Bari Currency Pairs Samajhna

Currency trading ya forex trading ek aham hissa hai financial markets ka. Is mein traders mukhtalif currencies ke darmiyan tabdeel karne ki koshish karte hain taake faida hasil kar sakein. Is kaam mein, bari currency pairs ka istemal hota hai. Ye article bari currency pairs ke bare mein samajh faraham karta hai.

1. Majors vs. Minors

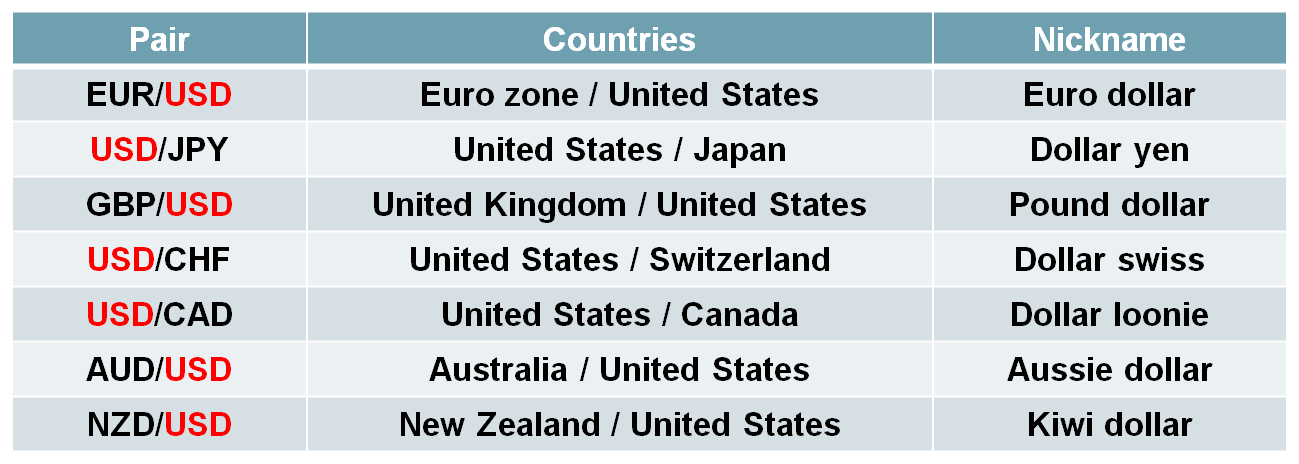

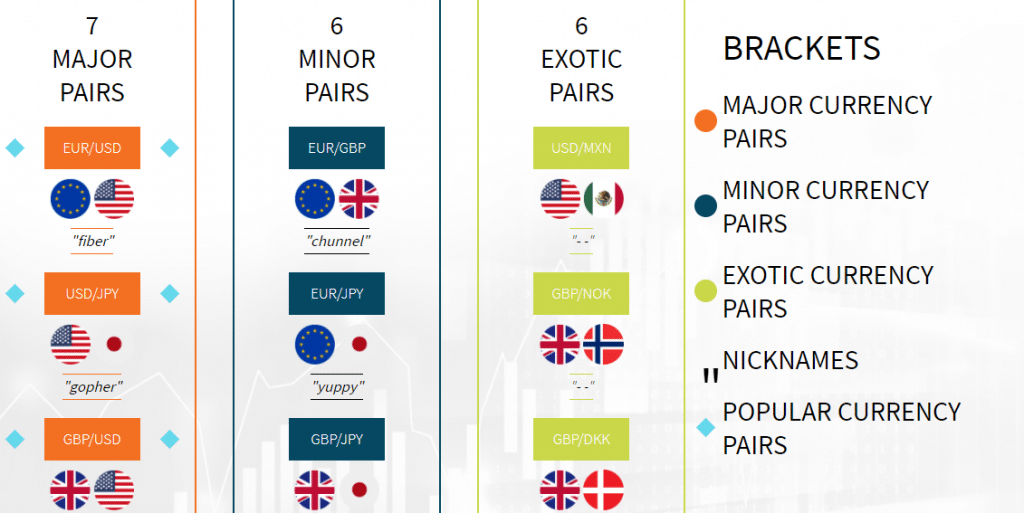

Bari currency pairs ko do kisam mein taqseem kiya jata hai: Majors and Minors. Majors mein woh currency pairs shamil hai jo dunya ke sab se powerful aur sab se zyada trade kiye jane wale countries ki currencies ko shamil karte hain. Jinhe Majors mein shamil kiya jata hai woh hai:

- USD/EUR (US Dollar/Euro)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

Minors ya crosses un currency pairs ko kehte hain jo Majors mein shamil nahi hote. Ye typically ek Major currency ke saath kisi aur currency ka pair hota hai, jaise ke EUR/GBP ya AUD/JPY.

2. USD as Base Currency

Majors mein se zyada tar currency pairs mein US Dollar (USD) base currency hoti hai. Base currency woh hoti hai jiski keemat dusri currency ke muqable mein darust hoti hai. Maslan, agar hum USD/EUR currency pair ka tajzia karte hain, to USD base currency hai aur EUR quote currency hai. Iska matlab hai ke ek USD ki keemat kitni Euros mein hai.

3. Currency Pair ki Keemat

Currency pair ki keemat ko samajhne ke liye, traders ko exchange rate dekhna hota hai. Exchange rate woh rate hota hai jisse ek currency ko doosri currency ke sath tabdeel kiya jata hai. Maslan, agar USD/EUR exchange rate 1.20 hai, to iska matlab hai ke 1 US Dollar 1.20 Euros ke barabar hai.

4. Trading Major Currency Pairs

Majors mein trading karna aam tor par zyada asan hota hai kyun ke in pairs mein zyada liquidity hoti hai aur spreads kam hote hain. Liquidity aur tight spreads traders ko transactions ko aasan banate hain aur unhein achhi entry and exit points prapt karne mein madad karte hain.

Bari currency pairs, forex trading ka aham hissa hain aur inko samjhna har trader ke liye zaroori hai. Majors aur Minors ke darmiyan farq samajhna aur in pairs ki dynamics ko samajh kar trading karne se traders apni trading strategies ko behtar bana sakte hain aur mukhtalif market situations ka behtar jawab de sakte hain.

تبصرہ

Расширенный режим Обычный режим