Long Butterfly Spread Introduction,

Long Butterfly Spread ek trading strateegi hai jo investors ke liye aham hai jise market mein mukhtalif istehkamatiyon aur tanazzulat ka muqablah karna hota hai. Yeh strateegi options market mein istemal hoti hai aur teesre darjah ki complexity aur nuqsanat ke sath sath, munafa bhi ziada karti hai.Long Butterfly Spread ek advanced trading strateegi hai jo market ke tajaweezat aur istehkamatiyon ka muqablah karne mein madad karta hai. Is strateegi ke istemal se investor ko market ke mukhtalif scenarios mein faida uthane ka mauka milta hai. Lekin, iske istemal mein khatraat bhi hote hain jin par amal kiya jana zaroori hai. Har investor ko apni maaliyat, maqasid aur risk tolerance ke mutabiq is strateegi ka istemal karna chahiye.

Purpose of Long Butterfly Spread,

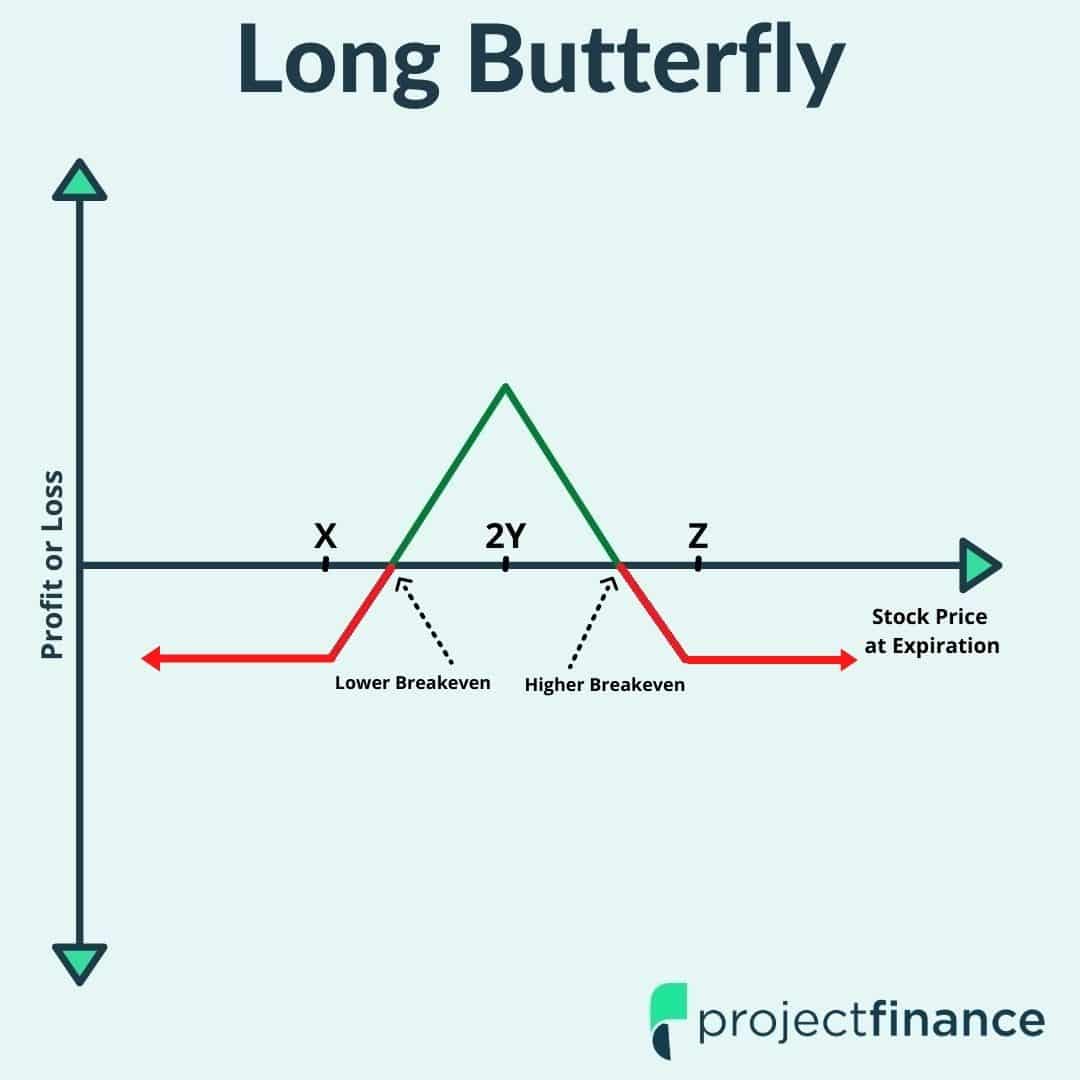

Long Butterfly Spread ka maqsad ek makhsoos price range mein asset ki movement se faida uthana hai. Is strateegi mein teen options istemal hoti hain jin mein long call ya put option, aur do short calls ya puts shamil hote hain.

Mechanics of Long Butterfly Spread,

Long Butterfly Spread mein, investor pehle toh ek long call ya put option buy karta hai. Phir, do short calls ya puts sell karta hai jin ke strike prices alag hote hain, lekin ek dusre ke qareeb hoti hain. Akhir mein, ek aur long call ya put option buy karta hai jiska strike price doosre short option ke beech hota hai. Yeh tarteeb ek butterfly jaisi hoti hai.

Benefits of Long Butterfly Spread,

Long Butterfly Spread ka sab se bara faida yeh hai ke isse investor ko market ki tezi ya dheemi gati se faida uthane ka mauka milta hai. Agar asset ki keemat makhsoos range mein rehti hai toh investor ko ziada munafa hota hai. Iske ilawa, risk mehdood hota hai kyunki teen options ki madad se position kiya jata hai.

Is strateegi ke istemal mein kuch khatraat bhi hain. Agar market bahut zyada tezi ya girawat mein hoti hai toh investor ko nuksan ho sakta hai. Iske ilawa, commission aur fees bhi zyada ho sakti hain jisse overall profit kam ho.

Cases of Long Butterfly Spread,

Long Butterfly Spread ka istemal tab kiya jata hai jab investor ko lagta hai ke market mein thori tezi ya girawat hogi, lekin wo makhsoos range mein reh kar stabil rahegi. Yeh strateegi neutral market conditions mein ziada faida pohanchati hai.

Long Butterfly Spread ek trading strateegi hai jo investors ke liye aham hai jise market mein mukhtalif istehkamatiyon aur tanazzulat ka muqablah karna hota hai. Yeh strateegi options market mein istemal hoti hai aur teesre darjah ki complexity aur nuqsanat ke sath sath, munafa bhi ziada karti hai.Long Butterfly Spread ek advanced trading strateegi hai jo market ke tajaweezat aur istehkamatiyon ka muqablah karne mein madad karta hai. Is strateegi ke istemal se investor ko market ke mukhtalif scenarios mein faida uthane ka mauka milta hai. Lekin, iske istemal mein khatraat bhi hote hain jin par amal kiya jana zaroori hai. Har investor ko apni maaliyat, maqasid aur risk tolerance ke mutabiq is strateegi ka istemal karna chahiye.

Purpose of Long Butterfly Spread,

Long Butterfly Spread ka maqsad ek makhsoos price range mein asset ki movement se faida uthana hai. Is strateegi mein teen options istemal hoti hain jin mein long call ya put option, aur do short calls ya puts shamil hote hain.

Mechanics of Long Butterfly Spread,

Long Butterfly Spread mein, investor pehle toh ek long call ya put option buy karta hai. Phir, do short calls ya puts sell karta hai jin ke strike prices alag hote hain, lekin ek dusre ke qareeb hoti hain. Akhir mein, ek aur long call ya put option buy karta hai jiska strike price doosre short option ke beech hota hai. Yeh tarteeb ek butterfly jaisi hoti hai.

Benefits of Long Butterfly Spread,

Long Butterfly Spread ka sab se bara faida yeh hai ke isse investor ko market ki tezi ya dheemi gati se faida uthane ka mauka milta hai. Agar asset ki keemat makhsoos range mein rehti hai toh investor ko ziada munafa hota hai. Iske ilawa, risk mehdood hota hai kyunki teen options ki madad se position kiya jata hai.

Is strateegi ke istemal mein kuch khatraat bhi hain. Agar market bahut zyada tezi ya girawat mein hoti hai toh investor ko nuksan ho sakta hai. Iske ilawa, commission aur fees bhi zyada ho sakti hain jisse overall profit kam ho.

Cases of Long Butterfly Spread,

Long Butterfly Spread ka istemal tab kiya jata hai jab investor ko lagta hai ke market mein thori tezi ya girawat hogi, lekin wo makhsoos range mein reh kar stabil rahegi. Yeh strateegi neutral market conditions mein ziada faida pohanchati hai.

تبصرہ

Расширенный режим Обычный режим