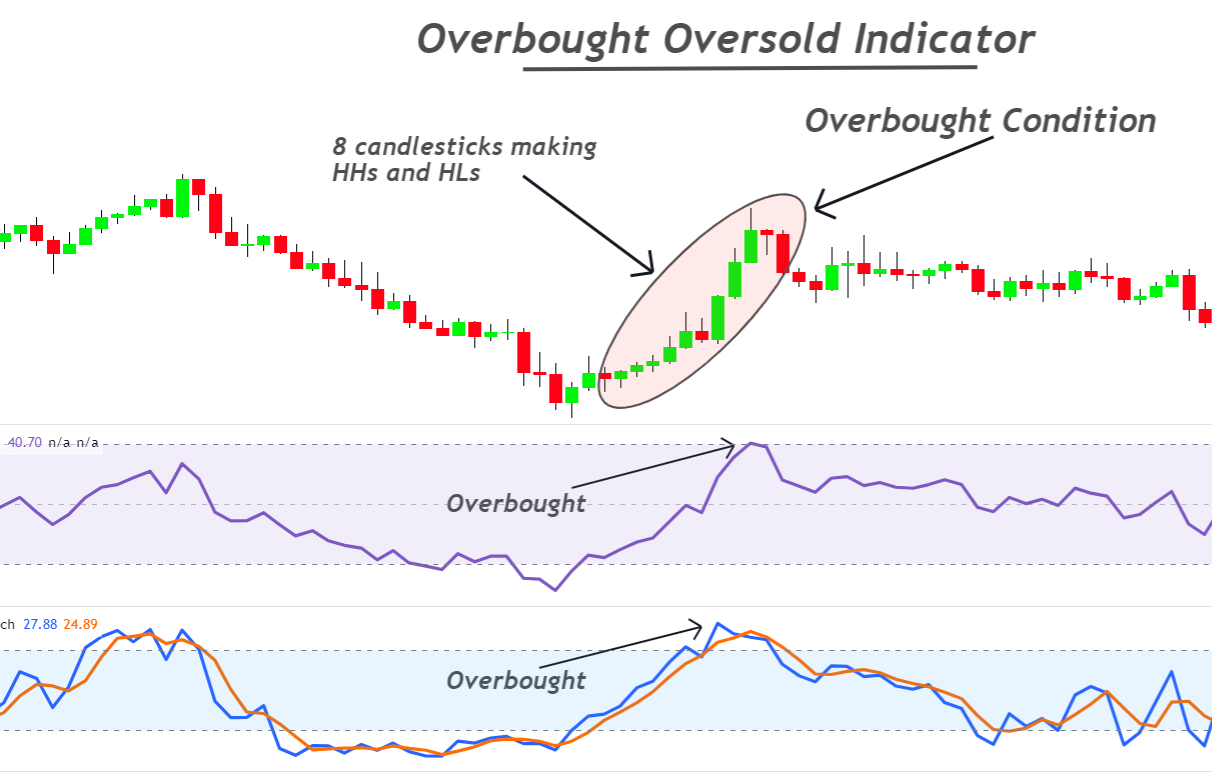

Identifying Overbought level:

Zar e mubadla bazaar mein Overbought ke halaat ko samajhney ke liye istemaal honay wala aik aam takneeki isharay rishta daar taaqat index hai. ( rsi ). rsi aik momentum oscalter hai jo charge ki naqal o harkat ki sharah aur tabdeeli ki pemaiesh karta hai. jab rsi 70 se oopar uthta hai, to is mil ki aksar is alamat ke tor par tashreeh ki jati hai ke ghair mulki raqam ka jora ziyada khareeda ja sakta hai aur mumkina ulat palat ki wajah se ho sakta hai. tajir Overbought ke halaat ki tasdeeq ke liye stochastic oscalter ya money flow index samait deegar isharay bhi dekh satke hain.

Identifying Oversold level:

Isi terhan, khredar forex market mein Oversold honay walay halaat se aagah honay ke liye takneeki alamaat ka istemaal kar satke hain. jab are s aayi 30 se neechay aata hai, to usay is alamat ke tor par samjha jata hai ke currency ke jore ko Oversold kya ja sakta hai aur mumkina tor par is ki qader kam ki ja sakti hai. tajir Oversold honay walay halaat ki tasdeeq karne aur mumkina kharidari ke imkanaat talaash karne ke liye commodity channel index ( si si aayi ) ya Villiams ? are jaisay mukhtalif isharay ki bhi jaanch kar satke hain.

Trading With Overbought and Oversold Condition:

Agarchay ziyada kharidi hui aur Oversold honay wali alamtain bazaar ke halaat ke baray mein qeemti baseerat paish kar sakti hain, lekin kharidaron ke liye yeh bohat zaroori hai ke woh mukhtalif alaat aur tashkhees ke sath un ka itlaq karen. sirf khud un isharay par bharosa karna bhi ghalat isharay aur khareed o farokht ki ghaltion ka sabab ban sakta hai. taajiron ko Overbought ya Oversold ke halaat ki bunyaad par khareed o farokht ke faislay karne se pehlay mukhtalif takneeki alamaat, chart ke namonon aur zaroori tashkhees se tasdeeq talaash karni chahiye.

Limitations of Overbought and Oversold Condition:

aisi mukhtalif tknikin hain jin ka istemaal tajir zar e mubadla bazaar mein Overbought aur Oversold ke halaat ko tabdeel karne ke liye kar satke hain. aik aam tareeqa yeh hai ke tasdeeq ke isharay ka intzaar kya jaye, jis mein charge reversal patteren ya deegar alamaat mein inhiraf shaamil ho, mutabadil mein anay se pehlay. aik aur tareeqa yeh hai ke salahiyat tak rasai aur bahar jane walay awamil ko daryaft karne ke liye Overbought aur Oversold honay walay isharay ke majmoay ka itlaq kya jaye. agar market tawaqqa ke mutabiq bartao nahi karti hai to khatray aur Sheild capital mein heera pheri karne ke liye nuqsaan ke orders ko rokna bhi zaroori hai. majmoi tor par, Overbought aur Oversold ke halaat aur inhen mukammal tijarti nuqta nazar mein shaamil karne se sarmaya karon ko khatarnaak ghair mulki currency ke bazaar ko ziyada durust tareeqay se navigate karne mein madad mil sakti hai.

Forex market mein, Overbought aur Oversold ke halaat ke usool sarmaya karon ke liye ahem hain ke woh bakhabar tijarti intikhab karne ki koshish mein samjhain. yeh halaat mukammal tor par is khayaal par mabni hain ke currency ke jore ki sharah ko mukhtasir muddat mein shadeed darjay tak pohanchaya ja sakta hai, jis ki wajah se salahiyat mein tabdeeli ya islahat ho sakti hain. Overbought ke halaat is waqt hotay hain jab fees mein taizi se izafah sun-hwa hai aur yeh pal back ki wajah se ho sakta hai, isi waqt jab Oversold honay walay halaat peda hotay hain jab ke fees mein taizi se kami waqay hoti hai aur yeh rebound ke liye tayyar ho sakta hai.

Identifying Overbought level:

Zar e mubadla bazaar mein Overbought ke halaat ko samajhney ke liye istemaal honay wala aik aam takneeki isharay rishta daar taaqat index hai. ( rsi ). rsi aik momentum oscalter hai jo charge ki naqal o harkat ki sharah aur tabdeeli ki pemaiesh karta hai. jab rsi 70 se oopar uthta hai, to is mil ki aksar is alamat ke tor par tashreeh ki jati hai ke ghair mulki raqam ka jora ziyada khareeda ja sakta hai aur mumkina ulat palat ki wajah se ho sakta hai. tajir Overbought ke halaat ki tasdeeq ke liye stochastic oscalter ya money flow index samait deegar isharay bhi dekh satke hain.

Identifying Oversold level:

Isi terhan, khredar forex market mein Oversold honay walay halaat se aagah honay ke liye takneeki alamaat ka istemaal kar satke hain. jab are s aayi 30 se neechay aata hai, to usay is alamat ke tor par samjha jata hai ke currency ke jore ko Oversold kya ja sakta hai aur mumkina tor par is ki qader kam ki ja sakti hai. tajir Oversold honay walay halaat ki tasdeeq karne aur mumkina kharidari ke imkanaat talaash karne ke liye commodity channel index ( si si aayi ) ya Villiams ? are jaisay mukhtalif isharay ki bhi jaanch kar satke hain.

Trading With Overbought and Oversold Condition:

Agarchay ziyada kharidi hui aur Oversold honay wali alamtain bazaar ke halaat ke baray mein qeemti baseerat paish kar sakti hain, lekin kharidaron ke liye yeh bohat zaroori hai ke woh mukhtalif alaat aur tashkhees ke sath un ka itlaq karen. sirf khud un isharay par bharosa karna bhi ghalat isharay aur khareed o farokht ki ghaltion ka sabab ban sakta hai. taajiron ko Overbought ya Oversold ke halaat ki bunyaad par khareed o farokht ke faislay karne se pehlay mukhtalif takneeki alamaat, chart ke namonon aur zaroori tashkhees se tasdeeq talaash karni chahiye.

Limitations of Overbought and Oversold Condition:

aisi mukhtalif tknikin hain jin ka istemaal tajir zar e mubadla bazaar mein Overbought aur Oversold ke halaat ko tabdeel karne ke liye kar satke hain. aik aam tareeqa yeh hai ke tasdeeq ke isharay ka intzaar kya jaye, jis mein charge reversal patteren ya deegar alamaat mein inhiraf shaamil ho, mutabadil mein anay se pehlay. aik aur tareeqa yeh hai ke salahiyat tak rasai aur bahar jane walay awamil ko daryaft karne ke liye Overbought aur Oversold honay walay isharay ke majmoay ka itlaq kya jaye. agar market tawaqqa ke mutabiq bartao nahi karti hai to khatray aur Sheild capital mein heera pheri karne ke liye nuqsaan ke orders ko rokna bhi zaroori hai. majmoi tor par, Overbought aur Oversold ke halaat aur inhen mukammal tijarti nuqta nazar mein shaamil karne se sarmaya karon ko khatarnaak ghair mulki currency ke bazaar ko ziyada durust tareeqay se navigate karne mein madad mil sakti hai.

تبصرہ

Расширенный режим Обычный режим