WEDGE PATTERN

Forex market mein trading ky process ko learn kerny ky leye markey mein patterns ka bhout important role hota hy.ess ko samajny k leye market ko time dena aur apny knowledge ko patterns aur indicators ky according improve kerna ess business mein kamyabi ki guarantee samja jata hy. Ess leye market ki past movement ko mind mein rakh ker analysis kerny ki zarorat hoti hy. Market main jub correction ho rahi hoti hai tab market main wdges show ho rahy hoty hain. Jis ko dekh kar hum apni trade kar skty hain or profit lay skty hain forex main jo wedges hoty hain wo hmain tarde find out karny mein help dety hain. Forex main wedges ki sorat main bhi hum market ko achi trha se observe ker skty hain.aur phir oss ky according trade place ker ky profit kamma sakty hein, aur market mein expert ho sakty hein.

DESCRIPTIVE INFORMATION OF WEDGE PATTERN

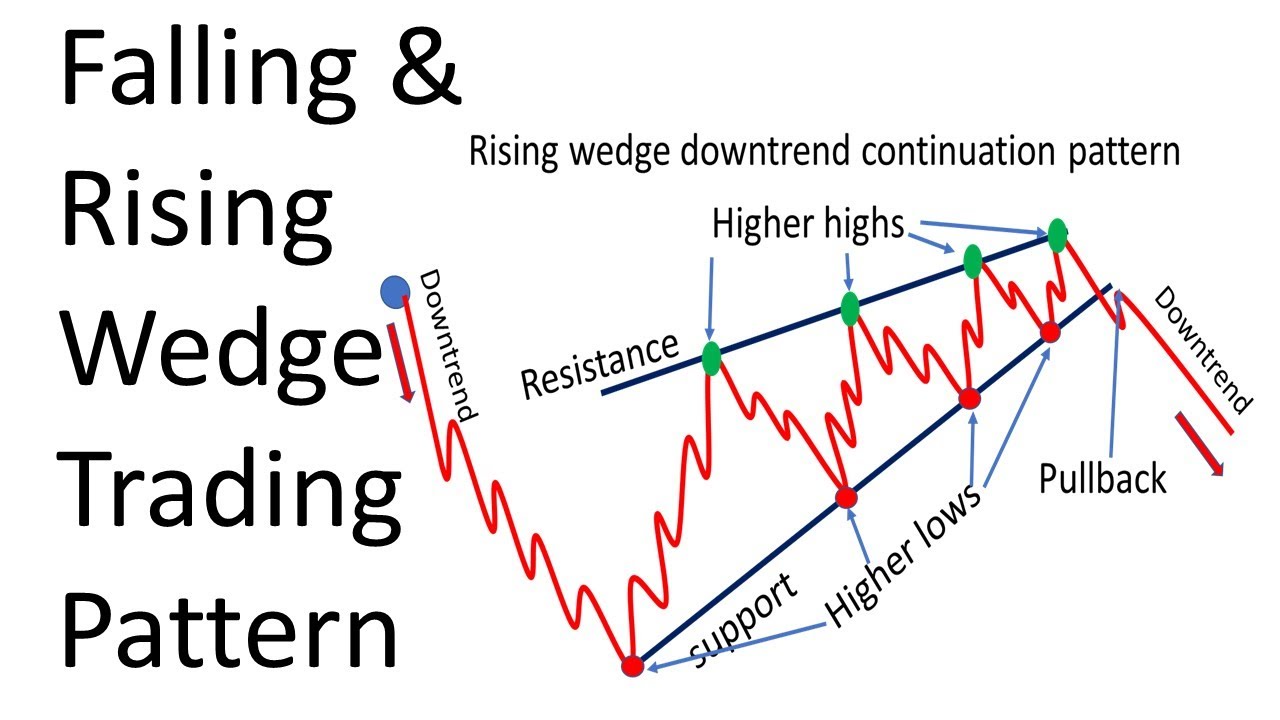

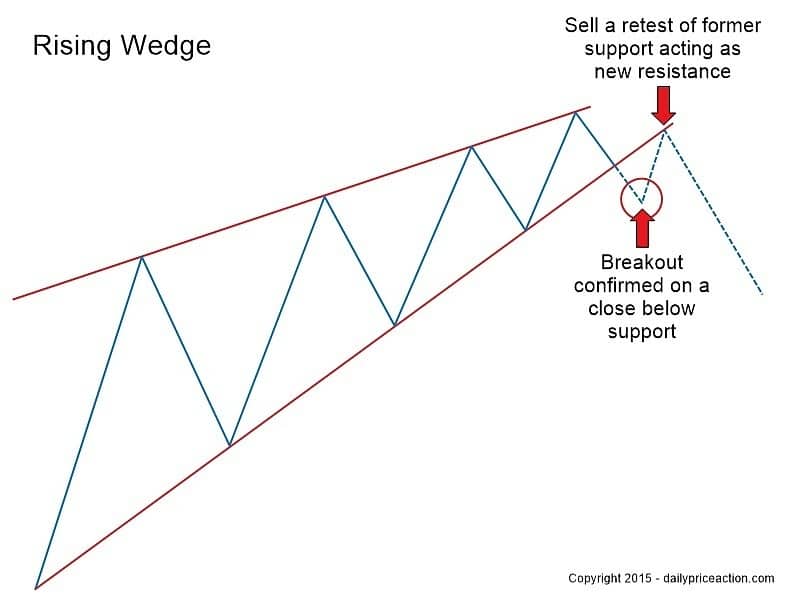

JabTraders trading maein different patterns ko properly learning karne ke bad samajh Nahin paty, tu oss time tak Ham kabhi bhi market mein kamyab Nahin ho sakte.ess liye Hamari yahe koshish honi chahie ke Ham trading se related jitni bi information hai usko learn Karen aur oss ky baad usko apni trading per apply karne ki koshish karen.ta ky market mein trading sy benefit ly sakein.ab hum forex market mein wedge pattern ki types ko discuss kerty hein. market yeh pattern oss particular time aur area mein create hota hy jab aapko downtrend ke bare mein indication milti Hai. Jab aapko market Mein bearish trend milega tou oss time per market Mein falling wedge create hota hay. yeh sabse pahle aapko higher Low banati hai aur uske baad phir lower Low banati hai.wahan per bhi sell ki entry banti hay.ess ko deikhty hoye hamain yahan per sell ki trade open kerny per hi acha profit hasil ho sakta hy. Jab market apni maximum limit tak ponch jaey tu market hamesha uptrend main kuch time ky liay movement continue kerti hai, aur maximum limit tak ponchny ky leye uptrend main achi movement kerny ky sath hee kuch time ky liay bar bar stay bhi ker rehi hoti hai tou aesy time per jab market uptrend main move kery phir stay kery phir same direction main movement kery tou aesi condition main rising wedge pattern create hota hay. jis per hamain buy ki trade ko enter kerny sy acha profit hasil ho sakta hy.

CONCLUSION

Friends forex trading mein hamein kam karnay kaye liye khud ko mentally prepare kartay hoye successful trading karni chahiye, aur apney aggressive aur emotions ko control may rakhtay hoye trading karney may hi kamyaabi hay.jo traders market main support aur resistance ko follow kerty huey trade kerty hain tou aesy wedges in traders ky liay bahot faidamind hoty hain ky jab market kisi bhi trend main move kerty huey kisi jaga per stay kerti hai tou wahan per reverse order main trade open kerny ki bajaey kuch time ky liay wait ker lena chahiay.ta ky ho sakta hai rising ya falling wedges create ho rehy hon tou aesy mein trade wedges ky according hi open kerni mein market sy targeted result leye ja sakty hein.Trade place kerny sy pehly hee traders ko stop loss ki position ko determine ker lena chehye,Kyu kay ess sey undesired market ki movement ki waja sey traders ka account secure rehy ga.

Forex market mein trading ky process ko learn kerny ky leye markey mein patterns ka bhout important role hota hy.ess ko samajny k leye market ko time dena aur apny knowledge ko patterns aur indicators ky according improve kerna ess business mein kamyabi ki guarantee samja jata hy. Ess leye market ki past movement ko mind mein rakh ker analysis kerny ki zarorat hoti hy. Market main jub correction ho rahi hoti hai tab market main wdges show ho rahy hoty hain. Jis ko dekh kar hum apni trade kar skty hain or profit lay skty hain forex main jo wedges hoty hain wo hmain tarde find out karny mein help dety hain. Forex main wedges ki sorat main bhi hum market ko achi trha se observe ker skty hain.aur phir oss ky according trade place ker ky profit kamma sakty hein, aur market mein expert ho sakty hein.

DESCRIPTIVE INFORMATION OF WEDGE PATTERN

JabTraders trading maein different patterns ko properly learning karne ke bad samajh Nahin paty, tu oss time tak Ham kabhi bhi market mein kamyab Nahin ho sakte.ess liye Hamari yahe koshish honi chahie ke Ham trading se related jitni bi information hai usko learn Karen aur oss ky baad usko apni trading per apply karne ki koshish karen.ta ky market mein trading sy benefit ly sakein.ab hum forex market mein wedge pattern ki types ko discuss kerty hein. market yeh pattern oss particular time aur area mein create hota hy jab aapko downtrend ke bare mein indication milti Hai. Jab aapko market Mein bearish trend milega tou oss time per market Mein falling wedge create hota hay. yeh sabse pahle aapko higher Low banati hai aur uske baad phir lower Low banati hai.wahan per bhi sell ki entry banti hay.ess ko deikhty hoye hamain yahan per sell ki trade open kerny per hi acha profit hasil ho sakta hy. Jab market apni maximum limit tak ponch jaey tu market hamesha uptrend main kuch time ky liay movement continue kerti hai, aur maximum limit tak ponchny ky leye uptrend main achi movement kerny ky sath hee kuch time ky liay bar bar stay bhi ker rehi hoti hai tou aesy time per jab market uptrend main move kery phir stay kery phir same direction main movement kery tou aesi condition main rising wedge pattern create hota hay. jis per hamain buy ki trade ko enter kerny sy acha profit hasil ho sakta hy.

CONCLUSION

Friends forex trading mein hamein kam karnay kaye liye khud ko mentally prepare kartay hoye successful trading karni chahiye, aur apney aggressive aur emotions ko control may rakhtay hoye trading karney may hi kamyaabi hay.jo traders market main support aur resistance ko follow kerty huey trade kerty hain tou aesy wedges in traders ky liay bahot faidamind hoty hain ky jab market kisi bhi trend main move kerty huey kisi jaga per stay kerti hai tou wahan per reverse order main trade open kerny ki bajaey kuch time ky liay wait ker lena chahiay.ta ky ho sakta hai rising ya falling wedges create ho rehy hon tou aesy mein trade wedges ky according hi open kerni mein market sy targeted result leye ja sakty hein.Trade place kerny sy pehly hee traders ko stop loss ki position ko determine ker lena chehye,Kyu kay ess sey undesired market ki movement ki waja sey traders ka account secure rehy ga.

تبصرہ

Расширенный режим Обычный режим