1. (Introduction to Bollinger Band Indicator):

Bollinger Band Indicator ek ahem technical analysis tool hai jo market volatility aur price levels ko samajhne mein madad deta hai. John Bollinger ne 1980s mein is indicator ko tashkeel di thi. Yeh traders ko market trends, reversals, aur potential breakouts ke baare mein malumat faraham karta hai.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Bollinger_Bands_to_Gauge_Trends_Oct_2020-03-11daeb096d8045e395432b57de6bfa06.jpg)

2. (How Bollinger Bands Work):

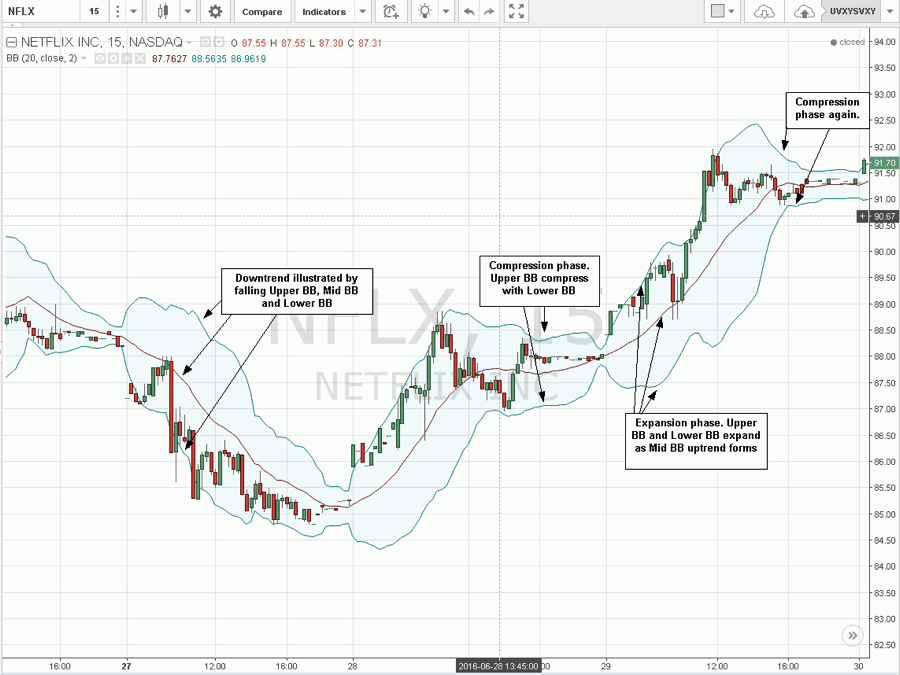

Bollinger Bands, market price ke aas paas ek set of lines hote hain jo volatility aur price levels ko darust karte hain. Yeh teesri party price indicators hote hain jo ke market ke current state ko represent karte hain. Bollinger Bands ek middle band aur do outer bands se mil kar bante hain. Middle band usually 20-day simple moving average (SMA) hota hai, jabke outer bands volatility ko measure karte hain.

3. (Construction of Bollinger Bands):

4. (Bollinger Bands ke Sath Trading Strategies):

5. (Bollinger Bands and Market Trends):

6. (Limitations of Bollinger Bands):

7. (Pros and Cons of Bollinger Bands):

Bollinger Band Indicator, traders ke liye aik mawafiqat ka jazba hai jo market trends aur volatility ko samajhne mein madad karta hai. Iska sahi istemal karke,

Bollinger Band Indicator ek ahem technical analysis tool hai jo market volatility aur price levels ko samajhne mein madad deta hai. John Bollinger ne 1980s mein is indicator ko tashkeel di thi. Yeh traders ko market trends, reversals, aur potential breakouts ke baare mein malumat faraham karta hai.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Bollinger_Bands_to_Gauge_Trends_Oct_2020-03-11daeb096d8045e395432b57de6bfa06.jpg)

2. (How Bollinger Bands Work):

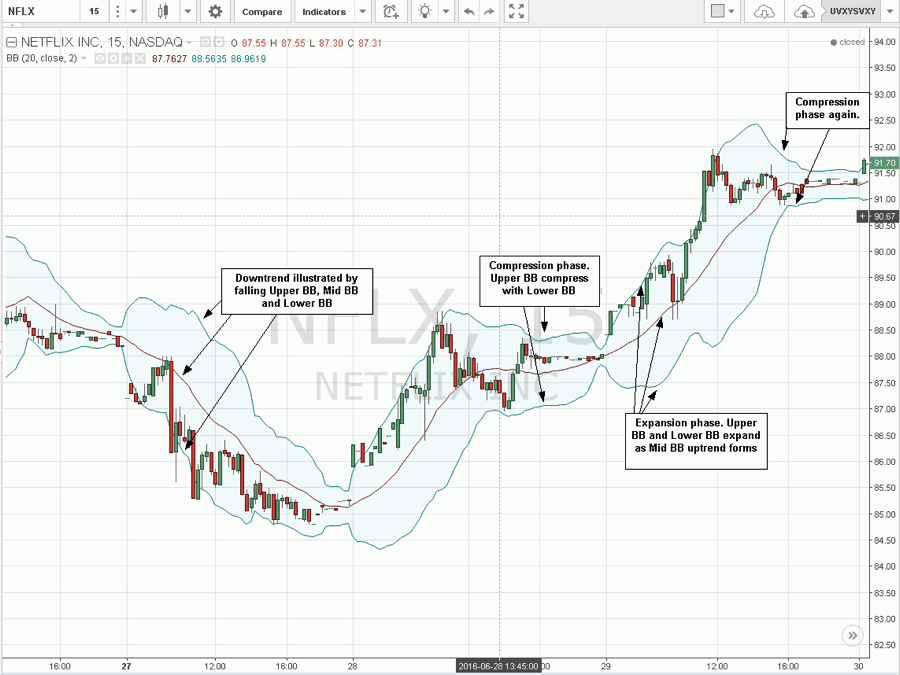

Bollinger Bands, market price ke aas paas ek set of lines hote hain jo volatility aur price levels ko darust karte hain. Yeh teesri party price indicators hote hain jo ke market ke current state ko represent karte hain. Bollinger Bands ek middle band aur do outer bands se mil kar bante hain. Middle band usually 20-day simple moving average (SMA) hota hai, jabke outer bands volatility ko measure karte hain.

3. (Construction of Bollinger Bands):

- Middle Band (Middle Band): Middle band, jo ke 20-day SMA hota hai, market ke trend ko represent karta hai. Yeh traders ko trend ka pata lagane mein madad deta hai.

- Upper Band (Upper Band): Upper band, middle band ke 20-day standard deviation ke ek multiple par mojood hota hai. Yeh volatility ko darust karta hai aur traders ko overbought conditions ko pehchanne mein madad deta hai.

- Lower Band (Lower Band): Lower band bhi middle band ke 20-day standard deviation ke ek multiple par mojood hota hai. Yeh volatility ko darust karta hai aur traders ko oversold conditions ko pehchanne mein madad deta hai.

4. (Bollinger Bands ke Sath Trading Strategies):

- Bollinger Squeeze: Jab market mein volatility kam hoti hai, Bollinger Bands narrow ho jate hain, is phenomenon ko "Bollinger Squeeze" kehte hain. Traders is situation mein future price breakout ki talaash mein hote hain.

- Overbought and Oversold Conditions: Jab prices upper band ke qareeb hote hain, yeh indicate karta hai ke market overbought hai aur prices girne ke amkaan hain. Jab prices lower band ke qareeb hote hain, yeh indicate karta hai ke market oversold hai aur prices barhne ke amkaan hain.

5. (Bollinger Bands and Market Trends):

- Trend Confirmation: Bollinger Bands ka istemal trend confirmation ke liye hota hai. Jab prices middle band ke around hote hain, toh yeh indicate karta hai ke market mein trend hai.

- Trend Reversals: Agar prices upper band ya lower band ke qareeb hain, toh yeh trend reversal ka indication ho sakta hai. Traders is situation mein apne positions ko adjust karte hain.

6. (Limitations of Bollinger Bands):

- Lack of Precision: Bollinger Bands ka istemal precision ke liye mushkil ho sakta hai kyun ke market dynamics mein tabdiliyan hoti rehti hain.

- Not Standalone Indicator: Bollinger Bands ko standalone indicator ke taur par istemal karna thoda mushkil ho sakta hai, is liye traders ko doosre technical indicators ke saath combine karna chahiye.

7. (Pros and Cons of Bollinger Bands):

- Pros: Bollinger Bands market trends, reversals, aur volatility ko identify karne mein madadgar hote hain. Inka istemal trading strategies mein versatility la sakta hai.

- Cons: Bollinger Bands ka istemal keval market conditions ko samajhne ke liye sufficient nahi hota, iske saath doosre indicators ki zarurat hoti hai. Yeh bhi yaad rakhna chahiye ke past performance future results ko accurately predict nahi karti.

Bollinger Band Indicator, traders ke liye aik mawafiqat ka jazba hai jo market trends aur volatility ko samajhne mein madad karta hai. Iska sahi istemal karke,

تبصرہ

Расширенный режим Обычный режим