Analysis of DragonFly Doji candlestick pattern

Dragonfly Doji ek candlestick pattern hai jo ki bullish reversal signal provide karta hai jab ye downtrend ke doran develop hota hai. Ye pattern ek single candlestick se banta hai aur market ke sentiment ko indicate karta hai.

Yahan Dragonfly Doji pattern ki kuch ahem pehchanat hain:

Dragonfly Doji pattern ki samajh aur sahi tajziya karne ke liye, traders ko candlestick patterns aur market context ko samajhna zaroori hota hai. Is pattern ko sahi taur par interpret karne ke liye, traders ko market ke aur factors aur confirmatory signals ko bhi consider karna chahiye.Dragonfly Doji pattern ka istemal traders market trend ka reversal identify karne mein karte hain. Agar ye pattern sahi jagah par form hota hai, aur saath hi confirming indicators bhi hain, toh traders is pattern ko buy signals ke liye istemal kar sakte hain. Lekin yaad rahe ke har pattern ki tarah, ye bhi ek indicator hai aur khud se hi trading decision lene se pehle dusri confirmations ka istemal zaroori hai.

Dragonfly Doji ek candlestick pattern hai jo ki bullish reversal signal provide karta hai jab ye downtrend ke doran develop hota hai. Ye pattern ek single candlestick se banta hai aur market ke sentiment ko indicate karta hai.

Yahan Dragonfly Doji pattern ki kuch ahem pehchanat hain:

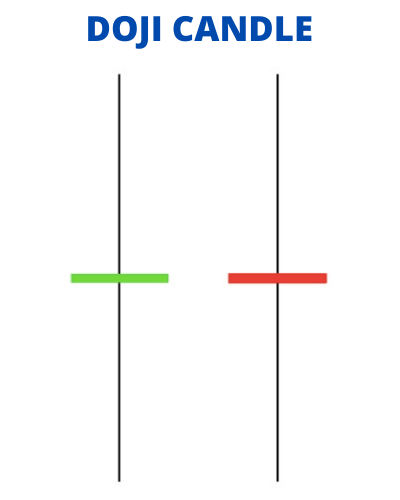

- Appearance: Dragonfly Doji pattern ek single candlestick hota hai jo ek lambi lower shadow ke saath hota hai, jabki upper shadow ki length minimal hoti hai. Body ke size ko ignore karte hue, candlestick resemble karta hai ek dragonfly ke jaise, isliye ise Dragonfly Doji kehte hain.

- Bullish Reversal Signal: Dragonfly Doji pattern downtrend ke doran form hota hai aur bullish reversal ka indication deta hai. Jab market mein downtrend hota hai aur Dragonfly Doji pattern develop hota hai, ye indicate karta hai ke selling pressure kam ho rahi hai aur buyers control mein aa rahe hain.

- Support Level: Jab Dragonfly Doji pattern support level par develop hota hai, toh ye us level ko confirm karta hai aur bullish reversal ki possibility ko strengthen karta hai. Traders support level ke paas yeh pattern dekh kar long positions enter kar sakte hain.

- Confirmation: Jaise ki har candlestick pattern ke saath hota hai, Dragonfly Doji ko confirm karne ke liye additional analysis ki zarurat hoti hai. Iske saath volume analysis aur doji ke aspaas ke candlestick patterns ko dekhna zaroori hota hai. Agar Dragonfly Doji ke baad ek strong bullish candle develop hota hai, toh ye pattern ka confirmation hota hai.

Dragonfly Doji pattern ki samajh aur sahi tajziya karne ke liye, traders ko candlestick patterns aur market context ko samajhna zaroori hota hai. Is pattern ko sahi taur par interpret karne ke liye, traders ko market ke aur factors aur confirmatory signals ko bhi consider karna chahiye.Dragonfly Doji pattern ka istemal traders market trend ka reversal identify karne mein karte hain. Agar ye pattern sahi jagah par form hota hai, aur saath hi confirming indicators bhi hain, toh traders is pattern ko buy signals ke liye istemal kar sakte hain. Lekin yaad rahe ke har pattern ki tarah, ye bhi ek indicator hai aur khud se hi trading decision lene se pehle dusri confirmations ka istemal zaroori hai.

تبصرہ

Расширенный режим Обычный режим