What is Dark Cloud Cover Pattern:

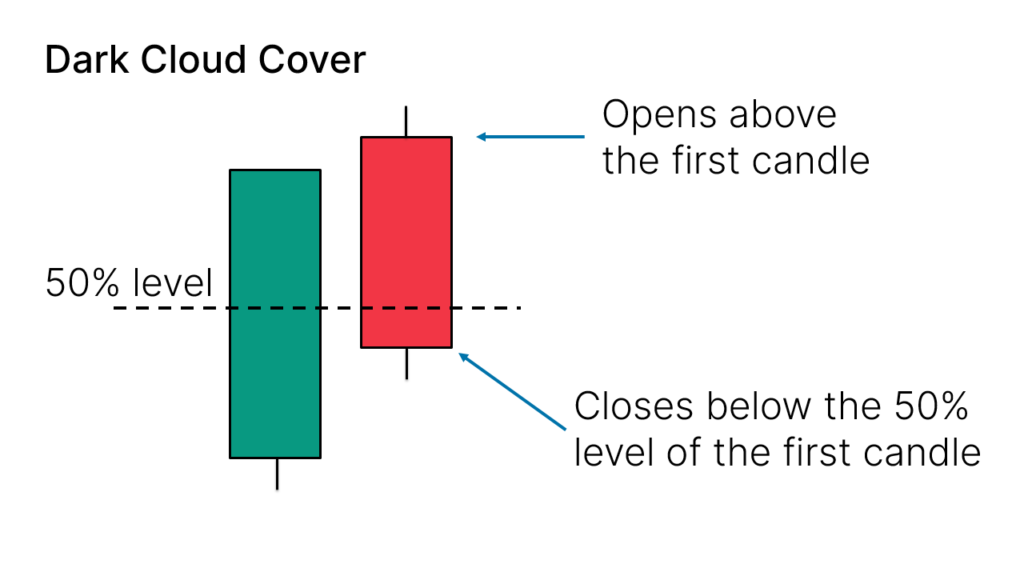

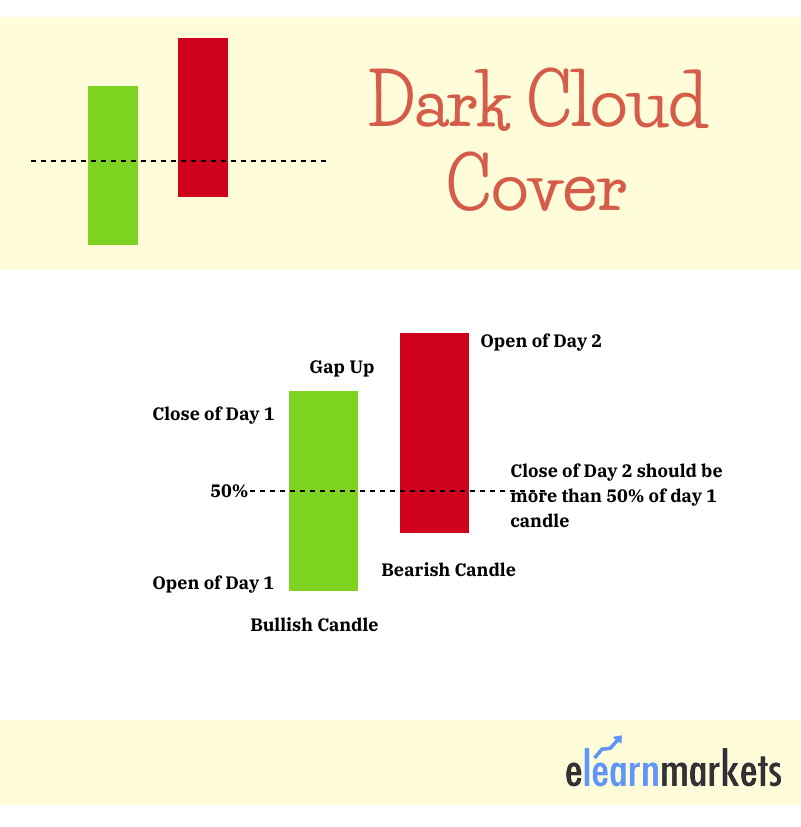

Dark cloud cover aik Bearish Reversal candle stick patteren hai jo up trained mein salahiyat ke ulat jane ki nishandahi karta hai. namoonay mein do mom batian shaamil hain : aik bohat barri taizi wali mom batii jis ke sath aik choti mom batii hoti hai jo pichlle din ki tijarat par siyah baadal banati hai. pehli mom batii aam tor par aik mazboot taizi wali mom batii hoti hai, jo aik darina up trained ki numaindagi karti hai. 2 d mom batii pichlle qareeb se behtar khulti hai, ibtidayi tor par ziyada oonchai haasil karti hai, lekin phir pehli mom batii ke wast nuqta se neechay band honay ke liye ulat jati hai. yeh ulat palat taizi se mandi ke jazbaat ki taraf raftaar mein tabdeeli ki nishandahi karta hai.

Interpretation and Important of Dark Cloud Cover Pattern:

Dark cloud cover ka namona bohat bara hai kyunkay is se market mein taizi se le kar mandi tak mumkina tijarat ka pata chalta hai. tajir is tarz ki tashreeh aik intibahi isharay ke tor par karte hain ke up trained taaqat ko kam kar sakta hai aur yeh ke aik ulat anay wala hai. namona khaas tor par taaqatwar hota hai jab ke yeh muzahmat ke kaleedi marahil par ya tosee shuda up trained ke baad kaghazi karwai karta hai, jo ulat jane ke ziyada imkaan ki nishandahi karta hai.

Dark cloud cover patteren ka tajzia karte waqt, doosri mom batii ka pemana, pichli mom batii mein dukhool ki miqdaar, aur market ke umomi sayaq o Sabaq ko mad e nazar rakhna chahiye. pichli mom batii mein gehri dukhool aur namoonay ke sath aik behtar had tak is ki ahmiyat ko taqwiyat deti hai. tajir is namoonay ki bunyaad par khareed o farokht ke faislay karne se pehlay baqaidagi se izafi takneeki alamaat ya charge action se tasdeeq ki talaash karte hain.

Conditions for Validity and Reliability of Dark Cloud Cover Pattern:

Dark cloud cover ke namoonay ke jaaiz aur qabil aetmaad honay ke liye, baaz halaat ko poora karne ki zaroorat hai. sab se pehlay, namona waqai bayan kardah up trained ke baad hona chahiye, jo bazaar ke jazbaat mein tabdeeli ki nishandahi karta hai. pehli mom batii aik barri taizi wali mom batii honi chahiye, jo mojooda rujhan ke andar taaqat ko zahir karti hai. 2 d mom batii ko pichlle qareeb se ziyada aur misali tor par bunyadi mom batii ke oopar se oopar kholna parta hai.

Mazeed bar-aan, doosri mom batii ko pehli mom batii ke wast ke neechay qareeb hona chahiye, jis se saaf siyah baadal ka ihata bantaa hai. namoonay ki washnosta mein izafah hota hai agar doosri mom batii ka lamba haqeeqi frame ho aur is ke sath behtar khareed o farokht ki had ho. yeh mahswara diya jata hai ke mukammal tor par Dark cloud cover patteren ki bunyaad par mandi ka tijarti kirdaar ada karne se pehlay baad ki sharah ki naqal o harkat ke zariye tasdeeq ka intzaar karen.

Trading With Dark Cloud Cover Pattern:

Tajir market ke andar salahiyat ke mukhtasir farokht ke mawaqay ki nishandahi karne ke liye apni kharidari aur farokht ki hikmat amlyon mein Dark cloud cover patteren ko shaamil kar satke hain. namoonay ki shanakht honay ke baad, sarmaya car siyah baadal ban'nay ke baad agli mom batii ke sorakh par fori kaam karna bhi nahi bhool satke hain. khatray ko kam karne ke liye stop las orders ko doosri mom batii ke oopar rakha ja sakta hai.

Mutabadil tor par, sarmaya car tasdeeq ke isharay ka bhi intzaar kar satke hain, jis mein Dark cloud cover ki taraf se ishara kardah mandi ke taasub ki toseeq karne ke liye aik bearish encloping namona ya kaleedi guide marhalay ke neechay waqfa shaamil hai. yeh tareeqa jaali isharay ko kam karne aur aik wazeh dakhli nuqta faraham karne ke zariye kamyaab tijarat ke imkaan ko barha sakta hai.

Limitations and Considerations When Trading the Dark Cloud Cover Pattern:

Agarchay Dark cloud cover patteren salahiyat ke rujhan ke ulat jane ki nishandahi karne ke liye aik qeemti aala ho sakta hai, lekin kharidaron ko is ki hudood ke baray mein aagah hona chahiye aur tijarat ke intikhab karte waqt izafi anasir ko yaad rakhna chahiye. kisi bhi takneeki isharay ki terhan, namona be aib nahi hai aur baaz auqaat is ke nateejay mein ghalat isharay mil satke hain.

Dark cloud cover ke namoonay par mukammal tor par inhisaar karne se pehlay majmoi tor par market ke sayaq o Sabaq ke sath sath macro economic awamil, news events aur deegar takneeki isharay ko zehen mein rakhna zaroori hai. mazeed bar-aan, kharidaron ko khatray par qaboo panay ki sahih hikmat amlyon par amal karna chahiye, jis mein farist all las orders aur function size ka istemaal shaamil hai, taakay agar tijarat tawaqqa ke mutabiq nah ho to –apne sarmaye ki hifazat ki ja sakay.

Dark cloud cover aik Bearish Reversal candle stick patteren hai jo up trained mein salahiyat ke ulat jane ki nishandahi karta hai. namoonay mein do mom batian shaamil hain : aik bohat barri taizi wali mom batii jis ke sath aik choti mom batii hoti hai jo pichlle din ki tijarat par siyah baadal banati hai. pehli mom batii aam tor par aik mazboot taizi wali mom batii hoti hai, jo aik darina up trained ki numaindagi karti hai. 2 d mom batii pichlle qareeb se behtar khulti hai, ibtidayi tor par ziyada oonchai haasil karti hai, lekin phir pehli mom batii ke wast nuqta se neechay band honay ke liye ulat jati hai. yeh ulat palat taizi se mandi ke jazbaat ki taraf raftaar mein tabdeeli ki nishandahi karta hai.

Interpretation and Important of Dark Cloud Cover Pattern:

Dark cloud cover ka namona bohat bara hai kyunkay is se market mein taizi se le kar mandi tak mumkina tijarat ka pata chalta hai. tajir is tarz ki tashreeh aik intibahi isharay ke tor par karte hain ke up trained taaqat ko kam kar sakta hai aur yeh ke aik ulat anay wala hai. namona khaas tor par taaqatwar hota hai jab ke yeh muzahmat ke kaleedi marahil par ya tosee shuda up trained ke baad kaghazi karwai karta hai, jo ulat jane ke ziyada imkaan ki nishandahi karta hai.

Dark cloud cover patteren ka tajzia karte waqt, doosri mom batii ka pemana, pichli mom batii mein dukhool ki miqdaar, aur market ke umomi sayaq o Sabaq ko mad e nazar rakhna chahiye. pichli mom batii mein gehri dukhool aur namoonay ke sath aik behtar had tak is ki ahmiyat ko taqwiyat deti hai. tajir is namoonay ki bunyaad par khareed o farokht ke faislay karne se pehlay baqaidagi se izafi takneeki alamaat ya charge action se tasdeeq ki talaash karte hain.

Conditions for Validity and Reliability of Dark Cloud Cover Pattern:

Dark cloud cover ke namoonay ke jaaiz aur qabil aetmaad honay ke liye, baaz halaat ko poora karne ki zaroorat hai. sab se pehlay, namona waqai bayan kardah up trained ke baad hona chahiye, jo bazaar ke jazbaat mein tabdeeli ki nishandahi karta hai. pehli mom batii aik barri taizi wali mom batii honi chahiye, jo mojooda rujhan ke andar taaqat ko zahir karti hai. 2 d mom batii ko pichlle qareeb se ziyada aur misali tor par bunyadi mom batii ke oopar se oopar kholna parta hai.

Mazeed bar-aan, doosri mom batii ko pehli mom batii ke wast ke neechay qareeb hona chahiye, jis se saaf siyah baadal ka ihata bantaa hai. namoonay ki washnosta mein izafah hota hai agar doosri mom batii ka lamba haqeeqi frame ho aur is ke sath behtar khareed o farokht ki had ho. yeh mahswara diya jata hai ke mukammal tor par Dark cloud cover patteren ki bunyaad par mandi ka tijarti kirdaar ada karne se pehlay baad ki sharah ki naqal o harkat ke zariye tasdeeq ka intzaar karen.

Trading With Dark Cloud Cover Pattern:

Tajir market ke andar salahiyat ke mukhtasir farokht ke mawaqay ki nishandahi karne ke liye apni kharidari aur farokht ki hikmat amlyon mein Dark cloud cover patteren ko shaamil kar satke hain. namoonay ki shanakht honay ke baad, sarmaya car siyah baadal ban'nay ke baad agli mom batii ke sorakh par fori kaam karna bhi nahi bhool satke hain. khatray ko kam karne ke liye stop las orders ko doosri mom batii ke oopar rakha ja sakta hai.

Mutabadil tor par, sarmaya car tasdeeq ke isharay ka bhi intzaar kar satke hain, jis mein Dark cloud cover ki taraf se ishara kardah mandi ke taasub ki toseeq karne ke liye aik bearish encloping namona ya kaleedi guide marhalay ke neechay waqfa shaamil hai. yeh tareeqa jaali isharay ko kam karne aur aik wazeh dakhli nuqta faraham karne ke zariye kamyaab tijarat ke imkaan ko barha sakta hai.

Limitations and Considerations When Trading the Dark Cloud Cover Pattern:

Agarchay Dark cloud cover patteren salahiyat ke rujhan ke ulat jane ki nishandahi karne ke liye aik qeemti aala ho sakta hai, lekin kharidaron ko is ki hudood ke baray mein aagah hona chahiye aur tijarat ke intikhab karte waqt izafi anasir ko yaad rakhna chahiye. kisi bhi takneeki isharay ki terhan, namona be aib nahi hai aur baaz auqaat is ke nateejay mein ghalat isharay mil satke hain.

Dark cloud cover ke namoonay par mukammal tor par inhisaar karne se pehlay majmoi tor par market ke sayaq o Sabaq ke sath sath macro economic awamil, news events aur deegar takneeki isharay ko zehen mein rakhna zaroori hai. mazeed bar-aan, kharidaron ko khatray par qaboo panay ki sahih hikmat amlyon par amal karna chahiye, jis mein farist all las orders aur function size ka istemaal shaamil hai, taakay agar tijarat tawaqqa ke mutabiq nah ho to –apne sarmaye ki hifazat ki ja sakay.

تبصرہ

Расширенный режим Обычный режим