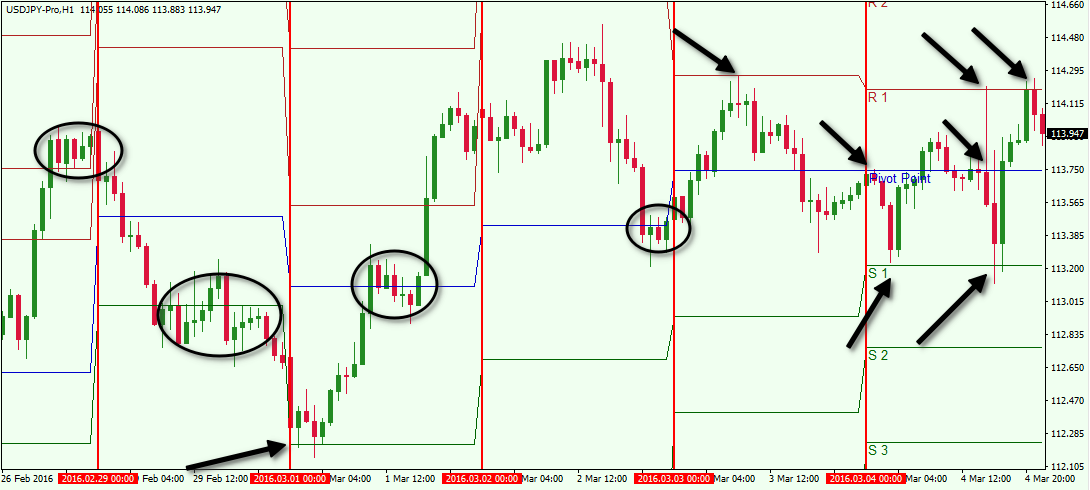

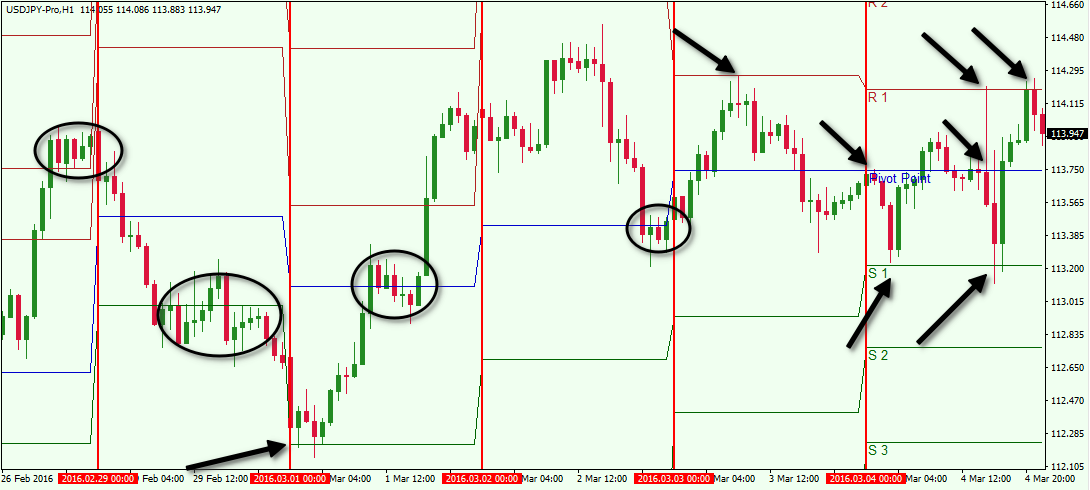

Pivot points pehlay ki trading session ke high, low, aur closing prices se mansoob ahem reference levels ke tor par kaam karte hain. Ye levels key support aur resistance zones ki tarah kaam karte hain, jo traders ko potential entry aur exit points ki pehchan mein madad faraham karte hain. Alag-alag formulas ka istemal kar ke calculate kiye jate hain, jinme classic method, Woodie's method, aur Fibonacci method shamil hain, pivot points mukhtalif trading styles aur pasandeedgiyon ke mutabiq tayyar kiye jate hain.

Pivot Points Ke Levels Ko Samajhna

a. Pivot Point (PP): Markazi pivot point pichli session ke high, low, aur closing prices ka ausat darja hai. Ye level aam market sentiment ko darust karta hai.

b. Support Levels (S1, S2, S3): Ye levels pivot point ke neeche hote hain aur khareedne ki dilchaspi ke potential areas ko darust karte hain. Traders aksar in levels pe price reactions ko dekhte hain, long positions mein dakhil hone ya stop-loss orders ko mazboot karne ke liye mauqe ko talash karte hain.

c. Resistance Levels (R1, R2, R3): Pivot point ke oopar muqarrar kiye gaye, ye levels bechne ki dabao ko darust karte hain. Traders in levels ke qareeb price behavior ko monitor karte hain, inhe munafa lenay ya short positions shuru karne ke liye ghor karte hain.

Pivot Point Strategies

a. Standard Pivot Point Strategy: Ye riwayati approach pivot points ke aas-pass ahem price reversals ko pehchanne ke liye istemal hota hai. Traders in levels pe trading shuru karte hain jab keematain support ya resistance levels se upar neeche hilti hain, aur iske andar mukhtalif doraan ki munafa ko pakarne ke liye koshish karte hain.

b. Breakout Pivot Point Strategy: Is strategy mein, traders pivot point levels ke bahar significant price movements ka intezar karte hain. Resistance ya support ke breakout ke baad chalne wale trends ko samajhte hue, traders breakout ki taraf positions mein dakhil hote hain.

c. Trend Confirmation Strategy: Pivot points ko doosre technical indicators, jaise ke moving averages ya trend lines ke sath istemal karke traders mukhtalif trend confirm karte hain. Aam trend ke mutabiq trades karke kamyabi ke imkaanat ko barhaate hain aur counter-trend movements ka iztiraar kam karte hain.

Pivot Points Ko Amal Mein Lanay Ki Practical Tips

a. Volume Ke Sath Tasdeeq Karein: Pivot point signals ko trading volume ka tajziya karke tasdeeq karein. High volume ke sath price movements ko dekh kar pivot point levels ki yaqeeni rukhsat ko mazboot kiya jata hai, jo market mein mukhtalif shirkat aur iqtedar ko darust karta hai.

b. Time Frames Ka Ghor Karein: Alag-alag time frames ke sath pivot point analysis ko adjust karein, strategies ko trading objectives ke sath milayein. Chotay arsay ke traders ghanton ya daily pivot points par tawajjo dete hain, jab ke lambay arsay ke investors weekly ya monthly levels par mukhtalif market perspective ke liye ehmiyat dete hain.

c. Risk Management Ke Sath Jor Karein: Pivot point trading ke sath risk management ko ehmiyat dein taki maal aur munafa ko bachaya ja sake aur hasilat ko behtar banaya ja sake. Pivot point calculations par mabni wazeh stop-loss aur take-profit levels tay karein, trade execution mein ikhtiyaar aur mustaqil rahain.

Nuqsanat Se Bachne Ka Tareeqa:

a. Market Context Ko Nazar Andaaz Karna: Jabke pivot points ahem insights faraham karte hain, trading decisions ko mazeed market ke conditions, jaise ke ma'ashiyati indicators, geopolitical events, aur sentiment analysis ke sath mutabiq kiya jana chahiye. Pivot point signals ko maqami maahol mein shamil karne ka na-insafi maqami maqami ashiyano mein aap ko bhatakne ka khatra hai.

b. Price Action Signals Ko Najar Andaaz Karna: Sirf pivot points par bharosa karne ke baghair price action signals ko ghaur se nahi lena, jhootay breakouts ya reversals ke liye muntaqil hone ka khatra barh jata hai. Pivot point signals ko tasdeeq karne aur trading precision ko barhane ke liye price action analysis ko shamil karein.

c. Lachak Ko Najar Andaz Karna: Markets musalsal tabdeel hoti hain, is wajah se traders ko pivot point strategies ko mutabiq adjust karna hota hai. Market dynamics ke barhte hue mutaqarar rahne ke liye waqt ki sahi information hasil karte rahain, zaroorat ke mutabiq trading parameters ko adjust karein, aur changing conditions ka jawab dene mein narmi se rahain.

Pivot Points Ke Levels Ko Samajhna

a. Pivot Point (PP): Markazi pivot point pichli session ke high, low, aur closing prices ka ausat darja hai. Ye level aam market sentiment ko darust karta hai.

b. Support Levels (S1, S2, S3): Ye levels pivot point ke neeche hote hain aur khareedne ki dilchaspi ke potential areas ko darust karte hain. Traders aksar in levels pe price reactions ko dekhte hain, long positions mein dakhil hone ya stop-loss orders ko mazboot karne ke liye mauqe ko talash karte hain.

c. Resistance Levels (R1, R2, R3): Pivot point ke oopar muqarrar kiye gaye, ye levels bechne ki dabao ko darust karte hain. Traders in levels ke qareeb price behavior ko monitor karte hain, inhe munafa lenay ya short positions shuru karne ke liye ghor karte hain.

Pivot Point Strategies

a. Standard Pivot Point Strategy: Ye riwayati approach pivot points ke aas-pass ahem price reversals ko pehchanne ke liye istemal hota hai. Traders in levels pe trading shuru karte hain jab keematain support ya resistance levels se upar neeche hilti hain, aur iske andar mukhtalif doraan ki munafa ko pakarne ke liye koshish karte hain.

b. Breakout Pivot Point Strategy: Is strategy mein, traders pivot point levels ke bahar significant price movements ka intezar karte hain. Resistance ya support ke breakout ke baad chalne wale trends ko samajhte hue, traders breakout ki taraf positions mein dakhil hote hain.

c. Trend Confirmation Strategy: Pivot points ko doosre technical indicators, jaise ke moving averages ya trend lines ke sath istemal karke traders mukhtalif trend confirm karte hain. Aam trend ke mutabiq trades karke kamyabi ke imkaanat ko barhaate hain aur counter-trend movements ka iztiraar kam karte hain.

Pivot Points Ko Amal Mein Lanay Ki Practical Tips

a. Volume Ke Sath Tasdeeq Karein: Pivot point signals ko trading volume ka tajziya karke tasdeeq karein. High volume ke sath price movements ko dekh kar pivot point levels ki yaqeeni rukhsat ko mazboot kiya jata hai, jo market mein mukhtalif shirkat aur iqtedar ko darust karta hai.

b. Time Frames Ka Ghor Karein: Alag-alag time frames ke sath pivot point analysis ko adjust karein, strategies ko trading objectives ke sath milayein. Chotay arsay ke traders ghanton ya daily pivot points par tawajjo dete hain, jab ke lambay arsay ke investors weekly ya monthly levels par mukhtalif market perspective ke liye ehmiyat dete hain.

c. Risk Management Ke Sath Jor Karein: Pivot point trading ke sath risk management ko ehmiyat dein taki maal aur munafa ko bachaya ja sake aur hasilat ko behtar banaya ja sake. Pivot point calculations par mabni wazeh stop-loss aur take-profit levels tay karein, trade execution mein ikhtiyaar aur mustaqil rahain.

Nuqsanat Se Bachne Ka Tareeqa:

a. Market Context Ko Nazar Andaaz Karna: Jabke pivot points ahem insights faraham karte hain, trading decisions ko mazeed market ke conditions, jaise ke ma'ashiyati indicators, geopolitical events, aur sentiment analysis ke sath mutabiq kiya jana chahiye. Pivot point signals ko maqami maahol mein shamil karne ka na-insafi maqami maqami ashiyano mein aap ko bhatakne ka khatra hai.

b. Price Action Signals Ko Najar Andaaz Karna: Sirf pivot points par bharosa karne ke baghair price action signals ko ghaur se nahi lena, jhootay breakouts ya reversals ke liye muntaqil hone ka khatra barh jata hai. Pivot point signals ko tasdeeq karne aur trading precision ko barhane ke liye price action analysis ko shamil karein.

c. Lachak Ko Najar Andaz Karna: Markets musalsal tabdeel hoti hain, is wajah se traders ko pivot point strategies ko mutabiq adjust karna hota hai. Market dynamics ke barhte hue mutaqarar rahne ke liye waqt ki sahi information hasil karte rahain, zaroorat ke mutabiq trading parameters ko adjust karein, aur changing conditions ka jawab dene mein narmi se rahain.

تبصرہ

Расширенный режим Обычный режим