Day trading strategy

Rozaana Tijarat: Roman Urdu Mein Din Ki Trading Ki Tadbeer

Day trading, ya din ki tijarat, aik tijarati tareeqa hai jismein investors ek din mein mukhtalif securities, jese ke stocks, currencies, ya commodities ko kharidte aur farokht karte hain, aur yeh sab transactions ek din ke andar mukammal hoti hain. Day trading aik tezi se badalne wale tareeqe ka istemal karta hai jahan traders markets ki chhoti si rukawat ko bhi faida uthane ki koshish karte hain. Yeh article Roman Urdu mein aapko kuch zaroori tips aur strategies provide karega jo ke aapke day trading ko behtar banane mein madad karega.

1. Saaf Tareeqe Se Tarjeeh Dain: Day trading mein tarjeeh ka aham hissa hai. Aapko achi tarah se maloom hona chahiye ke aap kis market ya stock par amal kar rahe hain. News, technical analysis, aur market trends ko ghor se dekhen aur phir faisla karen.

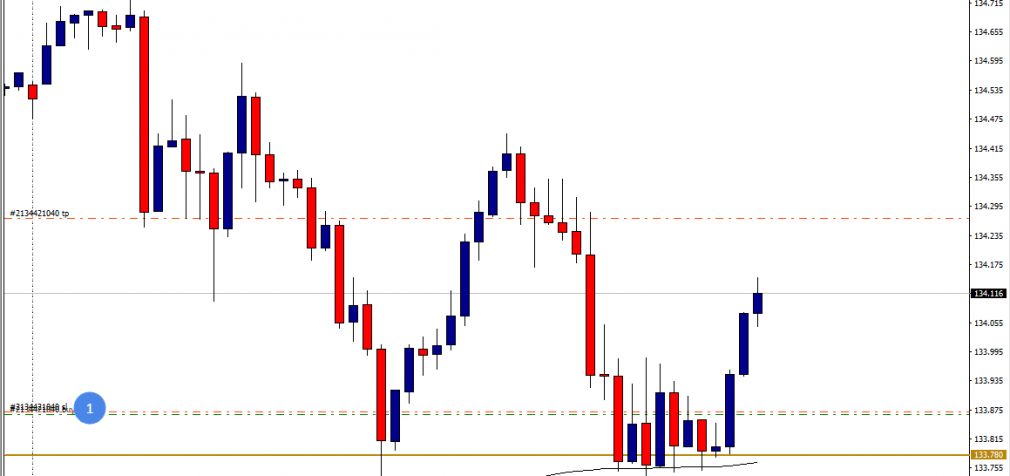

2. Planning Aur Research: Day trading ke liye, tayari aur tajziya kaafi ahem hai. Aapko apni trading strategy ko tay karna hai, jaise ke entry aur exit points, risk management, aur position sizing. Market mein aam chalne wale patterns aur indicators ka bhi istemal karna seekhen.

3. Risk Management: Day trading mein risk management bohot zaroori hai. Aapko apne trading capital ka ek choti se hissa ko har trade par risk karne se bachna chahiye. Har trade ke liye stop-loss orders ka istemal karna bhi zaroori hai taake aap nuqsaan ko kam kar sakein.

4. Emotionally Stable Rahen: Trading karne mein emotional stability bohot zaroori hai. Jab market mein volatility hoti hai, traders ka jazbaat unke faislon ko asar andaz kar sakta hai. Apni strategy ko follow karna aur hosh se kaam lena zaroori hai.

5. Regularly Monitor Karein: Market ke taza updates aur apni open positions ko regular monitor karna bohot zaroori hai. Agar market mein koi naye developments ya unexpected events hoti hain, toh aap apni strategy ko jaldi se adjust kar sakte hain.

6. Learning Process Par Dhyan Dein: Day trading ek seekhnay aur improve karne ka amal hai. Har trade se kuch naya seekhen aur apni mistakes se seekh kar agle trades mein behtar hone ki koshish karen.

Day trading challenging ho sakti hai aur ismein kafi risk hota hai, is liye agar aapko day trading ka tajurba nahi hai toh pehle demo accounts par practice karen. Aur yaad rahe, trading mein kamyabi ka raaz consistence aur patience mein hai.

تبصرہ

Расширенный режим Обычный режим