Head and Shoulders Pattern ki Tafseelat.

1. Pehchan.

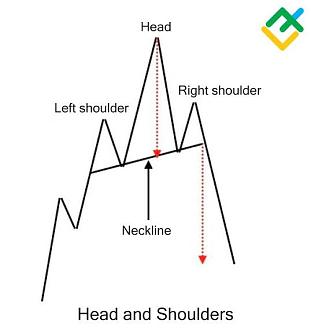

Head and Shoulders pattern ek technical analysis ka concept hai jo market trends ko analyze karne ke liye istemal hota hai. Is pattern ki pehchan chart par specific shapes se hoti hai jo ek particular trend ko darust karne ke liye istemal hoti hai.pattern ek powerful technical analysis tool hai jo market trends ko anticipate karne mein madad karta hai.Is pattern ko sahi taur par samajhna aur uska istemal karna traders ke liye zaroori hai taake wo market movements ko sahi taur par interpret kar sake.

2. Head and Shoulders Pattern.

Head and Shoulders pattern ek reversal pattern hai, jo ke uptrend ke baad market ko downtrend mein change hone ki possibility ko darust karta hai.Is pattern mein typically teen peaks hote hain, jinme se middle peak sab se bara hota hai aur do side peaks uske dono taraf hoti hain, jo ke us se chote hote hain.

3. Parts of Head and Shoulders Pattern.

Yeh peak uptrend ke doran ban jata hai aur do shoulders ke darmiyan hota hai.

Shoulders. In peaks ko head se connect karte hue, yeh market mein temporary reversals ko darust karte hain.

4. Types of Head and Shoulders Pattern Regular.

Is pattern mein head aur dono shoulders almost same height par hote hain, aur neckline ko breach karne ke baad downtrend ka start hota hai.

Inverse Head and Shoulders Pattern. Yeh pattern downtrend ke baad market mein uptrend ki possibility ko darust karta hai. Ismein bhi teen peaks hoti hain, lekin head shoulders se chote hote hain aur shoulders head ke dono taraf hoti hain.

5. Neckline aur Breakout.

Neckline pattern ki ek important component hai, jo ke head aur shoulders ko connect karta hai. Yeh ek horizontal line hoti hai jo head aur shoulders ke bottoms ko join karti hai.

Breakout jab hota hai jab market neckline ko breach karta hai, jise typically increased volume ke sath dekha jata hai.

6. Trading Strategy.

Jab market neckline ko breach karta hai, traders downtrend ki shuruat ka intezar karte hain. Agar volume breakout ke sath aata hai, to yeh signal strong hota hai.

Traders sell positions enter karte hain jab neckline ko breach hota hai aur price downtrend mein jaane ka signal deta hai.

7. Stop Loss aur Target Levels.

Stop loss levels ko define karna important hai, taake in case of false breakout, loss ko minimize kiya ja sake.

Target levels ko set karna bhi zaroori hai, jo ke typically pattern ke height ke hisab se calculate kiya jata hai.

8. Limitations of Head and Shoulders Pattern.

Kabhi kabhi false breakouts ho sakte hain, jismein market neckline ko breach karta hai lekin actual reversal nahi hota.

Is pattern ko confirm karne ke liye, traders ko dusre indicators aur price action ko bhi consider karna chahiye.

1. Pehchan.

Head and Shoulders pattern ek technical analysis ka concept hai jo market trends ko analyze karne ke liye istemal hota hai. Is pattern ki pehchan chart par specific shapes se hoti hai jo ek particular trend ko darust karne ke liye istemal hoti hai.pattern ek powerful technical analysis tool hai jo market trends ko anticipate karne mein madad karta hai.Is pattern ko sahi taur par samajhna aur uska istemal karna traders ke liye zaroori hai taake wo market movements ko sahi taur par interpret kar sake.

2. Head and Shoulders Pattern.

Head and Shoulders pattern ek reversal pattern hai, jo ke uptrend ke baad market ko downtrend mein change hone ki possibility ko darust karta hai.Is pattern mein typically teen peaks hote hain, jinme se middle peak sab se bara hota hai aur do side peaks uske dono taraf hoti hain, jo ke us se chote hote hain.

3. Parts of Head and Shoulders Pattern.

Yeh peak uptrend ke doran ban jata hai aur do shoulders ke darmiyan hota hai.

Shoulders. In peaks ko head se connect karte hue, yeh market mein temporary reversals ko darust karte hain.

4. Types of Head and Shoulders Pattern Regular.

Is pattern mein head aur dono shoulders almost same height par hote hain, aur neckline ko breach karne ke baad downtrend ka start hota hai.

Inverse Head and Shoulders Pattern. Yeh pattern downtrend ke baad market mein uptrend ki possibility ko darust karta hai. Ismein bhi teen peaks hoti hain, lekin head shoulders se chote hote hain aur shoulders head ke dono taraf hoti hain.

5. Neckline aur Breakout.

Neckline pattern ki ek important component hai, jo ke head aur shoulders ko connect karta hai. Yeh ek horizontal line hoti hai jo head aur shoulders ke bottoms ko join karti hai.

Breakout jab hota hai jab market neckline ko breach karta hai, jise typically increased volume ke sath dekha jata hai.

6. Trading Strategy.

Jab market neckline ko breach karta hai, traders downtrend ki shuruat ka intezar karte hain. Agar volume breakout ke sath aata hai, to yeh signal strong hota hai.

Traders sell positions enter karte hain jab neckline ko breach hota hai aur price downtrend mein jaane ka signal deta hai.

7. Stop Loss aur Target Levels.

Stop loss levels ko define karna important hai, taake in case of false breakout, loss ko minimize kiya ja sake.

Target levels ko set karna bhi zaroori hai, jo ke typically pattern ke height ke hisab se calculate kiya jata hai.

8. Limitations of Head and Shoulders Pattern.

Kabhi kabhi false breakouts ho sakte hain, jismein market neckline ko breach karta hai lekin actual reversal nahi hota.

Is pattern ko confirm karne ke liye, traders ko dusre indicators aur price action ko bhi consider karna chahiye.

تبصرہ

Расширенный режим Обычный режим