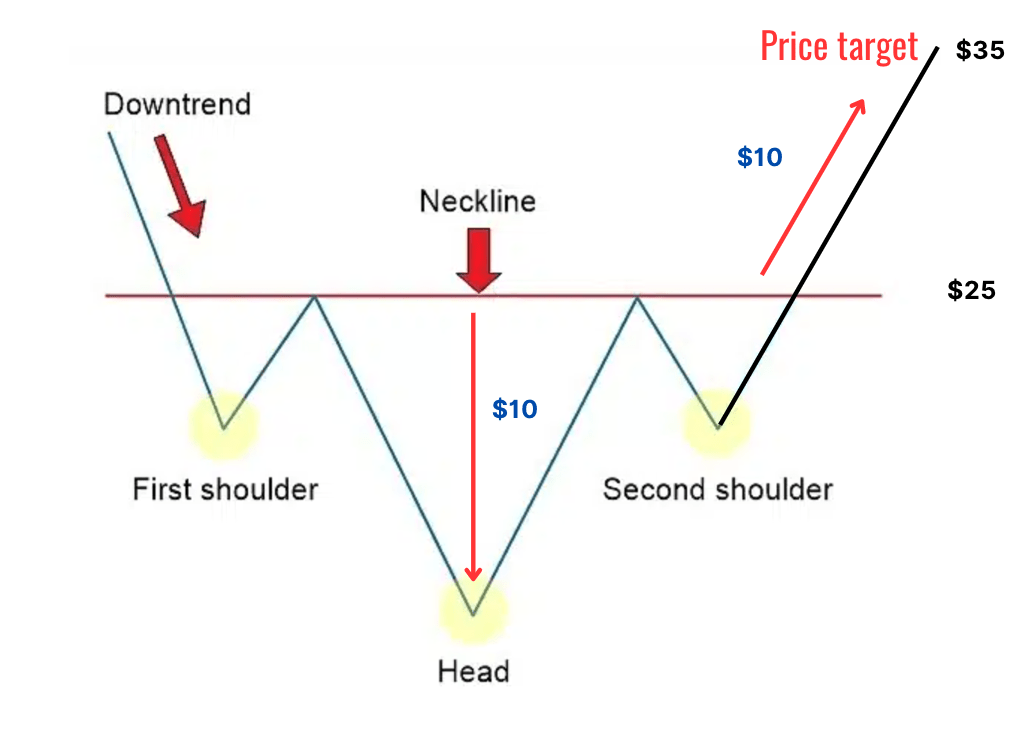

"Inverse Head and Shoulder Candlestick Pattern" ek aham technical analysis tool hai jo traders ko market mein potential trend reversals ko identify karne mein madad karta hai. Ye pattern typically downtrend ke baad dekha jata hai aur bullish reversal ka signal deta hai

Is pattern ko pehchanne ke liye, traders ko pehle market mein ek downtrend ki presence ko dekhna hota hai. Phir, ek "head" candle followed by two "shoulder" candles dekhe jate hain. "Head" candle downtrend ka peak hota hai, jabke "shoulder" candles is peak ke neeche ke dips ko represent karte hain. Iske baad, ek "neckline" draw ki jati hai jo ke "shoulder" candles ke tops ko join karta hai. Inverse Head and Shoulder pattern ka confirm hone ke liye, market ko "neckline" ko break kar ke upar move karna zaroori hota hai. Jab ye ho jata hai, yeh ek bullish reversal signal provide karta hai, aur traders ko ye samjhaata hai ke ab market ka trend change ho sakta hai aur upar jaane ki sambhavna hai

Traders ko is pattern ka istemal karne se pehle confirmation candles aur thorough analysis ka istemal karna chahiye taake wo sahi trading decisions le sakein. Ye pattern market trends aur potential reversals ke baare mein maloomat faraham karta hai aur traders ko market mein hone wale changes ke liye tayyar rakhta hai. Is pattern ko dekh kar traders apne trading strategies ko adjust kar sakte hain aur market mein hone wale potential reversals ka faida utha sakte hain. Lekin, is pattern ka istemal karne se pehle, traders ko market conditions aur confirmations ko dhyan mein rakhna zaroori hai taake wo sahi trading decisions le sakein

Overall, Inverse Head and Shoulder Candlestick Pattern ek useful aur effective tool hai jo traders ko market analysis mein madad deta hai aur unhe sahi trading opportunities ki pehchan karne mein madad karta hai. Lekin, hamesha yaad rahe ke har trade mein risk hota hai, isliye risk management ko hamesha priority dein

Is pattern ko pehchanne ke liye, traders ko pehle market mein ek downtrend ki presence ko dekhna hota hai. Phir, ek "head" candle followed by two "shoulder" candles dekhe jate hain. "Head" candle downtrend ka peak hota hai, jabke "shoulder" candles is peak ke neeche ke dips ko represent karte hain. Iske baad, ek "neckline" draw ki jati hai jo ke "shoulder" candles ke tops ko join karta hai. Inverse Head and Shoulder pattern ka confirm hone ke liye, market ko "neckline" ko break kar ke upar move karna zaroori hota hai. Jab ye ho jata hai, yeh ek bullish reversal signal provide karta hai, aur traders ko ye samjhaata hai ke ab market ka trend change ho sakta hai aur upar jaane ki sambhavna hai

Traders ko is pattern ka istemal karne se pehle confirmation candles aur thorough analysis ka istemal karna chahiye taake wo sahi trading decisions le sakein. Ye pattern market trends aur potential reversals ke baare mein maloomat faraham karta hai aur traders ko market mein hone wale changes ke liye tayyar rakhta hai. Is pattern ko dekh kar traders apne trading strategies ko adjust kar sakte hain aur market mein hone wale potential reversals ka faida utha sakte hain. Lekin, is pattern ka istemal karne se pehle, traders ko market conditions aur confirmations ko dhyan mein rakhna zaroori hai taake wo sahi trading decisions le sakein

Overall, Inverse Head and Shoulder Candlestick Pattern ek useful aur effective tool hai jo traders ko market analysis mein madad deta hai aur unhe sahi trading opportunities ki pehchan karne mein madad karta hai. Lekin, hamesha yaad rahe ke har trade mein risk hota hai, isliye risk management ko hamesha priority dein

:max_bytes(150000):strip_icc()/dotdash_Final_Inverse_Head_And_Shoulders_Definition_Feb_2020-01-97f223a0a4224c2f8d303e84f4725a39.jpg)

تبصرہ

Расширенный режим Обычный режим