I. Introductions (Tasveer-e-Haal):

Pullback aur breakout dono hi market mein price ke movements ko describe karne ke liye istemal hotay hain. Ye dono trading concepts hain jo traders ke liye important hote hain kyunkay ye market trends ko samajhne aur trading strategies ko design karne mein madad karte hain.

II. Pullback (پلبیک):

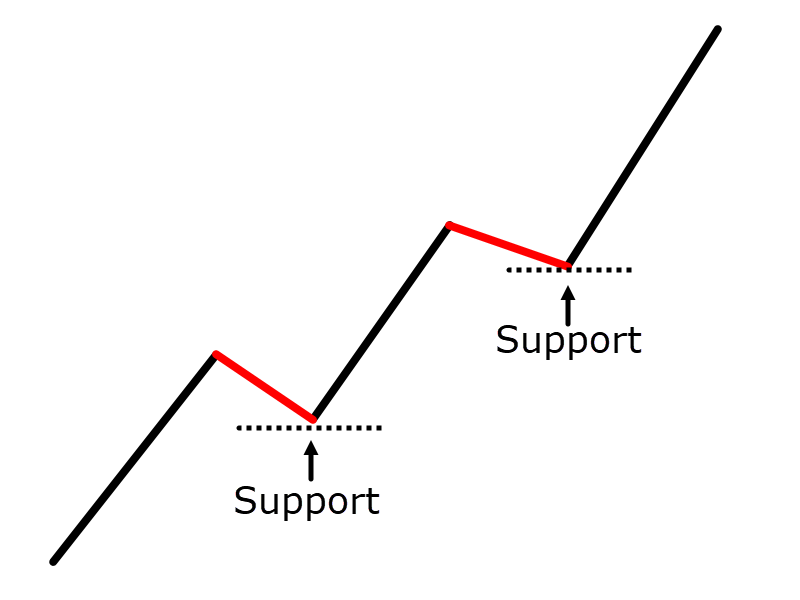

- Tasveer-e-Haal:

- Pullback market mein ek temporary reversal hota hai jo primary trend ke against hota hai.

- Jab price trend mein upar ja raha hota hai (bullish trend) ya neeche ja raha hota hai (bearish trend), to kabhi kabhi price ek short-term reversal dikhata hai, yani price temporarily opposite direction mein move karta hai.

- Ye temporary reversal typically ek correction hota hai jisme price previous trend ki kuch hisse ko cover karta hai.

- Trading Strategies (Tajurbaati Tareeqe):

- Pullback mein traders ko opportunity milti hai primary trend ke sath entry karne ki.

- Bullish pullback mein traders long positions lete hain jab price temporary downward move karta hai, aur bearish pullback mein traders short positions lete hain jab price temporary upward move karta hai.

III. Breakout (بریک آوٹ):

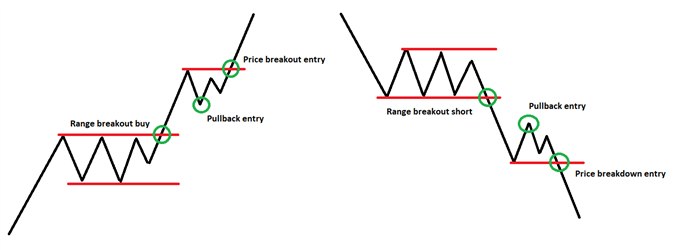

- Tasveer-e-Haal:

- Breakout hota hai jab price ek specific level ko cross karta hai, jise traders ek significant level of support ya resistance mante hain.

- Agar price upar se break karta hai, to ise bullish breakout kaha jata hai, aur agar neeche se break karta hai, to ise bearish breakout kaha jata hai.

- Breakout typically indicate karta hai ke market mein new trend start ho sakta hai.

- Trading Strategies (Tajurbaati Tareeqe):

- Breakout mein traders ko opportunity milti hai new trend ke sath entry karne ki.

- Jab price significant level ko break karta hai, traders positions enter karte hain in the direction of the breakout, expecting the trend to continue in that direction.

IV. Difference (Farq):

- Pullback vs. Breakout:

- Pullback ek temporary reversal hai jo primary trend ke against hota hai, jabke breakout ek sudden price movement hai jo kisi significant level ko cross karta hai aur potentially new trend start karta hai.

- Pullback mein traders primary trend ke sath entry karte hain, jabke breakout mein traders new trend ke sath entry karte hain.

V. Conclusion (Nateeja):

Pullback aur breakout dono hi important concepts hain forex trading mein. Pullback primary trend ke sath entry karne ka opportunity deta hai, jabke breakout new trend ke sath entry karne ka opportunity deta hai. Traders ko in dono concepts ko samajhna aur unke sath sath sahi tareeqe se istemal karna zaroori hai taake wo market trends ko effectively trade kar sakein.

تبصرہ

Расширенный режим Обычный режим