What is Rising Three Methods Pattern:

Rising three method patteren aik taizi se jari rehne wala namona hai jis ka taayun zar e mubadla ki tijarat mein candle stick charts par kya ja sakta hai. yeh mom btyon ke aik silsilay ke zariye tashkeel paata hai jo aik up trained ke andar aik mukhtasir waqfa ya istehkaam tashkeel deta hai. yeh namona aam tor par oopar ki taraf aik mazboot gardish ke baad hota hai aur khabardaar karta hai ke bail tanao ke liye apni kharidari dobarah shuru karne se pehlay saans le rahay hain.

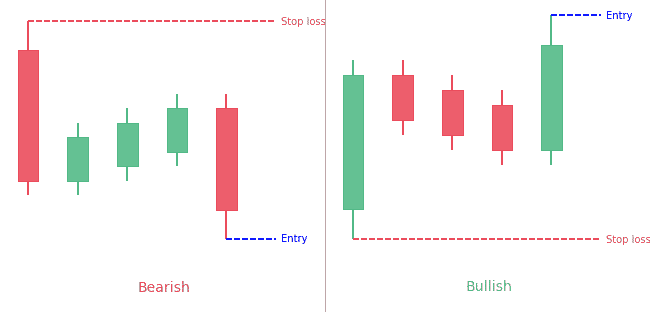

How to Identifying Rising Three Methods Pattern:

Rising three method patteren ko daryaft karne ke liye, tajir baad ki khususiyaat talaash karna chahtay hain. sab se pehlay, namoonay ki tashkeel tak aik mazboot oopar ki taraf rujhan hona chahiye. dosra, namona khud 5 mom btyon par mushtamil hota hai. pehli mom batii aik barri taizi wali mom batii hai, jis ke sath 3 choti mandi wali mom batian hoti hain jo bunyadi mom batii ki had ke andar mojood hoti hain. aakhri mom batii har doosri barri taizi wali mom batii hai jo pehli mom batii ki oonchai se oopar band hoti hai. yeh mushahida karna zaroori hai ke teen bearish mom btyon ke size aik jaisay nahi honay chahiye.

Confirmation Of Rising Three Methods Pattern:

Rising three method patteren aik up trained ke andar aik mukhtasir istehkaam ki akkaasi karta hai. is consolidation section ke douran, taizi walay tajir waqfa letay hain, jis ki wajah se market ke bahao mein mukhtasir tor par kami waqay hoti hai. taham, majmoi rujhan barqarar rehta hai, jaisa ke is ke baad anay wali taiz mom batii ke zariye dekha jata hai jo pehli mom batii ki oonchai se oopar band hoti hai. is namoonay se pata chalta hai ke bail aik aur behtar gardish ke liye raftaar jama kar rahay hain.

Trading With Three Methods Pattern:

Kuch makhsoos khareed o farokht ki hikmat e amli hain jinhein sarmaya car is waqt istemaal kar satke hain jab woh rising three method patteren se waaqif ho jayen. aik taknik yeh hai ke jab charge patteren ki band honay wali mom batii ki had se ziyada toot jaye to taweel kirdaar mein jana hai. is se zahir hota hai ke taizi ki raftaar dobarah shuru ho gayi hai, aur sarmaya car qabliyat ki aamdani ke liye up trained ka safar kar satke hain. aik aur tareeqa yeh hai ke imdadi satah ya muntaqili ost tak pal back ka intzaar kya jaye aur namoonay ke nichale hissay se neechay jungle ke nuqsaan ke sath aik taweel tabdeeli darj ki jaye.

Risk Management In Rising Three Methods Pattern:

Kisi bhi khareed o farokht ke andaaz ki terhan, khatray ka munasib intizam zaroori hai. agar tabdeeli un ke khilaaf jati hai to taajiron ko mumkina nuqsanaat ko mehdood karne ke liye hamesha munasib stop las orders ka istemaal karna chahiye. mukhtalif takneeki alamaat ya chart patteren ke sath rising three method patteren ki tasdeeq karna bhi zaroori hai. misaal ke tor par, sarmaya car rishta daar taaqat index ( are s aayi ) samait oscalter se taizi ke isharay talaash kar satke hain ya taizi se dhalnay wali mom btyon jaisay namonon ki talaash kar satke hain jo rising three method patteren ke zariye ishara kardah taizi ke taasub mein madad karte hain.

Rising three method patteren aik taizi se jari rehne wala namona hai jis ka taayun zar e mubadla ki tijarat mein candle stick charts par kya ja sakta hai. yeh mom btyon ke aik silsilay ke zariye tashkeel paata hai jo aik up trained ke andar aik mukhtasir waqfa ya istehkaam tashkeel deta hai. yeh namona aam tor par oopar ki taraf aik mazboot gardish ke baad hota hai aur khabardaar karta hai ke bail tanao ke liye apni kharidari dobarah shuru karne se pehlay saans le rahay hain.

How to Identifying Rising Three Methods Pattern:

Rising three method patteren ko daryaft karne ke liye, tajir baad ki khususiyaat talaash karna chahtay hain. sab se pehlay, namoonay ki tashkeel tak aik mazboot oopar ki taraf rujhan hona chahiye. dosra, namona khud 5 mom btyon par mushtamil hota hai. pehli mom batii aik barri taizi wali mom batii hai, jis ke sath 3 choti mandi wali mom batian hoti hain jo bunyadi mom batii ki had ke andar mojood hoti hain. aakhri mom batii har doosri barri taizi wali mom batii hai jo pehli mom batii ki oonchai se oopar band hoti hai. yeh mushahida karna zaroori hai ke teen bearish mom btyon ke size aik jaisay nahi honay chahiye.

Confirmation Of Rising Three Methods Pattern:

Rising three method patteren aik up trained ke andar aik mukhtasir istehkaam ki akkaasi karta hai. is consolidation section ke douran, taizi walay tajir waqfa letay hain, jis ki wajah se market ke bahao mein mukhtasir tor par kami waqay hoti hai. taham, majmoi rujhan barqarar rehta hai, jaisa ke is ke baad anay wali taiz mom batii ke zariye dekha jata hai jo pehli mom batii ki oonchai se oopar band hoti hai. is namoonay se pata chalta hai ke bail aik aur behtar gardish ke liye raftaar jama kar rahay hain.

Trading With Three Methods Pattern:

Kuch makhsoos khareed o farokht ki hikmat e amli hain jinhein sarmaya car is waqt istemaal kar satke hain jab woh rising three method patteren se waaqif ho jayen. aik taknik yeh hai ke jab charge patteren ki band honay wali mom batii ki had se ziyada toot jaye to taweel kirdaar mein jana hai. is se zahir hota hai ke taizi ki raftaar dobarah shuru ho gayi hai, aur sarmaya car qabliyat ki aamdani ke liye up trained ka safar kar satke hain. aik aur tareeqa yeh hai ke imdadi satah ya muntaqili ost tak pal back ka intzaar kya jaye aur namoonay ke nichale hissay se neechay jungle ke nuqsaan ke sath aik taweel tabdeeli darj ki jaye.

Risk Management In Rising Three Methods Pattern:

Kisi bhi khareed o farokht ke andaaz ki terhan, khatray ka munasib intizam zaroori hai. agar tabdeeli un ke khilaaf jati hai to taajiron ko mumkina nuqsanaat ko mehdood karne ke liye hamesha munasib stop las orders ka istemaal karna chahiye. mukhtalif takneeki alamaat ya chart patteren ke sath rising three method patteren ki tasdeeq karna bhi zaroori hai. misaal ke tor par, sarmaya car rishta daar taaqat index ( are s aayi ) samait oscalter se taizi ke isharay talaash kar satke hain ya taizi se dhalnay wali mom btyon jaisay namonon ki talaash kar satke hain jo rising three method patteren ke zariye ishara kardah taizi ke taasub mein madad karte hain.

تبصرہ

Расширенный режим Обычный режим