What is Butterfly Pattern:

Butterfly patteren mashhoor harmonic style mein se aik hai jo ghair mulki currency ke kharidaron ke zareya salahiyat market ke ulat palat ki tawaqqa ke liye baqaidagi se istemaal kya jata hai. yeh ain mutabiq namona taajiron ko forex market mein qabil amal rasai aur bahar jane walay awamil ki nishandahi karne ka imkaan faraham karta hai. titliyon ke namoonay ko is haqeeqat ki wajah se cal milta hai ke is ki shakal titliyon ke paron se millti jalti hai. is mein sharah ke chaar jhulay shaamil hain, jo ain mutabiq fabnoice tanasub ki tashkeel karte hain, jo madad aur muzahmat ke mumkina darjay ki nishandahi karte hain.

Characteristics of Butterfly Patern:

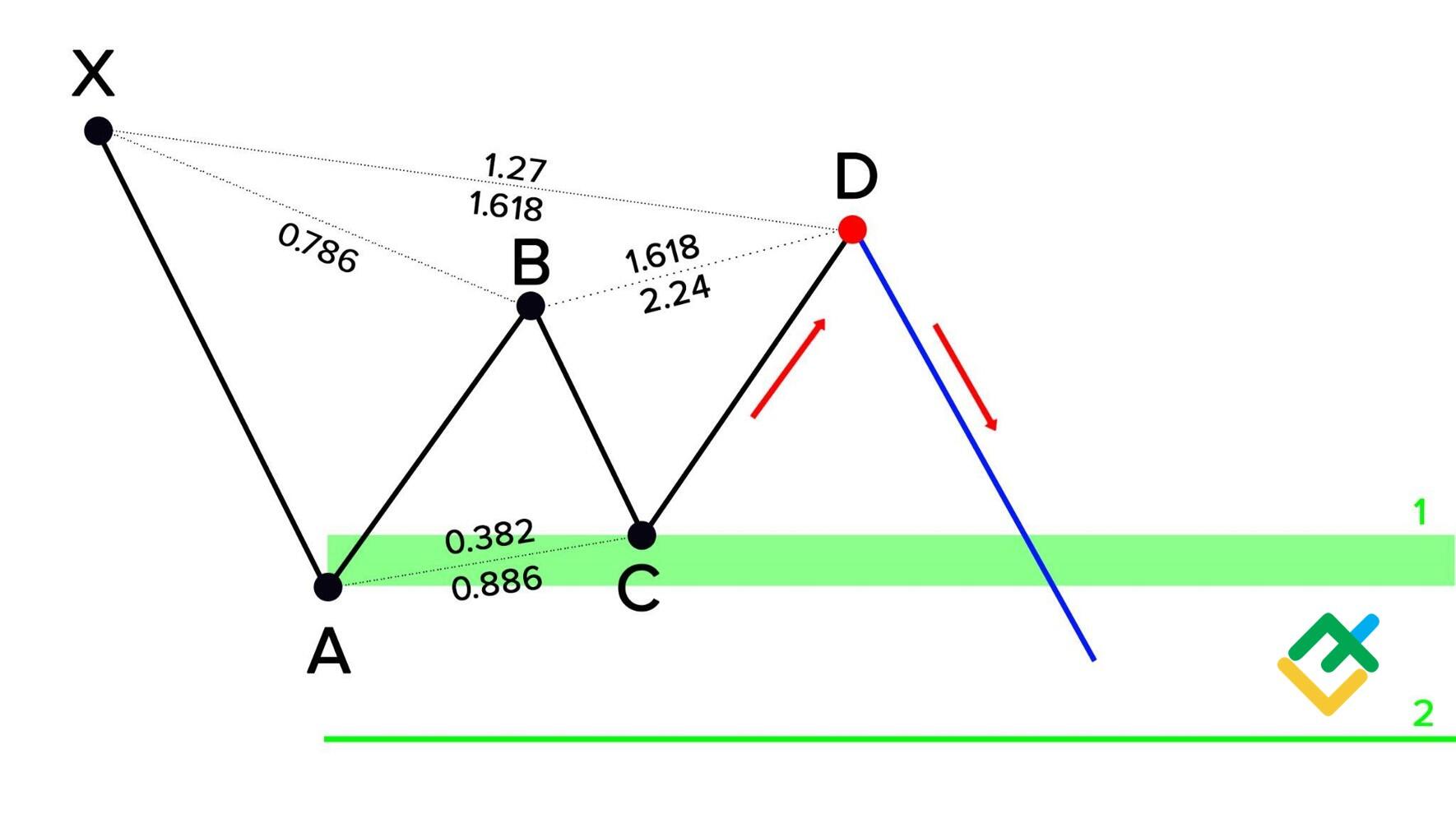

Butterfly ka namona aik taiz charge ke bahao ke sath shuru hota hai jisay x ae taang kaha jata hai. yeh taang ibtidayi soyng ki numaindagi karti hai jahan se namona nikalta hai. is ke baad ki harkat, jisay ae bi taang kaha jata hai, x ae taang ka peechay hatna hai. Retracement ko munfarid fabnoice tanasub se milna chahiye, aam tor par xa taang ke sifar. 382 aur 0. 786 ke darmiyan. bc taang mandarja zail bahao hai, jo tarjeehi tor par ab taang ke 0. 382 aur sifar 886 ke darmiyan dobarah haasil karne ki zaroorat hai. aakhir mein, si d taang namoonay ko mukammal karti hai, jo x ae taang se agay barh kar mukhalif rastay mein aik hi ya izafi paas banati hai.

Butterfly Pattern With Fibonacci:

Fabnoicce tanasub butterfly patteren mein aik ahem kirdaar ada karte hain aur sarmaya karon ko salahiyat ke indraaj aur ikhraj ke awamil ko muntakhib karne mein madad karte hain. is namoonay par istemaal honay walay kaleedi fabnoice tanasub 0. 382, sifar. 500, sifar. 618, 0. 786, aur sifar. 886 hain. yeh tanasub fabnoice tarteeb se akhaz kiye gaye hain, jo adaad ka aik silsila hai jis mein har qisam pichlle 2 ka majmoa hai. namoonay ke jhoolon ke liye un ka istemaal karkay, tajir rahnumai aur muzahmat ki mumkina sthon ka faisla kar satke hain.

Entry and Exit Point in Butterfly Pattern:

Tajir butterfly ke namoonay ka istemaal forex market mein salahiyat tak rasai aur bahar niklny ke maqamat ko muntakhib karne ke liye kar satke hain. aik aam rasai nuqta yeh hai ke jab si d taang mukammal hoti hai aur fees action mukhalif simt mein shuru hota hai. tajir taizi ke ulat palat ki tawaqqa karte hue is Ansar par aik taweel position daal satke hain. jahan tak bahar niklny ke maqamat ka talluq hai, tajir fabnoice ki tosiay hudood mein 1. 272 ya 1.618 bc taang ke sath aamdani ko zehen mein rakh satke hain. mazeed bar-aan, salahiyat ke nuqsaan ko mehdood karne ke liye form ke x Ansar ke neechay aik faristal nuqsaan rakha ja sakta hai.

Trading With Butterfly Pattern:

Agarchay titlee ka namona –apne tor par aik mo-asar zareya ho sakta hai, lekin usay deegar takneeki alamaat ke sath jor kar is ki taseer ko sajaya ja sakta hai. tajir patteren ka istemaal karte hue ishara kardah mumkina ulat palat ki tasdeeq ke liye momentum oscillator jaisay rishta daar taaqat index ( are s aayi ) ya stochastic oscillator ka istemaal kar satke hain. mazeed bar-aan, tajir –apne tijarti intikhab ki toseeq karne ke liye mukhtalif chart patteren ya guide aur muzahmat ki sthon ke sath sangam talaash kar satke hain.

Aakhir mein, butterfly ka namona aik mashhoor harmonic namona hai jo ghair mulki currency ke kharidaron ke zareya market mein mumkina ulat palat ki paish goi ke liye istemaal kya jata hai. patteren ki saakht, fabnoice tanasub, aur salahiyat tak rasai aur bahar niklny ke awamil ki maloomat ke zariye, sarmaya car is patteren ko apni khareed o farokht ki technical mein shaamil kar satke hain. mazeed bar-aan, butterfly patteren ko deegar takneeki isharay ke sath jornay se is ki ifadiyat ko sajaya ja sakta hai aur sarmaya karon ko izafi tasdeeq faraham ki ja sakti hai.

Butterfly patteren mashhoor harmonic style mein se aik hai jo ghair mulki currency ke kharidaron ke zareya salahiyat market ke ulat palat ki tawaqqa ke liye baqaidagi se istemaal kya jata hai. yeh ain mutabiq namona taajiron ko forex market mein qabil amal rasai aur bahar jane walay awamil ki nishandahi karne ka imkaan faraham karta hai. titliyon ke namoonay ko is haqeeqat ki wajah se cal milta hai ke is ki shakal titliyon ke paron se millti jalti hai. is mein sharah ke chaar jhulay shaamil hain, jo ain mutabiq fabnoice tanasub ki tashkeel karte hain, jo madad aur muzahmat ke mumkina darjay ki nishandahi karte hain.

Characteristics of Butterfly Patern:

Butterfly ka namona aik taiz charge ke bahao ke sath shuru hota hai jisay x ae taang kaha jata hai. yeh taang ibtidayi soyng ki numaindagi karti hai jahan se namona nikalta hai. is ke baad ki harkat, jisay ae bi taang kaha jata hai, x ae taang ka peechay hatna hai. Retracement ko munfarid fabnoice tanasub se milna chahiye, aam tor par xa taang ke sifar. 382 aur 0. 786 ke darmiyan. bc taang mandarja zail bahao hai, jo tarjeehi tor par ab taang ke 0. 382 aur sifar 886 ke darmiyan dobarah haasil karne ki zaroorat hai. aakhir mein, si d taang namoonay ko mukammal karti hai, jo x ae taang se agay barh kar mukhalif rastay mein aik hi ya izafi paas banati hai.

Butterfly Pattern With Fibonacci:

Fabnoicce tanasub butterfly patteren mein aik ahem kirdaar ada karte hain aur sarmaya karon ko salahiyat ke indraaj aur ikhraj ke awamil ko muntakhib karne mein madad karte hain. is namoonay par istemaal honay walay kaleedi fabnoice tanasub 0. 382, sifar. 500, sifar. 618, 0. 786, aur sifar. 886 hain. yeh tanasub fabnoice tarteeb se akhaz kiye gaye hain, jo adaad ka aik silsila hai jis mein har qisam pichlle 2 ka majmoa hai. namoonay ke jhoolon ke liye un ka istemaal karkay, tajir rahnumai aur muzahmat ki mumkina sthon ka faisla kar satke hain.

Entry and Exit Point in Butterfly Pattern:

Tajir butterfly ke namoonay ka istemaal forex market mein salahiyat tak rasai aur bahar niklny ke maqamat ko muntakhib karne ke liye kar satke hain. aik aam rasai nuqta yeh hai ke jab si d taang mukammal hoti hai aur fees action mukhalif simt mein shuru hota hai. tajir taizi ke ulat palat ki tawaqqa karte hue is Ansar par aik taweel position daal satke hain. jahan tak bahar niklny ke maqamat ka talluq hai, tajir fabnoice ki tosiay hudood mein 1. 272 ya 1.618 bc taang ke sath aamdani ko zehen mein rakh satke hain. mazeed bar-aan, salahiyat ke nuqsaan ko mehdood karne ke liye form ke x Ansar ke neechay aik faristal nuqsaan rakha ja sakta hai.

Trading With Butterfly Pattern:

Agarchay titlee ka namona –apne tor par aik mo-asar zareya ho sakta hai, lekin usay deegar takneeki alamaat ke sath jor kar is ki taseer ko sajaya ja sakta hai. tajir patteren ka istemaal karte hue ishara kardah mumkina ulat palat ki tasdeeq ke liye momentum oscillator jaisay rishta daar taaqat index ( are s aayi ) ya stochastic oscillator ka istemaal kar satke hain. mazeed bar-aan, tajir –apne tijarti intikhab ki toseeq karne ke liye mukhtalif chart patteren ya guide aur muzahmat ki sthon ke sath sangam talaash kar satke hain.

Aakhir mein, butterfly ka namona aik mashhoor harmonic namona hai jo ghair mulki currency ke kharidaron ke zareya market mein mumkina ulat palat ki paish goi ke liye istemaal kya jata hai. patteren ki saakht, fabnoice tanasub, aur salahiyat tak rasai aur bahar niklny ke awamil ki maloomat ke zariye, sarmaya car is patteren ko apni khareed o farokht ki technical mein shaamil kar satke hain. mazeed bar-aan, butterfly patteren ko deegar takneeki isharay ke sath jornay se is ki ifadiyat ko sajaya ja sakta hai aur sarmaya karon ko izafi tasdeeq faraham ki ja sakti hai.

تبصرہ

Расширенный режим Обычный режим