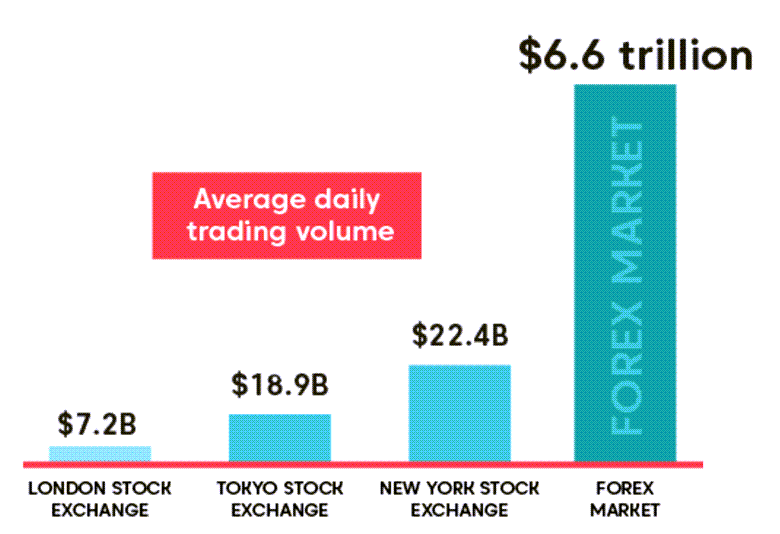

Trading volume in Forex

Introduction to Volume

Asalam o Alikum Dosto Umeed Krta Hun Kah ap Sub Khariyat Sy Hun Gy Trading volume, forex ya kisi bhi financial market me, ek important parameter hy jo market activity aur liquidity ka measure karta hy. Volume ka matlab hota hy ki market me kitny sary shares, contracts, ya units trade ho rahy hein, ya kitni quantity me buying aur selling ho rahi hy.Volume ko biyan karny ke liye traders aur investors commonly volume indicators ka istemal karty hein, jaise ki Volume Bars, Volume Oscillators, aur On-Balance Volume (OBV). Yeh indicators volume data ko graphically represent karte hein, jisse traders ko market activity ka idea mil jata hy ap is se bahut ziada faida hasil kar saky gy

Volume ki importance

1. Confirmation signal: Volume ka analysis karke traders ko tasdeek karne wale signals mil sakty hain. Jaise, agar price upar ja raha hai aur volume bhi badh raha hai, toh yeh ishara kar sakta hai ki uptrend majboot hai aur price aur bhi upar ja sakta hai.

2. Price reversal ki pehchan: Volume ki madad se traders price ke palatne ko pehchan sakty hain. Agar price upar ja raha hai lekin volume kam ho rahi hai, toh yeh ishara kar sakta hai ki market ka momentum kam ho raha hai aur price palatne ki sambhavna hai.

3. Liquidity: Volume market ki liquidity ka ek maapdand hai. High volume zyada liquidity ka signal deta hai, jis se traders ko behtar execution aur narrow spreads mil sakty hain.Volume analysis mein, traders volume patterns aur trends ko dekhty hain, jaisy ki volume badhny ke saath price ka badhna, volume kam hony ke saath price ka ghatna, high volume breakouts, aur volume divergences. In patterns aur trends se traders’ market ki direction aur potential trading opportunities ko pehchan sakty hain.Aakhir mein, volume analysis trading decisions mein ek ehm factor hai. Traders ko volume indicators aur patterns ka istemal karke market ki movement ko samajhna chahiye, taaki woh sahi trading decisions le saken

Introduction to Volume

Asalam o Alikum Dosto Umeed Krta Hun Kah ap Sub Khariyat Sy Hun Gy Trading volume, forex ya kisi bhi financial market me, ek important parameter hy jo market activity aur liquidity ka measure karta hy. Volume ka matlab hota hy ki market me kitny sary shares, contracts, ya units trade ho rahy hein, ya kitni quantity me buying aur selling ho rahi hy.Volume ko biyan karny ke liye traders aur investors commonly volume indicators ka istemal karty hein, jaise ki Volume Bars, Volume Oscillators, aur On-Balance Volume (OBV). Yeh indicators volume data ko graphically represent karte hein, jisse traders ko market activity ka idea mil jata hy ap is se bahut ziada faida hasil kar saky gy

Volume ki importance

1. Confirmation signal: Volume ka analysis karke traders ko tasdeek karne wale signals mil sakty hain. Jaise, agar price upar ja raha hai aur volume bhi badh raha hai, toh yeh ishara kar sakta hai ki uptrend majboot hai aur price aur bhi upar ja sakta hai.

2. Price reversal ki pehchan: Volume ki madad se traders price ke palatne ko pehchan sakty hain. Agar price upar ja raha hai lekin volume kam ho rahi hai, toh yeh ishara kar sakta hai ki market ka momentum kam ho raha hai aur price palatne ki sambhavna hai.

3. Liquidity: Volume market ki liquidity ka ek maapdand hai. High volume zyada liquidity ka signal deta hai, jis se traders ko behtar execution aur narrow spreads mil sakty hain.Volume analysis mein, traders volume patterns aur trends ko dekhty hain, jaisy ki volume badhny ke saath price ka badhna, volume kam hony ke saath price ka ghatna, high volume breakouts, aur volume divergences. In patterns aur trends se traders’ market ki direction aur potential trading opportunities ko pehchan sakty hain.Aakhir mein, volume analysis trading decisions mein ek ehm factor hai. Traders ko volume indicators aur patterns ka istemal karke market ki movement ko samajhna chahiye, taaki woh sahi trading decisions le saken

تبصرہ

Расширенный режим Обычный режим