Doji Candlestick Pattern

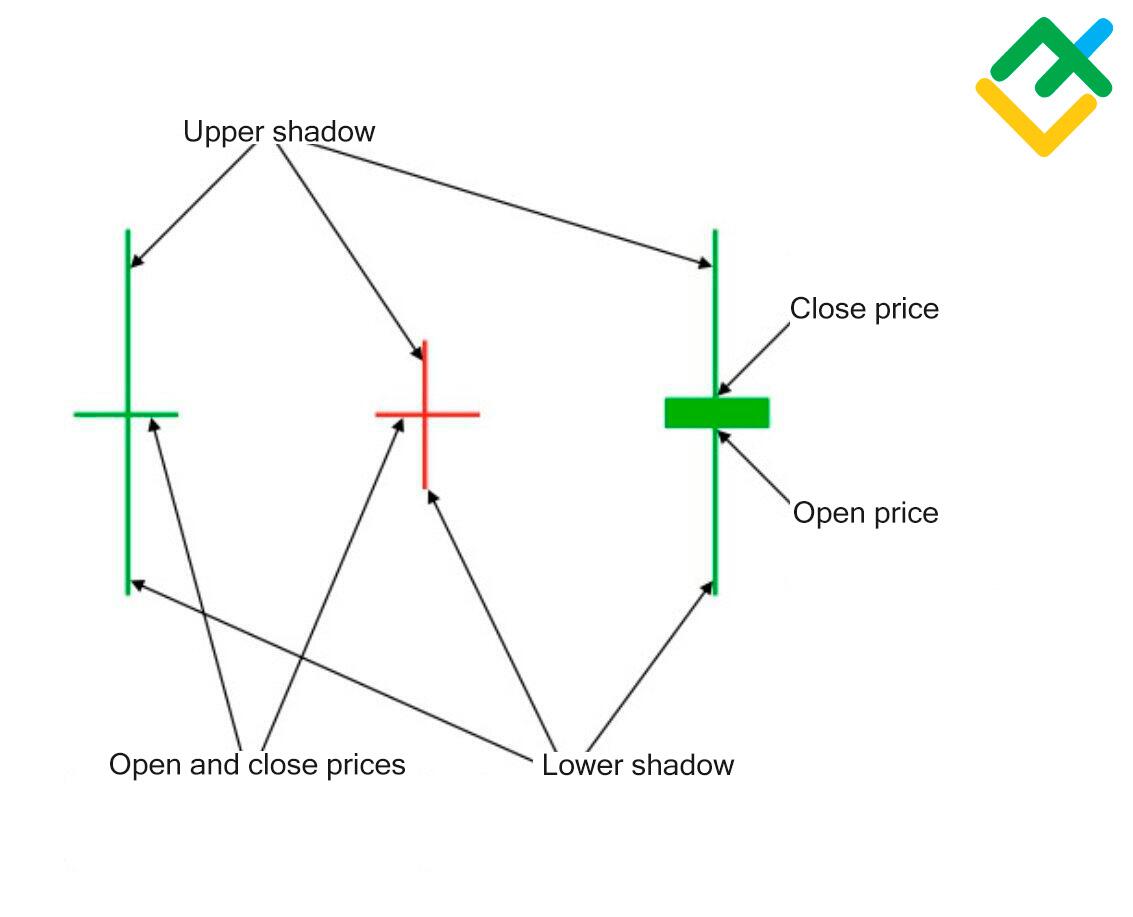

Doji Candlestick Pattern ek popular technical analysis tool hai jo market sentiment ka indication deta hai. Yeh pattern tab form hota hai jab ek trading session mein open aur close price barabar ya kareeb barabar hota hai. Iski shape ek cross ya plus sign ki tarah hoti hai.

Doji Candlestick Pattern ke do prakar hote hain:

Neutral Doji (Be-Baiki Doji):

Jab open aur close price ek dusre ke bohot kareeb hota hai lekin exact match nahi hota, tab ek neutral doji form hota hai.

Is doji ko market ka indecision ya uncertainty ka sign samjha jata hai. Yeh indicate karta hai ki buyers aur sellers ke darmiyan koi clear direction nahi hai.

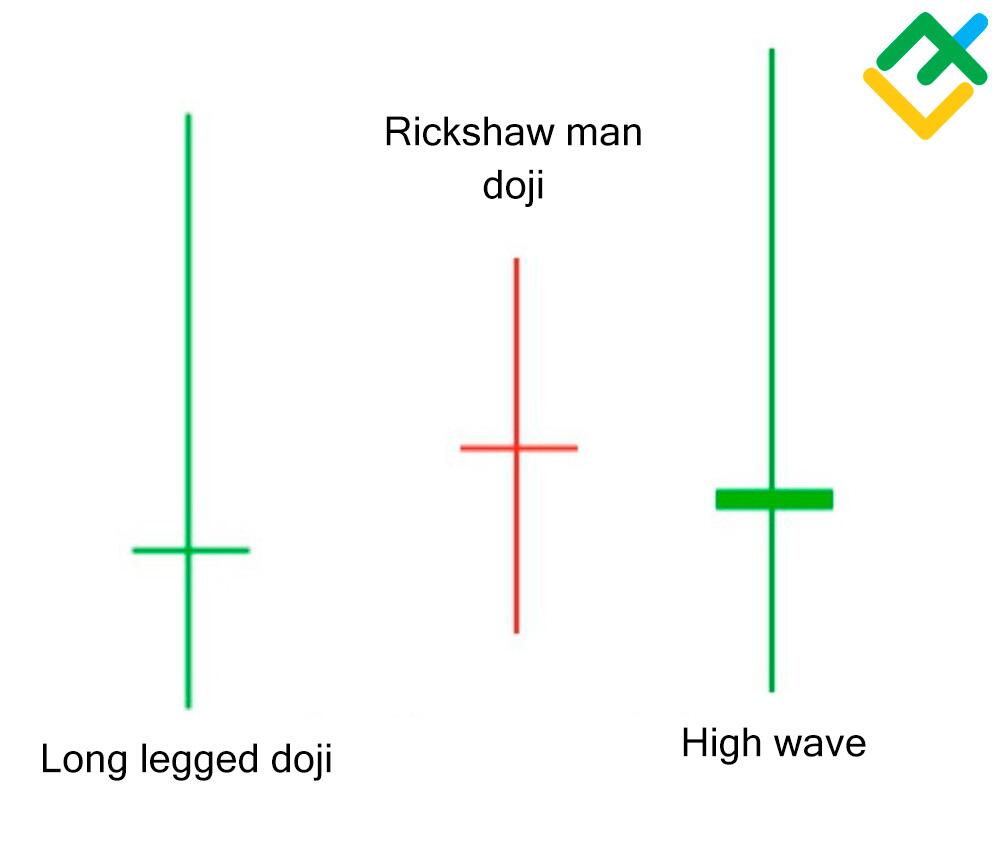

Long-legged Doji (Lambi Taang Wali Doji):

Long-legged doji tab form hota hai jab doji ke upper aur lower shadows lambe hote hain.

Is doji mein bhi market ka uncertainty hota hai, lekin iska interpretation thoda strong hota hai. Is doji ke baad market mein volatility ya trend change hone ke chances hote hain.

Doji Candlestick Pattern ko identify karne ke liye traders price ke movement ko closely observe karte hain aur pattern ke breakout point ka wait karte hain. Breakout ke baad, trend ka continuation ya reversal hone ke chances hote hain.

Hamesha yaad rahe ki chart patterns ke interpretation mein kabhi-kabhi false signals bhi ho sakte hain, isliye risk management ka dhyan rakhna important hai.

Doji Candlestick Pattern ko identify karne ke liye traders price ke movement ko acche se observe karte hain aur pattern ke breakout point ka wait karte hain. Breakout ke baad, trend ka continuation ya reversal hone ke chances hote hain.

Hamesha yaad rahe ki chart patterns ke interpretation mein kabhi-kabhi false signals bhi ho sakte hain, isliye risk management ka dhyan rakhna important hai.

Doji Candlestick Pattern ek popular technical analysis tool hai jo market sentiment ka indication deta hai. Yeh pattern tab form hota hai jab ek trading session mein open aur close price barabar ya kareeb barabar hota hai. Iski shape ek cross ya plus sign ki tarah hoti hai.

Doji Candlestick Pattern ke do prakar hote hain:

Neutral Doji (Be-Baiki Doji):

Jab open aur close price ek dusre ke bohot kareeb hota hai lekin exact match nahi hota, tab ek neutral doji form hota hai.

Is doji ko market ka indecision ya uncertainty ka sign samjha jata hai. Yeh indicate karta hai ki buyers aur sellers ke darmiyan koi clear direction nahi hai.

Long-legged Doji (Lambi Taang Wali Doji):

Long-legged doji tab form hota hai jab doji ke upper aur lower shadows lambe hote hain.

Is doji mein bhi market ka uncertainty hota hai, lekin iska interpretation thoda strong hota hai. Is doji ke baad market mein volatility ya trend change hone ke chances hote hain.

Doji Candlestick Pattern ko identify karne ke liye traders price ke movement ko closely observe karte hain aur pattern ke breakout point ka wait karte hain. Breakout ke baad, trend ka continuation ya reversal hone ke chances hote hain.

Hamesha yaad rahe ki chart patterns ke interpretation mein kabhi-kabhi false signals bhi ho sakte hain, isliye risk management ka dhyan rakhna important hai.

Doji Candlestick Pattern ko identify karne ke liye traders price ke movement ko acche se observe karte hain aur pattern ke breakout point ka wait karte hain. Breakout ke baad, trend ka continuation ya reversal hone ke chances hote hain.

Hamesha yaad rahe ki chart patterns ke interpretation mein kabhi-kabhi false signals bhi ho sakte hain, isliye risk management ka dhyan rakhna important hai.

تبصرہ

Расширенный режим Обычный режим