Inside Bar Candlestick Pattern ko kasy use kiya jata hay

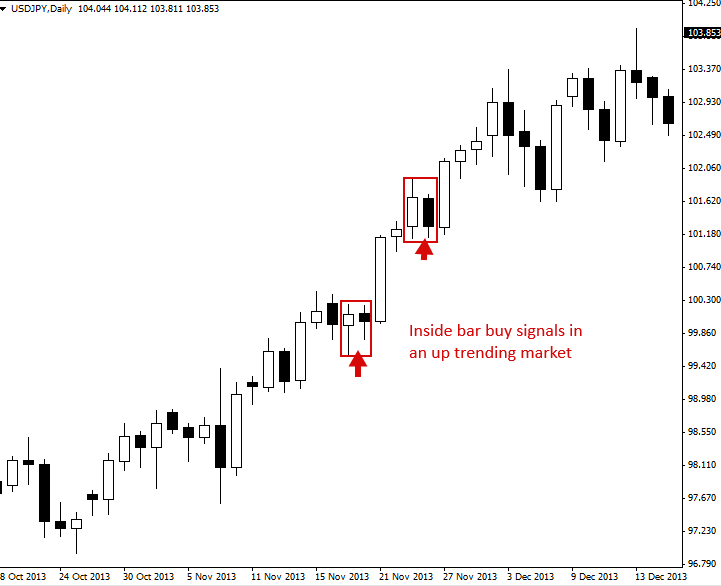

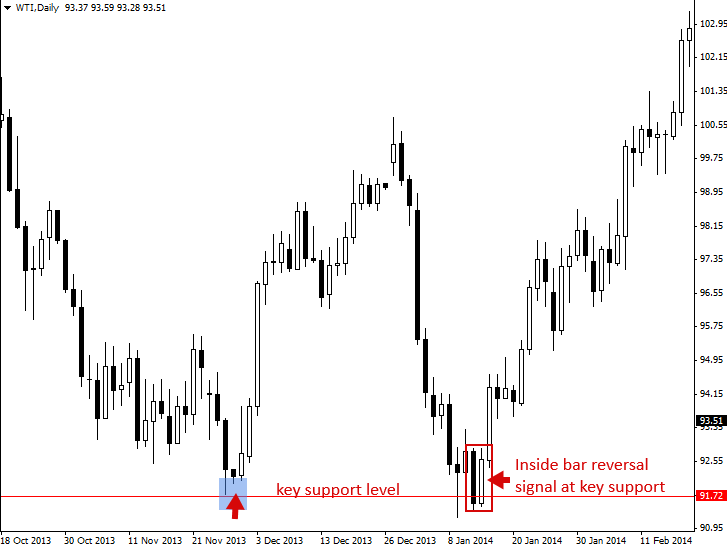

Man lijiye ki aap ek uptrend mein exchange kar rahe hain. Achanak, ek internal bar ban jata hai. Yah is baat ka signal ho sakta hai ki trend khatam hone wala hai. Aap dusri candle ke high aur low ke bahar breakout hone ka intezar karte hain. Agar price excessive ke bahar breakout hota hai, to Jis Din Soch samajhkar buying and selling Karenge To Hamen bahut Achcha fayda Hoga Kyunki marketplace Ek Aisa trend hai jo bahut se Logon Ko Lash bhi hota hai income bhi hota hai karne ke liye ismein Hamen mehnat aur Apna information aur revel in ko use karke hi trading Karni chahie Kyunki training Aise Nahin Hoti ismein Hamen access hone ke liye market take a look at karni padati hai aap ya down hone se bhi Hamen Khatra ho sakta hai isliye Hamen ismein bahut hi Soch samajhkar kam karna chahie aur acche mind ke sath kam karna chahie Agar Hamara mind open hoga to Ham ismein ummid Achcha kam kar Sakenge or hamko isme ditails ka sath put up karni chaiye isme marketplace ki candle or treading ki bat cheat ka hawaly say paintings karna hota hay quick exchange mein access kar sakte hain. Agar charge low ke bahar breakout hota hai, to aap long exchange mein entry kar sakte hain.

Inside Bar Ki malomat

Inside Bar ki pehchan karne ke liye, pehli candle ki high aur low ko dekhein. Doosri candle ki variety pehli candle ke andar honi chahiye, yaani doosri candle pehli candle ki range ke darmiyan honi chahiye. Hamen Kamyab hone ke liye is form in step with acchi mehnat Karni Hogi aur Achcha kam karna hoga Kyunki acchi mehnat karne se hi Insan Ko kamyabi milati Hai Ham ismein jo bhi baat karte hain form flex aur buying and selling ke naked mein baat karte hain Aaj Ham bahut se subject matter in step with baat karte rahte hain Kyunki bahut se Logon Ko is topic ka pata nahin Hota Jo Ham baat karte hain log dusre put up ko study karte hain aur uska fayda uthate Hain Jiska jawab Hamen Dete Hain aur jawab Ke Badle Mein Hamen Ek Achcha bonus Diya Jata Hai Kyunki yah Ghar baithkar Ham chatting karte hain aur yah shape aur platform bahut hi Achcha hai jo log berojgar hai unke bhi bahut Achcha fayda man Hai yah trading karne ka maksad yah hota hai ki Ham ismein acchi mehnat aur kamyabi aur ek expertise Hasil kar sake Agar hamare skip know-how hai agar hamare skip ismein kam karne ke liye enjoy Hai To Ham ismein Achcha kam kar sakte hain Kyunki ismein acchi mehnat karna

Man lijiye ki aap ek uptrend mein exchange kar rahe hain. Achanak, ek internal bar ban jata hai. Yah is baat ka signal ho sakta hai ki trend khatam hone wala hai. Aap dusri candle ke high aur low ke bahar breakout hone ka intezar karte hain. Agar price excessive ke bahar breakout hota hai, to Jis Din Soch samajhkar buying and selling Karenge To Hamen bahut Achcha fayda Hoga Kyunki marketplace Ek Aisa trend hai jo bahut se Logon Ko Lash bhi hota hai income bhi hota hai karne ke liye ismein Hamen mehnat aur Apna information aur revel in ko use karke hi trading Karni chahie Kyunki training Aise Nahin Hoti ismein Hamen access hone ke liye market take a look at karni padati hai aap ya down hone se bhi Hamen Khatra ho sakta hai isliye Hamen ismein bahut hi Soch samajhkar kam karna chahie aur acche mind ke sath kam karna chahie Agar Hamara mind open hoga to Ham ismein ummid Achcha kam kar Sakenge or hamko isme ditails ka sath put up karni chaiye isme marketplace ki candle or treading ki bat cheat ka hawaly say paintings karna hota hay quick exchange mein access kar sakte hain. Agar charge low ke bahar breakout hota hai, to aap long exchange mein entry kar sakte hain.

Inside Bar Ki malomat

Inside Bar ki pehchan karne ke liye, pehli candle ki high aur low ko dekhein. Doosri candle ki variety pehli candle ke andar honi chahiye, yaani doosri candle pehli candle ki range ke darmiyan honi chahiye. Hamen Kamyab hone ke liye is form in step with acchi mehnat Karni Hogi aur Achcha kam karna hoga Kyunki acchi mehnat karne se hi Insan Ko kamyabi milati Hai Ham ismein jo bhi baat karte hain form flex aur buying and selling ke naked mein baat karte hain Aaj Ham bahut se subject matter in step with baat karte rahte hain Kyunki bahut se Logon Ko is topic ka pata nahin Hota Jo Ham baat karte hain log dusre put up ko study karte hain aur uska fayda uthate Hain Jiska jawab Hamen Dete Hain aur jawab Ke Badle Mein Hamen Ek Achcha bonus Diya Jata Hai Kyunki yah Ghar baithkar Ham chatting karte hain aur yah shape aur platform bahut hi Achcha hai jo log berojgar hai unke bhi bahut Achcha fayda man Hai yah trading karne ka maksad yah hota hai ki Ham ismein acchi mehnat aur kamyabi aur ek expertise Hasil kar sake Agar hamare skip know-how hai agar hamare skip ismein kam karne ke liye enjoy Hai To Ham ismein Achcha kam kar sakte hain Kyunki ismein acchi mehnat karna

تبصرہ

Расширенный режим Обычный режим