What is Supply and Demand Zone:

Supply aur demand zone zar e mubadla ki kharidari aur farokht mein kaleedi tasawurat hain jo kharidaron ko rate reversal ki salahiyat ke shobo ki nishandahi karne mein madad karte hain. yeh zone fees chart ke woh ilaqay hain jin mein kisi makhsoos ghair mulki currency ke jore ki supply ( farokht knndgan aur maang ( gahkon ) ke darmiyan zabardast Adam tawazun ho sakta hai. jab fees un zonon ki pemaiesh karti hai, to is ka radd amal zahir karne aur mumkina tor par mukhalif simt ka imkaan hota hai. tajir un zonon ka istemaal bakhabar kharidari aur farokht ke intikhab karne aur aala imkaan walay mutabadil set up ko muntakhib karne ke liye karte hain.

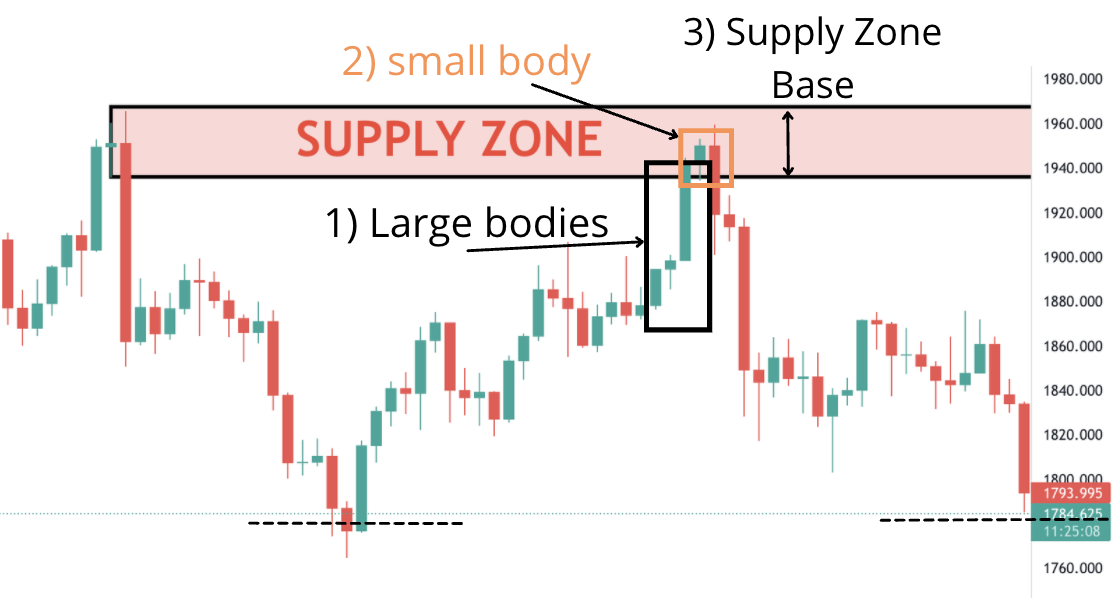

Identifying Supply and Demand zone:

Supply zone woh ilaqay hain jahan dilyori ki zayad-ti hoti hai, jis ki wajah se akhrajaat mumkina tor par kam hotay hain. un ilaqon ko aam tor par qeemat mein izafay ya bhaari farokht ke dabao ke zariye nishaan zad kya jata hai. doosri taraf demand zone woh ilaqay hain jin mein cal ki zayad-ti hoti hai, bunyadi tor par oopar ki taraf mumkina charge ulat jana. tajir un zonon ko sharah harkat ke klstrz ki talaash ka istemaal karte hue daryaft kar satke hain, Bashmole guide aur muzahmat ke marahil ya woh ilaqay jahan charge pehlay ulat chuka ho.

Importance of Supply and Demand zone:

Supply aur demand zone ghair mulki currency ki tijarat mein ahem hain kyunkay woh kaleedi marahil paish karte hain jin mein bhaari fees ke iqdamaat peda honay ka imkaan hota hai. maloomat ke mutabiq woh zone, sarmaya car tawaqqa kar satke hain ke kahan charge bhi ulat sakta hai aur is wajah se apni tijarat ka mansoobah bana satke hain. yeh zone taajiron ko un kaleedi sthon par salahiyat ki sharah ke radd amal ki bunyaad par haqeeqi aamdani ke ahdaaf aur nuqsaan se bachney ki hudood tay karne mein bhi madad karte hain.

Trading With Supply and Demand zone:

Kharidari aur farokht ki mtnoa tknikin hain jin ka istemaal sarmaya car dilyori aur cal far zone ka faida uthany ke liye kar satke hain. aik ghair mamooli tareeqa yeh hai ke dilyori ya cal far zone ki taknik ke liye charge ki tawaqqa ki jaye aur salahiyat ke ulat jane ki tasdeeq ke liye pan Baraz ya incloping patteren samait fees ki naqal o harkat ke isharay talaash kiye jayen. tajir hatt tabdeeli ke imkaan ko badhaane ke liye deegar takneeki alamaat ya bunyadi tajzia ke sath sangam ka bhi istemaal kar satke hain.

Risk Management with Supply and Demand zone:

Zar e mubadla ki kharidari aur farokht mein rissk control bohat zaroori hai, aur zone ki dilyori aur cal sarmaya karon ko –apne rissk mein ziyada heera pheri karne mein madad kar sakti hai. khareed tijarat mein cal far zone ke tehat ya promote tridz mein dilyori zone se oopar stop las orders tarteeb day kar, tajir –apne mumkina nuqsanaat ko mehdood kar satke hain agar market ab paish goi ke mutabiq radd amal zahir nahi karti hai. mazeed bar-aan, tajir un ilaqon ko un ilaqon ko muntakhib karne ke liye istemaal kar satke hain jin mein bazaar bhi utaar charhao ka shikaar ho sakta hai aur –apne sarmaye ko bachanay ke liye –apne function size ko adjust kar satke hain. majmoi tor par, ilm aur supply aur demand zone ko muaser tareeqay se istemaal karne se forex marketon mein tajir ki majmoi karkardagi aur munafe ko barray pemanay par behtar banaya ja sakta hai.

Supply aur demand zone zar e mubadla ki kharidari aur farokht mein kaleedi tasawurat hain jo kharidaron ko rate reversal ki salahiyat ke shobo ki nishandahi karne mein madad karte hain. yeh zone fees chart ke woh ilaqay hain jin mein kisi makhsoos ghair mulki currency ke jore ki supply ( farokht knndgan aur maang ( gahkon ) ke darmiyan zabardast Adam tawazun ho sakta hai. jab fees un zonon ki pemaiesh karti hai, to is ka radd amal zahir karne aur mumkina tor par mukhalif simt ka imkaan hota hai. tajir un zonon ka istemaal bakhabar kharidari aur farokht ke intikhab karne aur aala imkaan walay mutabadil set up ko muntakhib karne ke liye karte hain.

Identifying Supply and Demand zone:

Supply zone woh ilaqay hain jahan dilyori ki zayad-ti hoti hai, jis ki wajah se akhrajaat mumkina tor par kam hotay hain. un ilaqon ko aam tor par qeemat mein izafay ya bhaari farokht ke dabao ke zariye nishaan zad kya jata hai. doosri taraf demand zone woh ilaqay hain jin mein cal ki zayad-ti hoti hai, bunyadi tor par oopar ki taraf mumkina charge ulat jana. tajir un zonon ko sharah harkat ke klstrz ki talaash ka istemaal karte hue daryaft kar satke hain, Bashmole guide aur muzahmat ke marahil ya woh ilaqay jahan charge pehlay ulat chuka ho.

Importance of Supply and Demand zone:

Supply aur demand zone ghair mulki currency ki tijarat mein ahem hain kyunkay woh kaleedi marahil paish karte hain jin mein bhaari fees ke iqdamaat peda honay ka imkaan hota hai. maloomat ke mutabiq woh zone, sarmaya car tawaqqa kar satke hain ke kahan charge bhi ulat sakta hai aur is wajah se apni tijarat ka mansoobah bana satke hain. yeh zone taajiron ko un kaleedi sthon par salahiyat ki sharah ke radd amal ki bunyaad par haqeeqi aamdani ke ahdaaf aur nuqsaan se bachney ki hudood tay karne mein bhi madad karte hain.

Trading With Supply and Demand zone:

Kharidari aur farokht ki mtnoa tknikin hain jin ka istemaal sarmaya car dilyori aur cal far zone ka faida uthany ke liye kar satke hain. aik ghair mamooli tareeqa yeh hai ke dilyori ya cal far zone ki taknik ke liye charge ki tawaqqa ki jaye aur salahiyat ke ulat jane ki tasdeeq ke liye pan Baraz ya incloping patteren samait fees ki naqal o harkat ke isharay talaash kiye jayen. tajir hatt tabdeeli ke imkaan ko badhaane ke liye deegar takneeki alamaat ya bunyadi tajzia ke sath sangam ka bhi istemaal kar satke hain.

Risk Management with Supply and Demand zone:

Zar e mubadla ki kharidari aur farokht mein rissk control bohat zaroori hai, aur zone ki dilyori aur cal sarmaya karon ko –apne rissk mein ziyada heera pheri karne mein madad kar sakti hai. khareed tijarat mein cal far zone ke tehat ya promote tridz mein dilyori zone se oopar stop las orders tarteeb day kar, tajir –apne mumkina nuqsanaat ko mehdood kar satke hain agar market ab paish goi ke mutabiq radd amal zahir nahi karti hai. mazeed bar-aan, tajir un ilaqon ko un ilaqon ko muntakhib karne ke liye istemaal kar satke hain jin mein bazaar bhi utaar charhao ka shikaar ho sakta hai aur –apne sarmaye ko bachanay ke liye –apne function size ko adjust kar satke hain. majmoi tor par, ilm aur supply aur demand zone ko muaser tareeqay se istemaal karne se forex marketon mein tajir ki majmoi karkardagi aur munafe ko barray pemanay par behtar banaya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим