Assalmualikum aj is thread me apko me Pakistan Forex trading ke ak bhot he important topic risk management ke bare me btao ga or me umeed karta ho ke jo information me apse share kro ga wo apke knowledge or experience me zaror izafa kare ge.

1. Ta'aruf (Introduction):

Forex trading mein risk management ka kirdar buhat ahem hai. Yeh ta'eed aur tajwezat ki bunyad par mushtamil hota hai jo tijarat karne walay ko nuqsaan se bachane mein madad karta hai.

2. Asool (Principles):

Risk management forex trading mein asoolon ka paigham hai. Kamyabi ke liye, tijarat karne walay ko apne maaliyat aur manasibat ki sahi tarjih aur tadabeer ka intezam karna zaroori hai.

3. Qeemat ka Moolya (Value of Money):

Forex trading mein her aik rupiya ka ahem moolya hota hai. Risk management, maaliyat ke istemaal mein muqarrar tajaweezat ke mutabiq kiya jata hai, jisse maaliyat ka sahi istemal ho aur nuqsaan se bacha ja sake.

4. Hisab Kitab (Accounting):

Risk management, hisab kitab aur hissa dari ka tareeqa bhi tajwez karta hai. Tijarat karne walay ko apne hisson ki sahi tarah se tehqiqat karni chahiye aur maaliyat ko monitor karna zaroori hai.

5. Nisbatan Tijarat (Position Sizing):

Risk management, nisbatan tijarat ka behtareen intezam hai. Iske zariye, tijarat karne walay apne hisson ko sahi tareeqay se dozakhon mein taqseem kar sakte hain, jisse nuqsaan kam ho aur munafa ziada.

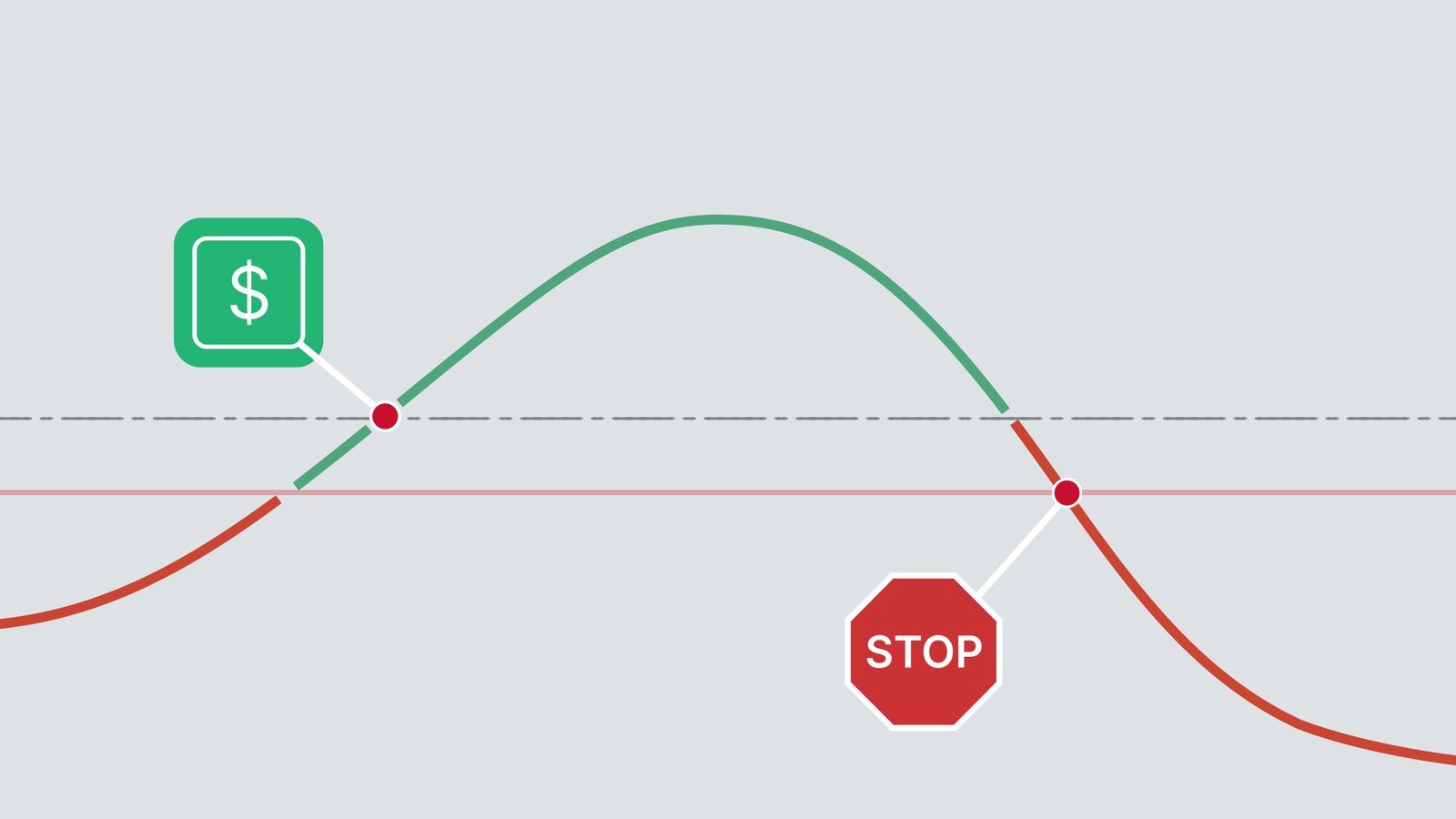

6. Hifazati Tadabeer (Protective Measures):

Forex trading mein hifazati tadabeer ka istemal bhi risk management ka hissa hai. Stop-loss orders aur doosre hifazati tajaweezat se tijarat karne walay apne maaliyat ko hifazati se chalate hain.

7. Jismani aur Zehni Tawon (Physical and Mental Well-being):

Risk management, jismani aur zehni tawon ka bhi khayal rakhta hai. Tijarat mein kamiyabi ke liye, tijarat karne walay ko tawon ko hifazati se rakhna zaroori hai.

8. Ilm aur Tehqiqat (Knowledge and Research):

Ilm aur tehqiqat, risk management mein eham hai. Forex trading mein kamiyabi ke liye, tijarat karne walay ko market trends aur economic indicators ko samajhna zaroori hai.

Ikhtitami Alfaz (Conclusion):

Forex trading mein risk management, tajwezat aur hisab kitab ka behtareen intezam tijarat karne walay ko nuqsaan se bachane mein madad karta hai aur usay munafa hasil karne mein sahayak hota hai. Isi liye, har tijarat karne wala ko apne risk management ka tajaweezati hissa bana lena chahiye.

1. Ta'aruf (Introduction):

Forex trading mein risk management ka kirdar buhat ahem hai. Yeh ta'eed aur tajwezat ki bunyad par mushtamil hota hai jo tijarat karne walay ko nuqsaan se bachane mein madad karta hai.

2. Asool (Principles):

Risk management forex trading mein asoolon ka paigham hai. Kamyabi ke liye, tijarat karne walay ko apne maaliyat aur manasibat ki sahi tarjih aur tadabeer ka intezam karna zaroori hai.

3. Qeemat ka Moolya (Value of Money):

Forex trading mein her aik rupiya ka ahem moolya hota hai. Risk management, maaliyat ke istemaal mein muqarrar tajaweezat ke mutabiq kiya jata hai, jisse maaliyat ka sahi istemal ho aur nuqsaan se bacha ja sake.

4. Hisab Kitab (Accounting):

Risk management, hisab kitab aur hissa dari ka tareeqa bhi tajwez karta hai. Tijarat karne walay ko apne hisson ki sahi tarah se tehqiqat karni chahiye aur maaliyat ko monitor karna zaroori hai.

5. Nisbatan Tijarat (Position Sizing):

Risk management, nisbatan tijarat ka behtareen intezam hai. Iske zariye, tijarat karne walay apne hisson ko sahi tareeqay se dozakhon mein taqseem kar sakte hain, jisse nuqsaan kam ho aur munafa ziada.

6. Hifazati Tadabeer (Protective Measures):

Forex trading mein hifazati tadabeer ka istemal bhi risk management ka hissa hai. Stop-loss orders aur doosre hifazati tajaweezat se tijarat karne walay apne maaliyat ko hifazati se chalate hain.

7. Jismani aur Zehni Tawon (Physical and Mental Well-being):

Risk management, jismani aur zehni tawon ka bhi khayal rakhta hai. Tijarat mein kamiyabi ke liye, tijarat karne walay ko tawon ko hifazati se rakhna zaroori hai.

8. Ilm aur Tehqiqat (Knowledge and Research):

Ilm aur tehqiqat, risk management mein eham hai. Forex trading mein kamiyabi ke liye, tijarat karne walay ko market trends aur economic indicators ko samajhna zaroori hai.

Ikhtitami Alfaz (Conclusion):

Forex trading mein risk management, tajwezat aur hisab kitab ka behtareen intezam tijarat karne walay ko nuqsaan se bachane mein madad karta hai aur usay munafa hasil karne mein sahayak hota hai. Isi liye, har tijarat karne wala ko apne risk management ka tajaweezati hissa bana lena chahiye.

تبصرہ

Расширенный режим Обычный режим