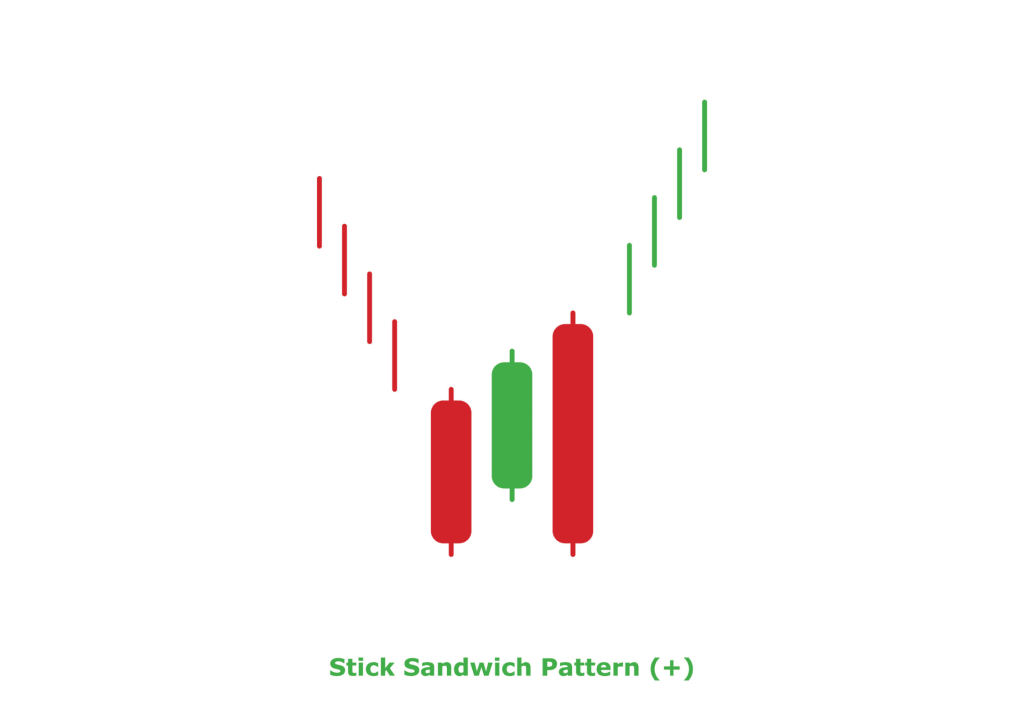

What is Sandwich Pattern:

Sandwich ka Sandwich aik takneeki tajzia markaz hai jis ke darmiyan aik Sandwich hota hai. Sandwich ki hui mom batii ki chhari dosray rang ki hoti hai aur is ke charon taraf do rang hotay hain, jo jazbaat mein tabdeeli ki nishandahi karte hain. Sandwich fashion ke oopri aur nichale dono taraf bhi nazar aasakta hai, jo mumkina tijarat ka ishara deta hai. agarchay yeh faul proof nahi hai, Sandwich ka Sandwich sarmaya karon ko market ki harkiyaat ke baray mein qeemti baseerat faraham kar sakta hai.

Characteristics of Sandwich Pattern:

Sandwich ke namoonay ki khasusiyat teen mom btyon ki herat angaiz tashkeel ke zariye hoti hai. pehli aur 0. 33 mom batian aik jaisay rang ki hain aur kamyaab rujhan ki tashkeel karti hain. darmiyani mom batii ki chhari, jo 2 ke darmiyan Sandwich ki gayi hai, mutabadil rang ki hai, jo salahiyat ko tabdeel karne ka mahswara deti hai. is markaz ki mom batii ki chhari ki ahmiyat ko badhaane ke liye tarjeehi tor par ihata karne wali mom btyon ke muqablay mein aik tosee shuda frame hona chahiye. mazeed bar-aan, Sandwich ziyada qabil aetmaad hai jab ke yeh aik taweel rujhan ke baad hota hai, jo mojooda daur mein thakawat ki nishandahi karta hai.

Trading With Sandwich Pattern:

Tajir Sandwich ke andaaz ko mukhtalif tareeqon se istemaal kar ke bakhabar khareed o farokht ke intikhab kar satke hain. aik aam hikmat e amli yeh hai ke namoonay ki tashkeel par nazar rakhi jaye aur is ke baad mojooda rujhan ke bar aks rastay mein tijarat darj ki jaye. yeh nuqta nazar patteren ke zareya ishara kardah paish goi shuda ulat palat ka faida uthany ki koshish karta hai. mazeed bar-aan, khredar isharay ki tasdeeq karne aur kamyaab tijarat ke imkanaat ko badhaane ke liye mukhtalif takneeki alamaat ya chart style ke sath mil kar Sandwich ka Sandwich istemaal kar satke hain. har dosray nuqta nazar ki terhan, bunyadi tor par Sandwich ke namoonay ki bunyaad par khareed o farokht karte waqt rissk control ahem hota hai.

Using Sandwich Pattern for Confirmation of Entry Level:

Sandwich patteren ghair mulki currency ke bazaar mein mumkina dakhlay ke awamil ki tasdeeq ke liye aik qeemti aala kaam kar sakta hai. jab madad aur muzahmat ki dgryon ya trained lines samait mukhtalif takneeki tshkhisi tools ke sath milaya jata hai, to tajir un ilaqon ki nishandahi kar satke hain jahan patteren kaafi charge dgryon ke sath saf bandi karta hai. cheezon ka yeh sangam tabdeeli ke set up mein aetmaad mein izafah kere ga aur wazeh rasai ke intabahat faraham kere ga. aik se ziyada asason se tasdeeq ka intzaar karne se, tajir jhutay isharay se bach satke hain aur apni tijarat mein durustagi ko barha satke hain.

Limitations and Risk Management in Sandwich Pattern:

Agarchay Sandwich ka Sandwich forex trading mein aik mufeed isharay ho sakta hai, lekin yeh hamesha rukawaton ke baghair nahi hota hai. kisi bhi takneeki tajziye ke alay ki terhan, yeh hamesha be aib nahi hota aur ghalat isharay peda kar sakta hai. taajiron ko musalsal intibah karne ki zaroorat hai aur ab tijarti intikhab karne ke liye mukammal tor par tarz par inhisaar nahi karna chahiye. Sandwich ke namoonay ke istemaal ke douran rissk managment ahem hai, kyunkay agar tijarat sahih mansoobah bandi ke baghair ki jati hai to nuqsaan ho sakta hai. Stop loss orders ka taayun karna, risk divider tanasub ki wazahat karna, aur nazam o zabt ki kharidari aur farokht ke mansoobay par amal pera hona Sandwich patteren par mabni tijarat karte waqt khatray ke taaqatwar intizam ke laazmi anasir hain. tarz ki rukawaton ko tasleem karte hue aur khatray ke intizam ke thos tareeqon ko nafiz karte hue, tajir salahiyat ke nuqsanaat ko kam kar satke hain aur zar e mubadla bazaar ke andar apni kamyabi ke imkanaat ko barha satke hain.

Sandwich ka Sandwich aik takneeki tajzia markaz hai jis ke darmiyan aik Sandwich hota hai. Sandwich ki hui mom batii ki chhari dosray rang ki hoti hai aur is ke charon taraf do rang hotay hain, jo jazbaat mein tabdeeli ki nishandahi karte hain. Sandwich fashion ke oopri aur nichale dono taraf bhi nazar aasakta hai, jo mumkina tijarat ka ishara deta hai. agarchay yeh faul proof nahi hai, Sandwich ka Sandwich sarmaya karon ko market ki harkiyaat ke baray mein qeemti baseerat faraham kar sakta hai.

Characteristics of Sandwich Pattern:

Sandwich ke namoonay ki khasusiyat teen mom btyon ki herat angaiz tashkeel ke zariye hoti hai. pehli aur 0. 33 mom batian aik jaisay rang ki hain aur kamyaab rujhan ki tashkeel karti hain. darmiyani mom batii ki chhari, jo 2 ke darmiyan Sandwich ki gayi hai, mutabadil rang ki hai, jo salahiyat ko tabdeel karne ka mahswara deti hai. is markaz ki mom batii ki chhari ki ahmiyat ko badhaane ke liye tarjeehi tor par ihata karne wali mom btyon ke muqablay mein aik tosee shuda frame hona chahiye. mazeed bar-aan, Sandwich ziyada qabil aetmaad hai jab ke yeh aik taweel rujhan ke baad hota hai, jo mojooda daur mein thakawat ki nishandahi karta hai.

Trading With Sandwich Pattern:

Tajir Sandwich ke andaaz ko mukhtalif tareeqon se istemaal kar ke bakhabar khareed o farokht ke intikhab kar satke hain. aik aam hikmat e amli yeh hai ke namoonay ki tashkeel par nazar rakhi jaye aur is ke baad mojooda rujhan ke bar aks rastay mein tijarat darj ki jaye. yeh nuqta nazar patteren ke zareya ishara kardah paish goi shuda ulat palat ka faida uthany ki koshish karta hai. mazeed bar-aan, khredar isharay ki tasdeeq karne aur kamyaab tijarat ke imkanaat ko badhaane ke liye mukhtalif takneeki alamaat ya chart style ke sath mil kar Sandwich ka Sandwich istemaal kar satke hain. har dosray nuqta nazar ki terhan, bunyadi tor par Sandwich ke namoonay ki bunyaad par khareed o farokht karte waqt rissk control ahem hota hai.

Using Sandwich Pattern for Confirmation of Entry Level:

Sandwich patteren ghair mulki currency ke bazaar mein mumkina dakhlay ke awamil ki tasdeeq ke liye aik qeemti aala kaam kar sakta hai. jab madad aur muzahmat ki dgryon ya trained lines samait mukhtalif takneeki tshkhisi tools ke sath milaya jata hai, to tajir un ilaqon ki nishandahi kar satke hain jahan patteren kaafi charge dgryon ke sath saf bandi karta hai. cheezon ka yeh sangam tabdeeli ke set up mein aetmaad mein izafah kere ga aur wazeh rasai ke intabahat faraham kere ga. aik se ziyada asason se tasdeeq ka intzaar karne se, tajir jhutay isharay se bach satke hain aur apni tijarat mein durustagi ko barha satke hain.

Limitations and Risk Management in Sandwich Pattern:

Agarchay Sandwich ka Sandwich forex trading mein aik mufeed isharay ho sakta hai, lekin yeh hamesha rukawaton ke baghair nahi hota hai. kisi bhi takneeki tajziye ke alay ki terhan, yeh hamesha be aib nahi hota aur ghalat isharay peda kar sakta hai. taajiron ko musalsal intibah karne ki zaroorat hai aur ab tijarti intikhab karne ke liye mukammal tor par tarz par inhisaar nahi karna chahiye. Sandwich ke namoonay ke istemaal ke douran rissk managment ahem hai, kyunkay agar tijarat sahih mansoobah bandi ke baghair ki jati hai to nuqsaan ho sakta hai. Stop loss orders ka taayun karna, risk divider tanasub ki wazahat karna, aur nazam o zabt ki kharidari aur farokht ke mansoobay par amal pera hona Sandwich patteren par mabni tijarat karte waqt khatray ke taaqatwar intizam ke laazmi anasir hain. tarz ki rukawaton ko tasleem karte hue aur khatray ke intizam ke thos tareeqon ko nafiz karte hue, tajir salahiyat ke nuqsanaat ko kam kar satke hain aur zar e mubadla bazaar ke andar apni kamyabi ke imkanaat ko barha satke hain.

تبصرہ

Расширенный режим Обычный режим