What is Bollinger Band Indicator:

Bollinger band aik technical hain, oopar walay band aur nichale band center band ke tarjeehi inhiraf hain. ounchay band ko aam tor par center band ke oopar mayaari inhiraf muqarrar kya jata hai, aur nichale band ke neechay taqreeban do umomi inhiraf hotay hain. Bollinger band bunyadi tor par is tasawwur par mabni hotay hain ke fees band ke andar hi rehti hai, aur agar woh band ke bahar muntaqil hotay hain, to is ka matlab mumkina charge ulat jana ya tasalsul ho sakta hai.

Calculation and Interpretation of Bollinger Band:

Bollinger band band ki choraai ka taayun karne ke liye aik shmaryati pemaiesh ka istemaal karte hain jisay utaar charhao kaha jata hai. band ke liye Maroof tarteeb 20 din ki harkat pazeeri ost se oopar aur is se neechay do maqbool inhiraf hain. jaisay jaisay sikyortiz ziyada ghair mustahkam hoti jati hain, band wasee hotay jatay hain, aur bohat kam utaar charhao walay adwaar mein, band moahida karte hain. tajir bazaar ke andar ziyada kharidari aur ziyada farokht ke halaat ko muntakhib karne ke liye Bollinger bindz ka istemaal karte hain. jab akhrajaat band se rabita karte hain ya bahar gardish karte hain, to yeh is baat ki waqalat kar sakta hai ke fees mein had se ziyada tosee ki gayi hai aur is ke bar aks ho sakta hai.

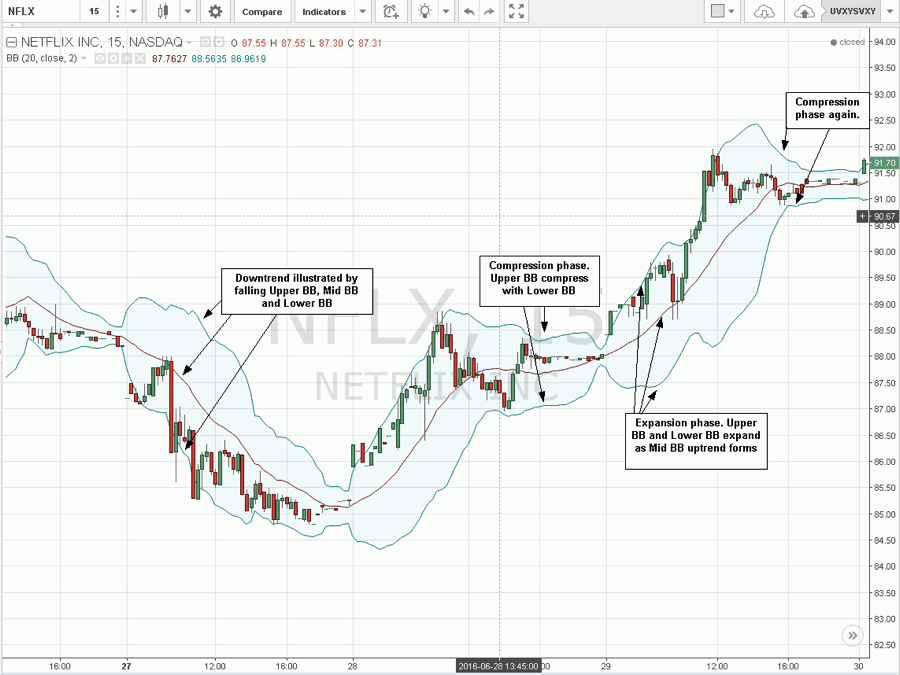

Using Bollinger Band for Trend Analysis:

Bollinger band ko istemaal karne ka aik mashhoor tareeqa rujhan ke tajziye ke liye hai. jab charge behtar rujhan mein hota hai, to is mein taap band ki sawari karne ka rujhan hota hai, aur down trained ke douran, yeh nichale band ko gilaay laganay ka rujhan rakhta hai. tajir muddaton ki talaash karte hain jab ke sharah band se bahar nikal kar salahiyat ki kharidari aur farokht ke imkanaat ke tor par nikalti hai. misaal ke tor par, oopri band ke oopar aik break out bhi mojooda up trained ke tasalsul ka ishara day sakta hai, jabkay nichale band ke neechay aik break out ka matlab masla ko tabdeel karna ho sakta hai.

Bollinger Bands with Other Indicators:

Bollinger band aksar tijarti ishaaron ki tasdeeq ke liye deegar takneeki ishaaron ke sath istemaal hotay hain. misaal ke tor par, khredar ziyada kharidari ya ziyada farokht ke halaat ko samajhney ke liye Bollinger bindz ke sath rishta daar taaqat index ( are s aayi ) ka istemaal kar satke hain. mazeed bar-aan, kuch sarmaya car kharidari peda karne ya intabahat ko farogh dainay ke liye Bollinger bindz ke sath aam cross over muntaqil karne ka istemaal karte hain. apni noiyat ki munfarid alamaton ko yakja karkay, khredar kamyaab tijarat ke imkaan ko barha satke hain.

Bollinger Bands Strategies:

Khareed o farokht ki mukhtalif tknikin hain jo tajir Bollinger band ke sath istemaal karte hain. aik mashhoor tareeqa Bollinger band nichor hai, jis mein band mazbooti se ijtimai tor par moahida karte hain, jo kam utaar charhao ki nishandahi karta hai. tajir dabao ke baad fees mein kaafi tabdeeli ki tawaqqa karte hain, jo qabil qader tijarti mawaqay ka baais ban sakta hai. aik aur hikmat e amli yeh hai ke khareed o farokht ke ishaaron ki tasdeeq ke liye mom batii ki chhari ke sath Bollinger band ka itlaq kya jaye. majmoi tor par, Bollinger bindz kharidaron ko utaar charhao ka mutalea karne, paish Raft ki nishandahi karne aur ghair mulki currency ke bazaar ke andar tijarti isharay peda karne ke liye aik lachak dar tool paish karte hain.

Bollinger band aik technical hain, oopar walay band aur nichale band center band ke tarjeehi inhiraf hain. ounchay band ko aam tor par center band ke oopar mayaari inhiraf muqarrar kya jata hai, aur nichale band ke neechay taqreeban do umomi inhiraf hotay hain. Bollinger band bunyadi tor par is tasawwur par mabni hotay hain ke fees band ke andar hi rehti hai, aur agar woh band ke bahar muntaqil hotay hain, to is ka matlab mumkina charge ulat jana ya tasalsul ho sakta hai.

Calculation and Interpretation of Bollinger Band:

Bollinger band band ki choraai ka taayun karne ke liye aik shmaryati pemaiesh ka istemaal karte hain jisay utaar charhao kaha jata hai. band ke liye Maroof tarteeb 20 din ki harkat pazeeri ost se oopar aur is se neechay do maqbool inhiraf hain. jaisay jaisay sikyortiz ziyada ghair mustahkam hoti jati hain, band wasee hotay jatay hain, aur bohat kam utaar charhao walay adwaar mein, band moahida karte hain. tajir bazaar ke andar ziyada kharidari aur ziyada farokht ke halaat ko muntakhib karne ke liye Bollinger bindz ka istemaal karte hain. jab akhrajaat band se rabita karte hain ya bahar gardish karte hain, to yeh is baat ki waqalat kar sakta hai ke fees mein had se ziyada tosee ki gayi hai aur is ke bar aks ho sakta hai.

Using Bollinger Band for Trend Analysis:

Bollinger band ko istemaal karne ka aik mashhoor tareeqa rujhan ke tajziye ke liye hai. jab charge behtar rujhan mein hota hai, to is mein taap band ki sawari karne ka rujhan hota hai, aur down trained ke douran, yeh nichale band ko gilaay laganay ka rujhan rakhta hai. tajir muddaton ki talaash karte hain jab ke sharah band se bahar nikal kar salahiyat ki kharidari aur farokht ke imkanaat ke tor par nikalti hai. misaal ke tor par, oopri band ke oopar aik break out bhi mojooda up trained ke tasalsul ka ishara day sakta hai, jabkay nichale band ke neechay aik break out ka matlab masla ko tabdeel karna ho sakta hai.

Bollinger Bands with Other Indicators:

Bollinger band aksar tijarti ishaaron ki tasdeeq ke liye deegar takneeki ishaaron ke sath istemaal hotay hain. misaal ke tor par, khredar ziyada kharidari ya ziyada farokht ke halaat ko samajhney ke liye Bollinger bindz ke sath rishta daar taaqat index ( are s aayi ) ka istemaal kar satke hain. mazeed bar-aan, kuch sarmaya car kharidari peda karne ya intabahat ko farogh dainay ke liye Bollinger bindz ke sath aam cross over muntaqil karne ka istemaal karte hain. apni noiyat ki munfarid alamaton ko yakja karkay, khredar kamyaab tijarat ke imkaan ko barha satke hain.

Bollinger Bands Strategies:

Khareed o farokht ki mukhtalif tknikin hain jo tajir Bollinger band ke sath istemaal karte hain. aik mashhoor tareeqa Bollinger band nichor hai, jis mein band mazbooti se ijtimai tor par moahida karte hain, jo kam utaar charhao ki nishandahi karta hai. tajir dabao ke baad fees mein kaafi tabdeeli ki tawaqqa karte hain, jo qabil qader tijarti mawaqay ka baais ban sakta hai. aik aur hikmat e amli yeh hai ke khareed o farokht ke ishaaron ki tasdeeq ke liye mom batii ki chhari ke sath Bollinger band ka itlaq kya jaye. majmoi tor par, Bollinger bindz kharidaron ko utaar charhao ka mutalea karne, paish Raft ki nishandahi karne aur ghair mulki currency ke bazaar ke andar tijarti isharay peda karne ke liye aik lachak dar tool paish karte hain.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Bollinger_Bands_to_Gauge_Trends_Oct_2020-03-11daeb096d8045e395432b57de6bfa06.jpg)

تبصرہ

Расширенный режим Обычный режим