Introduction,

Rounding Bottom Candlestick Pattern, yaar, trading mein ek important candlestick pattern hai jo market mein trend reversal ko indicate karta hai. Is pattern ko dekh kar traders ko maloom hota hai ke market ka trend downward se upward shift hone wala hai. Chalo ab detail mein is pattern ke baare mein baat karte hain.Rounding Bottom Candlestick Pattern ek powerful tool hai trading mein jo market trends ko identify karne aur profitable trading opportunities ko capture karne mein madad karta hai. Lekin yaad rahe ke har pattern ki tarah, is pattern ki bhi apni limitations hain aur traders ko proper risk management aur analysis ke saath kaam karna chahiye.

What is Rounding Bottom Candlestick Pattern?

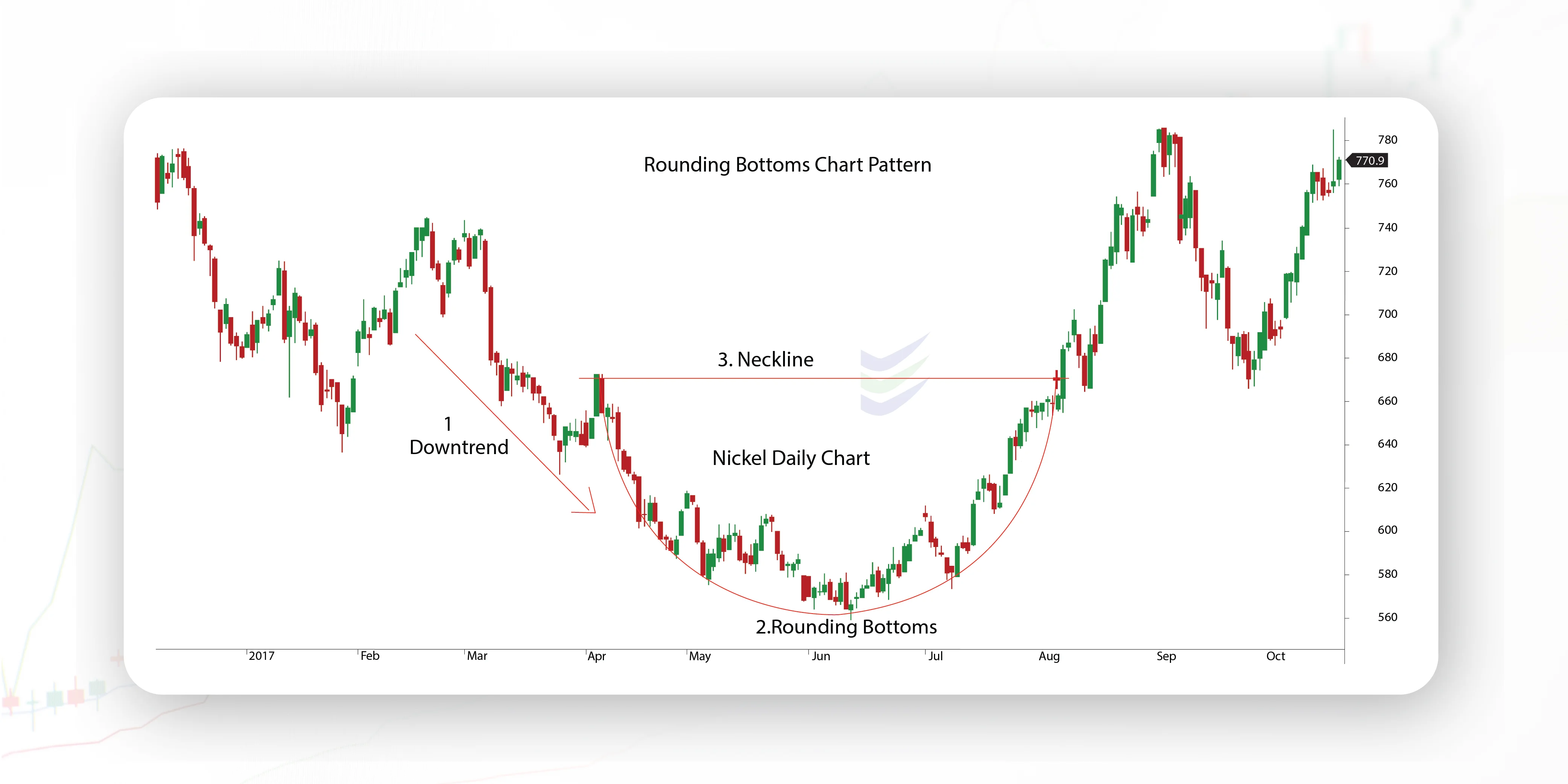

Rounding Bottom Candlestick Pattern ek technical analysis ka pattern hai jo chart analysis mein istemal hota hai. Ye pattern tab form hota hai jab ek security ya asset ke price mein gradual decline hota hai phir ek specific samay ke baad price stable ho jata hai aur phir gradual increase shuru ho jata hai. Is pattern ko dekh kar traders ko lagta hai ke market ka trend downward se upward change hone wala hai.

How to Identify Rounding Bottom Pattern?

Is pattern ko identify karne ke liye traders ko price chart pe dhyan dena hota hai. Rounding Bottom Pattern usually weeks ya months ke chart pe nazar aata hai. Is pattern ko recognize karne ke liye, ek curved shape ki tarah downward trend followed by a period of stabilization aur phir ek curved shape ki tarah upward trend dekhne ki zaroorat hoti hai.

Trading on Rounding Bottom Candlestick Pattern,

Rounding Bottom Candlestick Pattern ke trading mein, traders ko ek few steps follow karne hote hain:

Pehle step mein, traders ko Rounding Bottom Candlestick Pattern ko confirm karna hota hai. Iske liye, price chart pe pattern ki shape ko dhyan se dekhna hota hai aur confirm karna hota hai ke downward trend ke baad price stable hui hai aur phir upward trend shuru ho gaya hai.

Dusre step mein, traders ko entry point ka selection karna hota hai. Jab Rounding Bottom Pattern confirm ho jata hai, traders ko entry point ko select karna hota hai. Entry point usually wo point hota hai jahan price ne pattern ki upper trend line ko break kiya hai.

Teesre step mein, traders ko stop loss aur target levels ka setup karna hota hai. Stop loss level ko determine karne ke liye, traders usually pattern ki lower trend line ke neeche ek level set karte hain. Target level ko determine karne ke liye, traders usually pattern ki height ko measure karte hain aur phir us height ko entry point se upar extend karte hain.

Choutha step mein, traders ko risk aur reward ka evaluation karna hota hai. Is step mein, traders ko apne entry point se stop loss level tak ka risk aur apne entry point se target level tak ka reward calculate karna hota hai. Agar risk aur reward ka ratio satisfactory hai, tab traders trade execute karte hain.

Aakhir mein, traders trade ko execute karte hain jab pattern confirm ho jata hai aur entry point, stop loss aur target levels set ho jate hain. Trade execution ke baad, traders ko apne positions ko monitor karna hota hai aur stop loss aur target levels ko adjust karna hota hai agar zaroorat ho.

Rounding Bottom Candlestick Pattern, yaar, trading mein ek important candlestick pattern hai jo market mein trend reversal ko indicate karta hai. Is pattern ko dekh kar traders ko maloom hota hai ke market ka trend downward se upward shift hone wala hai. Chalo ab detail mein is pattern ke baare mein baat karte hain.Rounding Bottom Candlestick Pattern ek powerful tool hai trading mein jo market trends ko identify karne aur profitable trading opportunities ko capture karne mein madad karta hai. Lekin yaad rahe ke har pattern ki tarah, is pattern ki bhi apni limitations hain aur traders ko proper risk management aur analysis ke saath kaam karna chahiye.

What is Rounding Bottom Candlestick Pattern?

Rounding Bottom Candlestick Pattern ek technical analysis ka pattern hai jo chart analysis mein istemal hota hai. Ye pattern tab form hota hai jab ek security ya asset ke price mein gradual decline hota hai phir ek specific samay ke baad price stable ho jata hai aur phir gradual increase shuru ho jata hai. Is pattern ko dekh kar traders ko lagta hai ke market ka trend downward se upward change hone wala hai.

How to Identify Rounding Bottom Pattern?

Is pattern ko identify karne ke liye traders ko price chart pe dhyan dena hota hai. Rounding Bottom Pattern usually weeks ya months ke chart pe nazar aata hai. Is pattern ko recognize karne ke liye, ek curved shape ki tarah downward trend followed by a period of stabilization aur phir ek curved shape ki tarah upward trend dekhne ki zaroorat hoti hai.

Trading on Rounding Bottom Candlestick Pattern,

Rounding Bottom Candlestick Pattern ke trading mein, traders ko ek few steps follow karne hote hain:

Pehle step mein, traders ko Rounding Bottom Candlestick Pattern ko confirm karna hota hai. Iske liye, price chart pe pattern ki shape ko dhyan se dekhna hota hai aur confirm karna hota hai ke downward trend ke baad price stable hui hai aur phir upward trend shuru ho gaya hai.

Dusre step mein, traders ko entry point ka selection karna hota hai. Jab Rounding Bottom Pattern confirm ho jata hai, traders ko entry point ko select karna hota hai. Entry point usually wo point hota hai jahan price ne pattern ki upper trend line ko break kiya hai.

Teesre step mein, traders ko stop loss aur target levels ka setup karna hota hai. Stop loss level ko determine karne ke liye, traders usually pattern ki lower trend line ke neeche ek level set karte hain. Target level ko determine karne ke liye, traders usually pattern ki height ko measure karte hain aur phir us height ko entry point se upar extend karte hain.

Choutha step mein, traders ko risk aur reward ka evaluation karna hota hai. Is step mein, traders ko apne entry point se stop loss level tak ka risk aur apne entry point se target level tak ka reward calculate karna hota hai. Agar risk aur reward ka ratio satisfactory hai, tab traders trade execute karte hain.

Aakhir mein, traders trade ko execute karte hain jab pattern confirm ho jata hai aur entry point, stop loss aur target levels set ho jate hain. Trade execution ke baad, traders ko apne positions ko monitor karna hota hai aur stop loss aur target levels ko adjust karna hota hai agar zaroorat ho.

تبصرہ

Расширенный режим Обычный режим