Use of Regression Channel in Trading,

Regression Channel trading mein ek ahem tool hai jo ke statistical analysis par mabni hota hai. Iska istemal market trends aur price movements ko samajhne mein kiya jata hai.

What is Regression Channel Index?

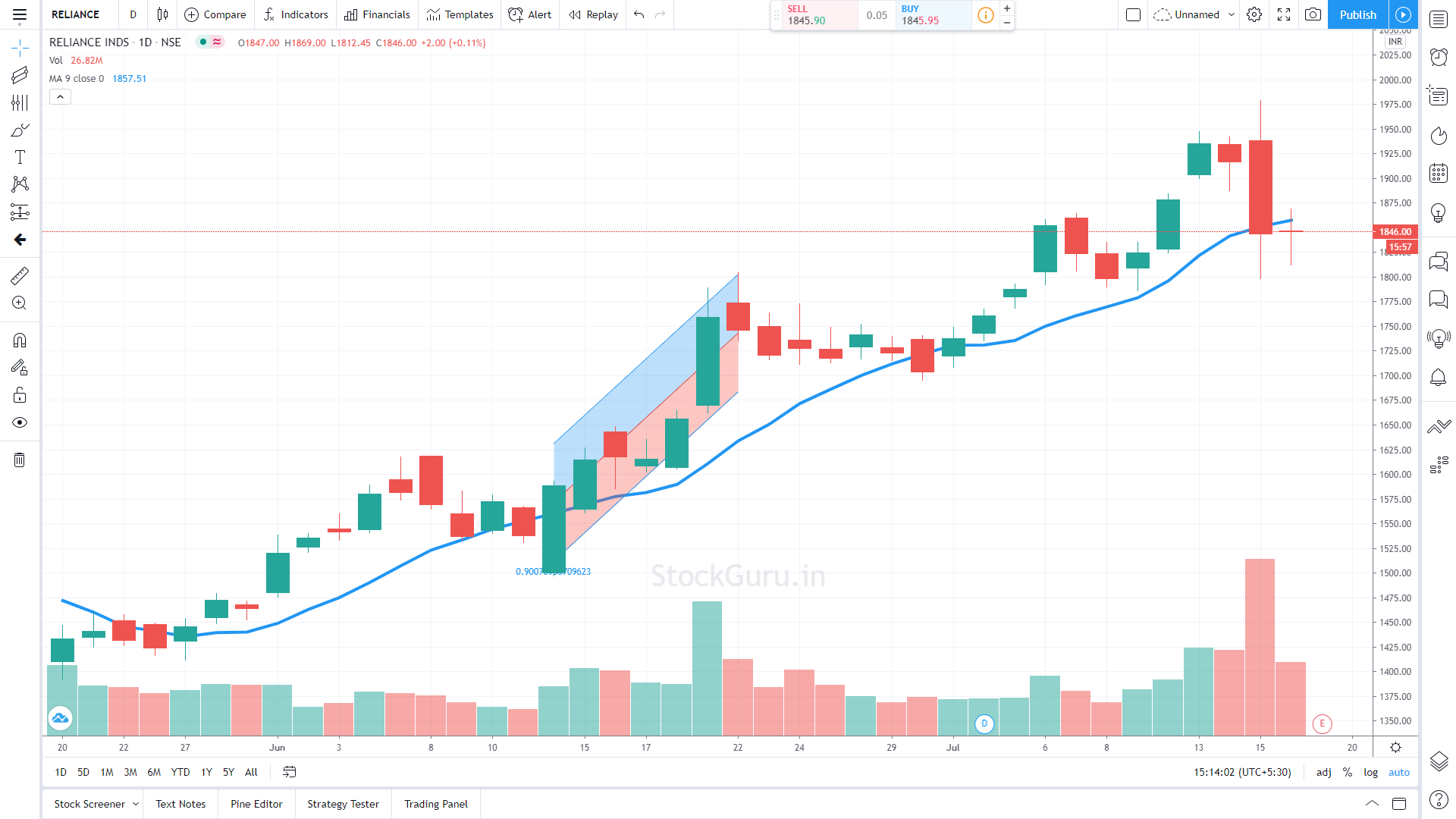

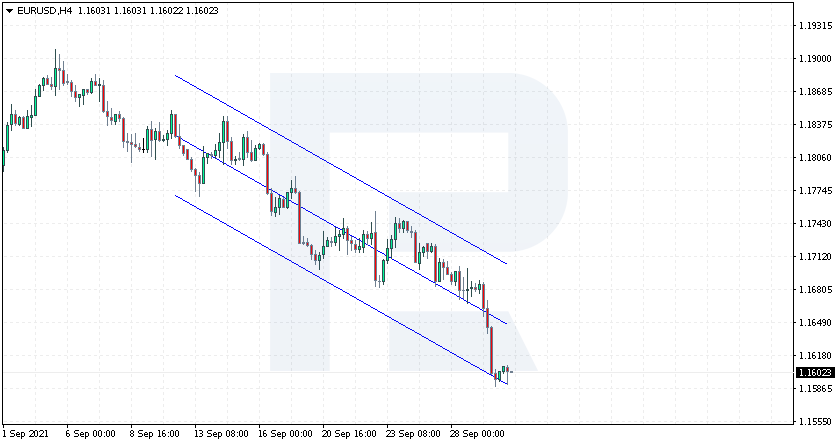

Regression Channel ek statistical concept hai jo data points ko analyze kar ke ek trend line create karta hai. Trading mein, yeh channel prices ke around ek line banata hai jo market trend ko represent karta hai. Isme do parallel lines hoti hain jo prices ke expected range ko define karti hain.

Components of Regression Channel Index,

Regression Channel mein do mukhtalif components hote hain:

Regression Line,Yeh line data points ko analyze kar ke market ka primary trend show karti hai.

Upper Channel Line,Yeh line regression line ke upar ek fixed distance par chalti hai, prices ke upper limit ko represent karti hai.

Lower Channel Line, Yeh line regression line ke neeche ek fixed distance par chalti hai, prices ke lower limit ko represent karti hai.

How to Draw Regression Channels,

Data Points, Pehle toh, trading data ko collect karein. Isme past prices shamil hote hain jo ke aapke analysis ke liye istemal hote hain.

Regression Line,Regression line ko draw karne ke liye, aapko statistical tools ka istemal karna hoga jo ke market ke trend ko represent kare.

Upper aur Lower Lines, Upper aur lower lines ko add karein jinhein regression line ke upar aur neeche ek fixed percentage se create kiya jata hai.

Trading Strategies Using Regression Channel,

Trend Identification,Regression Channel ke istemal se aap market trend ko identify kar sakte hain. Agar prices upper line ke pass hain toh yeh bullish trend ko indicate kar sakta hai aur agar lower line ke pass hain toh bearish trend indicate ho sakta hai.

Entry Points, Regression Channel se aap entry points bhi identify kar sakte hain. For example, agar prices lower line ke pass hain aur phir upper line ki taraf ja rahe hain toh yeh entry point ho sakta hai.

Risk Management,Regression Channel ko istemal kar ke aap apne trades ki risk management bhi improve kar sakte hain. Upper aur lower lines aapko price movements ke expected range ko batati hain jisse aap apne stop-loss aur take-profit levels set kar sakte hain.

Limitations and Precautions,

Regression Channel trading mein ek ahem tool hai jo ke statistical analysis par mabni hota hai. Iska istemal market trends aur price movements ko samajhne mein kiya jata hai.

What is Regression Channel Index?

Regression Channel ek statistical concept hai jo data points ko analyze kar ke ek trend line create karta hai. Trading mein, yeh channel prices ke around ek line banata hai jo market trend ko represent karta hai. Isme do parallel lines hoti hain jo prices ke expected range ko define karti hain.

Components of Regression Channel Index,

Regression Channel mein do mukhtalif components hote hain:

Regression Line,Yeh line data points ko analyze kar ke market ka primary trend show karti hai.

Upper Channel Line,Yeh line regression line ke upar ek fixed distance par chalti hai, prices ke upper limit ko represent karti hai.

Lower Channel Line, Yeh line regression line ke neeche ek fixed distance par chalti hai, prices ke lower limit ko represent karti hai.

How to Draw Regression Channels,

Data Points, Pehle toh, trading data ko collect karein. Isme past prices shamil hote hain jo ke aapke analysis ke liye istemal hote hain.

Regression Line,Regression line ko draw karne ke liye, aapko statistical tools ka istemal karna hoga jo ke market ke trend ko represent kare.

Upper aur Lower Lines, Upper aur lower lines ko add karein jinhein regression line ke upar aur neeche ek fixed percentage se create kiya jata hai.

Trading Strategies Using Regression Channel,

Trend Identification,Regression Channel ke istemal se aap market trend ko identify kar sakte hain. Agar prices upper line ke pass hain toh yeh bullish trend ko indicate kar sakta hai aur agar lower line ke pass hain toh bearish trend indicate ho sakta hai.

Entry Points, Regression Channel se aap entry points bhi identify kar sakte hain. For example, agar prices lower line ke pass hain aur phir upper line ki taraf ja rahe hain toh yeh entry point ho sakta hai.

Risk Management,Regression Channel ko istemal kar ke aap apne trades ki risk management bhi improve kar sakte hain. Upper aur lower lines aapko price movements ke expected range ko batati hain jisse aap apne stop-loss aur take-profit levels set kar sakte hain.

Limitations and Precautions,

- Regression Channel ke istemal mein hamesha limitations ko dhyan mein rakhein. Market conditions change ho sakti hain aur yeh tool sirf ek guide hai.

- Multiple indicators ke sath istemal karna behtar ho sakta hai for a more comprehensive analysis.

- Regularly update karein apne regression lines ko taki recent market conditions ko reflect kiya ja sake.

- Regression Channel ek powerful tool hai jo traders ko market trends samajhne mein aur trading strategies banane mein madad karta hai. Iska sahi istemal karke, aap apne trading approach ko refine kar sakte hain aur market movements ko better predict kar sakte hain.

تبصرہ

Расширенный режим Обычный режим