What is Hikkake Pattern:

Hikkake patteren aik takneeki chart patteren hai jo aam tor par forex trading mein rujhanaat ke ulat jane ki paish goi ke liye istemaal hota hai. yeh deegar mashhoor mom btyon ke namonon ke muqablay mein aik kam Maroof namona hai, lekin muaser tareeqay se istemaal honay par yeh kharidaron ke liye aik qeemti aala ho sakta hai. Hikkake patteren bunyadi tor par salahiyat ke break out ya sharah ki naqal o harkat mein ulat palat se aagah honay ke liye istemaal hota hai, jis se taajiron ko mauqa par pozishnon mein jane ya bahar niklny mein madad millti hai.

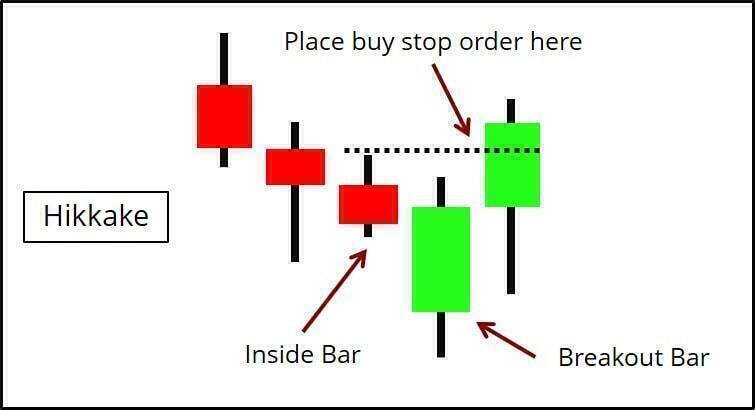

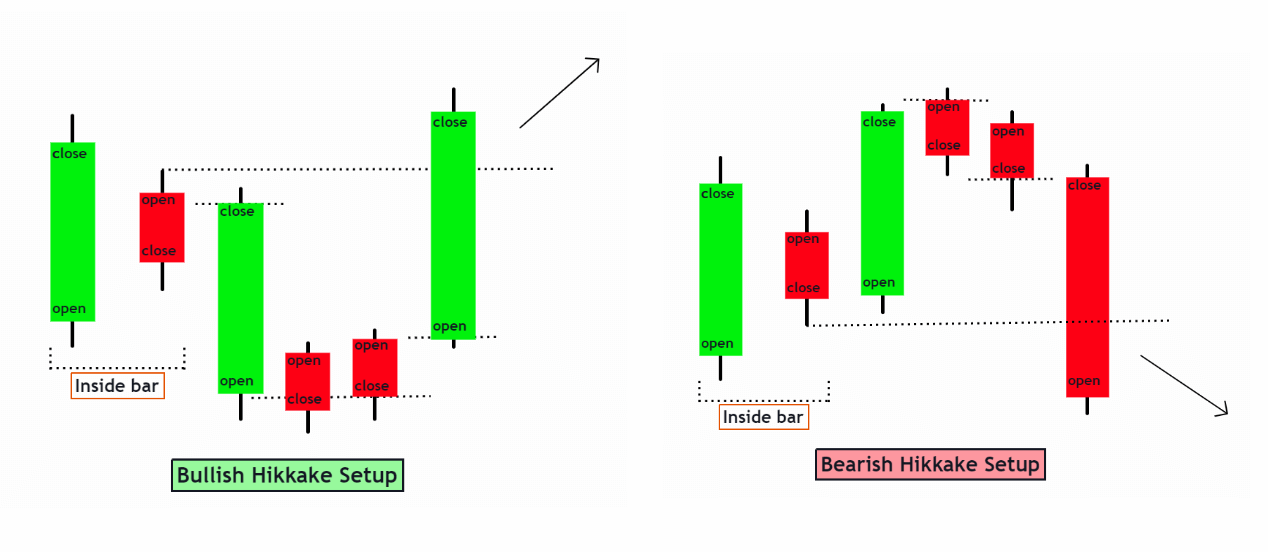

Hikkake patteren 3 kaleedi additives par mushtamil hai : aik androoni baar, aik ghalat break out, aur agla break out. namona aam tor par market mein istehkaam ya side way harkat ki lambai ke baad hota hai. yeh mushahida karna bohat zaroori hai ke Hikkake patteren ko kisi bhi waqt ke frame par pehchana ja sakta hai, jis se yeh mukhtalif khareed o farokht ki hikmat amlyon se mutaliq hota hai.

Anatomy of Hikkake Pattern:

Hikkake patteren aik androoni baar ke sath shuru hota hai, jo ke aik mom batii ki chhari hai jo pichli mom batii ki chhari se behtar kam aur kam onche hoti hai. yeh qeemat ki harkat mein sanchan ko zahir karta hai aur aksar break out ya ulat se pehlay hota hai. taajiron ko androoni baar ki had se aagah honay ki zaroorat hai, kyunkay aik choti qisam ziyada taaqatwar break out ya ulat jane ka ishara bhi day sakti hai.

Is ke baad, Hikkake namona kaghazi karwai aik ghalat break out hai. aisa is waqt hota hai jab fees androoni baar ki had se bahar nikal jati hai lekin phir taizi se ulat jati hai, aur had ke andar wapas aa jati hai. yeh jaali break out un sarmaya karon ko hasta hai jo break out ke douran pozishnon mein daakhil hue, jis ki wajah se mukhalif rastay mein salahiyat ulat jati hai.

Aakhir mein, Hikkake ka namona baad ke break out ke sath ulat jane ki tasdeeq karta hai. yeh break out is waqt hota hai jab qeemat androoni baar ke ounchay ya nichale hissay ko peechay chore deti hai, jo market ke jazbaat mein tabdeeli ki nishandahi karti hai. tajir is break out ko ulat jane ki tasdeeq ke tor par istemaal kar satke hain aur naye rastay ke andar position daakhil kar satke hain.

Trading With Hikkake Pattern:

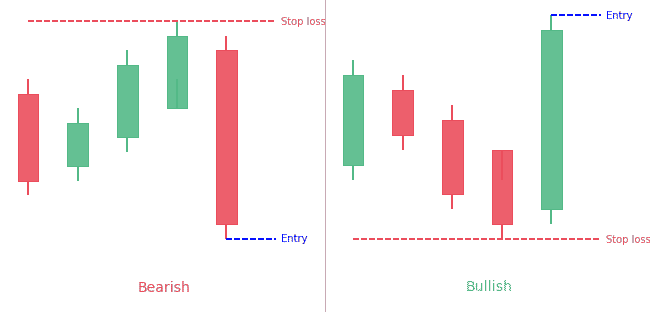

Khareed o farokht ki kayi hikmat e amli hain jin ka istemaal tajir Hikkake patteren ke liye muqarrar kar satke hain. aik tareeqa yeh hai ke tabadlay mein daakhil honay se pehlay tasdeeq ke break out par nazar rakhi jaye. yeh kamyabi ke behtar imkaan ki zamanat deta hai, kyunkay break out ulat jane ki tasdeeq karta hai. tajir mandarja zail bahao ko pakarney ke liye androoni baar ke ziyada ya kam se thora oopar ya neechay rasai ke order muqarrar kar satke hain.

Aik aur hikmat e amli mein jaali break out ki tijarat shaamil hai. tajir break out ke rastay mein position daakhil kar satke hain lekin ulat jane ki soorat mein salahiyat ke nuqsaan ko mehdood karne ke liye sakht farist all las orders ka istemaal karte hain. is tareeqa car ke liye mohtaat khatray ke intizam ki zaroorat hoti hai aur yeh ziyada hunar mand kharidaron ke liye aala miyaar ka hai.

Confirmation and Validation of Hikkake Pattern:

Kisi bhi takneeki namoonay ki terhan, izafi takneeki tshkhisi gear ya isharay ka istemaal karte hue Hikkake namoonay ki toseeq karna zaroori hai. tajir Hikkake patteren ke zariye faraham kardah ulat nishaan ki tasdeeq ke liye trained lines, moving average, ya mukhtalif oscalter ka istemaal kar satke hain.

Is ke ilawa, sarmaya karon ko bazaar ki umomi haalat aur jazbaat par tawajah deeni chahiye. yeh zaroori hai ke is sayaq o Sabaq ko nah bhulen jis mein Hikkake ka namona hota hai. agar namona byorokrisi aik mazboot up trained ya down trained mein hai, to yeh is se kahin ziyada wazan uthata hai agar yeh kisi range ya na hamwar bazaar mein hota hai.

Limitations and Considerations of Hikkake Pattern:

Agarchay Hikkake ka namona sarmaya karon ke liye aik qeemti zareya ho sakta hai, lekin yeh hamesha apni hudood se bahar nahi hota hai. agar khredar mukammal tor par patteren par inhisaar karte hain to jhutay break out baqaidagi se peda ho satke hain, bunyadi tor par korray maarny aur nuqsanaat ka baais ban satke hain. lehaza, kamyabi ke imkanaat ko badhaane ke liye deegar takneeki tajzia alaat ke sath mil kar Hikkake ke namoonay ka itlaq karna bohat zaroori hai.

Taajiron ko is time frame ko bhi yaad rakhna chahiye jis par woh Hikkake patteren ke istemaal ke douran tijarat kar rahay hon ge. namona taweel time frames par ziyada qabil aetmaad ho sakta hai, jis mein rozana ya hafta waar chart shaamil hain, mukhtasir time frames ke muqablay mein, jahan shore aur jaali signals ziyada aam hain.

Hikkake patteren aik takneeki chart patteren hai jo aam tor par forex trading mein rujhanaat ke ulat jane ki paish goi ke liye istemaal hota hai. yeh deegar mashhoor mom btyon ke namonon ke muqablay mein aik kam Maroof namona hai, lekin muaser tareeqay se istemaal honay par yeh kharidaron ke liye aik qeemti aala ho sakta hai. Hikkake patteren bunyadi tor par salahiyat ke break out ya sharah ki naqal o harkat mein ulat palat se aagah honay ke liye istemaal hota hai, jis se taajiron ko mauqa par pozishnon mein jane ya bahar niklny mein madad millti hai.

Hikkake patteren 3 kaleedi additives par mushtamil hai : aik androoni baar, aik ghalat break out, aur agla break out. namona aam tor par market mein istehkaam ya side way harkat ki lambai ke baad hota hai. yeh mushahida karna bohat zaroori hai ke Hikkake patteren ko kisi bhi waqt ke frame par pehchana ja sakta hai, jis se yeh mukhtalif khareed o farokht ki hikmat amlyon se mutaliq hota hai.

Anatomy of Hikkake Pattern:

Hikkake patteren aik androoni baar ke sath shuru hota hai, jo ke aik mom batii ki chhari hai jo pichli mom batii ki chhari se behtar kam aur kam onche hoti hai. yeh qeemat ki harkat mein sanchan ko zahir karta hai aur aksar break out ya ulat se pehlay hota hai. taajiron ko androoni baar ki had se aagah honay ki zaroorat hai, kyunkay aik choti qisam ziyada taaqatwar break out ya ulat jane ka ishara bhi day sakti hai.

Is ke baad, Hikkake namona kaghazi karwai aik ghalat break out hai. aisa is waqt hota hai jab fees androoni baar ki had se bahar nikal jati hai lekin phir taizi se ulat jati hai, aur had ke andar wapas aa jati hai. yeh jaali break out un sarmaya karon ko hasta hai jo break out ke douran pozishnon mein daakhil hue, jis ki wajah se mukhalif rastay mein salahiyat ulat jati hai.

Aakhir mein, Hikkake ka namona baad ke break out ke sath ulat jane ki tasdeeq karta hai. yeh break out is waqt hota hai jab qeemat androoni baar ke ounchay ya nichale hissay ko peechay chore deti hai, jo market ke jazbaat mein tabdeeli ki nishandahi karti hai. tajir is break out ko ulat jane ki tasdeeq ke tor par istemaal kar satke hain aur naye rastay ke andar position daakhil kar satke hain.

Trading With Hikkake Pattern:

Khareed o farokht ki kayi hikmat e amli hain jin ka istemaal tajir Hikkake patteren ke liye muqarrar kar satke hain. aik tareeqa yeh hai ke tabadlay mein daakhil honay se pehlay tasdeeq ke break out par nazar rakhi jaye. yeh kamyabi ke behtar imkaan ki zamanat deta hai, kyunkay break out ulat jane ki tasdeeq karta hai. tajir mandarja zail bahao ko pakarney ke liye androoni baar ke ziyada ya kam se thora oopar ya neechay rasai ke order muqarrar kar satke hain.

Aik aur hikmat e amli mein jaali break out ki tijarat shaamil hai. tajir break out ke rastay mein position daakhil kar satke hain lekin ulat jane ki soorat mein salahiyat ke nuqsaan ko mehdood karne ke liye sakht farist all las orders ka istemaal karte hain. is tareeqa car ke liye mohtaat khatray ke intizam ki zaroorat hoti hai aur yeh ziyada hunar mand kharidaron ke liye aala miyaar ka hai.

Confirmation and Validation of Hikkake Pattern:

Kisi bhi takneeki namoonay ki terhan, izafi takneeki tshkhisi gear ya isharay ka istemaal karte hue Hikkake namoonay ki toseeq karna zaroori hai. tajir Hikkake patteren ke zariye faraham kardah ulat nishaan ki tasdeeq ke liye trained lines, moving average, ya mukhtalif oscalter ka istemaal kar satke hain.

Is ke ilawa, sarmaya karon ko bazaar ki umomi haalat aur jazbaat par tawajah deeni chahiye. yeh zaroori hai ke is sayaq o Sabaq ko nah bhulen jis mein Hikkake ka namona hota hai. agar namona byorokrisi aik mazboot up trained ya down trained mein hai, to yeh is se kahin ziyada wazan uthata hai agar yeh kisi range ya na hamwar bazaar mein hota hai.

Limitations and Considerations of Hikkake Pattern:

Agarchay Hikkake ka namona sarmaya karon ke liye aik qeemti zareya ho sakta hai, lekin yeh hamesha apni hudood se bahar nahi hota hai. agar khredar mukammal tor par patteren par inhisaar karte hain to jhutay break out baqaidagi se peda ho satke hain, bunyadi tor par korray maarny aur nuqsanaat ka baais ban satke hain. lehaza, kamyabi ke imkanaat ko badhaane ke liye deegar takneeki tajzia alaat ke sath mil kar Hikkake ke namoonay ka itlaq karna bohat zaroori hai.

Taajiron ko is time frame ko bhi yaad rakhna chahiye jis par woh Hikkake patteren ke istemaal ke douran tijarat kar rahay hon ge. namona taweel time frames par ziyada qabil aetmaad ho sakta hai, jis mein rozana ya hafta waar chart shaamil hain, mukhtasir time frames ke muqablay mein, jahan shore aur jaali signals ziyada aam hain.

تبصرہ

Расширенный режим Обычный режим