Butterfly Trading Patterns,

Butterfly trading pattern ek technical analysis ka tareeqa hai jisme traders market ke movements ko analyze karte hain aur price trends ko predict karne ka maqsad rakhte hain. Yeh ek complex pattern hai, lekin agar aap ise samajh jaate hain to isay istemal kar ke aap apni trading strategy ko behtar bana sakte hain.Butterfly pattern ek specific chart pattern hai jisme price ki movements ko represent karte hain.

Yeh pattern traders ko market ke reversals ko identify karne mein madad karta hai. Butterfly pattern ko aksar harmonic trading patterns mein shamil kiya jata hai.Butterfly trading pattern ek powerful tool hai jo traders ko market ke movements ko analyze karne mein madad karta hai. Iski complexity ke bawajood, agar aap ise theek se samajh lete hain to yeh aapki trading strategy ko behtar bana sakta hai. Haan, isay istemal karne se pehle thorough research aur practice zaroori hai taki aap isey sahi taur par samajh sakein aur apni trading ko success tak pahuncha sakein.

Components of Butterfly Pattern,

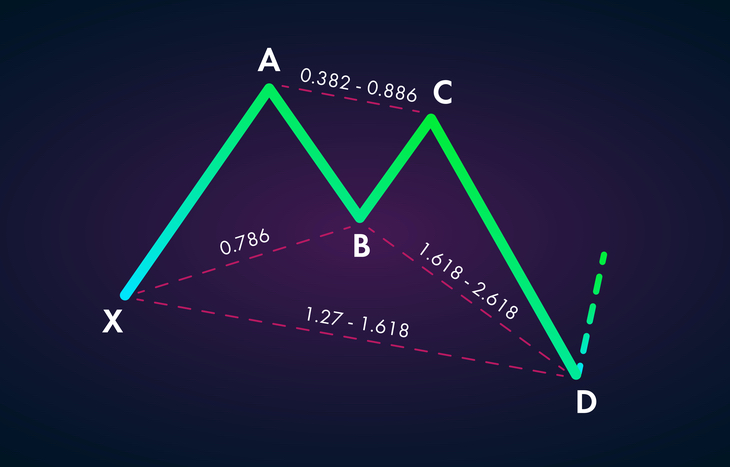

Butterfly pattern teen main components par mushtamil hota hai:

X-A Leg:

Yeh leg initial trend ko represent karta hai. Agar market upar ja raha hai, to X-A leg upar ki taraf hogi, aur agar market neeche ja raha hai, to X-A leg neeche ki taraf hogi.

A-B Leg:

A-B leg X-A leg ke opposite direction mein hota hai. Yani agar X-A leg upar hai, to A-B leg neeche hogi aur agar X-A leg neeche hai, to A-B leg upar hogi.

B-C Leg:

B-C leg market ke reversal ko indicate karta hai. Yeh leg A-B leg ke opposite direction mein hota hai.

C-D Leg:

C-D leg market ke direction ko confirm karta hai. Yeh leg B-C leg ke opposite direction mein hota hai.

Butterfly Pattern Trading Strategy,

Butterfly pattern ko samajhne ke baad, traders isay istemal kar ke apni trading strategy ko improve kar sakte hain. Kuch key points hain jo traders ko madadgar sabit ho sakte hain:

Confirmation,

Butterfly pattern ke istemal se pehle, aapko confirm karna hoga ke market actual mein pattern ke mutabiq ja raha hai ya nahi. Iske liye, aapko technical indicators ka istemal kar ke price movements ko verify karna hoga.

Risk Management With Time Frame,

Har trading strategy mein risk management ka khaas khayal rakhna zaroori hai. Butterfly pattern ko istemal karte waqt, aapko apne stop-loss aur take-profit levels ko tay karna hoga taake aap apne nuksan ko control mein rakh sakein.Butterfly pattern ko alag-alag time frames par apply kiya ja sakta hai. Aapko apni trading goals ke mutabiq time frame choose karna chahiye.

Benefits of Butterfly Pattern,

Disadvantages,

Butterfly trading pattern ek technical analysis ka tareeqa hai jisme traders market ke movements ko analyze karte hain aur price trends ko predict karne ka maqsad rakhte hain. Yeh ek complex pattern hai, lekin agar aap ise samajh jaate hain to isay istemal kar ke aap apni trading strategy ko behtar bana sakte hain.Butterfly pattern ek specific chart pattern hai jisme price ki movements ko represent karte hain.

Yeh pattern traders ko market ke reversals ko identify karne mein madad karta hai. Butterfly pattern ko aksar harmonic trading patterns mein shamil kiya jata hai.Butterfly trading pattern ek powerful tool hai jo traders ko market ke movements ko analyze karne mein madad karta hai. Iski complexity ke bawajood, agar aap ise theek se samajh lete hain to yeh aapki trading strategy ko behtar bana sakta hai. Haan, isay istemal karne se pehle thorough research aur practice zaroori hai taki aap isey sahi taur par samajh sakein aur apni trading ko success tak pahuncha sakein.

Components of Butterfly Pattern,

Butterfly pattern teen main components par mushtamil hota hai:

X-A Leg:

Yeh leg initial trend ko represent karta hai. Agar market upar ja raha hai, to X-A leg upar ki taraf hogi, aur agar market neeche ja raha hai, to X-A leg neeche ki taraf hogi.

A-B Leg:

A-B leg X-A leg ke opposite direction mein hota hai. Yani agar X-A leg upar hai, to A-B leg neeche hogi aur agar X-A leg neeche hai, to A-B leg upar hogi.

B-C Leg:

B-C leg market ke reversal ko indicate karta hai. Yeh leg A-B leg ke opposite direction mein hota hai.

C-D Leg:

C-D leg market ke direction ko confirm karta hai. Yeh leg B-C leg ke opposite direction mein hota hai.

Butterfly Pattern Trading Strategy,

Butterfly pattern ko samajhne ke baad, traders isay istemal kar ke apni trading strategy ko improve kar sakte hain. Kuch key points hain jo traders ko madadgar sabit ho sakte hain:

Confirmation,

Butterfly pattern ke istemal se pehle, aapko confirm karna hoga ke market actual mein pattern ke mutabiq ja raha hai ya nahi. Iske liye, aapko technical indicators ka istemal kar ke price movements ko verify karna hoga.

Risk Management With Time Frame,

Har trading strategy mein risk management ka khaas khayal rakhna zaroori hai. Butterfly pattern ko istemal karte waqt, aapko apne stop-loss aur take-profit levels ko tay karna hoga taake aap apne nuksan ko control mein rakh sakein.Butterfly pattern ko alag-alag time frames par apply kiya ja sakta hai. Aapko apni trading goals ke mutabiq time frame choose karna chahiye.

Benefits of Butterfly Pattern,

- Butterfly pattern traders ko market ke reversals ko identify karne mein madad karta hai, jisse unhe profitable trading opportunities mil sakti hain.

- Is pattern ke istemal se traders apne trades ke liye achi risk-reward ratio maintain kar sakte hain, jo unke liye beneficial hota hai.

Disadvantages,

- Butterfly pattern ek complex pattern hai, isay samajhna aur istemal karna beginners ke liye mushkil ho sakta hai.

- Jaise har trading strategy mein hota hai, butterfly pattern bhi false signals generate kar sakta hai. Isliye, confirmatory indicators ka istemal karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим