What is Crab Pattern:

Crab patteren aik takneeki tshkhisi tool hai jo forex trading mein istemaal hota hai jo market ki taraqqi mein salahiyat ke ulat awamil ki nishandahi karne mein madad karta hai. yeh hum aahang tarzo ke wasee tar –apne khandan ka hissa hai aur usay samajhney ke liye sab se jadeed aur paicheeda namonon mein se aik samjha jata hai. crab ka namona market ke ulat palat ki paish goi mein is ki aala durustagi ke liye jana jata hai, jis se yeh hunar mand zar e mubadla ke kharidaron mein aik mashhoor khwahish ban jata hai.

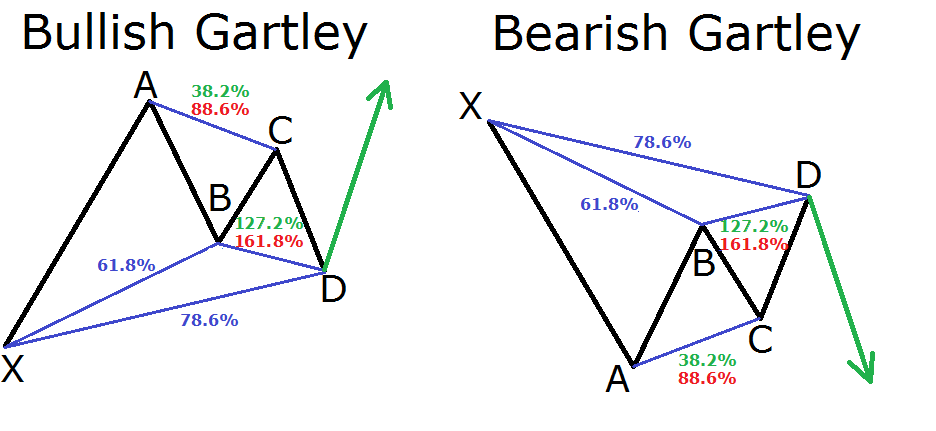

Crab ke patteren ki khasusiyat munfarid fabnoci retracement marahil hain jo charge chart par aik allag hindsi shakal ki tashkeel karte hain. usay crab se is ki shakal ki mamaslat ke naam se jana jata hai, is ki zabardast lambi soyng tangon aur aik nakli mourr ke sath. patteren ki shanakht aik wasee qeemat gardish ki madad se ki jati hai jis ka mushahida retracement ke zariye kya jata hai, aur phir kuch aur harkat jo ibtidayi bahao se agay barh jati hai. yeh tosee aik ab = cd namona banati hai, jahan nuqta d mumkina ulat nuqta hai.

harmonic-crab-patterns.webp

Structure and Fibonacci ratio of Crab Pattern:

Crab ka namona ain mutabiq Fibonacci retracement ki sthon ke artkaz ke zariye tashkeel diya jata hai. yeh marahil Fibonacci series se akhaz kiye gaye hain, jo aik multiple majmoa hai jis mein har wasee tanawu do Sabiqa nambaron ka majmoa hai. crab patteren ke tanazur mein, istemaal honay wali ahem cheez Fibonacci tanasub sifar. 382, 0. 618, 1.618, aur aik jori of. 618 hain.

Crab ke patteren ko daryaft karne ke liye, tajir nuqta x se nuqta a tak Fibonacci retracement degree khech kar shuru karte hain, jo ibtidayi qeemat ki gardish ki numaindagi karta hai. bazyaft ka marhala aksar 0. 382 aur sifar. 618 ke darmiyan aata hai. agla, aik Fibonacci tosee Ansar a se Ansar d tak khenchi jati hai, jo salahiyat ke ulat nuqta ki numaindagi karti hai. tosee ka marhala aam tor par 1.618 aur aik jore of. 618 ke darmiyan hai.

Trading With Crab Pattern:

Crab patteren ki trading ke liye takneeki tashkhees aur rissk managment ki hikmat amlyon ke majmoay ki zaroorat hoti hai. jab crab ke patteren ko pehchana jata hai, to sarmaya car patteren ke rastay par inhisaar karte hue mukhtasir ya lambi pozishnon mein anay ki madad se salahiyat ke ulat jane ka faida utha satke hain.

Fori pozishnon ke liye, tajir is waqt daakhil ho satke hain jab sharah mumkina ulat nuqta ( point d ) tak pahonch jati hai aur mandi ke ulat honay ki alamaton ki nishandahi karta hai, jis mein mandi ki mom batii ka namona ya raftaar ke isharay ke andar inhiraf shaamil hota hai. stop las order ko Ansar d se oopar rakha ja sakta hai, jabkay take income ka hadaf pichlle soyng lo ya is ke baad ke Fibonacci darjay par muqarrar kya ja sakta hai.

Taweel pozishnon ke liye, amal mawazna hai lekin mukhalif simt ke andar. tajir is waqt un pitt kar satke hain jab charge point d tak pahonch jaye aur taizi ke ulat jane ki alamaat ka ishara day. Faristal las order ko Ansar d ke neechay rakha ja sakta hai, jabkay take praft ka hadaf pichli soyng high ya agli fabonoci satah par muqarrar kya ja sakta hai.

Limitations of Crab Pattern:

Agarchay crab ka namona zar e mubadla ki tijarat mein aik mo-asar zareya ho sakta hai, lekin is ki hudood ka notice lena aur tijarti faislay karne se pehlay izafi anasir ko nah bhoolna bohat zaroori hai. mukhtalif takneeki tshkhisi alaat ki terhan, crab ka namona faul proof nahi hai aur ghalat isharay peda kar sakta hai. lehaza, yeh bohat zaroori hai ke usay dosray takneeki isharay ke sath milaya jaye, jis mein rujhan ki linen, shifting average, ya oscillator shaamil hain, taakay kamyabi ke mutabadil ke imkaan ko badhaya ja sakay.

Mazeed bar-aan, crab patteren trending marketon mein miyaar ke mutabiq kaam karta hai jis mein fees ke iqdamaat kaafi hamwar aur paish goi ke qabil hotay hain. mutazalzal ya side way baazaaron mein, patteren ki durustagi mein bhi kami askati hai, jis se ziyada ghalat isharay mlitay hain. lehaza, crab patteren par mukammal tor par inhisaar karne se pehlay bazaar ke majmoi halaat ka jaiza lena zaroori hai.

Real Word Example of Crab Pattern:

Mashq mein crab ke namoonay ko behtar tor par samajhney ke liye, aayiyae kuch haqeeqi duniya ki misalein talaash karen. farz karen ke aik ghair mulki raqam ka jora up trained mein hai aur 100 dollar ki qeemat par point x tak pahonch gaya hai. is ke baad fees $ 80 par a ki taraf ishara karti hai, jo sifar. 382 Fibonacci retracement ki numaindagi karti hai. point ae se, charge apni oopar ki harkat ko dobarah shuru karta hai aur factor d tak pahonch jata hai $ 100 bees, jo 1.618 Fibonacci tosee hai.

Crab patteren ki bunyaad par, aik dealer ko mumkina ulat palat ko dekhte hue, $ 120 par aik mukhtasir function darj karna chahiye. nuqsaan se bachao ka order $ 120 se oopar rakha ja sakta hai, jab ke aamdani ka hadaf $ 80 ki pichli soyng kam ya aglay Fibonacci marhalay par muqarrar kya ja sakta hai.

Crab patteren aik takneeki tshkhisi tool hai jo forex trading mein istemaal hota hai jo market ki taraqqi mein salahiyat ke ulat awamil ki nishandahi karne mein madad karta hai. yeh hum aahang tarzo ke wasee tar –apne khandan ka hissa hai aur usay samajhney ke liye sab se jadeed aur paicheeda namonon mein se aik samjha jata hai. crab ka namona market ke ulat palat ki paish goi mein is ki aala durustagi ke liye jana jata hai, jis se yeh hunar mand zar e mubadla ke kharidaron mein aik mashhoor khwahish ban jata hai.

Crab ke patteren ki khasusiyat munfarid fabnoci retracement marahil hain jo charge chart par aik allag hindsi shakal ki tashkeel karte hain. usay crab se is ki shakal ki mamaslat ke naam se jana jata hai, is ki zabardast lambi soyng tangon aur aik nakli mourr ke sath. patteren ki shanakht aik wasee qeemat gardish ki madad se ki jati hai jis ka mushahida retracement ke zariye kya jata hai, aur phir kuch aur harkat jo ibtidayi bahao se agay barh jati hai. yeh tosee aik ab = cd namona banati hai, jahan nuqta d mumkina ulat nuqta hai.

harmonic-crab-patterns.webp

Structure and Fibonacci ratio of Crab Pattern:

Crab ka namona ain mutabiq Fibonacci retracement ki sthon ke artkaz ke zariye tashkeel diya jata hai. yeh marahil Fibonacci series se akhaz kiye gaye hain, jo aik multiple majmoa hai jis mein har wasee tanawu do Sabiqa nambaron ka majmoa hai. crab patteren ke tanazur mein, istemaal honay wali ahem cheez Fibonacci tanasub sifar. 382, 0. 618, 1.618, aur aik jori of. 618 hain.

Crab ke patteren ko daryaft karne ke liye, tajir nuqta x se nuqta a tak Fibonacci retracement degree khech kar shuru karte hain, jo ibtidayi qeemat ki gardish ki numaindagi karta hai. bazyaft ka marhala aksar 0. 382 aur sifar. 618 ke darmiyan aata hai. agla, aik Fibonacci tosee Ansar a se Ansar d tak khenchi jati hai, jo salahiyat ke ulat nuqta ki numaindagi karti hai. tosee ka marhala aam tor par 1.618 aur aik jore of. 618 ke darmiyan hai.

Trading With Crab Pattern:

Crab patteren ki trading ke liye takneeki tashkhees aur rissk managment ki hikmat amlyon ke majmoay ki zaroorat hoti hai. jab crab ke patteren ko pehchana jata hai, to sarmaya car patteren ke rastay par inhisaar karte hue mukhtasir ya lambi pozishnon mein anay ki madad se salahiyat ke ulat jane ka faida utha satke hain.

Fori pozishnon ke liye, tajir is waqt daakhil ho satke hain jab sharah mumkina ulat nuqta ( point d ) tak pahonch jati hai aur mandi ke ulat honay ki alamaton ki nishandahi karta hai, jis mein mandi ki mom batii ka namona ya raftaar ke isharay ke andar inhiraf shaamil hota hai. stop las order ko Ansar d se oopar rakha ja sakta hai, jabkay take income ka hadaf pichlle soyng lo ya is ke baad ke Fibonacci darjay par muqarrar kya ja sakta hai.

Taweel pozishnon ke liye, amal mawazna hai lekin mukhalif simt ke andar. tajir is waqt un pitt kar satke hain jab charge point d tak pahonch jaye aur taizi ke ulat jane ki alamaat ka ishara day. Faristal las order ko Ansar d ke neechay rakha ja sakta hai, jabkay take praft ka hadaf pichli soyng high ya agli fabonoci satah par muqarrar kya ja sakta hai.

Limitations of Crab Pattern:

Agarchay crab ka namona zar e mubadla ki tijarat mein aik mo-asar zareya ho sakta hai, lekin is ki hudood ka notice lena aur tijarti faislay karne se pehlay izafi anasir ko nah bhoolna bohat zaroori hai. mukhtalif takneeki tshkhisi alaat ki terhan, crab ka namona faul proof nahi hai aur ghalat isharay peda kar sakta hai. lehaza, yeh bohat zaroori hai ke usay dosray takneeki isharay ke sath milaya jaye, jis mein rujhan ki linen, shifting average, ya oscillator shaamil hain, taakay kamyabi ke mutabadil ke imkaan ko badhaya ja sakay.

Mazeed bar-aan, crab patteren trending marketon mein miyaar ke mutabiq kaam karta hai jis mein fees ke iqdamaat kaafi hamwar aur paish goi ke qabil hotay hain. mutazalzal ya side way baazaaron mein, patteren ki durustagi mein bhi kami askati hai, jis se ziyada ghalat isharay mlitay hain. lehaza, crab patteren par mukammal tor par inhisaar karne se pehlay bazaar ke majmoi halaat ka jaiza lena zaroori hai.

Real Word Example of Crab Pattern:

Mashq mein crab ke namoonay ko behtar tor par samajhney ke liye, aayiyae kuch haqeeqi duniya ki misalein talaash karen. farz karen ke aik ghair mulki raqam ka jora up trained mein hai aur 100 dollar ki qeemat par point x tak pahonch gaya hai. is ke baad fees $ 80 par a ki taraf ishara karti hai, jo sifar. 382 Fibonacci retracement ki numaindagi karti hai. point ae se, charge apni oopar ki harkat ko dobarah shuru karta hai aur factor d tak pahonch jata hai $ 100 bees, jo 1.618 Fibonacci tosee hai.

Crab patteren ki bunyaad par, aik dealer ko mumkina ulat palat ko dekhte hue, $ 120 par aik mukhtasir function darj karna chahiye. nuqsaan se bachao ka order $ 120 se oopar rakha ja sakta hai, jab ke aamdani ka hadaf $ 80 ki pichli soyng kam ya aglay Fibonacci marhalay par muqarrar kya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим