Wolf Wave Pattern

Wolf Wave Pattern ek technical analysis ka pattern hai jo financial markets mein istemal hota hai. Ye pattern market trends ko predict karne ke liye istemal hota hai aur traders ko entry aur exit points tay karne mein madad karta hai.

Wolf Wave Pattern ko pehli baar 1990s mein trader Bill Wolfe ne introduce kiya tha. Ye pattern market mein aane wale potential reversals ko identify karne mein madad karta hai. Is pattern mein market ke price action ko dekha jata hai, aur specific criteria ke mutabiq ek geometric shape banta hai.

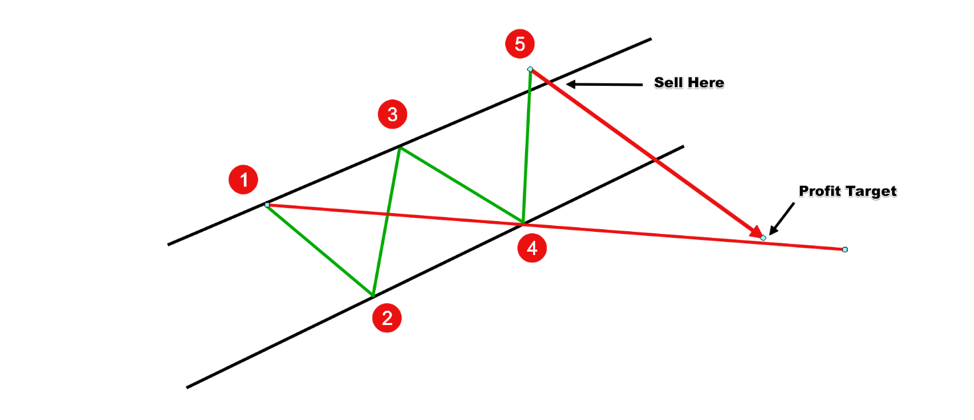

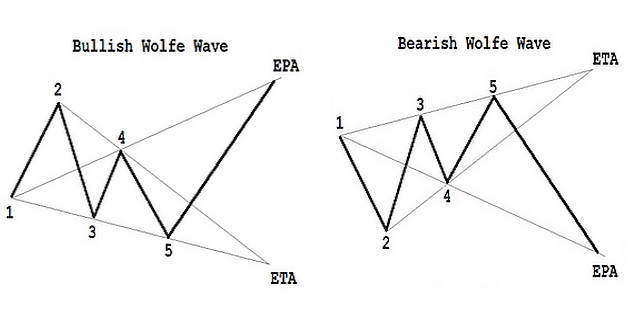

Is pattern mein typically 5 waves hote hain jo ek specific order mein move karte hain. Ye waves market ke natural movement ko capture karte hain. In 5 waves mein, 1, 3, aur 5 waves up-move hote hain, jabki 2 aur 4 waves down-move hote hain. In waves ki lengths aur proportions ka bhi khaas dhyan rakha jata hai.

Wolf Wave Pattern ke criteria ke mutabiq, jab ye 5 waves complete hote hain, toh trader ko ek potential reversal signal milta hai. Agar market mein ye pattern ban raha hai, toh trader long ya short positions le sakta hai, depending on the direction of the pattern.

Is pattern ki understanding aur sahi tajaweez ke liye technical analysis ka acchi tarah se ilm hona zaroori hai. Traders is pattern ko trend reversal ka early indication samajh kar apne trading strategies ko refine karte hain.

Yeh pattern market volatility aur price action ke based par bana hota hai, isliye iske istemal mein kuch risk hota hai. Traders ko hamesha risk management ka khayal rakhna chahiye jab wo is pattern ka istemal karte hain.

In conclusion, Wolf Wave Pattern ek technical analysis tool hai jo traders ko market trends aur reversals ke bare mein malumat dene mein madad karta hai. Is pattern ko samajhne ke liye traders ko market ke price movements aur technical analysis ke concepts ka sahi se ilm hona chahiye.

Wolf Wave Pattern ek technical analysis ka pattern hai jo financial markets mein istemal hota hai. Ye pattern market trends ko predict karne ke liye istemal hota hai aur traders ko entry aur exit points tay karne mein madad karta hai.

Wolf Wave Pattern ko pehli baar 1990s mein trader Bill Wolfe ne introduce kiya tha. Ye pattern market mein aane wale potential reversals ko identify karne mein madad karta hai. Is pattern mein market ke price action ko dekha jata hai, aur specific criteria ke mutabiq ek geometric shape banta hai.

Is pattern mein typically 5 waves hote hain jo ek specific order mein move karte hain. Ye waves market ke natural movement ko capture karte hain. In 5 waves mein, 1, 3, aur 5 waves up-move hote hain, jabki 2 aur 4 waves down-move hote hain. In waves ki lengths aur proportions ka bhi khaas dhyan rakha jata hai.

Wolf Wave Pattern ke criteria ke mutabiq, jab ye 5 waves complete hote hain, toh trader ko ek potential reversal signal milta hai. Agar market mein ye pattern ban raha hai, toh trader long ya short positions le sakta hai, depending on the direction of the pattern.

Is pattern ki understanding aur sahi tajaweez ke liye technical analysis ka acchi tarah se ilm hona zaroori hai. Traders is pattern ko trend reversal ka early indication samajh kar apne trading strategies ko refine karte hain.

Yeh pattern market volatility aur price action ke based par bana hota hai, isliye iske istemal mein kuch risk hota hai. Traders ko hamesha risk management ka khayal rakhna chahiye jab wo is pattern ka istemal karte hain.

In conclusion, Wolf Wave Pattern ek technical analysis tool hai jo traders ko market trends aur reversals ke bare mein malumat dene mein madad karta hai. Is pattern ko samajhne ke liye traders ko market ke price movements aur technical analysis ke concepts ka sahi se ilm hona chahiye.

تبصرہ

Расширенный режим Обычный режим