Inverted Hammer Pattern:

(Heading): "Inverted Hammer Pattern"

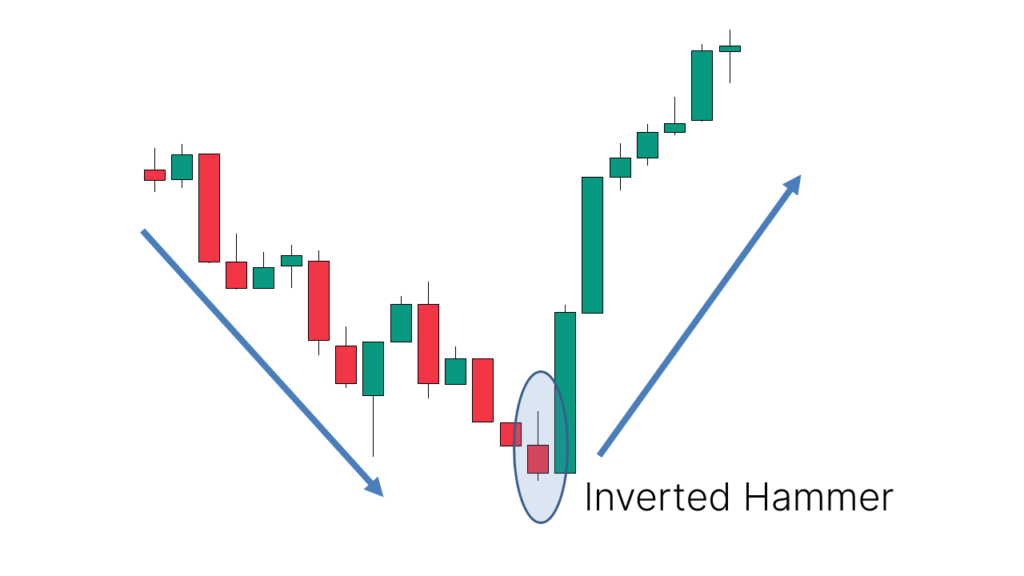

(Haalat): Inverted Hammer ek candlestick pattern hai jo market mein hone wale potential reversals ko darust karta hai. Ye pattern downtrend ke baad aata hai aur bullish reversal ko represent karta hai.

Kaise Pehchanein:

(Heading): "Kaise Pehchanein"

(Haalat): Inverted Hammer pattern ko pehchanne ke liye, aapko ek specific candle ki zarurat hoti hai:

- Inverted Hammer Candle:

- Inverted Hammer candle ek single candle hoti hai jiska structure neeche di gayi tarah hota hai:

- Small body (chota sa body) jo upper shadow ke barabar hota hai.

- Long lower shadow (lambi neeche wali shadow) jo body se neeche extend hota hai.

- Little or no upper shadow (kam ya bilkul bhi upper shadow nahi).

- Inverted Hammer candle ek single candle hoti hai jiska structure neeche di gayi tarah hota hai:

Key Features:

(Heading): "Key Features"

(Haalat): Inverted Hammer Pattern ke kuch key features hote hain:

- Downtrend Ke Baad Aata Hai:

- Ye pattern hamesha ek downtrend ke baad aata hai, jo ke bearish sentiment ko darust karta hai.

- Small Body Aur Long Lower Shadow:

- Inverted Hammer candle ka body chota hota hai aur lower shadow lamba hota hai, jo selling pressure ko indicate karta hai.

- Little or No Upper Shadow:

- Is candle mein upper shadow kam ya bilkul bhi nahi hota, jo ke buying interest ko darust karta hai.

Market Signals:

(Heading): "Market Signals"

(Haalat): Inverted Hammer Pattern ka appearance market mein potential bullish reversal ko indicate karta hai. Is pattern ke baad traders ko confirmatory signals ka wait karna chahiye.

Tawajjuat Aur Hifazati Tadabeer:

(Heading): "Tawajjuat Aur Hifazati Tadabeer"

(Haalat): Inverted Hammer Pattern ke trade karte waqt hamesha tawajju dena chahiye ke ye pattern market conditions ke mutabiq hai aur confirmatory signals ka wait karna important hai.

Conclusion:

(Heading): "Tadbeer Aur Gyaan Baratne Ka Waqt"

(Haalat): Inverted Hammer Pattern ek reversal pattern hai jo traders ko indicate karta hai ke downtrend ke baad market mein potential bullish reversal ho sakta hai. Confirmatory signals ke bina is pattern par pura bharosa na karein aur market trends ke mutabiq trading decisions lein.

تبصرہ

Расширенный режим Обычный режим