INTRODUCTION OF HOCKEY PATTERN:-

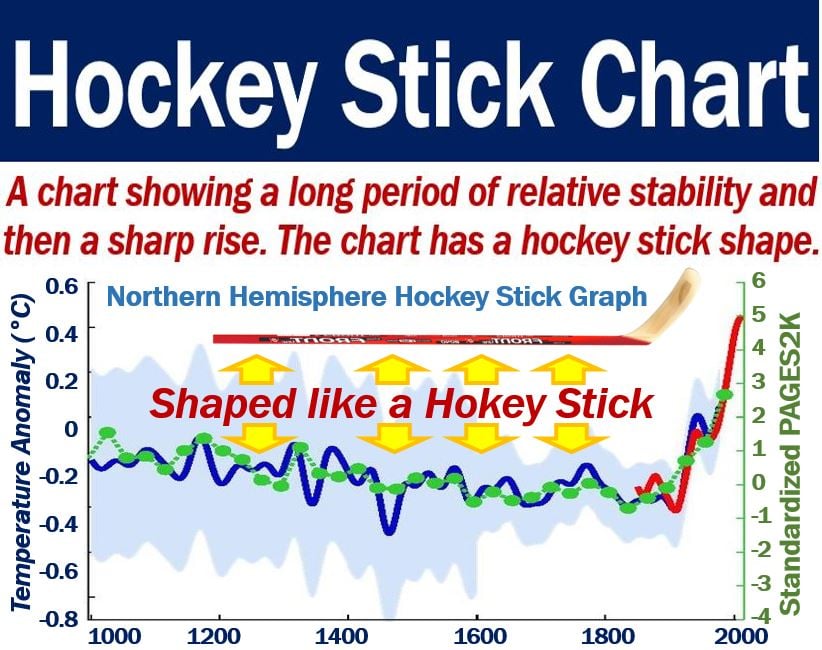

My dear traders aaj ki yeh post hockey candlestick pattern per mushtammil hy ky kis tarah yeh pattern forex mein apny traders ko aik achi business deal jo ky forex market mein hoti hy help ker sakta hy.market mein jity bi patterns hoty hein unn ka aim only apny trders ko trading mein help out kerna hota hy.traders different patterns per apni study ko enhance ker ky woh patterns apni trading per apply ker ky acha profit kama sakty hein,esi leye patterns ki indications aur ko samajna aur unn ky according trading kerna bhout zaroori factor hy.yeah chart pattern market ki position ko confirm karne mein traders ko acche tarike se sport karta hai. traders market Mein handle inflation distance parts identify karne ke liye market Mein available hockey stick chart pattern ka istemal kar sakte hain, Kyun ky yeh chart pattaern en ke related complete information provide karta hai.

DESCRIPTIVE DETAIL OF OF HOCKEY CANDLESTICK PATTERN:-

Dear friends market Mein yah candlestick chart pattern expanded growth Ko indicate karta hai market Mein trader ess chart pattern Ky zariya se revenue growth and volume growth ko bhi acche tarike se show Karte Hain, aur yah chart pattern highlighted interest company products ki services ko indicate Karte Hain. bhout log apni trade ke liye is chart pattern Ka istemal Karke market Mein long position ko acche tarike se confirm kar sakte hain aur yah position Unki trading ke liye bahut perfect Hoti Hai woh ess ky zariya se acche profot Hasil kar sakte hain. Yeh pattern bullish trend ki taraf ishara karta hai yaani ke price kay barhnay ki ummeed hai. Isi tarah jab aik bari lal candlestick dikhayi deti hai jis ka jisam bara hota hai aur dum choti hoti hai to isay bhi hockey stick kehte hain. Yeh pattern bearish trend ki taraf ishara karta hai, yaani ke price kay decrease hony ki hope live rehti hay.yeh pattern har pair main nai create hota. Qyu keh kisi bhi currency ya commodity pairs ki market main itni fast change ya taizi nai ati keh ess mein very short time main high increase a jaye yani ess pattern main jab aik aisa bahao ata hay keh ess ky last periods ki nisbat bahut limited time main bahut ziada aur clear high increase a jaye tu isko hockey stick say tashbeeh di jati hay.maximum traders daily currency pairs main he trading karty hain kyun keh inka trend bahut stable hota hay jis waja say is pattern main woh routine basis per achi earning kar laity hain. Aur in pairs main kabhi bhi hockey stick pattern nai banta.ess tarah ki trading account bi safe rehta hy aur traders big loss ky danger sy bi bachy rehty hein.

TRADING ANALYSIS METHODS:-

Trading ky duran forex market mein patterns ki identification ky baad most important element trading method hy jis hamein pata chalta hy ky market mein enter hony ka accurate time kiya hy, aur kis lot ki trading helpful ho sakti hy.matlab trading depend kerti hy accoun t per, but sometime trend itny clear hoty hein ky small account bi big profit earning mein kaam aa sakta hy.Isay samajh kar aap price kay ky trend ka andaza laga sakte hy hain. Hockey stick pattern trading ke faislay mein madad deta hai. Agar aap bullish trend ka andaza lagate hain to aap buy kar sakte hain aur agar bearish trend ka andaza lagate hain to aap sell kar sakte hain. Stop loss aur profit target ka andaza lagana Hockey stick pattern stop loss aur profit target ka andaza lagane mein bhi madad deta hai. Agar aap hockey stick pattern ko samajh jaty hain tu aap entry point stop loss aur profit target ko theek tarah se set kar sakte hain.yeh basically aik risky pattern hy but ess pattern ki completion risk kafi kam ker deti hy aur profit earning easy ho jati hy.

My dear traders aaj ki yeh post hockey candlestick pattern per mushtammil hy ky kis tarah yeh pattern forex mein apny traders ko aik achi business deal jo ky forex market mein hoti hy help ker sakta hy.market mein jity bi patterns hoty hein unn ka aim only apny trders ko trading mein help out kerna hota hy.traders different patterns per apni study ko enhance ker ky woh patterns apni trading per apply ker ky acha profit kama sakty hein,esi leye patterns ki indications aur ko samajna aur unn ky according trading kerna bhout zaroori factor hy.yeah chart pattern market ki position ko confirm karne mein traders ko acche tarike se sport karta hai. traders market Mein handle inflation distance parts identify karne ke liye market Mein available hockey stick chart pattern ka istemal kar sakte hain, Kyun ky yeh chart pattaern en ke related complete information provide karta hai.

DESCRIPTIVE DETAIL OF OF HOCKEY CANDLESTICK PATTERN:-

Dear friends market Mein yah candlestick chart pattern expanded growth Ko indicate karta hai market Mein trader ess chart pattern Ky zariya se revenue growth and volume growth ko bhi acche tarike se show Karte Hain, aur yah chart pattern highlighted interest company products ki services ko indicate Karte Hain. bhout log apni trade ke liye is chart pattern Ka istemal Karke market Mein long position ko acche tarike se confirm kar sakte hain aur yah position Unki trading ke liye bahut perfect Hoti Hai woh ess ky zariya se acche profot Hasil kar sakte hain. Yeh pattern bullish trend ki taraf ishara karta hai yaani ke price kay barhnay ki ummeed hai. Isi tarah jab aik bari lal candlestick dikhayi deti hai jis ka jisam bara hota hai aur dum choti hoti hai to isay bhi hockey stick kehte hain. Yeh pattern bearish trend ki taraf ishara karta hai, yaani ke price kay decrease hony ki hope live rehti hay.yeh pattern har pair main nai create hota. Qyu keh kisi bhi currency ya commodity pairs ki market main itni fast change ya taizi nai ati keh ess mein very short time main high increase a jaye yani ess pattern main jab aik aisa bahao ata hay keh ess ky last periods ki nisbat bahut limited time main bahut ziada aur clear high increase a jaye tu isko hockey stick say tashbeeh di jati hay.maximum traders daily currency pairs main he trading karty hain kyun keh inka trend bahut stable hota hay jis waja say is pattern main woh routine basis per achi earning kar laity hain. Aur in pairs main kabhi bhi hockey stick pattern nai banta.ess tarah ki trading account bi safe rehta hy aur traders big loss ky danger sy bi bachy rehty hein.

TRADING ANALYSIS METHODS:-

Trading ky duran forex market mein patterns ki identification ky baad most important element trading method hy jis hamein pata chalta hy ky market mein enter hony ka accurate time kiya hy, aur kis lot ki trading helpful ho sakti hy.matlab trading depend kerti hy accoun t per, but sometime trend itny clear hoty hein ky small account bi big profit earning mein kaam aa sakta hy.Isay samajh kar aap price kay ky trend ka andaza laga sakte hy hain. Hockey stick pattern trading ke faislay mein madad deta hai. Agar aap bullish trend ka andaza lagate hain to aap buy kar sakte hain aur agar bearish trend ka andaza lagate hain to aap sell kar sakte hain. Stop loss aur profit target ka andaza lagana Hockey stick pattern stop loss aur profit target ka andaza lagane mein bhi madad deta hai. Agar aap hockey stick pattern ko samajh jaty hain tu aap entry point stop loss aur profit target ko theek tarah se set kar sakte hain.yeh basically aik risky pattern hy but ess pattern ki completion risk kafi kam ker deti hy aur profit earning easy ho jati hy.

تبصرہ

Расширенный режим Обычный режим