What is Impulse Wave Pattern:

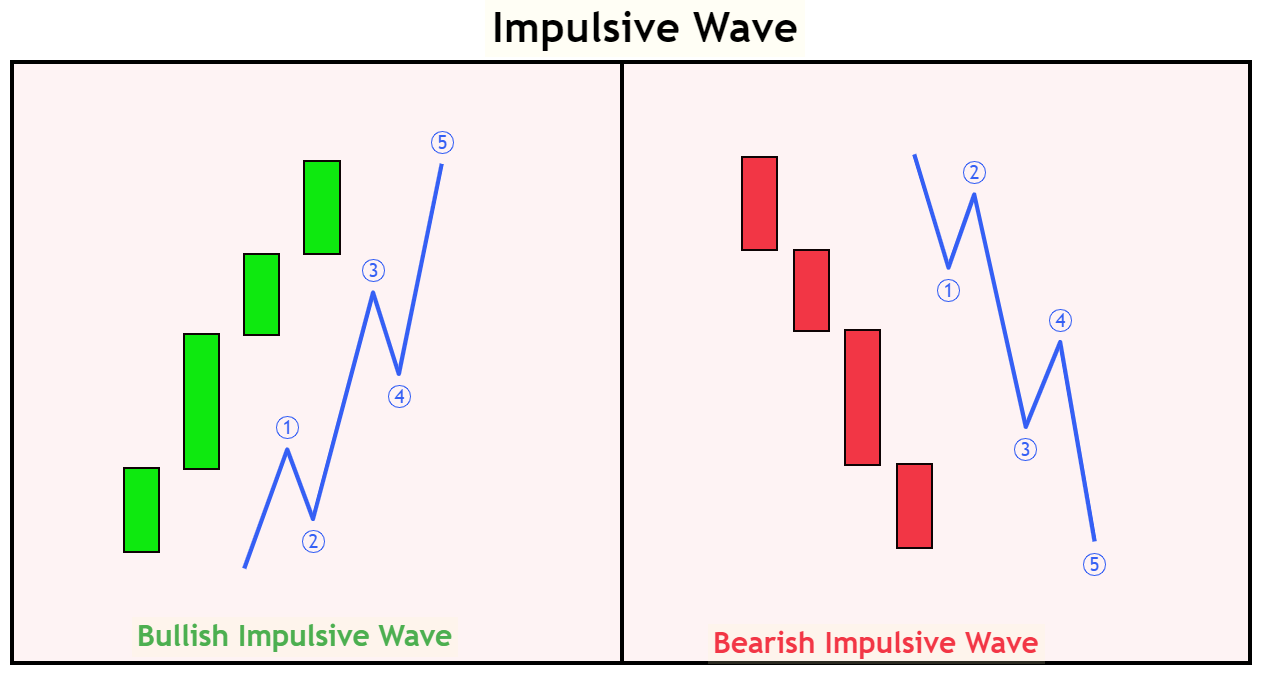

Impulse Wave patteren takneeki tajzia mein ziyada se ziyada bunyadi mayarat mein se aik hai, khaas tor par zar e mubadla ki tijarat ke shobay mein. yeh aylit Wave theory ka aik ahem jazo hai, jo 1930 ki dahai mein ralf nelson aylit ke zariye paish kya gaya tha. Impulse Wave ka namona up trained ya down trained dono mein ghair mulki raqam ke jore ki harkat ki numaindagi karta hai. yeh paanch lehron par mushtamil hai, jin ki darja bandi 1, 2, 3, 4, aur 5 ke tor par ki gayi hai, jis mein laharen 1, 3, aur 5 fatihana andaaz ke douran harkat karti hain, aur laharen 2 aur 4 islahi lehron ke tor par zahir hoti hain. Impulse Wave patteren ko samjhna ghair mulki currency ke taajiron ke liye ahem hai kyunkay yeh aam rujhan ki simt ke ilawa salahiyat tak rasai aur bahar jane ke awamil ko samajhney mein sahoolat faraham karta hai.

Characteristic of Impulse Wave Pattern:

Impulse Wave ka namona Maroof tor par kayi khaslato ko zahir karta hai jo usay baghair kisi mushkil ke deegar lehar ke namonon se mumtaz karta hai. sab se pehlay, aik up trained mein, lehron 1, 3, aur paanch ko Impulse lehron ke tor par label kya jata hai, jis se mazboot kharidari ke tanao aur oopar ki taraf harkat ka ishara hota hai. is ke bar aks, down trained mein, lehron 1, 3, aur paanch ko Impulse lehron ke tor par darja band kya jata hai, jo barray farogh dainay walay tanao aur neechay ki harkat ki nishandahi karte hain. yeh Impulse laharen mazboot hoti hain aur baqaidagi se mukammal size ki sharah harkat latayen hain.

Dosra, laharen 2 aur 4 ko islahi lehron ke tor par darja band kya gaya hai. woh counter trained chalon ko injaam dete hain jo Sabiqa Impulse lehar ke aik hissay ko peechay hatatay hain. yeh islahi laharen Impulse lehron ke zariye peda honay wali ziyada kharidari ya ziyada farokht honay wali sorat e haal ko kam karne mein madad karti hain aur kharidaron ko un pitt ya apni position par up load karne ka mauqa faraham karti hain.

Trading With Impulse Wave Pattern:

Forex mein Impulse Wave patteren ki trading ke liye takneeki tshkhisi gear aur market ki harkiyaat ki gehri maloomat ka murakkab darkaar hota hai. aik mashhoor tareeqa yeh hai ke lehar 2 ya 4 mein pal back ka intzaar kya jaye aur jeetnay wali Impulse lehar ke rastay mein aik mutabadil daakhil kya jaye. yeh hikmat e amli majmoi fashion ki salahiyat ke tasalsul ka faida uthaati hai.

Aik aam taknik yeh hai ke fashion ki simt ki tasdeeq karne aur salahiyat tak rasai aur bahar niklny ke awamil ko samajhney ke liye transfer average, trained lines aur oscalter par mushtamil mutadid alamaat ka itlaq kya jaye. misaal ke tor par, aik dealer up trained mein Impulse Wave ke aaghaz ki tasdeeq karne ke liye taizi se chalne walay ost cross over ya trained line ke khandarath ki bhi talaash kar sakta hai.

Mazeed bar-aan, tajir –apne tajziye ki mazeed himayat karne ke liye izafi tor par mom batii ki chhari ke andaaz aur chart ke namoonay istemaal kar satke hain. misaal ke tor par, aik taizi se dhalnay wali mom batii ki chhari ka namona ya mutanasib masalas patteren ka tukda izafi tor par aik up trained mein aik Impulse lehar ki salahiyat ke tasalsul ki tajweez kar sakta hai.

Usimg Impulse Wave Pattern in Multiple Time Frames:

Impulse Wave patteren aik qisam ke time frames mein paaya ja sakta hai, mukhtasir muddat ke intra day charts se le kar taweel mudti har din, hafta waar, ya mahana charts tak. waqt ke frame se qata nazar, Impulse Wave patteren ki khususiyaat barabar rehti hain, taham lehron ki lambai aur qader bhi mukhtalif ho sakti hai.

Intra day charts samait qaleel mudti time frames mein, Impulse Wave patteren izafi tor par kuch ghanton ya minute ke andar bhi ho sakta hai. woh tajir jo qaleel mudti tijarat ko tasleem karte hain woh is namoonay ko mumkina qaleel mudti aamdani ke mawaqay ko muntakhib karne ke liye bhi istemaal kar satke hain.

Identifying Impulse Wave Pattern:

Impulse Wave patteren ki shanakht karne ke liye takneeki tshkhisi gear ke majmoay ki zaroorat hoti hai aur lutaf uthayen. taajiron ko paanch lehron ka aik saaf majmoa talaash karna chahiye, jis mein laharen 1, 3, aur 5 mojooda rujhan ke douran harkat karti hain aur laharen 2 aur 4 islahi lehron ke tor par kaam karti hain.

Mazeed bar-aan, sarmaya karon ko har lehar ke dhanchay aur is ki pichli aur anay wali lehron se mutabqat ka notice lainay ki zaroorat hai. Impulse lehron ko aam tor par mazboot hona parta hai aur is mein ziyada sharah ke iqdamaat hotay hain, jis terhan islahi lehron ko Sabiqa Impulse lehar ke aik hissay ko peechay hatana parta hai.

Impulse Wave patteren takneeki tajzia mein ziyada se ziyada bunyadi mayarat mein se aik hai, khaas tor par zar e mubadla ki tijarat ke shobay mein. yeh aylit Wave theory ka aik ahem jazo hai, jo 1930 ki dahai mein ralf nelson aylit ke zariye paish kya gaya tha. Impulse Wave ka namona up trained ya down trained dono mein ghair mulki raqam ke jore ki harkat ki numaindagi karta hai. yeh paanch lehron par mushtamil hai, jin ki darja bandi 1, 2, 3, 4, aur 5 ke tor par ki gayi hai, jis mein laharen 1, 3, aur 5 fatihana andaaz ke douran harkat karti hain, aur laharen 2 aur 4 islahi lehron ke tor par zahir hoti hain. Impulse Wave patteren ko samjhna ghair mulki currency ke taajiron ke liye ahem hai kyunkay yeh aam rujhan ki simt ke ilawa salahiyat tak rasai aur bahar jane ke awamil ko samajhney mein sahoolat faraham karta hai.

Characteristic of Impulse Wave Pattern:

Impulse Wave ka namona Maroof tor par kayi khaslato ko zahir karta hai jo usay baghair kisi mushkil ke deegar lehar ke namonon se mumtaz karta hai. sab se pehlay, aik up trained mein, lehron 1, 3, aur paanch ko Impulse lehron ke tor par label kya jata hai, jis se mazboot kharidari ke tanao aur oopar ki taraf harkat ka ishara hota hai. is ke bar aks, down trained mein, lehron 1, 3, aur paanch ko Impulse lehron ke tor par darja band kya jata hai, jo barray farogh dainay walay tanao aur neechay ki harkat ki nishandahi karte hain. yeh Impulse laharen mazboot hoti hain aur baqaidagi se mukammal size ki sharah harkat latayen hain.

Dosra, laharen 2 aur 4 ko islahi lehron ke tor par darja band kya gaya hai. woh counter trained chalon ko injaam dete hain jo Sabiqa Impulse lehar ke aik hissay ko peechay hatatay hain. yeh islahi laharen Impulse lehron ke zariye peda honay wali ziyada kharidari ya ziyada farokht honay wali sorat e haal ko kam karne mein madad karti hain aur kharidaron ko un pitt ya apni position par up load karne ka mauqa faraham karti hain.

Trading With Impulse Wave Pattern:

Forex mein Impulse Wave patteren ki trading ke liye takneeki tshkhisi gear aur market ki harkiyaat ki gehri maloomat ka murakkab darkaar hota hai. aik mashhoor tareeqa yeh hai ke lehar 2 ya 4 mein pal back ka intzaar kya jaye aur jeetnay wali Impulse lehar ke rastay mein aik mutabadil daakhil kya jaye. yeh hikmat e amli majmoi fashion ki salahiyat ke tasalsul ka faida uthaati hai.

Aik aam taknik yeh hai ke fashion ki simt ki tasdeeq karne aur salahiyat tak rasai aur bahar niklny ke awamil ko samajhney ke liye transfer average, trained lines aur oscalter par mushtamil mutadid alamaat ka itlaq kya jaye. misaal ke tor par, aik dealer up trained mein Impulse Wave ke aaghaz ki tasdeeq karne ke liye taizi se chalne walay ost cross over ya trained line ke khandarath ki bhi talaash kar sakta hai.

Mazeed bar-aan, tajir –apne tajziye ki mazeed himayat karne ke liye izafi tor par mom batii ki chhari ke andaaz aur chart ke namoonay istemaal kar satke hain. misaal ke tor par, aik taizi se dhalnay wali mom batii ki chhari ka namona ya mutanasib masalas patteren ka tukda izafi tor par aik up trained mein aik Impulse lehar ki salahiyat ke tasalsul ki tajweez kar sakta hai.

Usimg Impulse Wave Pattern in Multiple Time Frames:

Impulse Wave patteren aik qisam ke time frames mein paaya ja sakta hai, mukhtasir muddat ke intra day charts se le kar taweel mudti har din, hafta waar, ya mahana charts tak. waqt ke frame se qata nazar, Impulse Wave patteren ki khususiyaat barabar rehti hain, taham lehron ki lambai aur qader bhi mukhtalif ho sakti hai.

Intra day charts samait qaleel mudti time frames mein, Impulse Wave patteren izafi tor par kuch ghanton ya minute ke andar bhi ho sakta hai. woh tajir jo qaleel mudti tijarat ko tasleem karte hain woh is namoonay ko mumkina qaleel mudti aamdani ke mawaqay ko muntakhib karne ke liye bhi istemaal kar satke hain.

Identifying Impulse Wave Pattern:

Impulse Wave patteren ki shanakht karne ke liye takneeki tshkhisi gear ke majmoay ki zaroorat hoti hai aur lutaf uthayen. taajiron ko paanch lehron ka aik saaf majmoa talaash karna chahiye, jis mein laharen 1, 3, aur 5 mojooda rujhan ke douran harkat karti hain aur laharen 2 aur 4 islahi lehron ke tor par kaam karti hain.

Mazeed bar-aan, sarmaya karon ko har lehar ke dhanchay aur is ki pichli aur anay wali lehron se mutabqat ka notice lainay ki zaroorat hai. Impulse lehron ko aam tor par mazboot hona parta hai aur is mein ziyada sharah ke iqdamaat hotay hain, jis terhan islahi lehron ko Sabiqa Impulse lehar ke aik hissay ko peechay hatana parta hai.

:max_bytes(150000):strip_icc()/ImpulseWavePattern2-4fbe1579a90d41a7aede49886eae1e85.png)

:max_bytes(150000):strip_icc()/aet-a-5bfc386946e0fb00260eac4c.png)

تبصرہ

Расширенный режим Обычный режим