Introduction

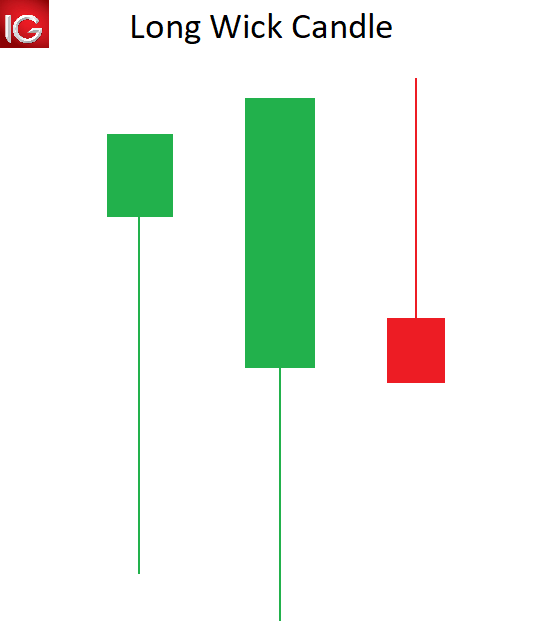

forex market mein long wick pattern aik aisa pattern hota hey jo keh market ke movement candlestick pattern kay sath aik long wick jore hove hote hey forex market mein candlestick ke body positive bhe ho sakte hey or negative bhe ho sakte hey forex market mein long wick kese bhe kesam kay pattern kay ley mozon he hote hey

long wick pattrn pattern pehchan

forex market mein long wick pattern aik kesam ka candlestick pattern hota hy jokeh aas pas ke wick ke nesbat zyada ghair motnasab llong hote hey

forex market mein price ke important level ko identify karnay kay ley price action ka estamal karna chihay

jo keh forex market mein long wick kay sath mel saktay hein support or resistance kay signal level ka he estamal karna chihay

forex market mein mumkana trading chance ka idea laganay kayley market mein long wick or key level ka stamal karna chihay

forex market mein long wick candlestick ka estamal

forex market mein aik long wick jes ko shooting star or gravestone doji ka naam deya jata hey hammer reversal pattern ke family ka hesa hota hey

NZD/JPY chart pattern

zail ka nehay deya geya chart NZD/JPY Ka weekly chart deya geya hey jo keh forex market ke moving mein reversal janay ke akace karta hey dosree taraf ager long wick forex market ke candlestick kay nechay ho to forex market ke price barah sakte hey

forex market mein es kay opposite ager long wick forex market ke candlestick kay nechay to price increase ho sakte hey yeh tosee wick candlestick kay ley forex market ke maloomat frahm kar sakte hey

forex market mein aik long wick jo keh forex market ke candlestick kay nechay phaile hove hote hey es ko forex market mein identify karnay kay ley seller forex market ko nechay ke taraf lay kar jatay hein tahum forex market kay bulls buyer ke strength ko increase karnay kay kabel ho saktay hein forex market mein bear kay zarey say market ke strength par kabo pa leya jata hey jes kay result mein price mein ezafa ho jata hey

forex market mein long wick pattern aik aisa pattern hota hey jo keh market ke movement candlestick pattern kay sath aik long wick jore hove hote hey forex market mein candlestick ke body positive bhe ho sakte hey or negative bhe ho sakte hey forex market mein long wick kese bhe kesam kay pattern kay ley mozon he hote hey

long wick pattrn pattern pehchan

forex market mein long wick pattern aik kesam ka candlestick pattern hota hy jokeh aas pas ke wick ke nesbat zyada ghair motnasab llong hote hey

forex market mein price ke important level ko identify karnay kay ley price action ka estamal karna chihay

jo keh forex market mein long wick kay sath mel saktay hein support or resistance kay signal level ka he estamal karna chihay

forex market mein mumkana trading chance ka idea laganay kayley market mein long wick or key level ka stamal karna chihay

forex market mein long wick candlestick ka estamal

forex market mein aik long wick jes ko shooting star or gravestone doji ka naam deya jata hey hammer reversal pattern ke family ka hesa hota hey

NZD/JPY chart pattern

zail ka nehay deya geya chart NZD/JPY Ka weekly chart deya geya hey jo keh forex market ke moving mein reversal janay ke akace karta hey dosree taraf ager long wick forex market ke candlestick kay nechay ho to forex market ke price barah sakte hey

forex market mein es kay opposite ager long wick forex market ke candlestick kay nechay to price increase ho sakte hey yeh tosee wick candlestick kay ley forex market ke maloomat frahm kar sakte hey

forex market mein aik long wick jo keh forex market ke candlestick kay nechay phaile hove hote hey es ko forex market mein identify karnay kay ley seller forex market ko nechay ke taraf lay kar jatay hein tahum forex market kay bulls buyer ke strength ko increase karnay kay kabel ho saktay hein forex market mein bear kay zarey say market ke strength par kabo pa leya jata hey jes kay result mein price mein ezafa ho jata hey

تبصرہ

Расширенный режим Обычный режим