Evening Star Candlestick Pattern in Forex Trading -

1. Pehchan (Identification): Evening Star candlestick pattern, market charts par paye jane wale bearish reversal patterns mein se ek hai. Ye pattern ek trend ke end ko indicate karta hai.

2. Structure:

3. Tajaweez (Implication): Evening Star pattern ka zahir hone par, ye suggest karta hai ke bullish trend weaken ho sakta hai aur bearish reversal hone ke chances hain.

4. Trading Strategies:

Jaise ke kisi bhi technical analysis tool ya pattern ki tarah, Evening Star pattern bhi kabhi-kabhi false signals de sakta hai. Confirmatory indicators ka istemal karna zaroori hai aur market conditions ka khayal rakhna important hai.

1. Pehchan (Identification): Evening Star candlestick pattern, market charts par paye jane wale bearish reversal patterns mein se ek hai. Ye pattern ek trend ke end ko indicate karta hai.

2. Structure:

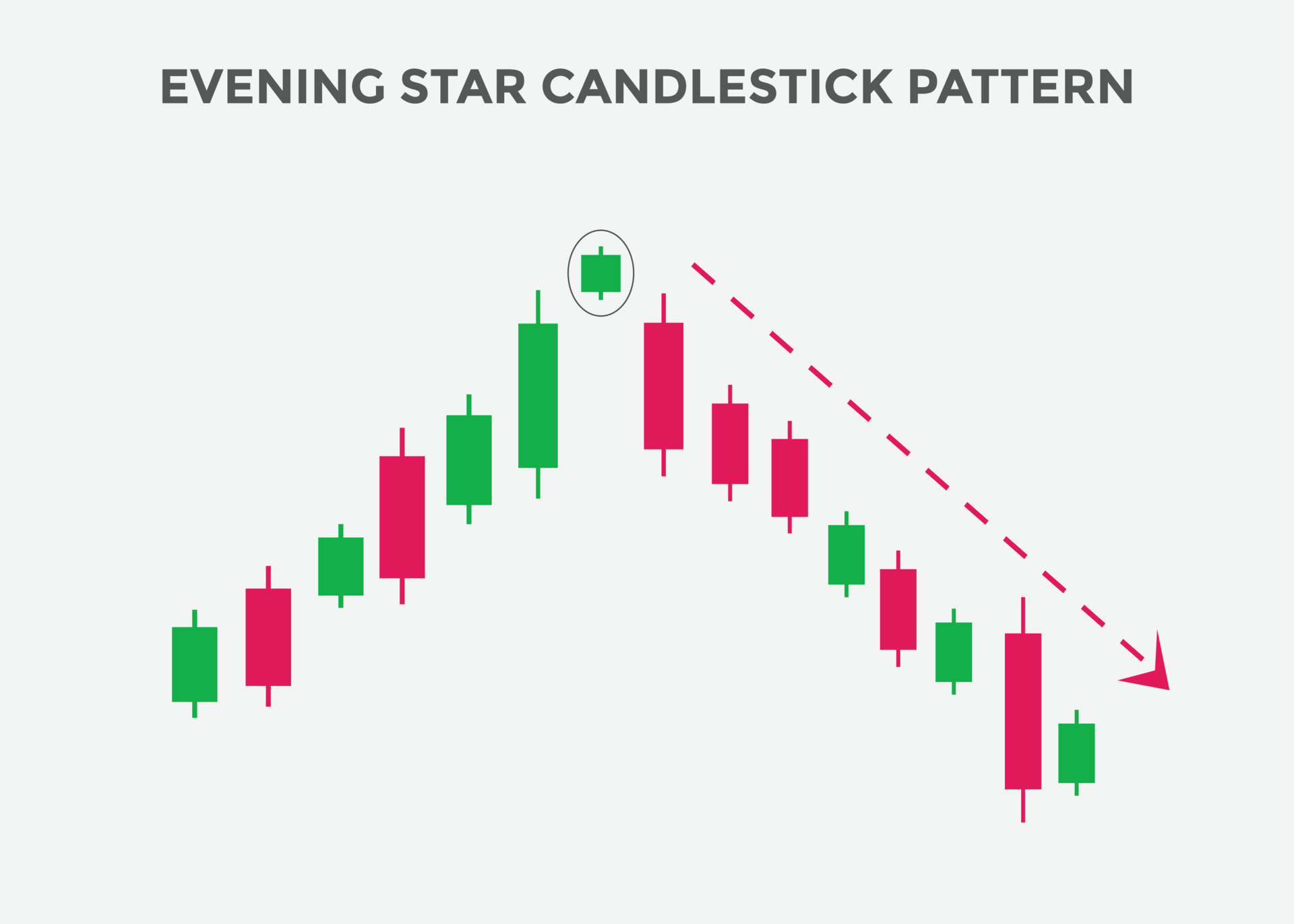

- Pehli Candle (Bullish): Evening Star pattern ki shuruaat ek strong bullish candle ke saath hoti hai, jo uptrend ko represent karta hai.

- Dusri Candle (Doji or Small Body): Dusri candle choti body ya doji hoti hai. Ye show karta hai ke market indecision mein hai aur bulls aur bears ke darmiyan struggle ho raha hai.

- Teesi Candle (Bearish): Teesi candle ek strong bearish candle hoti hai, jo indicate karta hai ke sellers ne control ko haasil kiya hai aur bearish trend shuru ho sakta hai.

3. Tajaweez (Implication): Evening Star pattern ka zahir hone par, ye suggest karta hai ke bullish trend weaken ho sakta hai aur bearish reversal hone ke chances hain.

4. Trading Strategies:

- Evening Star pattern ke appearance par, traders ko market mein hone wale bearish reversal ko tajwez karta hai.

- Is pattern ko confirm karne ke liye, traders ko doosre technical indicators aur confirmatory signals ka bhi istemal karna chahiye.

Jaise ke kisi bhi technical analysis tool ya pattern ki tarah, Evening Star pattern bhi kabhi-kabhi false signals de sakta hai. Confirmatory indicators ka istemal karna zaroori hai aur market conditions ka khayal rakhna important hai.

تبصرہ

Расширенный режим Обычный режим