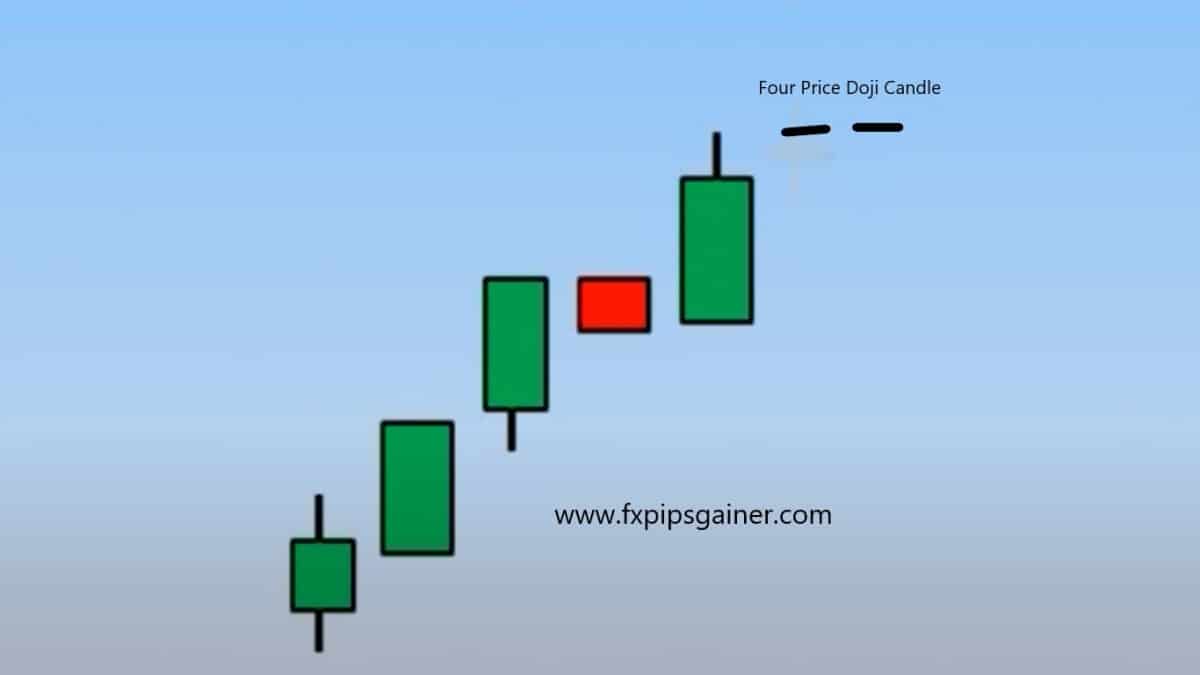

Four price doji candlestick

Char Price Doji Candlestick: Ek Technical Analysis Tool

Char price doji candlestick ek mukhtasir lekin ahem technical analysis tool hai jo share market ke traders aur investors ke liye mahatvapurna hai. Is article mein, hum char price doji candlestick ke bare mein Roman Urdu mein baat karenge aur iske mukhtalif aspects ko samjhenge.

1. Doji Candlestick:

Doji candlestick ek aham candlestick pattern hai jo indicate karta hai ke market mein buyers aur sellers ke darmiyan balance hai. Jab char doji candlesticks ek sath aate hain, yeh market ka mukhtalif phase ko darust karne ki sambhavna ko darust karte hain.

2. Char Price Doji Ka Matlab:

Char price doji candlestick pattern mein char consecutive candlesticks hote hain jo almost same price par close hote hain. Yeh pattern market ke uncertainty ya indecision ko darust karta hai.

3. Technical Analysis Mein Istemal:

Char price doji candlestick pattern ko technical analysis mein istemal kar ke traders market ka potential trend reversal anticipate kar sakte hain. Agar yeh pattern uptrend ke baad aata hai, toh yeh bearish reversal ka sign ho sakta hai, aur agar downtrend ke baad aata hai, toh yeh bullish reversal ka sign ho sakta hai.

4. Confirmation Ki Zarurat:

Char price doji candlestick pattern ko sirf ek indicator ke roop mein dekha nahi ja sakta. Iske sath confirmation ke liye dusre technical indicators aur price action patterns ka bhi istemal kiya jata hai.

5. Risk Management:

Har trading decision ke sath sahi risk management bhi zaruri hai. Char price doji candlestick pattern ko samajhne ke baad, traders ko apne trade ko manage karne ke liye sahi stop loss aur target levels tay karna chahiye.

Char price doji candlestick pattern ek powerful tool hai jo traders ko market ke mukhtalif phases ko samajhne mein madad karta hai.

Char Price Doji Candlestick aur Uske Aage Ke Implications

1. Continuation Patterns:

Char price doji candlestick pattern ke baad, market mein existing trend ka continuation ho sakta hai. Agar yeh pattern uptrend ke baad aata hai, toh yeh indicate karta hai ke uptrend jari hai aur traders ko long positions hold karne ki salahiyat deti hai.

2. Trend Reversal Possibilities:

Dusri taraf, char price doji candlestick pattern downtrend ke baad aata hai, toh yeh bullish reversal ka sign ho sakta hai. Yeh indicate karta hai ke sellers ki strength kam hoti ja rahi hai aur buyers ka dominance badh raha hai.

3. Volume Analysis:

Char price doji candlestick pattern ke analysis mein volume ka bhi ek ahem hissa hai. Agar yeh pattern high volume ke sath aata hai, toh uska significance aur bhi zyada hota hai. High volume ke sath char price doji pattern bullish ya bearish reversal ke liye strong indication provide kar sakta hai.

4. Timeframe Consideration:

Is pattern ke interpretation mein timeframe ka bhi mahatva hota hai. Chhoti timeframe par yeh pattern zyada frequent ho sakta hai, lekin uski reliability bhi kam hoti hai. Bade timeframe par yeh pattern kam frequency mein aata hai, lekin uska reliability zyada hota hai.

5. Multiple Timeframe Analysis:

Char price doji candlestick pattern ko samajhne aur uski confirmation ke liye multiple timeframe analysis ki zarurat hoti hai. Traders ko alag-alag timeframes par is pattern ko dekh kar confirm karna chahiye ke market mein kis direction mein ja raha hai aur kya uska trading strategy ke saath alignment hai.

Char price doji candlestick pattern ke aage ke implications ko samajh kar, traders apne trading decisions ko aur bhi precise aur informed bana sakte hain. Lekin, zaroori hai ke traders is pattern ko sahi tarah se samajh kar aur dusre technical analysis tools ke sath combine karke istemal karein.

Char Price Doji Candlestick: Ek Technical Analysis Tool

Char price doji candlestick ek mukhtasir lekin ahem technical analysis tool hai jo share market ke traders aur investors ke liye mahatvapurna hai. Is article mein, hum char price doji candlestick ke bare mein Roman Urdu mein baat karenge aur iske mukhtalif aspects ko samjhenge.

1. Doji Candlestick:

Doji candlestick ek aham candlestick pattern hai jo indicate karta hai ke market mein buyers aur sellers ke darmiyan balance hai. Jab char doji candlesticks ek sath aate hain, yeh market ka mukhtalif phase ko darust karne ki sambhavna ko darust karte hain.

2. Char Price Doji Ka Matlab:

Char price doji candlestick pattern mein char consecutive candlesticks hote hain jo almost same price par close hote hain. Yeh pattern market ke uncertainty ya indecision ko darust karta hai.

3. Technical Analysis Mein Istemal:

Char price doji candlestick pattern ko technical analysis mein istemal kar ke traders market ka potential trend reversal anticipate kar sakte hain. Agar yeh pattern uptrend ke baad aata hai, toh yeh bearish reversal ka sign ho sakta hai, aur agar downtrend ke baad aata hai, toh yeh bullish reversal ka sign ho sakta hai.

4. Confirmation Ki Zarurat:

Char price doji candlestick pattern ko sirf ek indicator ke roop mein dekha nahi ja sakta. Iske sath confirmation ke liye dusre technical indicators aur price action patterns ka bhi istemal kiya jata hai.

5. Risk Management:

Har trading decision ke sath sahi risk management bhi zaruri hai. Char price doji candlestick pattern ko samajhne ke baad, traders ko apne trade ko manage karne ke liye sahi stop loss aur target levels tay karna chahiye.

Char price doji candlestick pattern ek powerful tool hai jo traders ko market ke mukhtalif phases ko samajhne mein madad karta hai.

Char Price Doji Candlestick aur Uske Aage Ke Implications

1. Continuation Patterns:

Char price doji candlestick pattern ke baad, market mein existing trend ka continuation ho sakta hai. Agar yeh pattern uptrend ke baad aata hai, toh yeh indicate karta hai ke uptrend jari hai aur traders ko long positions hold karne ki salahiyat deti hai.

2. Trend Reversal Possibilities:

Dusri taraf, char price doji candlestick pattern downtrend ke baad aata hai, toh yeh bullish reversal ka sign ho sakta hai. Yeh indicate karta hai ke sellers ki strength kam hoti ja rahi hai aur buyers ka dominance badh raha hai.

3. Volume Analysis:

Char price doji candlestick pattern ke analysis mein volume ka bhi ek ahem hissa hai. Agar yeh pattern high volume ke sath aata hai, toh uska significance aur bhi zyada hota hai. High volume ke sath char price doji pattern bullish ya bearish reversal ke liye strong indication provide kar sakta hai.

4. Timeframe Consideration:

Is pattern ke interpretation mein timeframe ka bhi mahatva hota hai. Chhoti timeframe par yeh pattern zyada frequent ho sakta hai, lekin uski reliability bhi kam hoti hai. Bade timeframe par yeh pattern kam frequency mein aata hai, lekin uska reliability zyada hota hai.

5. Multiple Timeframe Analysis:

Char price doji candlestick pattern ko samajhne aur uski confirmation ke liye multiple timeframe analysis ki zarurat hoti hai. Traders ko alag-alag timeframes par is pattern ko dekh kar confirm karna chahiye ke market mein kis direction mein ja raha hai aur kya uska trading strategy ke saath alignment hai.

Char price doji candlestick pattern ke aage ke implications ko samajh kar, traders apne trading decisions ko aur bhi precise aur informed bana sakte hain. Lekin, zaroori hai ke traders is pattern ko sahi tarah se samajh kar aur dusre technical analysis tools ke sath combine karke istemal karein.

تبصرہ

Расширенный режим Обычный режим