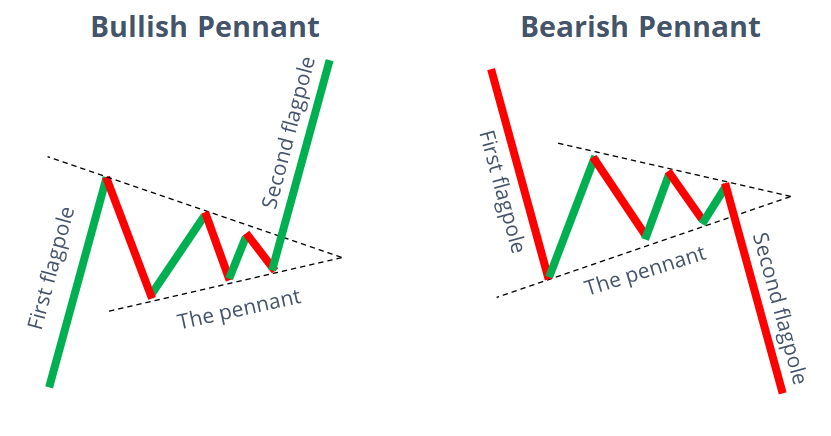

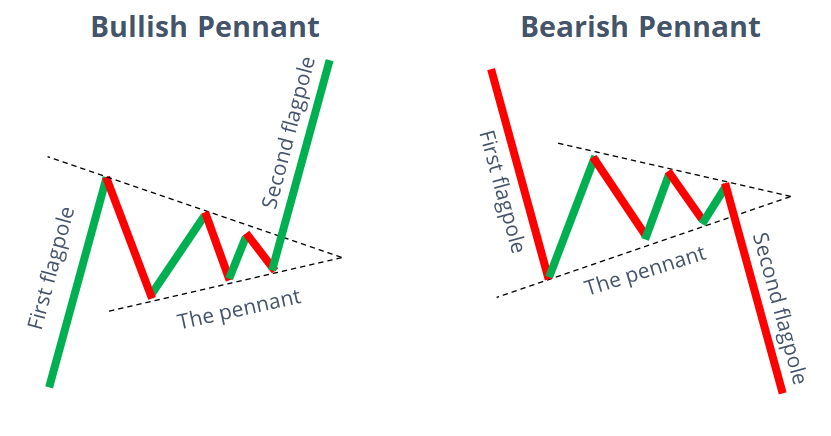

Pennant chart pattern forex market mein aik aam jari rahne wala pattern hai. Ye pattern tab banta hai jab kisi taqatwar trending move ke baad qeemat mein mukhtasir tarahi ka consolidation hota hai. Ye pattern aik chota muwafiq tirchah jo ke taqatwar qeemat ki chal ke darmiyan ban jata hai, ki manind hota hai. Agar ye pattern uptrend ke baad banaye jata hai to ise bullish continuation pattern samjha jata hai, aur agar ye pattern downtrend ke baad banaye jata hai to ise bearish continuation pattern samjha jata hai.

Pennant Chart Pattern ki Khususiyyat:

Chaliye EUR/USD currency pair mein aik bullish pennant pattern ka misal lete hain. EUR/USD mein aik taqatwar uptrend hai, jise ek consolidation muddat ke baad pennant pattern banta hai. Consolidation muddat ke doran, price decreasing volume ke sath aik symmetrical triangle banata hai.

Jaise hi pennant pattern mukammal hone ke qareeb hota hai, traders uptrend ke rukh mein breakout ka intezar karte hain. Jab price pennant ke upper trendline se bahir nikalta hai aur volume mein izafa hota hai, traders ek long position mein dakhil ho jate hain aur stop-loss order breakout point ke neeche lagate hain.

Trade ka munafa maqsad pennant formation ke unchai par mabni hota hai. Traders pennant ki unchai aur nichai ke darmiyan faslay ko nap kar uss faslay ko breakout point se mukhtalif karte hain taakay maqsad ke qeemat tay ki ja sake. Jab price maqsad ko haasil karta hai, traders munafa le sakte hain aur trade ko band kar sakte hain

Pennant Chart Pattern ki Khususiyyat:

- Shakal: Pennant pattern choti symmetrical triangle se nazar aata hai jo ke bara price move ke andar banta hai. Triangle do milte julte trendlines dwara bana hota hai jo ke consolidation muddat ke high aur low points se shuru hota hai.

- Muddat: Pennant pattern ki muddat mukhtalif ho sakti hai, lekin aam tor par yeh chand dino se lekar chand hafton tak ka short-term consolidation hota hai. Jitni muddat kam hoti hai, pattern utna hi mazboot hota hai.

- Volume: Pennant pattern ke consolidation muddat mein volume mehsool hota hai. Volume ka yeh kami trading activity mein waqtan-fawaqtan rukawat ki alamat hai jab tak ke market participants agle directional move ka intezar karte hain.

- Breakout: Pennant pattern tab tasdeeq hota hai jab ke price triangle formation se bahir nikalta hai pichle trend ke rukh mein. Breakout aam tor par volume ke izafay ke sath hota hai jo ke naye trend ki taqat ko tasdeeq karta hai.

- Daakhil: Traders price ke pennant pattern se breakout hone par daakhil hotay hain pichle trend ke rukh mein. Bullish continuation pattern ke liye, long entry tab lete hain jab price pennant ke upper trendline se bahir nikal jata hai. Bearish continuation pattern ke liye, short entry tab lete hain jab price pennant ke lower trendline se bahir nikal jata hai.

- Stop Loss: Long trade ke liye stop-loss order breakout point ke neeche lagaya jata hai, aur short trade ke liye breakout point ke oopar. Yeh madad karta hai potential nuqsanat ko mehdood karna agar breakout nakam hota hai aur price consolidation range mein palat jata hai.

- Take Profit: Pennant pattern trade ka munafa maqsad pennant formation ki unchai par mabni hota hai. Traders pennant ki unchai aur nichai ke darmiyan faslay ko nap sakte hain aur uss faslay ko breakout point se mukhtalif karte hain taakay maqsad ke qeemat tay ki ja sake.

- Risk Management: Traders ko hamesha apni risk bardasht ke qabiliyat ko mad e nazar rakhte hue aur pennant pattern trading mein munasib risk management strategies ko amal mein lena chahiye. Is mein munasib position sizing ka istemal, stop-loss orders ka taayun aur trading plan ka paalan shamil hai.

Chaliye EUR/USD currency pair mein aik bullish pennant pattern ka misal lete hain. EUR/USD mein aik taqatwar uptrend hai, jise ek consolidation muddat ke baad pennant pattern banta hai. Consolidation muddat ke doran, price decreasing volume ke sath aik symmetrical triangle banata hai.

Jaise hi pennant pattern mukammal hone ke qareeb hota hai, traders uptrend ke rukh mein breakout ka intezar karte hain. Jab price pennant ke upper trendline se bahir nikalta hai aur volume mein izafa hota hai, traders ek long position mein dakhil ho jate hain aur stop-loss order breakout point ke neeche lagate hain.

Trade ka munafa maqsad pennant formation ke unchai par mabni hota hai. Traders pennant ki unchai aur nichai ke darmiyan faslay ko nap kar uss faslay ko breakout point se mukhtalif karte hain taakay maqsad ke qeemat tay ki ja sake. Jab price maqsad ko haasil karta hai, traders munafa le sakte hain aur trade ko band kar sakte hain

تبصرہ

Расширенный режим Обычный режим