What is Bearish Flag Pattern:

Mandi ke jhanday ka namona ghair mulki zar e mubadla ki kharidari aur farokht mein daryaft honay wala aik maqbool chart namona hai jo neechay ki taraf rujhan ke salahiyat ke tasalsul ki nishandahi karta hai. usay aik qabil aetmaad namona samjha jata hai jo taajiron ko market mein mandi ki tehreek se faida uthany ka mauqa faraham karta hai. namoonay ko neechay ki taraf dhalwan channel ke zariye numaya kya jata hai, jo aik taiz istehkaam walay hissay ke zariye mushahida kardah taiz charge mein kami ke zariye tashkeel paata hai, jo jhanday se milta jalta hai.

Identifying Bearish Flag Pattern:

Mandi ke jhanday ka namona lainay ke liye, khredar darj zail ajzaa talaash karna chahtay hain:

1. Pol : pol ibtidayi taiz fees mein kami ki numaindagi karta hai, jo namoonay ke oopar ki taraf dhalwan walay flag pol ki tashkeel karta hai. yeh kami baqaidagi se aala tijarti hajam ke sath hoti hai.

2. Istehkaam ka marhala : qutub ke baad, aik istehkaam ka hissa hota hai, jis mein charge aik taraf ya baa-mushkil oopar ki taraf gardish karte hain. yeh kaghazi karwai patteren ke parcham walay hissay par hoti hai. istehkaam ke hissay ki khasusiyat tijarti had ko kam karne ka tareeqa hai, jo bazaar ki sargarmi mein kami ki nishandahi karta hai.

Conformation and Consideration in Bearish Flag Pattern:

Aik baar Bearish flag patteren ko pehchane jane ke baad, sarmaya karon ko mutabadil mein anay se pehlay patteren ki tasdeeq karne ki zaroorat hai. tasdeeq takneeki isharay aur sharah harkat ke tajziye ke zariye ki ja sakti hai. tabadlay ki tasdeeq karne aur is mein daakhil honay ki kuch tknikin yeh hain:

1. break out ki tasdeeq : jhanday ke namoonay ke guide marhalay ke neechay saaf aur qabil aetmaad samish ka intzaar karen. is break out ke sath kayi gina kharidari aur farokht ki had tak jane ki zaroorat hai, jo aik mazboot mandi ki raftaar ki nishandahi karta hai.

2. Fibanocci retracement : qutub ke oopri hissay se istehkaam ke marhalay ke nichale hissay tak Fibanocci retracement ke darjay ka itlaq karen. taqreeban 50 % ya is se ziyada ki wapsi ki talaash karen, kyunkay yeh aik mazboot Bearish dabao ki nishandahi karta hai.

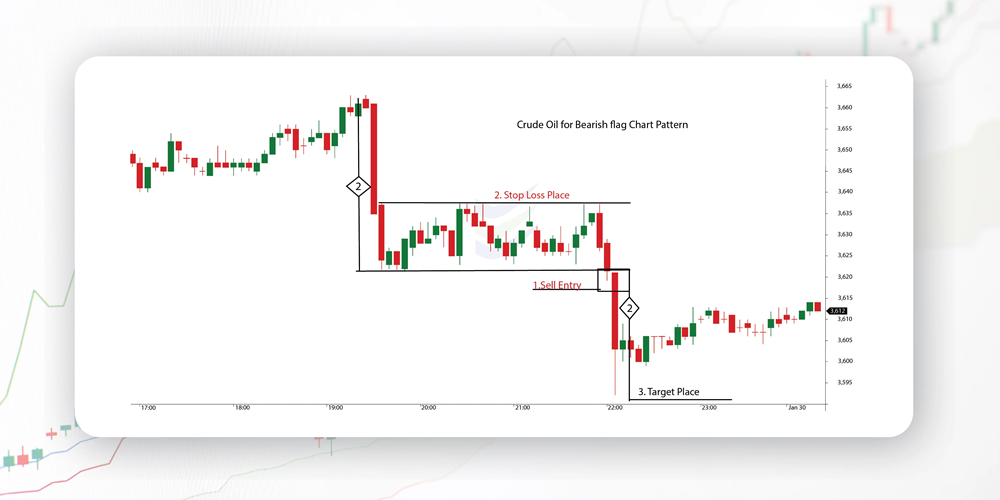

Profit Target and Stop Loss in Bearish Flag Pattern:

Khatray se nimatnay aur bearish flag patteren ki kharidari aur farokht ke douran salahiyat ke munafe ko ziyada se ziyada karne ke liye munafe ke ahdaaf ka taayun karna aur nuqsaan ke marahil ko rokna bohat zaroori hai. munafe ke ahdaaf rakhnay aur nuqsaan ko roknay ke liye kuch tahaffuzaat yeh hain:

1. munafe ke ahdaaf : support ke kaleedi marahil ya pichli soyng lovs ko salahiyat ki kamaai ke ahdaaf ke tor par shanakht karen. yeh degreeian salahiyat ki kharidari ke shoq ke ilaqon ke tor par kaam kar sakti hain aur neechay ki taraf rujhan mein ulat ya earzi waqfay ka sabab ban sakti hain.

2. stop las : salahiyat ke nuqsanaat ko mehdood karne ke liye flag patteren ki muzahmat se oopar stop las degree muqarrar karen. is satah ka faisla market ke utaar charhao aur khatray ko bardasht karne ke jaizay ki bunyaad par kya jana chahiye.

Trading and Risk Control in Bearish Flag Pattern:

Mandi ke jhanday ke namoonay ki tijarat karte hue tijarat ko kamyabi se sambhalay aur khatray ko sambhalay ke liye, darj zail technology ko nah bhulen :

1. Terling stop : aik baar jab aap ke haq mein fees kam hona shuru ho jaye to aamdani ko bachanay aur rujhan ko agay badhaane ke liye terling las order ka istemaal karna nah bhulen. is mein rokkk thaam ke nuqsaan ke marhalay ko adjust karna shaamil hai kyunkay sharah aap ki khwahish par amal karti hai, rastay ke sath sath munafe mein lock karna.

2.Risk divider tanasub : daakhil honay se pehlay har tijarat ki salahiyat ke risk price tanasub ka jaiza len. is baat ko yakeeni banayen ke salahiyat ki tareef aap ke munafe ke ahdaaf ki bunyaad par salahiyat ke imkanaat se ziyada hai aur nuqsaan ke darjay ko rokain.

Mandi ke jhanday ka namona ghair mulki zar e mubadla ki kharidari aur farokht mein daryaft honay wala aik maqbool chart namona hai jo neechay ki taraf rujhan ke salahiyat ke tasalsul ki nishandahi karta hai. usay aik qabil aetmaad namona samjha jata hai jo taajiron ko market mein mandi ki tehreek se faida uthany ka mauqa faraham karta hai. namoonay ko neechay ki taraf dhalwan channel ke zariye numaya kya jata hai, jo aik taiz istehkaam walay hissay ke zariye mushahida kardah taiz charge mein kami ke zariye tashkeel paata hai, jo jhanday se milta jalta hai.

Identifying Bearish Flag Pattern:

Mandi ke jhanday ka namona lainay ke liye, khredar darj zail ajzaa talaash karna chahtay hain:

1. Pol : pol ibtidayi taiz fees mein kami ki numaindagi karta hai, jo namoonay ke oopar ki taraf dhalwan walay flag pol ki tashkeel karta hai. yeh kami baqaidagi se aala tijarti hajam ke sath hoti hai.

2. Istehkaam ka marhala : qutub ke baad, aik istehkaam ka hissa hota hai, jis mein charge aik taraf ya baa-mushkil oopar ki taraf gardish karte hain. yeh kaghazi karwai patteren ke parcham walay hissay par hoti hai. istehkaam ke hissay ki khasusiyat tijarti had ko kam karne ka tareeqa hai, jo bazaar ki sargarmi mein kami ki nishandahi karta hai.

Conformation and Consideration in Bearish Flag Pattern:

Aik baar Bearish flag patteren ko pehchane jane ke baad, sarmaya karon ko mutabadil mein anay se pehlay patteren ki tasdeeq karne ki zaroorat hai. tasdeeq takneeki isharay aur sharah harkat ke tajziye ke zariye ki ja sakti hai. tabadlay ki tasdeeq karne aur is mein daakhil honay ki kuch tknikin yeh hain:

1. break out ki tasdeeq : jhanday ke namoonay ke guide marhalay ke neechay saaf aur qabil aetmaad samish ka intzaar karen. is break out ke sath kayi gina kharidari aur farokht ki had tak jane ki zaroorat hai, jo aik mazboot mandi ki raftaar ki nishandahi karta hai.

2. Fibanocci retracement : qutub ke oopri hissay se istehkaam ke marhalay ke nichale hissay tak Fibanocci retracement ke darjay ka itlaq karen. taqreeban 50 % ya is se ziyada ki wapsi ki talaash karen, kyunkay yeh aik mazboot Bearish dabao ki nishandahi karta hai.

Profit Target and Stop Loss in Bearish Flag Pattern:

Khatray se nimatnay aur bearish flag patteren ki kharidari aur farokht ke douran salahiyat ke munafe ko ziyada se ziyada karne ke liye munafe ke ahdaaf ka taayun karna aur nuqsaan ke marahil ko rokna bohat zaroori hai. munafe ke ahdaaf rakhnay aur nuqsaan ko roknay ke liye kuch tahaffuzaat yeh hain:

1. munafe ke ahdaaf : support ke kaleedi marahil ya pichli soyng lovs ko salahiyat ki kamaai ke ahdaaf ke tor par shanakht karen. yeh degreeian salahiyat ki kharidari ke shoq ke ilaqon ke tor par kaam kar sakti hain aur neechay ki taraf rujhan mein ulat ya earzi waqfay ka sabab ban sakti hain.

2. stop las : salahiyat ke nuqsanaat ko mehdood karne ke liye flag patteren ki muzahmat se oopar stop las degree muqarrar karen. is satah ka faisla market ke utaar charhao aur khatray ko bardasht karne ke jaizay ki bunyaad par kya jana chahiye.

Trading and Risk Control in Bearish Flag Pattern:

Mandi ke jhanday ke namoonay ki tijarat karte hue tijarat ko kamyabi se sambhalay aur khatray ko sambhalay ke liye, darj zail technology ko nah bhulen :

1. Terling stop : aik baar jab aap ke haq mein fees kam hona shuru ho jaye to aamdani ko bachanay aur rujhan ko agay badhaane ke liye terling las order ka istemaal karna nah bhulen. is mein rokkk thaam ke nuqsaan ke marhalay ko adjust karna shaamil hai kyunkay sharah aap ki khwahish par amal karti hai, rastay ke sath sath munafe mein lock karna.

2.Risk divider tanasub : daakhil honay se pehlay har tijarat ki salahiyat ke risk price tanasub ka jaiza len. is baat ko yakeeni banayen ke salahiyat ki tareef aap ke munafe ke ahdaaf ki bunyaad par salahiyat ke imkanaat se ziyada hai aur nuqsaan ke darjay ko rokain.

تبصرہ

Расширенный режим Обычный режим