Importence.

Morning aur Evening Star pattern ka matlab hai kisi stock ya share ke price movement ka pattern, jismein kuch din ke baad price ki movement ek particular shape banati hai jise hum Morning Star aur Evening Star kehte hain. Is pattern ko dekh kar traders apni investment aur trading decisions lete hain.

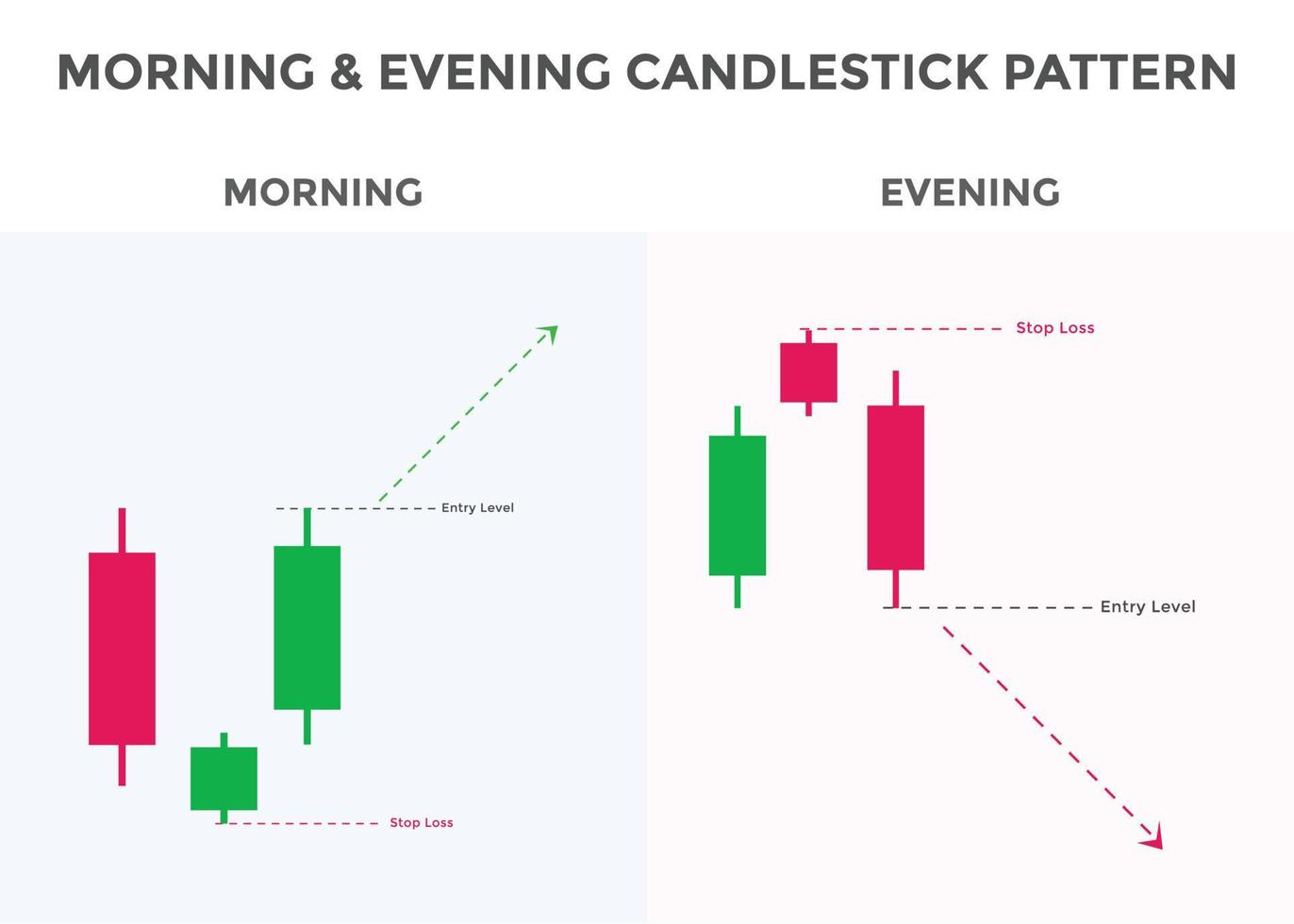

Morning Star Pattern.

Morning Star pattern ek bullish reversal pattern hai, jismein stock ki price ek downtrend ke baad ek dojis candle ke baad ek bullish candle banati hai. Iske baad dojis candle ek bullish candle ke baad banti hai, jismein price gap up hoti hai aur volume bhi increase hota hai.

Is pattern mein dojis candle ki length choti honi chahiye aur bullish candle ki length long honi chahiye. Agar yeh pattern sahi tarah se form ho jata hai to yeh bullish trend ka signal deta hai aur traders buy karne ke liye ready ho jaate hain.

Evening Star Pattern.

Evening Star pattern ek bearish reversal pattern hai, jismein stock ki price ek uptrend ke baad ek long bullish candle ke baad ek dojis candle banati hai. Iske baad dojis candle ek bearish candle ke baad banti hai, jismein price gap down hoti hai aur volume bhi increase hota hai.

Is pattern mein dojis candle ki length choti honi chahiye aur bearish candle ki length long honi chahiye. Agar yeh pattern sahi tarah se form ho jata hai to yeh bearish trend ka signal deta hai aur traders sell karne ke liye ready ho jaate hain.

Make and Shape.

Morning aur Evening Star pattern ki madad se traders apni trading decisions lete hain aur stock market ke movement ko predict karte hain. Yeh pattern sahi tarah se samajhna aur identify karna traders ke liye bahut important hai.

Morning aur Evening Star pattern ka matlab hai kisi stock ya share ke price movement ka pattern, jismein kuch din ke baad price ki movement ek particular shape banati hai jise hum Morning Star aur Evening Star kehte hain. Is pattern ko dekh kar traders apni investment aur trading decisions lete hain.

Morning Star Pattern.

Morning Star pattern ek bullish reversal pattern hai, jismein stock ki price ek downtrend ke baad ek dojis candle ke baad ek bullish candle banati hai. Iske baad dojis candle ek bullish candle ke baad banti hai, jismein price gap up hoti hai aur volume bhi increase hota hai.

Is pattern mein dojis candle ki length choti honi chahiye aur bullish candle ki length long honi chahiye. Agar yeh pattern sahi tarah se form ho jata hai to yeh bullish trend ka signal deta hai aur traders buy karne ke liye ready ho jaate hain.

Evening Star Pattern.

Evening Star pattern ek bearish reversal pattern hai, jismein stock ki price ek uptrend ke baad ek long bullish candle ke baad ek dojis candle banati hai. Iske baad dojis candle ek bearish candle ke baad banti hai, jismein price gap down hoti hai aur volume bhi increase hota hai.

Is pattern mein dojis candle ki length choti honi chahiye aur bearish candle ki length long honi chahiye. Agar yeh pattern sahi tarah se form ho jata hai to yeh bearish trend ka signal deta hai aur traders sell karne ke liye ready ho jaate hain.

Make and Shape.

Morning aur Evening Star pattern ki madad se traders apni trading decisions lete hain aur stock market ke movement ko predict karte hain. Yeh pattern sahi tarah se samajhna aur identify karna traders ke liye bahut important hai.

تبصرہ

Расширенный режим Обычный режим