Long Butterfly Spread Trading Strategy overview.

Long Butterfly Spread Trading Strategy

Tareef:

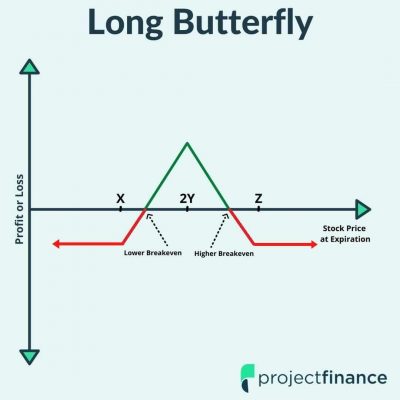

Long Butterfly Spread ek options trading strategy hai jo traders istemal karte hain jab unhein ek asset ka price stable ya range-bound hone ki umeed hoti hai.

Components:

Kamayabi ki Shart:

Keemat:

Faida:

Nuqsan:

Udaharan:

Udaharan aur Tafseelat

Scenario:

Asset ka current price $50 hai aur ek trader ne long butterfly spread setup kiya hai.

Option Kharidne:

Expiration Date:

Sabhi options ka expiration date ek hai.

Profitable Outcome: Agar expiration ke waqt asset ka price $50 ke qareeb hota hai, toh trader ko maximum profit milta hai.

Loss Situation: Agar asset ka price expiration ke waqt kisi ek strike price ke qareeb hota hai, toh loss hoti hai.

Conclusion:

Long Butterfly Spread ek mufeed trading strategy hai agar asset ka price range-bound ho, lekin agar price kisi ek direction mein chal rahi hai, toh loss ka khatra hota hai. Isliye, traders ko market ki movement ko dhyaan mein rakhte hue apne decisions ko lena chahiye.

Long Butterfly Spread Trading Strategy

Tareef:

Long Butterfly Spread ek options trading strategy hai jo traders istemal karte hain jab unhein ek asset ka price stable ya range-bound hone ki umeed hoti hai.

Components:

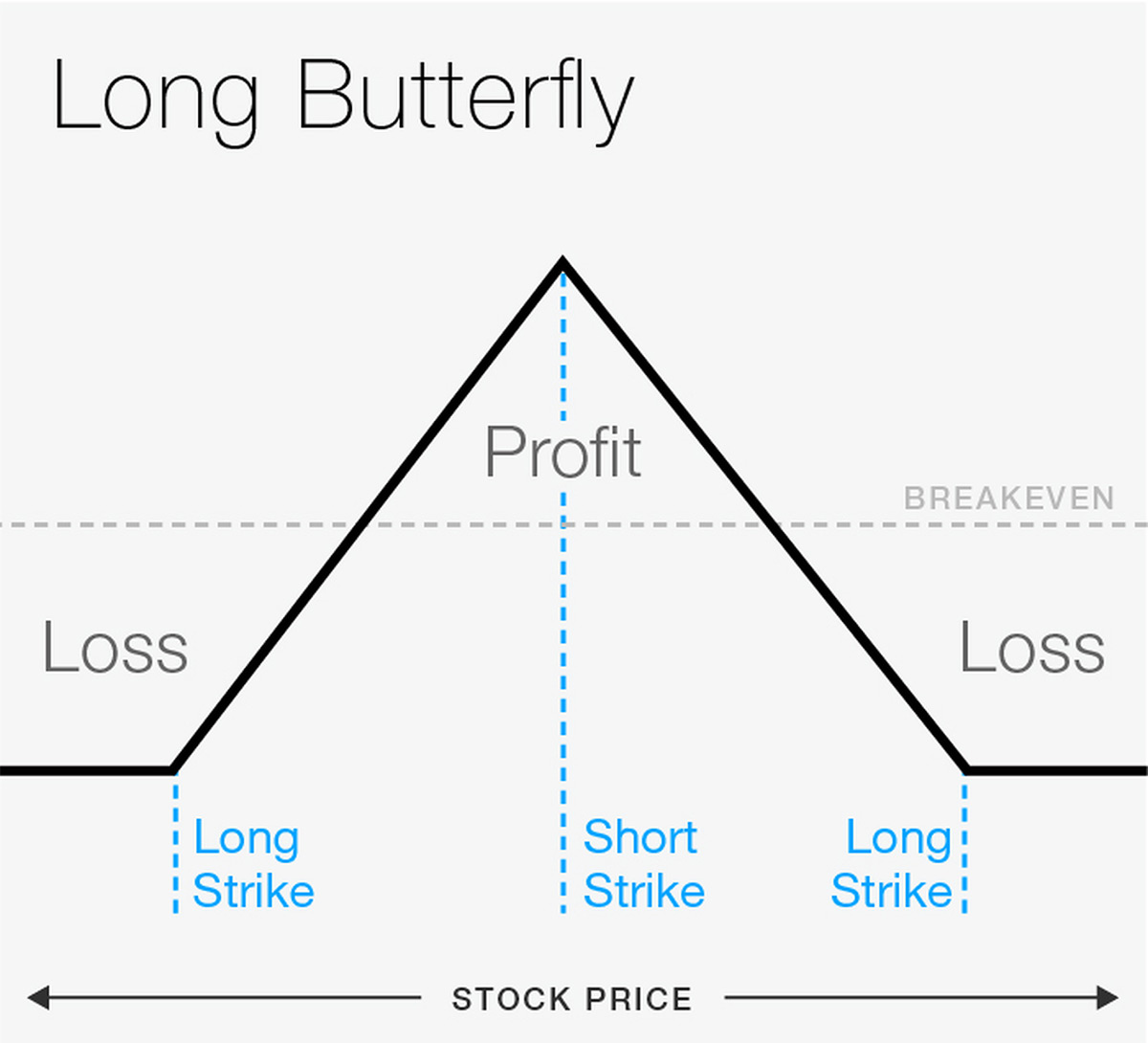

- Call Options:

- Do call options kharidte hain.

- Ek call option ATM (At-The-Money) pe kharida jata hai.

- Do aur call options OTM (Out-of-The-Money) pe kharide jate hain, ek upper strike price aur doosra lower strike price pe.

- Expiration Date:

- Sabhi options ka ek expiration date hota hai, jo usually ek hi hota hai.

Kamayabi ki Shart:

- Asset ka price expiration ke waqt middle strike price ke qareeb hona chahiye.

Keemat:

- Initial investment option premiums se hoti hai.

Faida:

- Agar asset ka price expiration ke waqt middle strike price ke qareeb hota hai, toh trader ko maximum profit milta hai.

- Risk limit hoti hai kyunki initial investment fixed hoti hai.

Nuqsan:

- Agar asset ka price expiration ke waqt kisi ek strike price ke qareeb hota hai, toh loss hoti hai.

Udaharan:

- Asset ka current price $50 hai.

- Ek trader ne long butterfly spread setup kiya.

- Call options kharide hain:

- 1 call option $50 strike price pe (ATM)

- 1 call option $55 strike price pe (OTM)

- 1 call option $45 strike price pe (OTM)

- Agar expiration ke waqt asset ka price $50 ke qareeb hota hai, toh trader ko maximum profit milta hai.

Udaharan aur Tafseelat

Scenario:

Asset ka current price $50 hai aur ek trader ne long butterfly spread setup kiya hai.

Option Kharidne:

- 1 call option $50 strike price pe (ATM)

- 1 call option $55 strike price pe (OTM)

- 1 call option $45 strike price pe (OTM)

Expiration Date:

Sabhi options ka expiration date ek hai.

Profitable Outcome: Agar expiration ke waqt asset ka price $50 ke qareeb hota hai, toh trader ko maximum profit milta hai.

Loss Situation: Agar asset ka price expiration ke waqt kisi ek strike price ke qareeb hota hai, toh loss hoti hai.

Conclusion:

Long Butterfly Spread ek mufeed trading strategy hai agar asset ka price range-bound ho, lekin agar price kisi ek direction mein chal rahi hai, toh loss ka khatra hota hai. Isliye, traders ko market ki movement ko dhyaan mein rakhte hue apne decisions ko lena chahiye.

تبصرہ

Расширенный режим Обычный режим