What is Aroon Indicator:

Aroon indicator aik takneeki tajziye ka aala hai jo ghair mulki zar e mubadla ki khareed o farokht mein istemaal hota hai taakay fashion ki taaqat aur rastay ka taayun kya ja sakay. usay tshar chnde ne tayyar kya tha, aik mashhoor takneeki tajzia yeh maloom karne ke liye istemaal kya jata hai ke naya rujhan kab shuru ho raha hai ya khatam honay wala hai. lafz aroon sansikrat ke jumlay' tulu aftaab' ya' ibtidayi halkay' se makhoz hai, jo rujhan ki ibtidayi alamaat aur alamaat ki nishandahi karne ke isharay ke iraday ki akkaasi karta hai.

Aroon indicator linon par mushtamil hai : Aroon up line aur Aroon down line. Aroon up line waqfon ki miqdaar ki pemaiesh karti hai kyunkay kisi di gayi lambai mein sab se ziyada charge hota hai, jabkay Aroon down line aik di gayi muddat ke douran sab se kam qeemat ke tor par waqfon ki had ki pemaiesh karti hai. un linon ka mawazna karkay, tajir bijli aur rujhan ke course ka faisla kar satke hain

Calculation Of Aroon Indicator:

Aroon up aur Aroon down linon ka hisaab laganay ke liye, Aroon indicator mandarja zail farmolon ka istemaal karta hai :

Aroon up = ( waqfon ki tadaad jab aap is ziyada se ziyada par ghhor karte hain ) / muddaton ki tadaad ) * 100

Aroon dawn = ( muddaton kise kam kam honay ke baad ke adwaar ki tadaad ) / waqfon ki tadaad ) * aik so

Aroon indicator ko aam tor par rate chart ke neechay aik alehda chart par plot kya jata hai, jis se sarmaya karon ko aasani se is ke aamaal ka tajzia karne ki ijazat millti hai. isharay ki had 0 se 100 tak hoti hai, jis mein Aroon up line 0 aur 100 ke darmiyan aur Aroon down line sifar or ke darmiyan muntaqil hoti hai.

Interpretation of Aroon Indicator:

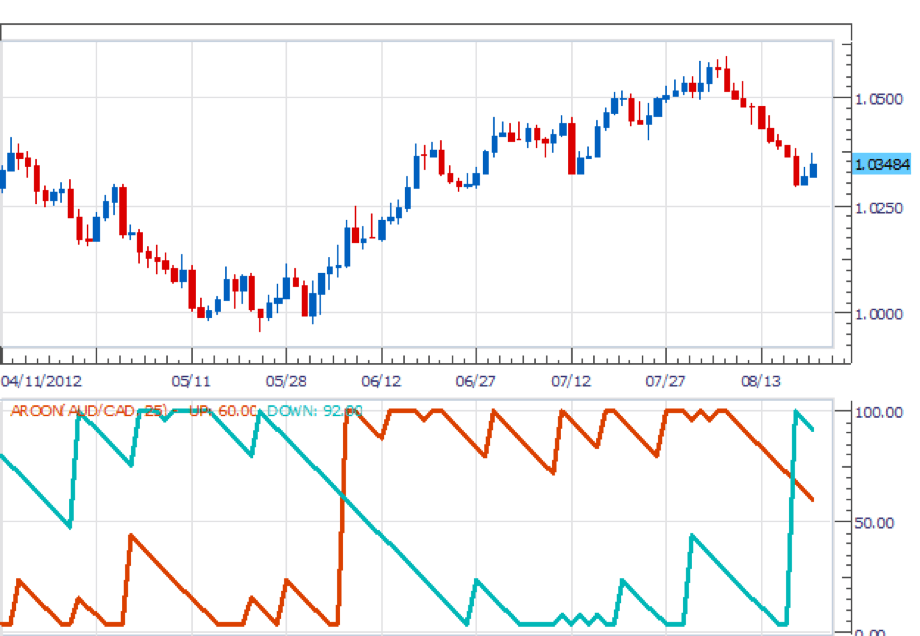

Tajir Aroon indicator ki tashreeh mutadid tareeqon se kar satke hain. jab Aroon up line Aroon down line ke oopar se guzarti hai, to yeh is baat ki nishandahi karti hai ke bilkul naya up trained shuru ho sakta hai. is ke bar aks, jab Aroon down line Aroon up line ke oopar se guzarti hai, to yeh zahir karta hai ke aik naya down trained shuru ho sakta hai. un cross overs ko salahiyat tak rasai ke tor par istemaal kya ja sakta hai aur tijarat ke liye points se bahar ja sakta hai.

Mazeed bar-aan, Aroon up aur Aroon down linon ke darmiyan farq rujhan ki taaqat ki nishandahi kar sakta hai. agar Aroon up line Aroon down line se musalsal behtar hai, to yeh aik mazboot up trained ki tajweez karta hai, yahan tak ke agar Aroon down line Aroon up line se musalsal behtar hai, to yeh aik mazboot down trained ki nishandahi karta hai. tajir is maloomat ko is baat ka taayun karne ke liye istemaal kar satke hain ke tijarat mein jana hai ya bahar niklana hai.

Understanding Aroon indicator:

Aroon indicator ko rujhan ki pairwi karne wali technical mein baqaidagi se istemaal kya jata hai, jis mein sarmaya car rujhan ki raftaar ka tajurbah karne ka iradah rakhtay hain. rujhan ki taaqat aur rastay ki nishandahi karkay, sarmaya car rujhan ki simt mein tijarat mein daakhil ho satke hain aur rujhan ke ulat jane tak inhen barqarar rakh satke hain.

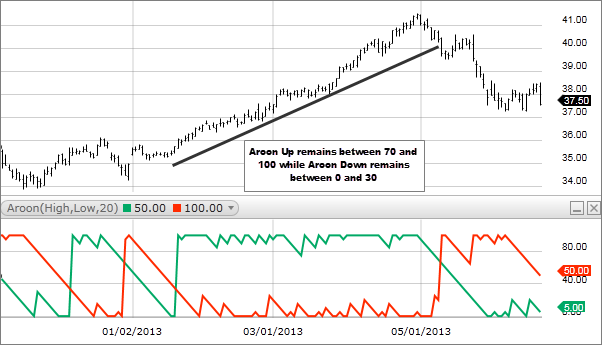

Misaal ke tor par, agar Aroon up line musalsal 70 se oopar hai aur Aroon down line musalsal 30 se neechay hai, to yeh aik mazboot up trained ki nishandahi karta hai. is ke baad tajir lambi pozishnon mein daakhil honay ke imkanaat talaash kar satke hain aur inhen is waqt tak barqarar rakh satke hain jab tak ke Aroon up line 30 se neechay nah aajay ya Aroon down line Aroon up line ke oopar se nah guzar jaye, jo salahiyat ki tabdeeli ki nishandahi karta hai.

Limitations of Aroon Indicator:

Agarchay Aroon indicator paish Raft ka pata laganay ke liye aik mufeed zareya ho sakta hai, lekin is ki kuch hudood hain jin se taajiron ko aagah hona chahiye. sab se pehlay, yeh aik pasmandah isharay hai, matlab yeh hai ke yeh signal peda karne ke liye maazi ki sharah ke adad o shumaar par mabni hai. yeh nuqta nazar ke jab koi fashion shuru hota hai ya khatam hota hai aur jab Aroon indicator is ki tasdeeq karta hai to is mein takheer ho sakti hai.

Dosra, Aroon indicator trading marketon mein behtareen hai aur side way ya renging marketon mein ghalat alert peda kar sakta hai. taajiron ko Aroon indicator ke isharay ki tasdeeq ke liye izafi takneeki isharay ya fees ki naqal o harkat ki tashkhees ka istemaal karne ki zaroorat hai aur mukammal tor par is ki reading ki bunyaad par tijarat mein daakhil honay se guraiz karna chahiye.

Aroon indicator aik takneeki tajziye ka aala hai jo ghair mulki zar e mubadla ki khareed o farokht mein istemaal hota hai taakay fashion ki taaqat aur rastay ka taayun kya ja sakay. usay tshar chnde ne tayyar kya tha, aik mashhoor takneeki tajzia yeh maloom karne ke liye istemaal kya jata hai ke naya rujhan kab shuru ho raha hai ya khatam honay wala hai. lafz aroon sansikrat ke jumlay' tulu aftaab' ya' ibtidayi halkay' se makhoz hai, jo rujhan ki ibtidayi alamaat aur alamaat ki nishandahi karne ke isharay ke iraday ki akkaasi karta hai.

Aroon indicator linon par mushtamil hai : Aroon up line aur Aroon down line. Aroon up line waqfon ki miqdaar ki pemaiesh karti hai kyunkay kisi di gayi lambai mein sab se ziyada charge hota hai, jabkay Aroon down line aik di gayi muddat ke douran sab se kam qeemat ke tor par waqfon ki had ki pemaiesh karti hai. un linon ka mawazna karkay, tajir bijli aur rujhan ke course ka faisla kar satke hain

Calculation Of Aroon Indicator:

Aroon up aur Aroon down linon ka hisaab laganay ke liye, Aroon indicator mandarja zail farmolon ka istemaal karta hai :

Aroon up = ( waqfon ki tadaad jab aap is ziyada se ziyada par ghhor karte hain ) / muddaton ki tadaad ) * 100

Aroon dawn = ( muddaton kise kam kam honay ke baad ke adwaar ki tadaad ) / waqfon ki tadaad ) * aik so

Aroon indicator ko aam tor par rate chart ke neechay aik alehda chart par plot kya jata hai, jis se sarmaya karon ko aasani se is ke aamaal ka tajzia karne ki ijazat millti hai. isharay ki had 0 se 100 tak hoti hai, jis mein Aroon up line 0 aur 100 ke darmiyan aur Aroon down line sifar or ke darmiyan muntaqil hoti hai.

Interpretation of Aroon Indicator:

Tajir Aroon indicator ki tashreeh mutadid tareeqon se kar satke hain. jab Aroon up line Aroon down line ke oopar se guzarti hai, to yeh is baat ki nishandahi karti hai ke bilkul naya up trained shuru ho sakta hai. is ke bar aks, jab Aroon down line Aroon up line ke oopar se guzarti hai, to yeh zahir karta hai ke aik naya down trained shuru ho sakta hai. un cross overs ko salahiyat tak rasai ke tor par istemaal kya ja sakta hai aur tijarat ke liye points se bahar ja sakta hai.

Mazeed bar-aan, Aroon up aur Aroon down linon ke darmiyan farq rujhan ki taaqat ki nishandahi kar sakta hai. agar Aroon up line Aroon down line se musalsal behtar hai, to yeh aik mazboot up trained ki tajweez karta hai, yahan tak ke agar Aroon down line Aroon up line se musalsal behtar hai, to yeh aik mazboot down trained ki nishandahi karta hai. tajir is maloomat ko is baat ka taayun karne ke liye istemaal kar satke hain ke tijarat mein jana hai ya bahar niklana hai.

Understanding Aroon indicator:

Aroon indicator ko rujhan ki pairwi karne wali technical mein baqaidagi se istemaal kya jata hai, jis mein sarmaya car rujhan ki raftaar ka tajurbah karne ka iradah rakhtay hain. rujhan ki taaqat aur rastay ki nishandahi karkay, sarmaya car rujhan ki simt mein tijarat mein daakhil ho satke hain aur rujhan ke ulat jane tak inhen barqarar rakh satke hain.

Misaal ke tor par, agar Aroon up line musalsal 70 se oopar hai aur Aroon down line musalsal 30 se neechay hai, to yeh aik mazboot up trained ki nishandahi karta hai. is ke baad tajir lambi pozishnon mein daakhil honay ke imkanaat talaash kar satke hain aur inhen is waqt tak barqarar rakh satke hain jab tak ke Aroon up line 30 se neechay nah aajay ya Aroon down line Aroon up line ke oopar se nah guzar jaye, jo salahiyat ki tabdeeli ki nishandahi karta hai.

Limitations of Aroon Indicator:

Agarchay Aroon indicator paish Raft ka pata laganay ke liye aik mufeed zareya ho sakta hai, lekin is ki kuch hudood hain jin se taajiron ko aagah hona chahiye. sab se pehlay, yeh aik pasmandah isharay hai, matlab yeh hai ke yeh signal peda karne ke liye maazi ki sharah ke adad o shumaar par mabni hai. yeh nuqta nazar ke jab koi fashion shuru hota hai ya khatam hota hai aur jab Aroon indicator is ki tasdeeq karta hai to is mein takheer ho sakti hai.

Dosra, Aroon indicator trading marketon mein behtareen hai aur side way ya renging marketon mein ghalat alert peda kar sakta hai. taajiron ko Aroon indicator ke isharay ki tasdeeq ke liye izafi takneeki isharay ya fees ki naqal o harkat ki tashkhees ka istemaal karne ki zaroorat hai aur mukammal tor par is ki reading ki bunyaad par tijarat mein daakhil honay se guraiz karna chahiye.

:max_bytes(150000):strip_icc()/Aroon-5c549e7d46e0fb000152e737.png)

تبصرہ

Расширенный режим Обычный режим