What is Tasuki Gap Pattern:

Tasuki gap patteren aik mashhoor chart patteren hai jo ghair mulki currency ki kharidari aur farokht ke liye takneeki tajzia mein istemaal hota hai. is mein aik waqfay ke sath aik taizi ya mandi wali mom batii ka namona shaamil hota hai, jis ke baad ibtidayi tarz ke isi rastay mein aik tasalsul mom batii ka namona hota hai. do mom btyon ke darmiyan farq rujhan ki taaqat ki tasdeeq karne mein madad karta hai aur taajiron ko mumkina rasai aur bahar niklny ke awamil ke sath paish karta hai. is namoonay ko japani lafz Tasuki ke naam se jana jata hai, jo japani libaas mein istemaal honay walay riwayati sash se morad hai.

Identifying Tasuki Gap Pattern:

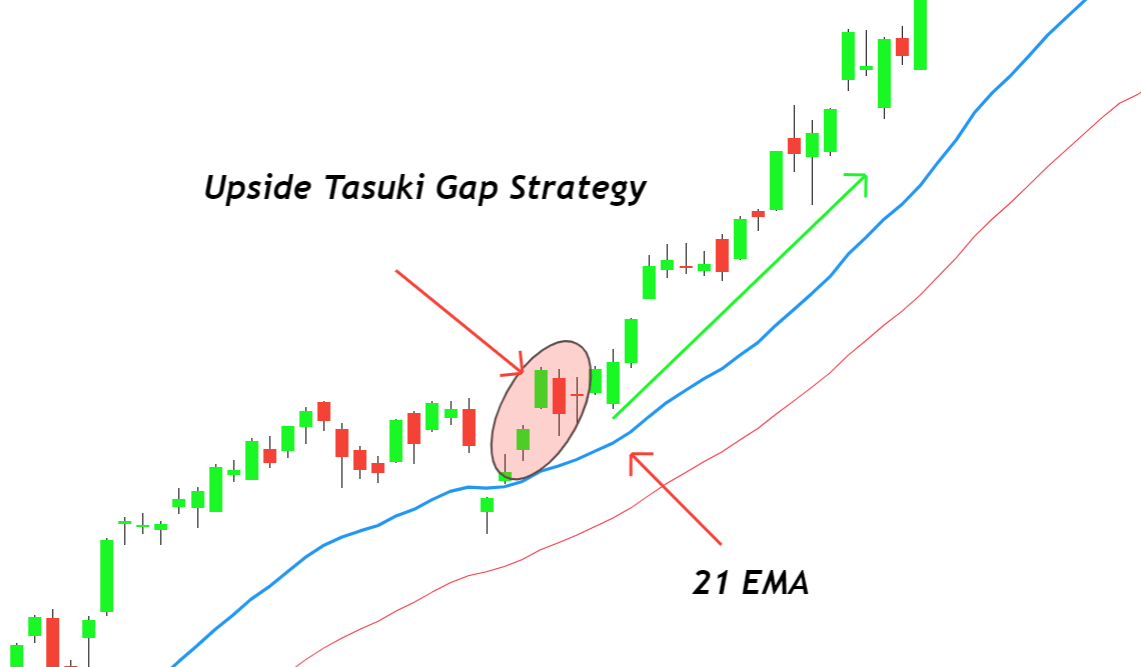

Tasuki gap patteren se waaqif honay ke liye, tajir isi course mein aik iftitahi ki madad se mushahida ki jane wali aik mazboot taizi ya mandi ki mom batii ki talaash karna chahtay hain. farq aik tabah kin charge action ki numaindagi karta hai aur rujhan ke tasalsul ki tajweez karta hai. doosri mom batii ki chhari ko Sabiqa mom batii ki chhari ki qisam mein kholnay ki zaroorat hai, misali tor par markaz mein ya out late ki satah ke qareeb. is se pata chalta hai ke market ke log ab bhi cheezon ke oopar hain aur fashion ke tasalsul ki tasdeeq karte hain. tajir namoonay ki tasdeeq karne aur hatt tabdeeli ke imkaan ko badhaane ke liye mutadid takneeki alamaat ka istemaal kar satke hain, jin mein muntaqili ki ost ya rujhan ke tanao shaamil hain.

Trading With Tasuki Gap Pattern:

Trading ki kayi tknikin hain jinhein sarmaya car Tasuki gap patteren ke istemaal ke douran istemaal kar satke hain. aik nuqta nazar yeh hai ke aik taweel kirdaar mein jana hai jab patteren kaghazi kaam taweel zawaal ke baad hota hai, jo salahiyat ke ulat jane ki nishandahi karta hai. tajir doosri mom batii ki chhari ke neechay stop las order day satke hain aur Sabiqa madad ya muzahmat ke marahil ki bunyaad par munafe ka hadaf muqarrar kar satke hain.

Aik aur tareeqa yeh hai ke jab namona taweel up trained ke baad bantaa hai to mukhtasir function mein jana, jo salahiyat ke ulat jane ki nishandahi karta hai. tajir doosri mom batii ki chhari ke oopar nuqsaan se bachao ka order day satke hain aur pichlle support ya muzahmat ke marahil ki bunyaad par aamdani ka hadaf muqarrar kar satke hain.

Potential Pitfall and Considerations in Tasuki Gap Pattern:

Agarchay Tasuki gap patteren fashion ke tasalsul ya ulat palat ka qabil aetmaad ishara ho sakta hai, lekin kharidaron ke liye kuch khadshaat aur salahiyat ke nuqsanaat hain jin ke baray mein aagah hona chahiye. sab se pehlay, namoonay par mukammal tor par mabni mutabadil mein daakhil honay se pehlay tasdeeq ka intzaar karna zaroori hai. yeh izafi alamaat ko dekhnay ya mandarja zail candle stick ke ban'nay ke muntazir honay ki madad se kya ja sakta hai. dosra, nuqsaan se bachao ke ehkamaat aur rule size ke technical ke istemaal ki madad se khatray par qaboo paana bohat zaroori hai. market ki ghair mutawaqqa naqal o harkat ke nateejay mein nuqsaan ho sakta hai, bunyadi tor par agar namona tawaqqa ke mutabiq amal mein anay mein nakaam rehta hai. taajiron ko bazaar ke majmoi halaat aur mukhtalif anasir ko bhi yaad rakhnay ki zaroorat hai jo namoonay ki taseer ko mutasir kar satke hain, Bashmole muashi record ki release ya siyasi mawaqay.

Conclusion of Tasuki Gap Pattern:

Tasuki gap patteren forex charts ka mutalea karte waqt dealer ke hathyaaron mein aik qeemti aala hai. patteren ka pata laganay aur samajhney se, sarmaya car qabliyat fashion ke tasalsul ya ulat palat se faida utha satke hain. taham, is baat ko zehen mein rakhna zaroori hai ke koi bhi khareed o farokht ka tareeqa be bunyaad nahi hai, aur rissk managment sab se ahem hai. taajiron ko zar e mubadla ki tijarat mein Tasuki gap patteren ka istemaal karte waqt istiqamat, jagah aur khatray se nimatnay ki munasib hikmat amlyon ka istemaal karna chahiye. majmoi tor par, mohtaat tashkhees aur sahih amal daraamad ke sath, Tasuki gap patteren ghair mulki zar e mubadla market se faida uthany ke khwahan sarmaya karon ke liye aik mufeed zareya saabit ho sakta hai.

Tasuki gap patteren aik mashhoor chart patteren hai jo ghair mulki currency ki kharidari aur farokht ke liye takneeki tajzia mein istemaal hota hai. is mein aik waqfay ke sath aik taizi ya mandi wali mom batii ka namona shaamil hota hai, jis ke baad ibtidayi tarz ke isi rastay mein aik tasalsul mom batii ka namona hota hai. do mom btyon ke darmiyan farq rujhan ki taaqat ki tasdeeq karne mein madad karta hai aur taajiron ko mumkina rasai aur bahar niklny ke awamil ke sath paish karta hai. is namoonay ko japani lafz Tasuki ke naam se jana jata hai, jo japani libaas mein istemaal honay walay riwayati sash se morad hai.

Identifying Tasuki Gap Pattern:

Tasuki gap patteren se waaqif honay ke liye, tajir isi course mein aik iftitahi ki madad se mushahida ki jane wali aik mazboot taizi ya mandi ki mom batii ki talaash karna chahtay hain. farq aik tabah kin charge action ki numaindagi karta hai aur rujhan ke tasalsul ki tajweez karta hai. doosri mom batii ki chhari ko Sabiqa mom batii ki chhari ki qisam mein kholnay ki zaroorat hai, misali tor par markaz mein ya out late ki satah ke qareeb. is se pata chalta hai ke market ke log ab bhi cheezon ke oopar hain aur fashion ke tasalsul ki tasdeeq karte hain. tajir namoonay ki tasdeeq karne aur hatt tabdeeli ke imkaan ko badhaane ke liye mutadid takneeki alamaat ka istemaal kar satke hain, jin mein muntaqili ki ost ya rujhan ke tanao shaamil hain.

Trading With Tasuki Gap Pattern:

Trading ki kayi tknikin hain jinhein sarmaya car Tasuki gap patteren ke istemaal ke douran istemaal kar satke hain. aik nuqta nazar yeh hai ke aik taweel kirdaar mein jana hai jab patteren kaghazi kaam taweel zawaal ke baad hota hai, jo salahiyat ke ulat jane ki nishandahi karta hai. tajir doosri mom batii ki chhari ke neechay stop las order day satke hain aur Sabiqa madad ya muzahmat ke marahil ki bunyaad par munafe ka hadaf muqarrar kar satke hain.

Aik aur tareeqa yeh hai ke jab namona taweel up trained ke baad bantaa hai to mukhtasir function mein jana, jo salahiyat ke ulat jane ki nishandahi karta hai. tajir doosri mom batii ki chhari ke oopar nuqsaan se bachao ka order day satke hain aur pichlle support ya muzahmat ke marahil ki bunyaad par aamdani ka hadaf muqarrar kar satke hain.

Potential Pitfall and Considerations in Tasuki Gap Pattern:

Agarchay Tasuki gap patteren fashion ke tasalsul ya ulat palat ka qabil aetmaad ishara ho sakta hai, lekin kharidaron ke liye kuch khadshaat aur salahiyat ke nuqsanaat hain jin ke baray mein aagah hona chahiye. sab se pehlay, namoonay par mukammal tor par mabni mutabadil mein daakhil honay se pehlay tasdeeq ka intzaar karna zaroori hai. yeh izafi alamaat ko dekhnay ya mandarja zail candle stick ke ban'nay ke muntazir honay ki madad se kya ja sakta hai. dosra, nuqsaan se bachao ke ehkamaat aur rule size ke technical ke istemaal ki madad se khatray par qaboo paana bohat zaroori hai. market ki ghair mutawaqqa naqal o harkat ke nateejay mein nuqsaan ho sakta hai, bunyadi tor par agar namona tawaqqa ke mutabiq amal mein anay mein nakaam rehta hai. taajiron ko bazaar ke majmoi halaat aur mukhtalif anasir ko bhi yaad rakhnay ki zaroorat hai jo namoonay ki taseer ko mutasir kar satke hain, Bashmole muashi record ki release ya siyasi mawaqay.

Conclusion of Tasuki Gap Pattern:

Tasuki gap patteren forex charts ka mutalea karte waqt dealer ke hathyaaron mein aik qeemti aala hai. patteren ka pata laganay aur samajhney se, sarmaya car qabliyat fashion ke tasalsul ya ulat palat se faida utha satke hain. taham, is baat ko zehen mein rakhna zaroori hai ke koi bhi khareed o farokht ka tareeqa be bunyaad nahi hai, aur rissk managment sab se ahem hai. taajiron ko zar e mubadla ki tijarat mein Tasuki gap patteren ka istemaal karte waqt istiqamat, jagah aur khatray se nimatnay ki munasib hikmat amlyon ka istemaal karna chahiye. majmoi tor par, mohtaat tashkhees aur sahih amal daraamad ke sath, Tasuki gap patteren ghair mulki zar e mubadla market se faida uthany ke khwahan sarmaya karon ke liye aik mufeed zareya saabit ho sakta hai.

:max_bytes(150000):strip_icc()/DownsideTasukiGap2-7e2a5f16e7b4470bbf749e366993d3cb.png)

تبصرہ

Расширенный режим Обычный режим