Pattern details.

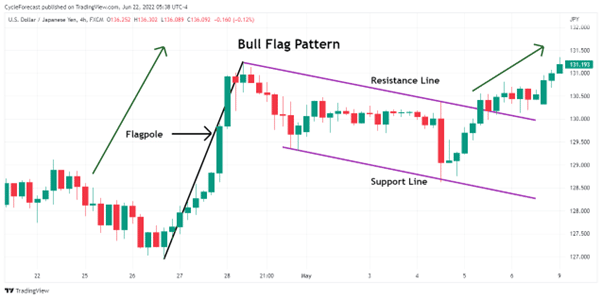

Flag Chart Pattern ka matlab hai jhande ki shakal ka chart pattern. Is pattern mein market mein price ka ek short-term consolidation phase hota hai, jiske baad price ka trend wapas direction mein move karta hai.

Flag Chart Pattern Identification.

Price Consolidation Phase.

Flag Chart Pattern mein price ka short-term consolidation phase hota hai, jise flag ke shape se compare kiya jata hai.

Flagpole.

Flagpole, jisme price ka sudden move hota hai, flag pattern ki ek zaroori shart hai.

Volume.

Flag Chart Pattern mein volume ka ek important role hota hai. Jab flag pattern ban raha hota hai to volume kam ho jata hai, jabki jab price direction mein move karta hai to volume wapas badh jata hai.

Breakout.

Jab flag pattern ban jata hai, to iske baad ek breakout point hota hai, jisme price wapas trend direction mein move karta hai.

Flag Chart Pattern Uses.

Entry Point.

Flag Chart Pattern ko dekh kar entry point ka pata lagaya ja sakta hai. Breakout point ke baad entry point decide kiya jata hai.

Stop Loss.

Stop loss ko bhi flag pattern ke basis par set kiya jata hai. Breakout point ke neeche stop loss set kiya jata hay pattern ki help say trading krna or bhi easy ho jata hay.

Target.

Target price bhi flag pattern ke basis par set kiya jata hai. Flagpole ke length ke hisaab se target price decide kiya jata hai.

Basic of Flag chart pattern.

Flag Chart Pattern ek important technical analysis tool hai, jise dekh kar trading decisions liye jate hai. Is pattern ko samajhne ke liye price movement aur volume ko closely monitor kiya jata hai.

Flag Chart Pattern ka matlab hai jhande ki shakal ka chart pattern. Is pattern mein market mein price ka ek short-term consolidation phase hota hai, jiske baad price ka trend wapas direction mein move karta hai.

Flag Chart Pattern Identification.

Price Consolidation Phase.

Flag Chart Pattern mein price ka short-term consolidation phase hota hai, jise flag ke shape se compare kiya jata hai.

Flagpole.

Flagpole, jisme price ka sudden move hota hai, flag pattern ki ek zaroori shart hai.

Volume.

Flag Chart Pattern mein volume ka ek important role hota hai. Jab flag pattern ban raha hota hai to volume kam ho jata hai, jabki jab price direction mein move karta hai to volume wapas badh jata hai.

Breakout.

Jab flag pattern ban jata hai, to iske baad ek breakout point hota hai, jisme price wapas trend direction mein move karta hai.

Flag Chart Pattern Uses.

Entry Point.

Flag Chart Pattern ko dekh kar entry point ka pata lagaya ja sakta hai. Breakout point ke baad entry point decide kiya jata hai.

Stop Loss.

Stop loss ko bhi flag pattern ke basis par set kiya jata hai. Breakout point ke neeche stop loss set kiya jata hay pattern ki help say trading krna or bhi easy ho jata hay.

Target.

Target price bhi flag pattern ke basis par set kiya jata hai. Flagpole ke length ke hisaab se target price decide kiya jata hai.

Basic of Flag chart pattern.

Flag Chart Pattern ek important technical analysis tool hai, jise dekh kar trading decisions liye jate hai. Is pattern ko samajhne ke liye price movement aur volume ko closely monitor kiya jata hai.

تبصرہ

Расширенный режим Обычный режим