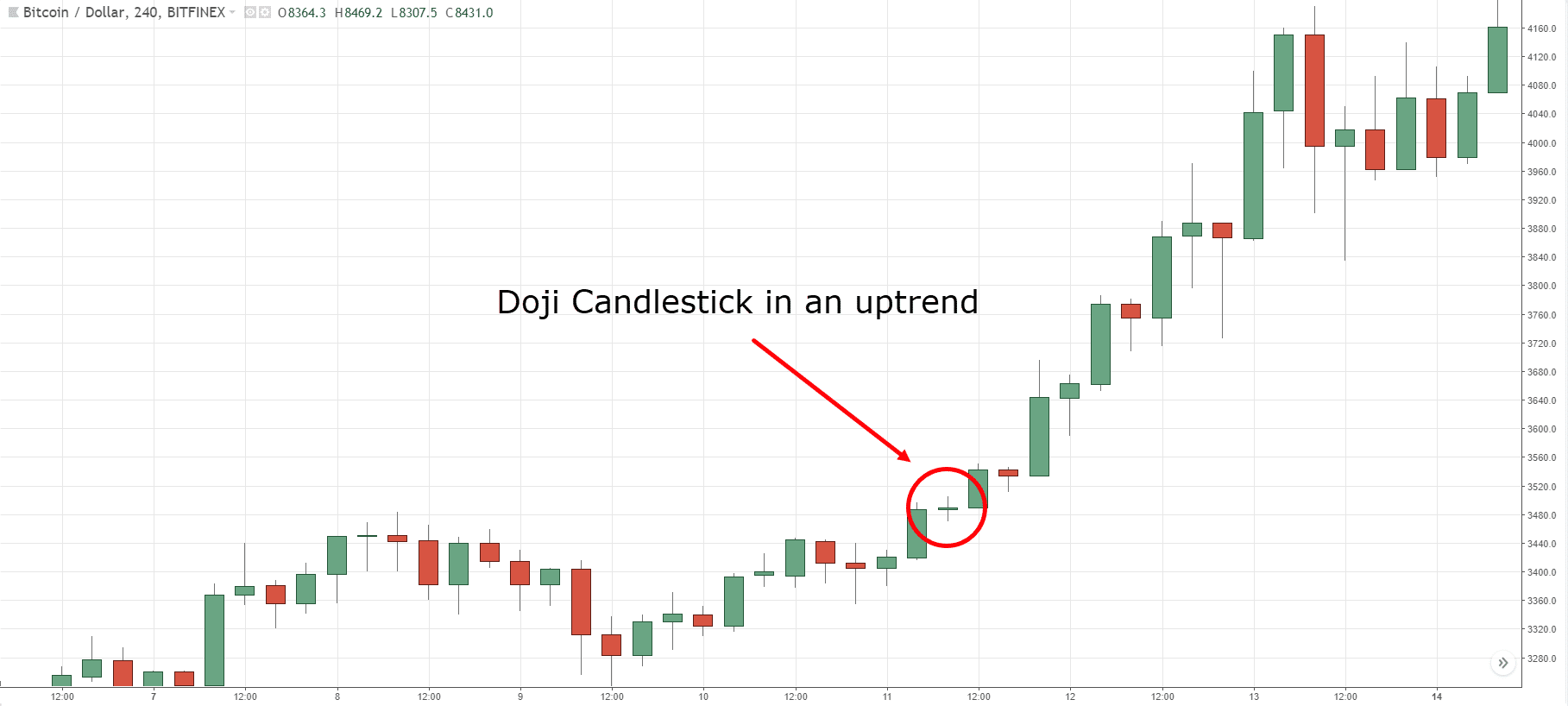

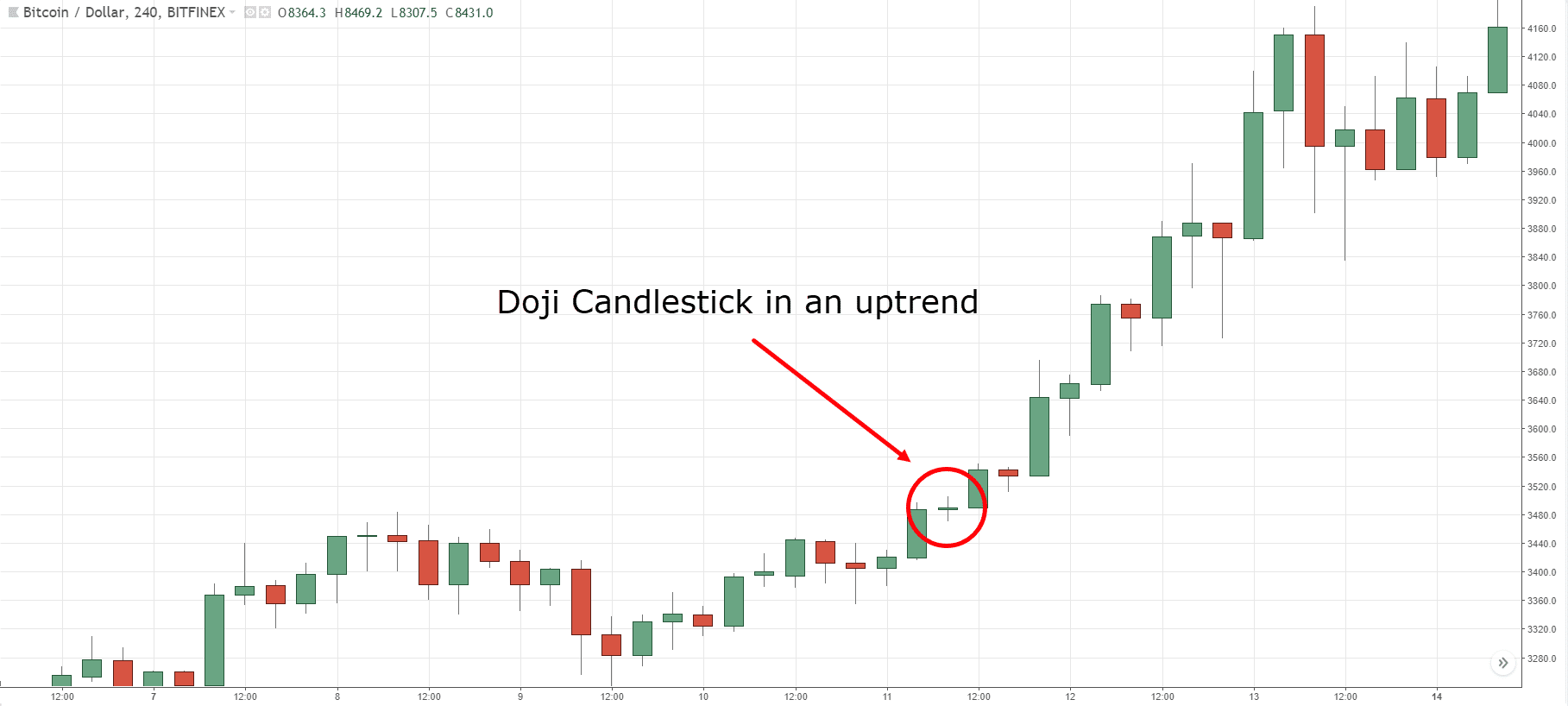

Price Doji Candlestick pattern ek technical analysis ka zaria hai jo forex trading mein istemal hota hai taake market ke reversals ya price movement mein indecision ko pehchana ja sake. Ye pattern tab banta hai jab currency pair ka opening aur closing price lagbhag barabar hota hai, trading period ke doran thori ya koi bhi price movement nahi hoti.

Price Doji Candlestick Pattern ki Definition

Price Doji Candlestick pattern ek candlestick formation ka ek type hai jo price chart par appear hota hai jab currency pair ka opening aur closing prices lagbhag barabar hote hain, trading period ke doran thori ya koi bhi price movement nahi hoti. Japanese word Doji ka matlab English mein nothing ya equality hai, jo yeh darust karta hai ke opening aur closing prices lagbhag same hain.

Price Doji Candlestick pattern tab banta hai jab candlestick ka asal body open aur close prices ke darmiyan ka vertical line chhota ya mojud nahi hota, aur upper aur lower shadows wicks ya tails barabar lambay hotay hain. Ye candlestick formation yeh darust karta hai ke buyers aur sellers barabar match hain, aur market indecision ya equilibrium mein hai.

Price Doji Candlestick Pattern ki Ahmiyat

Price Doji Candlestick pattern forex trading mein ahmiyat rakhta hai kyunki ye potential market reversal ya current trend ke continuation ko darust karta hai, us context par depend karta hai jisme ye appear hota hai. Yahan kuch Price Doji Candlestick pattern ke mumkin interpretations hain:

Price Doji Candlestick Pattern ko Interpret Karna

Price Doji Candlestick pattern ko forex trading mein interpret karne ke liye, aapko us context ko consider karna hoga jisme ye appear hota hai, sath hi doosre technical indicators aur fundamental factors ko bhi. Yahan kuch tips hain Price Doji Candlestick pattern ko interpret karne ke liye:

Price Doji Candlestick Pattern ki Definition

Price Doji Candlestick pattern ek candlestick formation ka ek type hai jo price chart par appear hota hai jab currency pair ka opening aur closing prices lagbhag barabar hote hain, trading period ke doran thori ya koi bhi price movement nahi hoti. Japanese word Doji ka matlab English mein nothing ya equality hai, jo yeh darust karta hai ke opening aur closing prices lagbhag same hain.

Price Doji Candlestick pattern tab banta hai jab candlestick ka asal body open aur close prices ke darmiyan ka vertical line chhota ya mojud nahi hota, aur upper aur lower shadows wicks ya tails barabar lambay hotay hain. Ye candlestick formation yeh darust karta hai ke buyers aur sellers barabar match hain, aur market indecision ya equilibrium mein hai.

Price Doji Candlestick Pattern ki Ahmiyat

Price Doji Candlestick pattern forex trading mein ahmiyat rakhta hai kyunki ye potential market reversal ya current trend ke continuation ko darust karta hai, us context par depend karta hai jisme ye appear hota hai. Yahan kuch Price Doji Candlestick pattern ke mumkin interpretations hain:

- Market Reversal: Jab Price Doji Candlestick pattern ek lambay arsey ke trend ke baad appear hota hai, to ye us trend ka potential reversal signal de sakta hai. Maslan, agar Price Doji Candlestick pattern ek bullish trend ke baad appear hota hai, to ye darust karta hai ke buyers momentum kho rahe hain, aur sellers control mein aa rahe hain. Ye ek ishara ho sakta hai ke price girne ka aghaz ho sakta hai.

- Market Consolidation: Jab Price Doji Candlestick pattern range-bound market ke doran appear hota hai, to ye darust karta hai ke market consolidate ya haal mein darust kar rahi hai. Ye ek ishara ho sakta hai ke price mazeed waqt tak wahi range ke andar move karti rahegi.

- Market Indecision: Jab Price Doji Candlestick pattern volatile market ke doran appear hota hai, to ye darust karta hai ke market indecision ya equilibrium mein hai. Ye ek ishara ho sakta hai ke price mazeed waqt tak fluctuate karegi jab tak ek clear direction establish nahi hota.

Price Doji Candlestick Pattern ko Interpret Karna

Price Doji Candlestick pattern ko forex trading mein interpret karne ke liye, aapko us context ko consider karna hoga jisme ye appear hota hai, sath hi doosre technical indicators aur fundamental factors ko bhi. Yahan kuch tips hain Price Doji Candlestick pattern ko interpret karne ke liye:

- Confirmation dhundhein: Price Doji Candlestick pattern ko doosre technical indicators jaise moving averages, oscillators, aur support aur resistance levels ke through confirm kiya jana chahiye. Agar ye indicators bhi potential reversal ya continuation ko indicate kar rahe hain, to Price Doji Candlestick pattern ki reliability ko increase kar sakta hai.

- Time frame ka tawazun rakhein: Price Doji Candlestick pattern ka time frame chart par depend karke alag alag matlab hota hai. Maslan, ek daily chart par Price Doji Candlestick pattern ek potential reversal ko indicate kar sakta hai, jabke ek 1-hour chart par Price Doji Candlestick pattern market indecision ko indicate kar sakta hai.

- Market structure ka analysis karein: Price Doji Candlestick pattern ko overall market structure ke context mein analyze karna chahiye, jaise trend, support aur resistance levels, aur previous price action. Ye aapko madad karega ke Price Doji Candlestick pattern potential reversal ya continuation ka sign hai.

- Apna risk manage karein: Price Doji Candlestick pattern par trading karte waqt, apna risk effectively manage karna zaroori hai. Isme stop-loss orders set karna, proper money management techniques ka istemal karna, aur apni positions ko over-leverage karne se bachna shamil hai.

تبصرہ

Расширенный режим Обычный режим