"Homing Pigeon Pattern" ka istemal karke traders market ke direction mein changes ko anticipate kar sakte hain aur sahi trading decisions le sakte hain. Ye pattern bullish reversal ko suggest karta hai aur traders ko ye samjhaata hai ke market ke sentiment mein change hone ki sambhavna hai. Is pattern ko confirm karne ke liye, traders doosri candle ki closing price ke upar se ek confirmation candle ka wait karte hain. Agar ye confirmation candle mil jaata hai, to traders ko entry point mil jaata hai aur wo trading positions le sakte hain. "Homing Pigeon Pattern" ka istemal karne se pehle, traders ko confirmation candles aur thorough analysis ka istemal karna chahiye taake wo sahi trading decisions le sakein. Ye pattern market trends aur potential reversals ke baare mein maloomat faraham karta hai aur traders ko market mein hone wale changes ke liye tayyar rakhta hai. Overall, "Homing Pigeon Pattern" ek useful aur effective tool hai jo traders ko market analysis mein madad deta hai aur unhe sahi trading opportunities ki pehchan karne mein madad karta hai. Lekin, is pattern ka istemal karne se pehle traders ko market conditions aur confirmations ko dhyan mein rakhna zaroori hai taake wo sahi trading decisions le sakein.

`

X

new posts

-

#1 Collapse

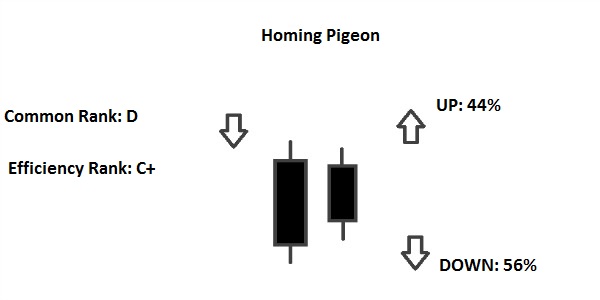

Homing Pigeon Pattern - White and Black"Homing Pigeon Pattern - Safed aur Kala" "Homing Pigeon Pattern" ek mukhtalif aur aham candlestick charting technique hai jo traders ko market mein potential reversals ka pata lagane mein madad karta hai. Is pattern ka naam "Homing Pigeon" is liye rakha gaya hai kyunki ye pattern candlestick charts par doosri candle ki tarah ek safed aur kala pigeon ki shakal mein dikhta hai. Ye pattern typically downtrend ke baad dekha jata hai aur bullish reversal ka signal deta hai. Is pattern ko identify karne ke liye, pehle traders ko pehli candle ki body aur range ko dekhna hota hai. Phir, doosri candle ki body aur range ko bhi dekha jata hai. Agar doosri candle pehli candle ke neeche close hoti hai aur uski body pehli candle ki body ke andar hoti hai, to ye ek potential "Homing Pigeon" pattern ka indication hota hai.

"Homing Pigeon Pattern" ka istemal karke traders market ke direction mein changes ko anticipate kar sakte hain aur sahi trading decisions le sakte hain. Ye pattern bullish reversal ko suggest karta hai aur traders ko ye samjhaata hai ke market ke sentiment mein change hone ki sambhavna hai. Is pattern ko confirm karne ke liye, traders doosri candle ki closing price ke upar se ek confirmation candle ka wait karte hain. Agar ye confirmation candle mil jaata hai, to traders ko entry point mil jaata hai aur wo trading positions le sakte hain. "Homing Pigeon Pattern" ka istemal karne se pehle, traders ko confirmation candles aur thorough analysis ka istemal karna chahiye taake wo sahi trading decisions le sakein. Ye pattern market trends aur potential reversals ke baare mein maloomat faraham karta hai aur traders ko market mein hone wale changes ke liye tayyar rakhta hai. Overall, "Homing Pigeon Pattern" ek useful aur effective tool hai jo traders ko market analysis mein madad deta hai aur unhe sahi trading opportunities ki pehchan karne mein madad karta hai. Lekin, is pattern ka istemal karne se pehle traders ko market conditions aur confirmations ko dhyan mein rakhna zaroori hai taake wo sahi trading decisions le sakein.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Homing Pigeon Pattern, yaani "ghar wale kabootar ka nakaab" ek trading pattern hai jo ki candlestick charts par dikhai deta hai aur usually bullish reversals ko darust karta hai. Ye pattern asal mein do candlesticks se bana hota hai, jismein pehla candle bearish hota hai aur doosra candle bullish hota hai. Is pattern ko dekh kar traders bullish trend ki possibility ka andaza laga sakte hain.

Jab ek Homing Pigeon Pattern candlestick chart par dikhai deta hai, to ye indicate karta hai ke bearish trend khatam ho sakta hai aur bullish trend shuru hone wala hai. Is pattern ki pehchan karnay ke liye, pehla candlestick typically ek lambi bearish candle hoti hai, jise kuch traders "mother candle" bhi kehte hain. Iske baad, doosra candlestick, jo ke chhoti hai, bullish hoti hai aur pehli candlestick ke andar ki range mein hoti hai. Ye do candlesticks mil kar ek "ghar wale kabootar" ya "homing pigeon" ki shakal bana deti hain.

Homing Pigeon Pattern ko confirm karnay ke liye, traders ko doosre technical indicators aur tools ka bhi istemal karna chahiye. Jaise ke volume analysis aur trend lines ka istemal, jo pattern ki strength ko confirm karte hain. Agar ye indicators bhi bullish signals dete hain, to traders ko entry point aur stop-loss level ka faisla karna asaan ho jata hai.

Ye pattern khaas tor par intraday trading aur short-term trading ke liye faidemand hota hai. Iske istemal se traders ko achi trading opportunities mil sakti hain, lekin iska istemal karne se pehle, traders ko pattern ki sahi samajh aur istemal ki training leni chahiye. Homing Pigeon Pattern ka bhi apna risk hota hai, aur traders ko hamesha apni risk management aur money management ko mad e nazar rakhte hue trading karna chahiye.

Ek achi strategy banane ke liye, traders ko Homing Pigeon Pattern ke saath doosre technical indicators ko bhi shamil karna chahiye, jaise ke moving averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence). Ye sab indicators mil kar traders ko ek mukammal picture dete hain aur unhe market ki direction ka pata lagane mein madad karte hain.

In conclusion, Homing Pigeon Pattern ek powerful bullish reversal pattern hai jo ki traders ko market mein achi trading opportunities provide karta hai. Is pattern ko samajh kar aur sahi tareeke se istemal kar ke, traders apni trading strategies ko improve kar sakte hain aur consistent profits earn kar sakte hain. Lekin, jaise har trading pattern aur strategy ki tarah, Homing Pigeon Pattern ka bhi apna risk hota hai, aur traders ko hamesha apni risk management ko mad e nazar rakhte hue trading karna chahiye

-

#3 Collapse

Introduction About Homing Pigeon Pattern:

Assalam o Alicom! Dear Fellows Umeed karta hu sab dost heryat se hongy dosto mera aj ka topic homing pigeon pattern ke bary me hy ya bohot he important or interesting topic hy ya Homing Pigeon Pattern White aur Black "Homing Pigeon Pattern" ek mukhtalif aur aham candlestick charting technique hai jo traders ko market mein potential reversals ka pata lagany mein madad karta hai. Is pattern ka name "Homing Pigeon" is liye rakha gaya hai kyunke ye pattern candlestick charts par doosri candle ki tarah ek safed aur kala pigeon ki shakal mein dikhta hai. Ye pattern typically downtrend ke badh dekha jata hai aur bullish reversal ka signal deta hai. Is pattern ko identify karny ke liye, pehle traders ko pehli candle ki body aur range ko dekhna hota hai. Phir doosri candle ki body aur range ko bhi dekha jata hai. Agar doosri candle pehli candle ke neechy close hoti hai aur uski body pehli candle ki body ke andar hoti hai, to ye ek potential "Homing Pigeon" pattern ka indication hota hai.

Information of Homing Pigeon Pattern:

Dear Friends Homing Pigeon Pattern ko confirm karny ke liye, traders ko doosre technical indicators aur tools ka bhi istemal karna chahiye. Jaise ke volume analysis aur trend lines ka istemal, jo pattern ki strength ko confirm karte hain. Agar ye indicators bhi bullish signals dety hain, tow traders ko entry point aur stop-loss level ka faisla karna asaan ho jata hai.

Conclusion of Homing Pigeon Pattern:

Dear Students Homing Pigeon Pattern ek powerful bullish reversal pattern hai jo ke traders ko market mein achi trading opportunities provide karta hai. Is pattern ko samajh kar aur sahi tariky se istemal kar ke, traders apni trading strategies ko improve kar sakte hain aur consistent profits earn kar sakte hain. Lekin, jaise har trading pattern aur strategy ki tarah, Homing Pigeon Pattern ka bhi apna risk hota hai, aur traders ko hamesha apni risk management ko mad e nazar rakhte hue trading karni chahiye. -

#4 Collapse

Assalamu Alaikum Dosto!

Homing Pigeon Candlestick Pattern

"Bullish Homing Pigeon" ek khaas candlestick pattern hai jo traders ki tawajju ko apni janib mabzool karta hai jo ke market ke mukhtalif mawadon ko samajhne aur trading ke liye istemal karta hai. Homing Pigeon candlestick pattern ek technical analysis ka zariya hai jo forex trading mein istemal hota hai taake currency pairs mein hosakti hai aane wale qeemat ke movement ko pehle se hee tehqeeq kiya ja sake. Is pattern ka naam ek homing pigeon ke naam par rakha gaya hai, jo ke aik parindah hai jise apne ghar wapas lote jaane ki salahiyat se pehchana jata hai lambi fasilon par.

Homing pigeon pattern teen musalsal bullish candlesticks se milta hai, har ek pehle se pehle ke close se zyada hai. Yeh darust karta hai ke kharidarein market mein barhne wale hain aur currency pair ke liye zyada keemat dene ke liye tayar hain. Homing pigeon pattern aksar ek bullish reversal pattern ke tor par istemal hota hai, jo kehta hai ke ek downtrend khatam hone wala hai aur ek mumkin uptrend ane wala hai.- Red bear candle, us ke peeche small red bear candle, pehli candle ka body bear candle ke wick ke saath line hai jo ke dikhata hai ke bull market mein bear market se zyada quwat ikhatta hui hai.

- Is dikhata hai ke market mein taqatwar kharidari dabaav hai, kyunke kharidarein currency pair ke liye zyada keemat dene ke liye tayar hain.

- Yeh ek potential trend reversal ka signal ho sakta hai, kyunke pattern yeh darust karta hai ke kharidarein market mein peechle haath mein hain.

- Yeh dosre technical analysis tools ke saath istemal kiya ja sakta hai, jaise trend lines aur moving averages, taake trend reversal ke mumkinat ko mazeed tasdeeq kiya ja sake.

Bullish homing pigeon candlestick pattern traders ke liye aik taqatwar tool hai, jo market mein potential reversals aur continuations ki pehchan karta hai.

Yeh ek bada candle ke baad ek chhota candle ke saath hota hai, dono line ke bodies pehle ke bade candle ke range mein hoti hain, pattern black ya red colors ke sath hota hai jo ke close ke below open ko dikhata hai.

Halankeh zyada tar downtrends ke sath joda jata hai, bullish homing pigeon ka asar mukhtalif hota hai, aur traders aksar isko weakening downtrends ya support levels ke qareeb dekhte hain.

Pattern ki tasdeeq agle candle ko nazarandaaz karte hue hoti hai, jisme open ke upar ka chalna bullish reversal ko dikhata hai aur agle girawat ko zyada imkanaat ka dikhata hai.

Bullish Homing Pigeon ki Mafiad

Bullish homing pigeon aik candlestick pattern hai jo aam taur par support levels ke qareeb do candlesticks mein banta hai jahan doosri chhoti candle pehle bare bearish candle ke andar fit hoti hai. Aam taur par, jab doosri chhoti candle pehle ke andar fit hoti hai, qeemat bullish reversal ko paida karti hai. Yeh bullish haramis ki tarah dikhte hain magar thori mukhtalif hain. Pehli candle bari bearish candle hoti hai. Doosri chhoti bearish candle pehle bearish candle ke andar fit hoti hai, is tarah ek bullish harami ki tarah dikhte hain. Keemat doosre candle ke upar tordne aur bullish reversal ko tasdeeq karne ke liye dekhein.

Homing Pigeon candlestick pattern do-line candlestick pattern hota hai. Riwayati tor par, traders ise bullish reversal candlestick pattern tasleem karte hain. Magar, testing ne sabit kiya hai ke yeh bearish continuation pattern kaam kar sakta hai. Ye nai tajziya is baat ko sabit karta hai ke breakout ka rukh dohrana ke liye aap pur-ittifaq nahi honge. Magar iska overall performance bohot acha maana jata hai. Homing Pigeon candlestick pattern aam tor par downtrend mein banata hai aur trend ka ulat wakhtane ki tajweez karta hai. Jaise ke doosre candlestick patterns, isko bhi subsequent patterns tasdeeq karte hain. Iski pehli aur doosri lines dono black candles hoti hain. Pehli candle doosre candle ko gher leti hai. Pehli line koi bhi black candle ho sakti hai jaise ke Black Candle, Long Black Candle, waghera magar ye lambi line honi chahiye. Doosri candle bhi pehli line jaise koi bhi black candle ho sakti hai magar ye chhoti line ya lambi line dono hosakti hai.

Market mein bohot se bearish traders aur investors hote hain jo kayamat tak girne ka aitbaar karte hain. Jab Homing Pigeon candlestick pattern ki pehli candle ban jati hai, wahi scenario barpa hota hai. Lambi bearish candle ke banne se aane wale bearish trend ki mumkinat tasdeeq hoti hai. Kuch behtareen kharidari ke doran kuch kharidari dabaav banne lagta hai. Traders samajhte hain ke market mein trend ka ulta ho raha hai. Is assumption ki wajah se do candlesticks ke darmiyan gap hota hai. Magar kharidari dabaav abhi bhi market ko upar le jane mein kamiyab nahi hota, is wajah se doosri candle bearish ban jati hai.

Bullish Homing Pigeon Confirmation

Bullish homing pigeon ek aise candlestick pattern ke tor par numaya hota hai jisme ek bada candle chhota candle ke sath hota hai, dono line ke bodies pehle ke bade candle ke range mein hoti hain. Ahmiyat ka aham pehlu black color hai, jo dikhata hai ke band hone wale qeemat kholne wale qeemat se kam hai. Yeh pattern dilchasp hota hai kyunke yeh ab kehtawar downtrend ki kamzori ki nishani hai, is se upar ki taraf se trend reversal ki imkanaat barh jati hai.

Bullish reversal pattern ke tor par tasawur kiya jane wala bullish homing pigeon controversy ke baghair nahi hai. Kuch tajziyat ke mutabiq yeh zyada sahih bearish continuation pattern ke tor par samjha jata hai, qeemat ke movement ke ghair liniyat wale andaz ko zyada ahmiyat dete hue. Downtrends mein, qeemat aksar girawat, rukawat ya pullbacks ka samna karti hai phir apni girawat ka aghaz karta hai, aur bullish homing pigeon ko ek waqtan-fa-waqt rukawat ke tor par samajha ja sakta hai girawat ke dobara shuru hone se pehle.

Traders jo bullish reversal ka pata lagane mein dilchaspi rakhte hain wo pattern ko dekhte hain ek weakend downtrend ke doran ya support level ke qareeb. Ye ek signal ban jata hai ke short positions se nikalne ya long positions mein dakhil hone ka, agle market ke lehje ke shift ka intezar karte hue. Magar, ehmiyat rakhta hai ke bullish homing pigeon ka isat choppy market conditions mein kamzor hota hai jahan trends ki wazi raftar na ho.

Beshak ke bullish reversal ya continuation ka tasavvur karte hue, traders agle candle ki tasdeeq ka muntazir hotay hain. Pehli ya doosri candle ke kholne ke upar ka chalna, khas tor par agle bullish reversal ke tasdeeq ka saboot deti hai. Barabar ke bighar ke agar agle candle mein qeemat girati hai, khas tor par pehle ya doosri candle ke band hone ke upar, to ye ek zyada imkanaat ki nishani hai ke qeemat girne ka jari rahega.

Homing Pigeon ka Istemal

Bullish homing pigeon ko trading strategies mein shamil karna ek mufeed tareeqa hai. Traders is pattern ko short positions se nikalne ya long positions mein dakhil hone ka signal samajhte hain, maujooda market ke trend aur pattern ki tasdeeq ke mutabiq. Magar, ahmiyat hai ke doosre technical analysis tools aur indicators ko istemal karna bullish homing pigeon ke signal ko tasdeeq karne ke liye aur achi raayat lenay ke liye.

Yahan ek faide aur nuqsanat ki fehrist hai jo ghor kiye jaye.

Benifits:- Trend reversals ka signal deti hai, waqtan-fa-waqt faislay ke liye madad karti hai.

- Market ki lehje mein tabdeeli ka visual nishaan hai.

- Tasdeeq ke liye doosre technical analysis tools ke saath istemal kiya ja sakta hai.

Drawbacks:- Choppy market conditions mein asar khatam ho sakta hai jahan trends wazi raftar na rakhte hoon.

- Mufeed maqasid ke liye khaas munafa nahi deta, trade ki planning ke liye mazeed tajziya ki zarurat hoti hai.

- Pattern ko samajhne ke liye tajziya aur market dynamics ka gehra ilm hona zaroori hai.

Trading

Jab baat trading ki jati hai, to Homing Pigeon aik trend reversal ke liye aik shandar signal ho sakta hai. Ek Homing Pigeon candlestick pattern mein, ek trader ko long position mein dakhil hona chahiye. Pattern ke low ke neeche stop loss rakhna aqalmandana faisla hai. Unhe ye bhi kar sakte hain ke doosri line ke low ke neeche stop loss rakhain. Ek downtrend ke doran, traders ko Homing Pigeon pattern banne ke baad qeemat ke kafi girne ka intezaar karna chahiye. Ab, unhe short position mein dakhil hona chahiye, aur upar stop loss rakhna aqalmandana faisla hoga.

Magar, yaad rakha jana chahiye ke Homing Pigeon pattern kisi bhi qeemat ka maqsad nahi deta. Mumkin hai ke pattern ke baad aik naya trend shuru ho ya qeemat bilkul na bade. Isliye, traders ko qeemat ko aik wazeh faisle, aik achi miqdar aurat, ya aik trading strategy aur risk management ke mutabiq maqsad rakhna chahiye. Yahan kuch aham steps hain jo aap istemal kar sakte hain:- Confirmation: Hamesha pattern ko pura hone ka intezaar karen ek bullish candlestick ke saath agle muddat mein. Pattern tasdeeq hota hai agar agle candlestick ka band pehli ya doosri candlestick ke body ke ooper band hota hai.

- Entry Point: Tasdeeq ke baad, pattern ko tasdeeq karne ke liye dakhil nook par dakhil hone ka tajwez diya jata hai.

- Stop-Loss: Apna stop-loss thori si kamzori se pattern ke low ke neeche set karen. Agar pattern nakam ho jaye aur downtrend jari rahe, to potential nuksanen mein kami hogi.

- Target Set Karna: Faida hasil karne ke liye maqsad qeemat ke saath ya support levels par set karen, ya trading strategy aur risk management ke mutabiq.

Conclusion

Homing Pigeon pattern ka istemal karne ke liye, traders ko tajziya aur tajziya karne ke liye muqablay wakt ka sabr aur samajh ki zarurat hoti hai. Is pattern ka istemal karne se pehle, traders ko market ki mukhtalif shaoorat ko samajhna chahiye aur yeh yaqeeni banna chahiye ke pattern ke signals ko sahi tareeqe se interpret kiya jaye.

Yeh comprehensive guide traders ko bullish homing pigeon candlestick pattern ki ahmiyat samajhne mein madad karti hai, taake woh market mein behtar faislay kar sakein aur apni trading strategies ko mazeed behtar bana sakein. Magar, hamesha yaad rakhein ke har trading pattern aur tool ki tarah, bullish homing pigeon bhi sirf aik hissa hai aur isko istemal karne se pehle zaroori hai ke traders mazeed technical aur fundamental analysis ke saath milakar samajhna seekhein.

-

#5 Collapse

Forex main Homing Pigeon Pattern - White aur Black

Homing Pigeon Pattern ek technical analysis ka pattern hai jo candlestick charts par dekha jata hai. Yeh pattern bull market ke doran nazar ata hai aur aksar reversal ko darust karti hai. Is pattern mein do lambi candles hoti hain jo ek dosre ke upper niche hoti hain aur yeh ek bullish reversal pattern hai.

Components of Homing Pigeon Pattern

Homing Pigeon Pattern mein do mukhtalif components hote hain.

First Candle

Pehli candle lambi hoti hai aur typically downward trend ke doran shuru hoti hai. Is candle ki body choti hoti hai aur upper shadow bari hoti hai.

Second Candle

Dusri candle bhi lambi hoti hai aur pehli candle ke andar hoti hai. Iski body bhi choti hoti hai aur lower shadow bari hoti hai. Yeh candle pehli candle ki body ke andar close hoti hai.

Bullish Reversal Signal

Homing Pigeon Pattern ek bullish reversal signal hai, matlab ke jab yeh pattern ban jata hai to market ka trend bearish se bullish mein badalne ka ishara hota hai. Is pattern ko samajhna traders ke liye ahem hota hai takay wo market ke future direction ko theek tareeqay se samajh sakein.

Importance of White and Black

White aur Black colors ki istemal ka mukhtalif maqsad hota hai Homing Pigeon Pattern mein:

White Candles

White candles bullish sentiment ko darust karti hain aur uptrend ko represent karti hain. Jab pehli candle white hoti hai aur doosri bhi white hoti hai to yeh ek aur confirmation hoti hai ke market bullish direction mein ja sakta hai.

Black Candles

Black candles typically bearish sentiment ko darust karti hain aur downtrend ko represent karti hain. Agar pehli candle black hai aur doosri bhi black hai, to yeh ek indication ho sakta hai ke market ka trend continue kar sakta hai ya phir bearish reversal hone ka khatra hai.

Trading Strategy

Homing Pigeon Pattern ko samajh kar traders ek trading strategy develop kar sakte hain:

Entry Point

Entry point ka tay karna ahem hota hai. Agar Homing Pigeon Pattern ban raha hai to traders long position enter kar sakte hain.

Stop Loss

Stop loss ko set karna zaroori hai takay nuqsanat ko kam kiya ja sake. Stop loss typically dusri candle ke low ke thodi dar baad lagaya jata hai.

Target

Target ko set karna bhi zaroori hai. Iske liye traders previous resistance level ko dekhte hain ya phir Fibonacci retracement ka istemal karte hain.

- CL

- Mentions 0

-

سا0 like

-

#6 Collapse

Homing Pigeon Pattern - Safed aur Kala

Safar aur Pehchan - Homing Kabutar ka Tareeqa

Homing kabutar ek aham aur dilchasp nasal hai jo apni raah tak karne mein ustaad hai. Ye kabutar aam tor par safed aur kala rangon mein dekhe jaate hain. Inka husn aur inki pehchanat ke liye inki safedi aur kali rangon ka khaas maqam hai.

Rangon ka Afsana - Safed aur Kala Kabutar

Safed aur kala kabutaron ka husn aur inki pehchanat kaafi khaas hai. Inka yeh rangon ka milan unhe aasani se pehchanne mein madad karta hai. Inke parde safed ya kala hote hain jo inki shanakht mein aham kirdar ada karte hain. Inka yeh khas rangon ka joda inki pehchan mein madadgar hota hai jab ye apne ghar ki taraf lotte hain.

Safar Ki Raah - Homing Kabutar ka Adbhut Raasta

Homing kabutar safar ke doran apne ghar ki taraf wapas lotne mein maharat rakhte hain. Inka yeh khaas fun unki pehchanat ke liye zaroori hai. Inki raah chalne ki salahiyat unhe aasani se ghar tak pohanchata hai. Ye kabutar safar ke doran unchaai, rukawat aur tawajju ki kami jaise mushkilat ko bhi asani se guzar jate hain.

Shanakht aur Azmat - Safed aur Kala Kabutar ki Pechan

Safed aur kala kabutaron ki pehchan unke rangon se hoti hai jo inki shanakht mein zaroori kirdar ada karta hai. Inki pehchan ke liye inke rangon ka khaas maqam hai. Safed kabutaron ke parde jaise unka joda unhe asani se pehchanne mein madadgar hota hai. Kala kabutaron ka bhi apna khaas mahol hota hai jo inki pehchan mein madadgar hota hai.

Rangon ka Ta'alluq - Safed aur Kala Kabutaron ka Tafseeli Mutaliya

Safed aur kala kabutaron ke rangon ka mutaliya karne par pata chalta hai ke inka yeh joda unke husn aur pehchanat mein khaas ahmiyat rakhta hai. Inka yeh khas rangon ka ta'alluq inki zindagi ka aham pehlu hai. Inke rangon ka milaap unki pehchan mein izafa karta hai aur inhe doosron se alag banata hai.

Ikhtitam - Safed aur Kala Kabutaron ka Khas Tareeqa

Safed aur kala kabutaron ka husn aur inki pehchanat unke rangon ka khaas maqam hai. Inke safed ya kala parde unke zindagi ka aham pehlu hain jo unhe doosron se alag aur pehchanne mein asani deta hai. Inka yeh khas rangon ka joda unki raah takne mein madadgar hota hai aur unhe unchaai, rukawat aur tawajju ki kami jaise mushkilat ko asani se guzarne mein madad deta ha

- CL

- Mentions 0

-

سا0 like

-

#7 Collapse

Homing pigeon candlestick pattern

Introduction of Homing pigeon candlestick pattern:

As salam o alaikum dosto, Homing pigeon candlestick pattern ik bullish trend reversal pattern hy, jo price chart par do candles sy mil kar banta hy. Pattern main shamil dono candles bearish hoti hy, isi waja sy pattern k liye prices ka pehle sy low area ya bearish trend main hona zarori hy. Two days candles ki accuracy single day pattern sy behtar hota hy, q k is main ik candle thori bht confirmation bhe deti hy. Jab bhe market main syllers prices ko ik khas level tak nychay push karty hain, to yahan par trend reversal k imkanat ziada hoty hain, ye trend confirmation aksar kuch pattern sy confirm ho jati hy, jis main homing pigeon pattern bhe shamil hy.

Trading strategy of Homing pigeon candlestick pattern:

Hello dosto, Homing pigeon candlestick pattern trading k liye ik moasar candlestick pattern hy, jis par market main buy ki entry ki ja sakti hy. Trade k enter karny sy pehle market ka low price area ya bearish trend main hona zarori hy, jab k small bearish candle k baad ik trend confirmation candle ka hona zarori hy. Confirmation candle ka bullish hona lazmi hy, jo dosri candle k top par closy honi chaheye. Pattern ki confirmation CCI, RSI indicator or stochastic oscillator sy bhe ki ja sakti hy, jis par value oversold zony main hona chaheye. Stop Los pattern k sab sy low position ya pehli bullish candle k lower price sy two pips below syt karen.

Homing pigeon candlestick pattern ka istemal karny ka tareeka:

Dear friends, Agar Homing Pigeon pattern detect hota hy to ye indicate karta hy ke market main buyers ka dominance badh sakta hy.Traders ko apni positions or strategies ko is pattern ke mutabiq adjust karna chahiye.Ye tha mukhtasar jumla main Homing Pigeon candlestick pattern ke bary main forex trading main.Hamesha yaad rahy ke ek single pattern par pura bharosa na karen. Additional indicators or confirmations ki zarurat hoti hy.Is pattern ko samajh kar traders apni khatra nigrani ko behtar tor par handle kar sakty hain.Hamesha yaad rahy ke ek single pattern par pura bharosa na karen. Additional indicators or confirmations ki zarurat hoti hy.

-

#8 Collapse

?Homing pigeon candlestick pattern

:Homing pigeon candlestick pattern ka introduction

Assalam o alaikum dosto, Homing pigeon candlestick pattern ik bullish trend reversal pattern hy, jo price chart par do candles sy mil kar banta hy. Pattern main shamil dono candles bearish hoti hy, isi waja sy pattern k liye prices ka pehle sy low area ya bearish trend main hona zarori hy. Two days candles ki accuracy single day pattern sy behtar hota hy, q k is main ik candle thori bht confirmation bhe deti hy. Jab bhe market main syllers prices ko ik khas level tak nychay push karty hain, to yahan par trend reversal k imkanat ziada hoty hain, ye trend confirmation aksar kuch pattern sy confirm ho jati hy, jis main homing pigeon pattern bhe shamil hy.

aik taizi se ghar karne wala kabootarr ulta ریورسل patteren hai, halaank yeh bearish tasalsul ka patteren bhi ho sakta hai .

yeh candle stuck patteren down trindz ke douran ya up trained mein pal bacchus ke douran hota hai .

yeh aik barray asli jism par mushtamil hota hai jis ke baad aik chhota asli jism hota hai, aur dono mom batian siyah ( bhari hui ) ya surkh hoti hain jo zahir karti hain ke band khulay se neechay hai .

blush ہومنگ پیجن patteren munafe ke ahdaaf faraham nahi karte hain, aur ulta harkat ki tasdeeq honay ke baad aam tor par stop nuqsaan patteren ke neechay rakha jata hai .

Stop Loss and Price Targets

patteren ke anay ke baad, agar qeemat ziyada hoti hai to yeh taizi ke ulat jane ki nishandahi karta hai. aik tajir aik lambi position mein daakhil ho sakta hai aur patteren ke kam se neechay stap nuqsaan rakh sakta hai. mutabadil tor par, woh usay doosri mom batii ke neechay rakh satke hain, jo aksar pehli mom batii se ziyada ho gi ( lekin hamesha nahi ) .

agar koi tajir neechay ke rujhan ko jari rakhnay ke liye patteren ko istemaal karne ka faisla karta hai, to woh patteren ke form ban'nay ke baad qeemat ke kam honay ka intzaar karen ge. is ke baad woh patteren ki oonchai se oopar stap nuqsaan ke sath aik mukhtasir position mein daakhil ho satke hain. mutabadil tor par, woh stap nuqsaan ko doosri mom batii ki oonchai se oopar rakh satke hain .

taizi se ghar karne wala kabootarr, ziyada tar candle stuck patteren ki terhan, qeemat ka hadaf faraham nahi karta hai. patteren ke baad qeemat aik naya mukammal rujhan shuru kar sakti hai, ya qeemat baa-mushkil hi barh sakti hai. aik tajir mutayyan khatray / inaam ki bunyaad par qeemat ke hadaf ko istemaal kar sakta hai, aik pemaiesh shuda iqdaam, ya woh ٹریلنگ stop ka istemaal kar sakta hai .

Homing pigeon candlestick pattern ka istemal karny ka tareeka:

Dear friends, Agar Homing Pigeon pattern detect hota hy to ye indicate karta hy ke market main buyers ka dominance badh sakta hy.Traders ko apni positions or strategies ko is pattern ke mutabiq adjust karna chahiye.Ye tha mukhtasar jumla main Homing Pigeon candlestick pattern ke bary main forex trading main.Hamesha yaad rahy ke ek single pattern par pura bharosa na karen. Additional indicators or confirmations ki zarurat hoti hy.Is pattern ko samajh kar traders apni khatra nigrani ko behtar tor par handle kar sakty hain.Hamesha yaad rahy ke ek single pattern par pura bharosa na karen. Additional indicators or confirmations ki zarurat hoti hy.

-

#9 Collapse

Homing Pigeon Pattern

The "Homing Pigeon" pattern is a relatively rare candlestick pattern in forex trading. It is a bullish reversal pattern that consists of two candlesticks. The pattern resembles the shape of a homing pigeon, hence its name. Here's how the Homing Pigeon pattern is formed and its key characteristics:

Formation:- The first candlestick is a long bearish (downward) candlestick that appears within a downtrend.

- The second candlestick is a smaller bullish (upward) candlestick that follows the first candlestick.

- The second candlestick opens within the body of the first candlestick and closes above its midpoint.

Key Characteristics:- Downtrend Context: The Homing Pigeon pattern typically occurs within a downtrend, signaling a potential reversal in the downward momentum.

- Bearish Momentum Exhaustion: The long bearish candlestick in the pattern indicates strong selling pressure during the downtrend. However, the smaller bullish candlestick that follows shows a loss of bearish momentum.

- Bullish Reversal Signal: The fact that the second candlestick opens within the body of the first candlestick and closes above its midpoint suggests a shift from bearish to bullish sentiment.

- Confirmation: Traders often look for additional confirmation, such as a bullish follow-through in subsequent candles or other bullish reversal patterns forming after the Homing Pigeon pattern.

Trading Strategy:

Trading Strategy:- When the Homing Pigeon pattern is identified, traders may consider it as a potential signal to enter long positions or to close out existing short positions.

- Entry points can be set above the high of the second candlestick, with stop-loss orders placed below the low of the first candlestick.

- Target levels can be set based on previous resistance levels or using other technical analysis techniques.

- Risk management is essential, so traders should ensure that their risk-reward ratios are reasonable and that they are not risking more than they can afford to lose.It's worth noting that the effectiveness of the Homing Pigeon pattern may vary, and traders should always conduct thorough analysis and consider the broader market context before making trading decisions based on this pattern.

-

#10 Collapse

Homing pigeon pattern - white and blackTota palnay ka shauq bohot se logon mein paya jata hai, aur is mein mukhtalif rangon aur patterns ka chayan karna bhi ek dilchaspi ka sabab hai. Homing pigeons, yaani totay, ek aisi qisam ki pigeons hain jo ghar vapas lautne mein maharat hasil karte hain. In totayon mein mukhtalif rangon aur patterns ki kai qisamain payi jati hain. Yeh totay safaid aur kala rangon ke aakarshak pattern ke liye mashhoor hain.

1. Safaid Homing Pigeon:

Safaid totay ka husn kisi bhi shauqeen tota palak ke liye lazmi hai. Inka jism puri tarah safaid hota hai, aur inke paron mein koi bhi dosra rang nahi hota. In totayon ka sir bhi safaid hota hai, lekin kuchh totayon mein sir ke aas-paas halki si kalaaiyan hoti hain jo inke husn ko aur bhi barha deti hain.

2. Kala Homing Pigeon:

Kala tota bhi tota palnay walon ke darmiyan mashhoor hai. Inke jism ka rang puri tarah kala hota hai. Kala totay aksar apne aakarshak rang ke liye pehchane jate hain. Inki akhri paron mein bhi kuchh totayon mein safaid ya dusre rang ka chota sa patch hota hai, jo inke jism ka kala rang aur bhi khas banata hai.

3. Safaid aur Kala Mix Pattern:

Kuchh totay safaid aur kala rang ka achaar dalte hain, jise dekhte hi inka husn aur bhi izhaar hota hai. In totayon ka jism aksar safaid hota hai, lekin kuchh hisson mein kala acharan hota hai, jaise ke paron ke beech ya chonch ke aas-paas. Yeh totay aksar rangin hotay hain aur tota palnay walon mein iski badi demand hoti hai.

4. Checker Pattern:

Checker pattern wale totay bhi aam hain, jo ke safaid aur kala rangon ka achaar dalte hain. Inki khasiyat yeh hoti hai ke inke paron par squares ya rectangles ki shaklon mein safaid aur kala rang ka acharan hota hai. Yeh totay bahut hi aakarshak aur dilchaspi paida karte hain.

Homing pigeons ka har pattern apni kahani ke saath aata hai. In totayon ka dekhbhal karna, unke saath waqt bitana aur unke saath bonding banana totay palnay walon ke liye ek anokha tajurba hota hai. Safaid aur kala totayon ka chayan karna tota palnay mein ek izafi ranjish aur khushi ka sabab ban sakta hai. -

#11 Collapse

Homing Pigeon Pattern:

Homing pigeon aik candle stick patteren hai jahan aik barri mom batii ke baad aik choti mom batii hoti hai jis ka body barri mom batii ke jism ke andar waqay hota hai. patteren mein dono mom batian siyah, ya bhari hui honi chahiye, jis se zahir hota hai ke ikhtitami qeemat ibtidayi qeemat se kam thi .

yeh namona is baat ki nishandahi kar sakta hai ke mojooda neechay ki taraf rujhan kamzor ho raha hai, jis se oopar ki taraf ulat jane ka imkaan barh jata hai .

Ye homing pigeons aam tor par training ke zariye is pattern ko develop karte hain taake woh kisi bhi location par ja saken aur phir wapas apne ghar tak wapas aa saken. Ye pattern pigeons ke natural instincts aur training ke through develop hota hai.

:max_bytes(150000):strip_icc()/BullishHomingPigeon4-b34000720c824d07b269eaf75b1ad950.png)

Zarori points.

aik taizi se ghar karne wala pigeon ulta ریورسل patteren hai, halaank yeh bearish tasalsul ka patteren bhi ho sakta hai .

yeh candle stuck patteren down trindz ke douran ya up trained mein pal bacchus ke douran hota hai .

yeh aik barray asli jism par mushtamil hota hai jis ke baad aik chhota asli jism hota hai, aur dono mom batian siyah ( bhari hui ) ya surkh hoti hain jo zahir karti hain ke band khulay se neechay hai .

blush ہومنگ پیجن patteren munafe ke ahdaaf faraham nahi karte hain, aur ulta harkat ki tasdeeq honay ke baad aam tor par stop nuqsaan patteren ke neechay rakha jata hai.

Homing pigeon pattern ko smajhny ka treka.

bullish homing pigeons taizi se ulatnay ke patteren hain, halaank kuch tehqeeq ne tajweez kya hai ke yeh ziyada durust bearish tasalsul ka namona hai. is ki wajah yeh hai ke qeematein seedhi linon mein nahi chalti hain. neechay ke rujhan ke douran, qeemat girty hai, phir ruk jati hai ya peechay hatti hai, aur phir dobarah neechay ki taraf barh jati hai. qeemat kam honay se pehlay taizi se ghar anay wala kabootarr sirf aik waqfa ho sakta hai .

jab taizi ke ulat jane ki passion goi karne ke liye istemaal kya jata hai, to tajir neechay ke rujhan ke douran honay walay patteren ko dekhte hain jo support level ko kamzor ya qareeb kar raha hai. is waqt, woh mukhtasir pozishnon se niklny ya lambi pozishnon mein daakhil honay par ghhor kar satke hain. yeh patteren taizi ke ulat ke tor par kam maienay khaiz hai jab yeh katay hue bazaar ke halaat mein hota hai . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 Collapse

### Homing Pigeon Pattern: White and Black Candlestick Patterns

Forex aur stock trading mein, candlestick patterns technical analysis ke important tools hain jo market trends aur potential reversals ko identify karne mein madad karte hain. In patterns mein se ek "Homing Pigeon Pattern" hai, jo bullish aur bearish market scenarios ko represent karta hai. Is post mein, hum Homing Pigeon Pattern ke white aur black variations ke features aur trading significance ko detail mein samjhenge.

**Homing Pigeon Pattern Kya Hai?**

Homing Pigeon Pattern ek candlestick pattern hai jo market ke price action ko visualize karta hai aur potential trend reversals ko indicate karta hai. Yeh pattern do different variations mein hota hai: White Homing Pigeon aur Black Homing Pigeon. In patterns ke formation aur characteristics market ke bullish ya bearish sentiment ko reflect karte hain.

**White Homing Pigeon Pattern:**

1. **Formation:**

White Homing Pigeon Pattern bullish reversal pattern hai jo downtrend ke baad develop hota hai. Is pattern mein do candlesticks hoti hain: pehli candlestick ek long bearish candle hoti hai, aur doosri candlestick ek small bullish candle hoti hai jo pehli candlestick ke body ke andar close karti hai.

2. **Characteristics:**

- **Pehli Candlestick:** Long bearish candle jo strong selling pressure ko indicate karti hai.

- **Doosri Candlestick:** Small bullish candle jo bearish candle ke body ke andar close hoti hai, indicate karte hue ke buying pressure barh raha hai.

3. **Significance:**

White Homing Pigeon Pattern market ke bearish trend ko reverse karne ka signal deta hai. Jab yeh pattern develop hota hai, to yeh bullish trend reversal ka indication hota hai aur buying opportunities ko suggest karta hai. Confirmation ke liye additional technical indicators jaise RSI (Relative Strength Index) aur MACD (Moving Average Convergence Divergence) ka use kiya ja sakta hai.

**Black Homing Pigeon Pattern:**

1. **Formation:**

Black Homing Pigeon Pattern bearish reversal pattern hai jo uptrend ke baad develop hota hai. Is pattern mein bhi do candlesticks hoti hain: pehli candlestick ek long bullish candle hoti hai, aur doosri candlestick ek small bearish candle hoti hai jo pehli candlestick ke body ke andar close karti hai.

2. **Characteristics:**

- **Pehli Candlestick:** Long bullish candle jo strong buying pressure ko indicate karti hai.

- **Doosri Candlestick:** Small bearish candle jo bullish candle ke body ke andar close hoti hai, indicate karte hue ke selling pressure barh raha hai.

3. **Significance:**

Black Homing Pigeon Pattern market ke bullish trend ko reverse karne ka signal deta hai. Jab yeh pattern develop hota hai, to yeh bearish trend reversal ka indication hota hai aur selling opportunities ko suggest karta hai. Confirmation ke liye additional technical indicators aur volume analysis ka use bhi beneficial ho sakta hai.

**Trading Strategies with Homing Pigeon Patterns:**

1. **Entry Points:**

Entry points pattern ke confirmation ke baad set kiye jate hain. White Homing Pigeon ke case mein, entry buy positions ke liye consider ki jati hai jab pattern confirm ho jaye. Black Homing Pigeon ke case mein, entry sell positions ke liye consider ki jati hai.

2. **Stop-Loss Orders:**

Stop-loss orders ko pattern ke boundaries ke bahar set karna chahiye taake unexpected price movements se protection mil sake. White Homing Pigeon ke case mein, stop-loss order bearish candle ke low ke below set kiya jata hai. Black Homing Pigeon ke case mein, stop-loss order bullish candle ke high ke above set kiya jata hai.

3. **Profit Targets:**

Profit targets ko determine karne ke liye, traders price targets ko technical analysis aur risk-reward ratio ke basis par set karte hain. Targets ko pattern ke formation ke sath align karna chahiye.

**Conclusion**

Homing Pigeon Pattern, white aur black variations ke sath, market ke trend reversals aur potential trading opportunities ko identify karne mein madad karta hai. White Homing Pigeon bullish reversal aur Black Homing Pigeon bearish reversal patterns ko represent karte hain aur effective trading decisions ke liye valuable signals provide karte hain. In patterns ko samajhkar aur trading strategies ke sath integrate karke, aap apne trading performance ko enhance kar sakte hain aur market trends ko better leverage kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:52 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим