Details.

Forex Trading ka matlab hota hai foreign exchange ki trading jisme traders currencies ko buy ya sell karte hain. Take profit ka use traders apni open position ko close karne ke liye karte hain, jab unka desired profit level reach ho jata hai. Iss article mein hum forex trading mein take profit ka istemal roman urdu mein explain karenge.

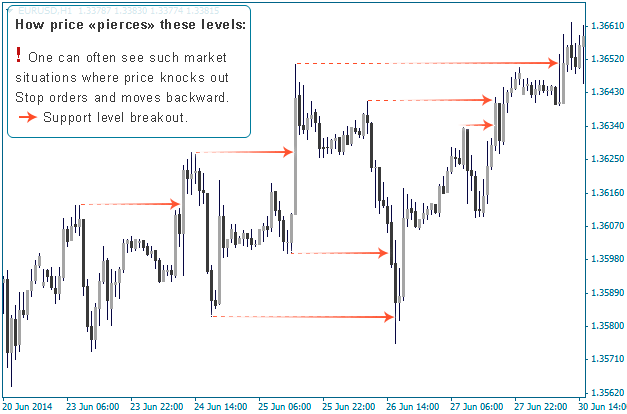

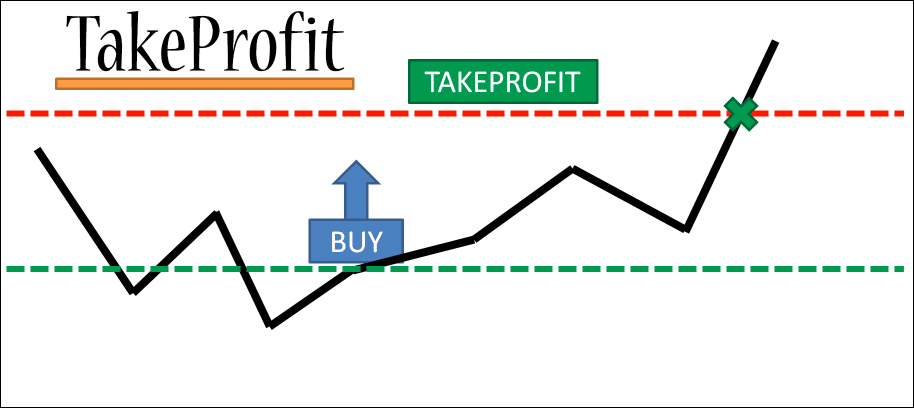

Take profit ek trading strategy hota hai jisme traders apni open position ko close karne ke liye ek target price set karte hain. Jab market price apne target price tak pahunch jata hai, to traders apni position ko close kar dete hain aur profit book karte hain. Iss strategy ka use traders apne trading plan mein karte hain, jisse unhe apne trades ko manage karne mein help milti hai.

Take Profit Working.

Take profit ka work karne ka tarika simple hai. Jab traders apni position open karte hain, to wo ek target price set karte hain jisse wo apni position ko close karna chahte hain. Jab market price unke target price tak pahunch jata hai, to unhe notification milta hai aur wo apni position ko close kar dete hain. Take profit ka use traders apni risk management strategy mein karte hain, jisse wo apne trades ko manage kar sake.

Take profit ka istemal karna traders ke liye important hai. Iss strategy ka use traders apne trades ko manage karne mein karte hain. Take profit ka istemal karne ke liye traders ko apne trading platform mein jana hoga. Yahan traders apni open position ko select karenge aur apni target price set karenge. Jab market price unke target price tak pahunch jata hai, to unhe notification milta hai aur wo apni position ko close kar dete hain.

Take Profit Benefits.

Take profit ka istemal karne ke bahut se benefits hai. Kuch benefits niche diye gaye hain:

Risk Management:

Take profit ka istemal karne se traders apne trades ko manage kar sakte hain aur apni risk management strategy ko follow kar sakte hain.

Profit Booking

Take profit ka istemal karne se traders apni profit book kar sakte hain aur apne trading account mein money add kar sakte hain.

Trading Plan:

Take profit ka istemal karne se traders apni trading plan ko follow kar sakte hain aur apne trades ko manage kar sakte hain.

Is thread mein humne forex trading mein take profit ka istemal roman urdu mein explain kiya hai. Take profit ka use traders apne trades ko manage karne ke liye karte hain. Iss strategy ka istemal karne se traders apne trading plan ko follow kar sakte hain aur apni risk management strategy ko follow kar sakte hain.

Forex Trading ka matlab hota hai foreign exchange ki trading jisme traders currencies ko buy ya sell karte hain. Take profit ka use traders apni open position ko close karne ke liye karte hain, jab unka desired profit level reach ho jata hai. Iss article mein hum forex trading mein take profit ka istemal roman urdu mein explain karenge.

Take profit ek trading strategy hota hai jisme traders apni open position ko close karne ke liye ek target price set karte hain. Jab market price apne target price tak pahunch jata hai, to traders apni position ko close kar dete hain aur profit book karte hain. Iss strategy ka use traders apne trading plan mein karte hain, jisse unhe apne trades ko manage karne mein help milti hai.

Take Profit Working.

Take profit ka work karne ka tarika simple hai. Jab traders apni position open karte hain, to wo ek target price set karte hain jisse wo apni position ko close karna chahte hain. Jab market price unke target price tak pahunch jata hai, to unhe notification milta hai aur wo apni position ko close kar dete hain. Take profit ka use traders apni risk management strategy mein karte hain, jisse wo apne trades ko manage kar sake.

Take profit ka istemal karna traders ke liye important hai. Iss strategy ka use traders apne trades ko manage karne mein karte hain. Take profit ka istemal karne ke liye traders ko apne trading platform mein jana hoga. Yahan traders apni open position ko select karenge aur apni target price set karenge. Jab market price unke target price tak pahunch jata hai, to unhe notification milta hai aur wo apni position ko close kar dete hain.

Take Profit Benefits.

Take profit ka istemal karne ke bahut se benefits hai. Kuch benefits niche diye gaye hain:

Risk Management:

Take profit ka istemal karne se traders apne trades ko manage kar sakte hain aur apni risk management strategy ko follow kar sakte hain.

Profit Booking

Take profit ka istemal karne se traders apni profit book kar sakte hain aur apne trading account mein money add kar sakte hain.

Trading Plan:

Take profit ka istemal karne se traders apni trading plan ko follow kar sakte hain aur apne trades ko manage kar sakte hain.

Is thread mein humne forex trading mein take profit ka istemal roman urdu mein explain kiya hai. Take profit ka use traders apne trades ko manage karne ke liye karte hain. Iss strategy ka istemal karne se traders apne trading plan ko follow kar sakte hain aur apni risk management strategy ko follow kar sakte hain.

تبصرہ

Расширенный режим Обычный режим