(Heading): "Inverted Head and Shoulders Pattern"

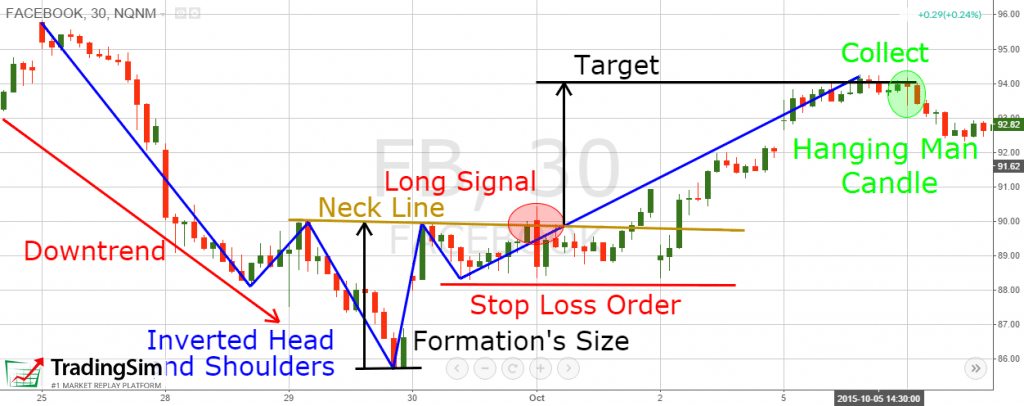

(Haalat): Inverted Head and Shoulders pattern ek technical analysis chart pattern hai jo ke market mein hone wale bullish reversals ko darust karta hai. Ye pattern generally downtrend ke baad aata hai aur bullish reversal ko indicate karta hai.

Bunyadi Tafseelat:

(Heading): "Bunyadi Tafseelat"

(Haalat): Inverted Head and Shoulders pattern ka formation jab hota hai, toh price chart par ek pattern create hota hai jisme teen peaks hote hain: ek low (head) aur doosre do lows (shoulders). Head shoulder pattern ke beech mein hota hai aur lower lows ke beech mein hota hai.

Kaise Pehchanein:

(Heading): "Kaise Pehchanein"

(Haalat): Inverted Head and Shoulders pattern ko pehchanne ke liye, traders ko price chart par teen peaks ki talaash karni chahiye. Pehla low (shoulder), doosra low (head), aur teesra low (shoulder) hone chahiye. Head shoulder pattern ke beech mein hota hai aur lower lows ke beech mein hota hai.

Market Signals:

(Heading): "Market Signals"

(Haalat): Inverted Head and Shoulders pattern market mein bullish reversal ko indicate karta hai. Iska formation downtrend ke baad hota hai aur ye show karta hai ke sellers ki strength kam ho rahi hai aur buyers market control mein aa rahe hain.

Trading Strategies:

(Heading): "Trading Strategies"

(Haalat): Inverted Head and Shoulders pattern ke formation ke baad, traders ko bullish reversal ke liye taiyar rehna chahiye. Confirmatory signals ke liye doosre technical indicators ka bhi istemal kiya ja sakta hai. Long positions consider kiye ja sakte hain, lekin hamesha risk management ka tawajju dena chahiye.

Tawajjuat Aur Hifazati Tadabeer:

(Heading): "Tawajjuat Aur Hifazati Tadabeer"

(Haalat): Inverted Head and Shoulders pattern ka istemal karne se pehle, traders ko overall market conditions aur doosre factors ka bhi tawajju dena chahiye. False signals se bachne ke liye confirmatory signals ka wait karna bhi zaroori hai.

Conclusion:

(Heading): "Tadbeer Aur Gyaan Baratne Ka Waqt"

(Haalat): Inverted Head and Shoulders pattern ek bullish reversal signal hai jo traders ko market trends ke changing dynamics ke baare mein malumat deta hai. Lekin, hamesha ek comprehensive analysis aur confirmatory signals ka wait karna chahiye trading decisions ke liye. Trading mein risk management ka bhi hamesha tawajju dena chahiye.

تبصرہ

Расширенный режим Обычный режим