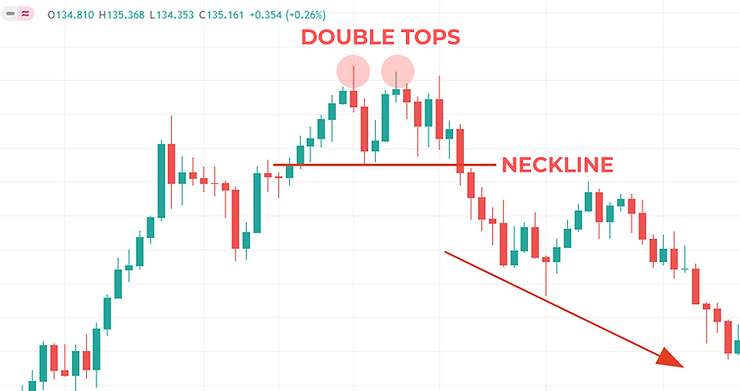

Double Top aur Double Bottom patterns, technical analysis mein ahem candlestick patterns hain jo market ke reversals ko indicate karte hain. Double Top pattern ek bearish reversal pattern hota hai jo uptrend ke baad dekha jata hai. Is pattern mein market ek resistance level ko do martaba touch karta hai aur har baar wahi level se bounce back kar ke neeche ki taraf move karta hai. Yeh indicate karta hai ke buyers ki strength khatam ho rahi hai aur sellers ka dominance badh raha hai, jisse market ka trend change hota hai aur bearish trend shuru hota hai

Double Bottom pattern ek bullish reversal pattern hota hai jo downtrend ke baad dekha jata hai. Is pattern mein market ek support level ko do martaba touch karta hai aur har baar wahi level se bounce back kar ke upar ki taraf move karta hai. Yeh indicate karta hai ke sellers ki strength khatam ho rahi hai aur buyers ka dominance badh raha hai, jisse market ka trend change hota hai aur bullish trend shuru hota hai. In dono patterns mein, jab market do martaba ek specific level ko touch karta hai aur phir opposite direction mein move karta hai, toh yeh ek potential reversal signal hai. Traders in patterns ko dekh kar market ke future direction ke baare mein anumaan lagate hain aur trading decisions lete hain

Double Top aur Double Bottom patterns ki pehchan aur samajh market analysis ka ahem hissa hai. Jab traders in patterns ko spot karte hain, toh woh market ke potential reversals ko identify karne mein madad milta hai. Agar market uptrend mein hai aur ek Double Top pattern dekha jata hai, toh yeh bearish reversal ki possibility ko darust karta hai, aur traders ko selling opportunities ke liye taiyyar hona chahiye. Ulte, agar market downtrend mein hai aur Double Bottom pattern nazar aata hai, toh yeh bullish reversal ka indication hota hai, aur traders ko buying opportunities ke liye taiyyar hona chahiye. Is tarah se, Double Top aur Double Bottom patterns ko samajh kar aur sahi tareeke se interpret karke, traders market ke future movements ko better anticipate kar sakte hain aur sahi trading decisions le sakte hain

Double Bottom pattern ek bullish reversal pattern hota hai jo downtrend ke baad dekha jata hai. Is pattern mein market ek support level ko do martaba touch karta hai aur har baar wahi level se bounce back kar ke upar ki taraf move karta hai. Yeh indicate karta hai ke sellers ki strength khatam ho rahi hai aur buyers ka dominance badh raha hai, jisse market ka trend change hota hai aur bullish trend shuru hota hai. In dono patterns mein, jab market do martaba ek specific level ko touch karta hai aur phir opposite direction mein move karta hai, toh yeh ek potential reversal signal hai. Traders in patterns ko dekh kar market ke future direction ke baare mein anumaan lagate hain aur trading decisions lete hain

Double Top aur Double Bottom patterns ki pehchan aur samajh market analysis ka ahem hissa hai. Jab traders in patterns ko spot karte hain, toh woh market ke potential reversals ko identify karne mein madad milta hai. Agar market uptrend mein hai aur ek Double Top pattern dekha jata hai, toh yeh bearish reversal ki possibility ko darust karta hai, aur traders ko selling opportunities ke liye taiyyar hona chahiye. Ulte, agar market downtrend mein hai aur Double Bottom pattern nazar aata hai, toh yeh bullish reversal ka indication hota hai, aur traders ko buying opportunities ke liye taiyyar hona chahiye. Is tarah se, Double Top aur Double Bottom patterns ko samajh kar aur sahi tareeke se interpret karke, traders market ke future movements ko better anticipate kar sakte hain aur sahi trading decisions le sakte hain

تبصرہ

Расширенный режим Обычный режим