Introduction of Price Rate of Change (ROC) Indicator,

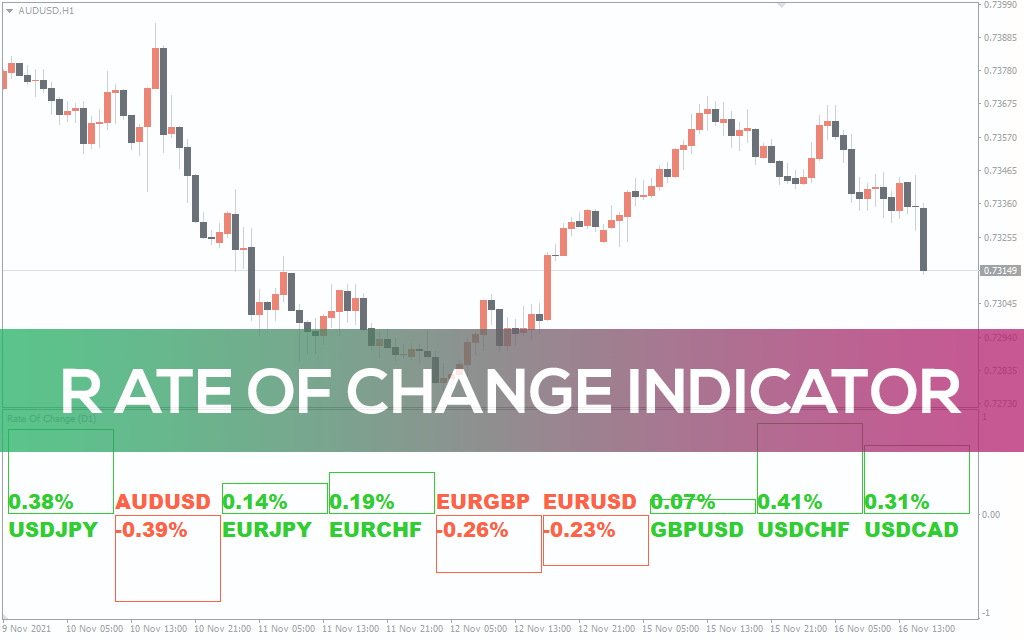

Dear friends Price Rate of Change (ROC),trading mein aik ahem indicator hai jo market ki tezi ya mandgi ko darust taur par maloom karne mein madad karta hai. Yeh indicator traders ko market trends ko samajhne mein aur trading decisions banane mein asanai pesh karta hai,Price Rate of Change, trading mein istemal hone wala aik technical indicator hai jo market ki momentum ya price changes ko measure karta hai. Yeh indicator percent mein hota hai aur woh daryaft karta hai ke asset ya security ki price mein mausamat kis tezi se ho rahi hai.

How Price Rate of Change (ROC) Indicator Works,

ROC kaam karne ke liye aapko do moqaablayat (periods) chunne padte hain: aaj ki price aur aik muddat pehle ki price. Formula is tarah kaam karta hai ROC, traders ke liye ahem hai kyun ke yeh unhe market ki momentum ko samajhne mein madad karta hai. Agar ROC zyada hai, toh yeh darust karta hai ke market tez hai, jabke agar ROC kam hai toh yeh ishara hai ke market mein kamzori hai. Isse traders apni strategies banate waqt market conditions ko behtar taur par samajh sakte hain.

Using Price Rate of Change (ROC) Indicator in Trading,

Traders ROC ko alag-alag tariqon se istemal karte hain. Kuch log isey trend confirmation ke liye istemal karte hain, jabke doosre ise overbought ya oversold conditions ko pehchanne ke liye istemal karte hain. ROC ki madad se traders ko entry aur exit points tay karne mein asanai hoti hai.

ROC and Divergence,

Divergence, jab asset ki price aur ROC mein farq hota hai, trading ke liye ek ahem signal hai. Agar asset ki price naye highs banati hai lekin ROC mein kamzori nazar aati hai, toh yeh ishara hai ke uptrend kamzor ho sakta hai aur market reversal hone ki sambhavna hai.Hamesha yaad rahe ke ROC bhi kisi ek indicator ki tarah 100% sahi nahi hota. Market mein hamesha uncertainties hoti hain aur kisi bhi indicator ki tarah ROC bhi false signals de sakta hai. Isliye, iska istemal karne se pehle doosre confirmatory indicators ka bhi istemal karna zaroori hai.

Benefits of Price Rate of Change (ROC) Indicator,

ROC and Risk Management,

Traders ko hamesha yeh yaad rakhna chahiye ke ROC sirf ek tool hai aur isay isolate kar ke istemal karna ghalat ho sakta hai. Hamesha doosre technical indicators aur market analysis ke saath istemal karein. Risk management ko bhi mad-e-nazar rakhein takay losses ko control kiya ja sake.Price Rate of Change (ROC) indicator, trading mein ek ahem tool hai jo market trends aur momentum ko samajhne mein madad karta hai. Iska istemal smartly kiya jaye toh yeh traders ko behtar trading decisions lene mein madad karta hai. Lekin, hamesha yaad rahe ke koi bhi indicator 100% perfect nahi hota, aur market conditions hamesha changing hoti hain, isliye prudent aur informed decisions lene ke liye zaroori hai.

Dear friends Price Rate of Change (ROC),trading mein aik ahem indicator hai jo market ki tezi ya mandgi ko darust taur par maloom karne mein madad karta hai. Yeh indicator traders ko market trends ko samajhne mein aur trading decisions banane mein asanai pesh karta hai,Price Rate of Change, trading mein istemal hone wala aik technical indicator hai jo market ki momentum ya price changes ko measure karta hai. Yeh indicator percent mein hota hai aur woh daryaft karta hai ke asset ya security ki price mein mausamat kis tezi se ho rahi hai.

How Price Rate of Change (ROC) Indicator Works,

ROC kaam karne ke liye aapko do moqaablayat (periods) chunne padte hain: aaj ki price aur aik muddat pehle ki price. Formula is tarah kaam karta hai ROC, traders ke liye ahem hai kyun ke yeh unhe market ki momentum ko samajhne mein madad karta hai. Agar ROC zyada hai, toh yeh darust karta hai ke market tez hai, jabke agar ROC kam hai toh yeh ishara hai ke market mein kamzori hai. Isse traders apni strategies banate waqt market conditions ko behtar taur par samajh sakte hain.

Using Price Rate of Change (ROC) Indicator in Trading,

Traders ROC ko alag-alag tariqon se istemal karte hain. Kuch log isey trend confirmation ke liye istemal karte hain, jabke doosre ise overbought ya oversold conditions ko pehchanne ke liye istemal karte hain. ROC ki madad se traders ko entry aur exit points tay karne mein asanai hoti hai.

ROC and Divergence,

Divergence, jab asset ki price aur ROC mein farq hota hai, trading ke liye ek ahem signal hai. Agar asset ki price naye highs banati hai lekin ROC mein kamzori nazar aati hai, toh yeh ishara hai ke uptrend kamzor ho sakta hai aur market reversal hone ki sambhavna hai.Hamesha yaad rahe ke ROC bhi kisi ek indicator ki tarah 100% sahi nahi hota. Market mein hamesha uncertainties hoti hain aur kisi bhi indicator ki tarah ROC bhi false signals de sakta hai. Isliye, iska istemal karne se pehle doosre confirmatory indicators ka bhi istemal karna zaroori hai.

Benefits of Price Rate of Change (ROC) Indicator,

- Momentum ko measure karne ka asan tariqa.

- Overbought ya oversold conditions ko pehchanne mein madad.

- Market trends ko confirm karne mein help karta hai.

- Divergence se market reversals ka pata lagane mein asanai pesh karta hai.

ROC and Risk Management,

Traders ko hamesha yeh yaad rakhna chahiye ke ROC sirf ek tool hai aur isay isolate kar ke istemal karna ghalat ho sakta hai. Hamesha doosre technical indicators aur market analysis ke saath istemal karein. Risk management ko bhi mad-e-nazar rakhein takay losses ko control kiya ja sake.Price Rate of Change (ROC) indicator, trading mein ek ahem tool hai jo market trends aur momentum ko samajhne mein madad karta hai. Iska istemal smartly kiya jaye toh yeh traders ko behtar trading decisions lene mein madad karta hai. Lekin, hamesha yaad rahe ke koi bhi indicator 100% perfect nahi hota, aur market conditions hamesha changing hoti hain, isliye prudent aur informed decisions lene ke liye zaroori hai.

تبصرہ

Расширенный режим Обычный режим