**Triple Top Pattern: Ek Jaiza**

**Triple Top Pattern** ek bearish reversal pattern hai jo technical analysis mein use hota hai. Yeh pattern market ke peak formation aur trend reversal points ko identify karne ke liye traders ke liye valuable hota hai. Yahan Triple Top Pattern aur iska Forex trading mein role detail mein explain kiya gaya hai:

1. **Definition**:

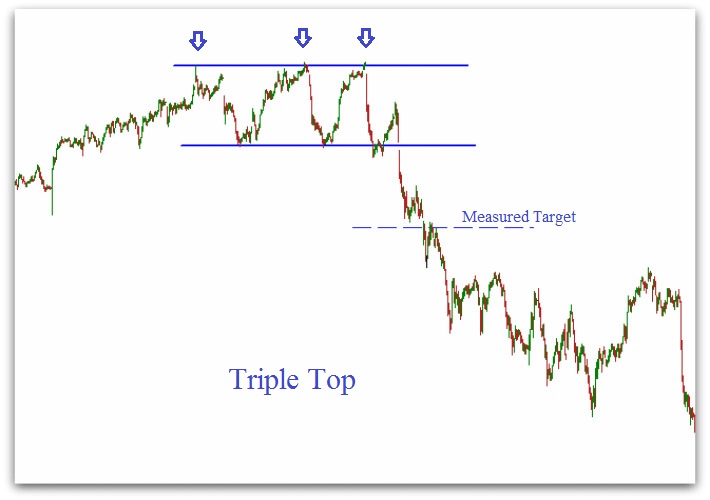

- Triple Top Pattern ek chart pattern hai jo teen high points (tops) ke formation se banta hai, jo ek resistance level ko indicate karte hain.

- Yeh pattern typically market ke bullish trend ke baad develop hota hai aur bearish trend ke reversal ka signal deta hai.

2. **Formation**:

- **Top 1**: Pehla top ek strong bullish move ke baad banta hai. Yeh price ka high point hota hai jo ek resistance level create karta hai.

- **Top 2**: Dusra top pehle top ke level ke aas-paas banta hai, indicating ke market resistance ko breach nahi kar pa raha.

- **Top 3**: Teesra top bhi pehle do tops ke level ke aas-paas banta hai, jo pattern ke completion ko confirm karta hai. Teesra top typically weaker hota hai aur market ki weakening bullish momentum ko reflect karta hai.

3. **Significance**:

- **Bearish Reversal**: Triple Top Pattern market ke bullish trend ke end aur bearish trend ke start ko signal karta hai. Yeh pattern resistance level ko repeatedly test karta hai aur fail hota hai, jisse trend reversal ka signal milta hai.

- **Resistance Level**: Pattern ke tops ke beech ka resistance level market ke strong selling pressure aur trend reversal ka indication hota hai.

4. **Trading Strategy**:

- **Entry Signal**: Triple Top Pattern ke completion ke baad, market ke breakdown ko confirm karne ke liye sell signal generate hota hai. Yeh signal pattern ke low ke niche ke breakout ke sath confirm hota hai.

- **Stop-Loss**: Risk management ke liye stop-loss ko pattern ke tops ke level ke upar set kiya jata hai. Yeh additional losses ko minimize karne ke liye help karta hai.

- **Take-Profit**: Profit targets ko pattern ke height ke basis par set kiya jata hai. Pattern ke height ko breakout point se minus karke potential profit targets define kiye jate hain.

5. **Pattern Validation**:

- **Volume Analysis**: Triple Top Pattern ke signals ko volume analysis ke saath validate kiya jata hai. Typically, volume trend reversal ke signals ko support karta hai. Pehle do tops ke sath volume zyada hota hai aur teesra top ke sath volume decrease hota hai.

- **Additional Indicators**: Moving Averages, RSI, aur MACD jaise indicators bhi pattern ke effectiveness ko confirm karne ke liye use kiye jate hain. Yeh indicators market ke trend strength aur reversal points ko validate karte hain.

6. **Limitations**:

- **False Signals**: Triple Top Pattern false signals bhi generate kar sakta hai agar market conditions aur additional indicators se confirm na ho. Yeh pattern choppy markets mein unreliable ho sakta hai.

- **Market Conditions**: Pattern ki effectiveness market conditions aur volatility ke basis par vary kar sakti hai. Yeh important hai ke market context ko consider kiya jaye.

Triple Top Pattern Forex trading mein bearish trend reversals ko accurately identify karne ke liye ek valuable tool hai. Is pattern ko sahi tarah se samajhkar aur additional confirmation tools ke sath use karke trading decisions ko optimize kiya ja sakta hai.

**Triple Top Pattern** ek bearish reversal pattern hai jo technical analysis mein use hota hai. Yeh pattern market ke peak formation aur trend reversal points ko identify karne ke liye traders ke liye valuable hota hai. Yahan Triple Top Pattern aur iska Forex trading mein role detail mein explain kiya gaya hai:

1. **Definition**:

- Triple Top Pattern ek chart pattern hai jo teen high points (tops) ke formation se banta hai, jo ek resistance level ko indicate karte hain.

- Yeh pattern typically market ke bullish trend ke baad develop hota hai aur bearish trend ke reversal ka signal deta hai.

2. **Formation**:

- **Top 1**: Pehla top ek strong bullish move ke baad banta hai. Yeh price ka high point hota hai jo ek resistance level create karta hai.

- **Top 2**: Dusra top pehle top ke level ke aas-paas banta hai, indicating ke market resistance ko breach nahi kar pa raha.

- **Top 3**: Teesra top bhi pehle do tops ke level ke aas-paas banta hai, jo pattern ke completion ko confirm karta hai. Teesra top typically weaker hota hai aur market ki weakening bullish momentum ko reflect karta hai.

3. **Significance**:

- **Bearish Reversal**: Triple Top Pattern market ke bullish trend ke end aur bearish trend ke start ko signal karta hai. Yeh pattern resistance level ko repeatedly test karta hai aur fail hota hai, jisse trend reversal ka signal milta hai.

- **Resistance Level**: Pattern ke tops ke beech ka resistance level market ke strong selling pressure aur trend reversal ka indication hota hai.

4. **Trading Strategy**:

- **Entry Signal**: Triple Top Pattern ke completion ke baad, market ke breakdown ko confirm karne ke liye sell signal generate hota hai. Yeh signal pattern ke low ke niche ke breakout ke sath confirm hota hai.

- **Stop-Loss**: Risk management ke liye stop-loss ko pattern ke tops ke level ke upar set kiya jata hai. Yeh additional losses ko minimize karne ke liye help karta hai.

- **Take-Profit**: Profit targets ko pattern ke height ke basis par set kiya jata hai. Pattern ke height ko breakout point se minus karke potential profit targets define kiye jate hain.

5. **Pattern Validation**:

- **Volume Analysis**: Triple Top Pattern ke signals ko volume analysis ke saath validate kiya jata hai. Typically, volume trend reversal ke signals ko support karta hai. Pehle do tops ke sath volume zyada hota hai aur teesra top ke sath volume decrease hota hai.

- **Additional Indicators**: Moving Averages, RSI, aur MACD jaise indicators bhi pattern ke effectiveness ko confirm karne ke liye use kiye jate hain. Yeh indicators market ke trend strength aur reversal points ko validate karte hain.

6. **Limitations**:

- **False Signals**: Triple Top Pattern false signals bhi generate kar sakta hai agar market conditions aur additional indicators se confirm na ho. Yeh pattern choppy markets mein unreliable ho sakta hai.

- **Market Conditions**: Pattern ki effectiveness market conditions aur volatility ke basis par vary kar sakti hai. Yeh important hai ke market context ko consider kiya jaye.

Triple Top Pattern Forex trading mein bearish trend reversals ko accurately identify karne ke liye ek valuable tool hai. Is pattern ko sahi tarah se samajhkar aur additional confirmation tools ke sath use karke trading decisions ko optimize kiya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим