Candlestick with short wick,

Candlestick with short wick, market ke indecision ko represent karta hai. Is pattern ko samajhna traders ke liye zaroori hai taake woh sahi waqt par sahi faislay kar sakein. Lekin, hamesha yaad rakhein ke ek pattern ke istemal mein, doosre technical tools aur market conditions ko bhi mad-e-nazar rakhein.

What is Candlestick Kya Hai?

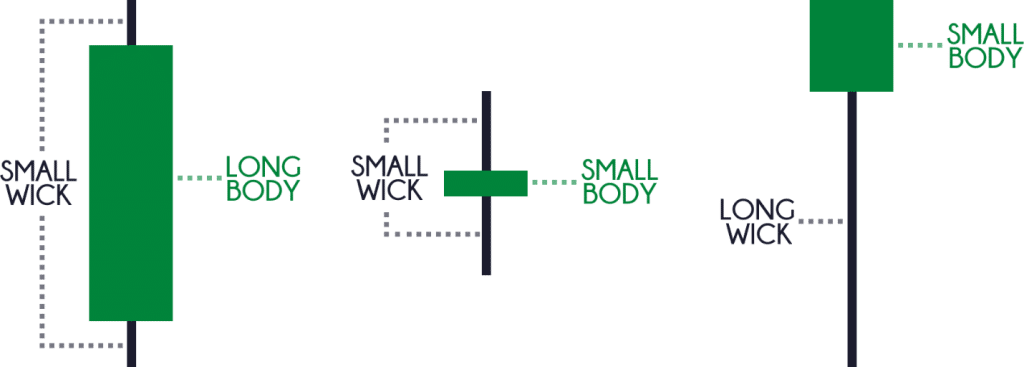

Candlestick ek tarah ka chart hai jise traders market analysis ke liye istemal karte hain. Har candlestick ek specific time period ko represent karta hai, jese ke 1 din, 1 ghanta, ya 15 minute. Har candlestick do hisson se milti hai: body aur wicks.

Structure of Candlestick,

Body: Candle ka mota hissa hota hai, jo opening aur closing prices ko represent karta hai. Agar closing price opening price se ziada hai, to candle green (bullish) hota hai. Wahi agar opening price closing price se ziada hai, to candle red (bearish) hota hai.

Upper Wick: Candle ki upper side ka hissa, jo highest price ko darust karta hai.

Lower Wick: Candle ki lower side ka hissa, jo lowest price ko darust karta hai.

What is Short Wick Kya Hai?

Short wick, ya choti chirhi, ek candlestick ka hissa hai jo normal se chota hota hai. Iska matlab hai ke during a specific time period, price mein kam farq tha, ya phir trading activity kam thi. Short wicks indicate market mein uncertainty ya indecision ko darust karte hain.

Importance of Candlestick with Short Wick?

Candlestick with short wick, market mein uncertainty ya consolidation ko darust karta hai. Jab market mein trading activity kam hoti hai aur buyers aur sellers mein kisi ne clear control nahi banaya hota, to aise mein short wicks dekhe ja sakte hain. Ye pattern traders ko yeh batata hai ke market mein kisi direction mein strong movement hona mushkil hai.

Bullish Candlestick with Short Upper Wick,

Agar ek candle bullish hai aur uski upper wick choti hai, to iska matlab hai ke buyers ne control banaya hua hai, lekin thora sa uncertainty bhi hai. Is situation mein traders ko hosla ho sakta hai ke bullish trend continue ho sakta hai, lekin cautious rehna bhi zaroori hai.

Bearish Candlestick with Short Lower Wick,

Bearish candlestick with short lower wick, yani ke candle bearish hai aur uski lower wick choti hai, indicate karta hai ke sellers control mein hain, lekin market mein thora sa uncertainty bhi hai. Is situation mein traders ko ya to bearish trend ko follow karna chahiye ya phir market ke further movement ka wait karna chahiye.

Trading Strategies with Candlestick with Short Wick candlestick,

Wait for Confirmation: Candlestick with short wick ke pehle, traders ko confirmatory signals ka wait karna chahiye. Doosre technical indicators aur patterns ke istemal se traders ko confirm hone wala signal mil sakta hai.

Risk Management: Short wicks ke hone par bhi market mein uncertainty hoti hai, isliye traders ko apne trades ke liye theek tarah se risk manage karna chahiye. Stop-loss orders ka istemal karna ek acha tareeqa ho sakta hai.

Trend Analysis: Short wicks ko trend analysis ke saath dekha jana chahiye. Agar overall trend strong hai, to short wicks ka asar kam hota hai. Lekin agar trend weak hai, to short wicks ka zyada asar ho sakta hai.

Candlestick with short wick, market ke indecision ko represent karta hai. Is pattern ko samajhna traders ke liye zaroori hai taake woh sahi waqt par sahi faislay kar sakein. Lekin, hamesha yaad rakhein ke ek pattern ke istemal mein, doosre technical tools aur market conditions ko bhi mad-e-nazar rakhein.

What is Candlestick Kya Hai?

Candlestick ek tarah ka chart hai jise traders market analysis ke liye istemal karte hain. Har candlestick ek specific time period ko represent karta hai, jese ke 1 din, 1 ghanta, ya 15 minute. Har candlestick do hisson se milti hai: body aur wicks.

Structure of Candlestick,

Body: Candle ka mota hissa hota hai, jo opening aur closing prices ko represent karta hai. Agar closing price opening price se ziada hai, to candle green (bullish) hota hai. Wahi agar opening price closing price se ziada hai, to candle red (bearish) hota hai.

Upper Wick: Candle ki upper side ka hissa, jo highest price ko darust karta hai.

Lower Wick: Candle ki lower side ka hissa, jo lowest price ko darust karta hai.

What is Short Wick Kya Hai?

Short wick, ya choti chirhi, ek candlestick ka hissa hai jo normal se chota hota hai. Iska matlab hai ke during a specific time period, price mein kam farq tha, ya phir trading activity kam thi. Short wicks indicate market mein uncertainty ya indecision ko darust karte hain.

Importance of Candlestick with Short Wick?

Candlestick with short wick, market mein uncertainty ya consolidation ko darust karta hai. Jab market mein trading activity kam hoti hai aur buyers aur sellers mein kisi ne clear control nahi banaya hota, to aise mein short wicks dekhe ja sakte hain. Ye pattern traders ko yeh batata hai ke market mein kisi direction mein strong movement hona mushkil hai.

Bullish Candlestick with Short Upper Wick,

Agar ek candle bullish hai aur uski upper wick choti hai, to iska matlab hai ke buyers ne control banaya hua hai, lekin thora sa uncertainty bhi hai. Is situation mein traders ko hosla ho sakta hai ke bullish trend continue ho sakta hai, lekin cautious rehna bhi zaroori hai.

Bearish Candlestick with Short Lower Wick,

Bearish candlestick with short lower wick, yani ke candle bearish hai aur uski lower wick choti hai, indicate karta hai ke sellers control mein hain, lekin market mein thora sa uncertainty bhi hai. Is situation mein traders ko ya to bearish trend ko follow karna chahiye ya phir market ke further movement ka wait karna chahiye.

Trading Strategies with Candlestick with Short Wick candlestick,

Wait for Confirmation: Candlestick with short wick ke pehle, traders ko confirmatory signals ka wait karna chahiye. Doosre technical indicators aur patterns ke istemal se traders ko confirm hone wala signal mil sakta hai.

Risk Management: Short wicks ke hone par bhi market mein uncertainty hoti hai, isliye traders ko apne trades ke liye theek tarah se risk manage karna chahiye. Stop-loss orders ka istemal karna ek acha tareeqa ho sakta hai.

Trend Analysis: Short wicks ko trend analysis ke saath dekha jana chahiye. Agar overall trend strong hai, to short wicks ka asar kam hota hai. Lekin agar trend weak hai, to short wicks ka zyada asar ho sakta hai.

:max_bytes(150000):strip_icc()/Hangingman-5a8019b0da864523b5129a71b983b87b.jpg)

تبصرہ

Расширенный режим Обычный режим