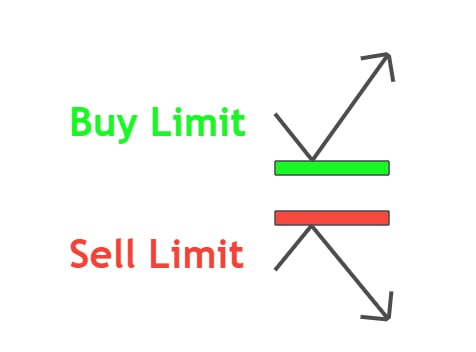

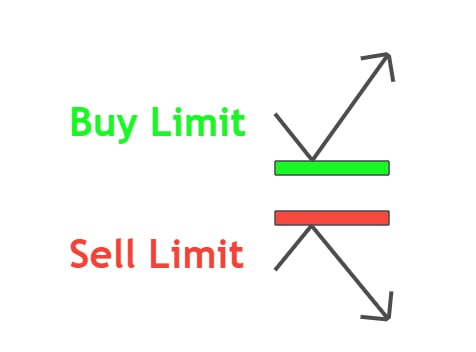

Forex main do mashhoor order types hain buy limit aur sell limit orders. Ye orders ye specify karte hain ke trader currency pair ko kis price pe buy ya sell karna chahta hai.

Buy Limit Order

Buy limit order ek aisa order hai jisme trader currency pair ko ek specify ki gayi price ya usse kam price pe kharidna chahta hai. Ye traders istemal karte hain jo maante hain ke currency pair ki price ek certain level tak giray gi, phir se badhne lagegi. Buy limit order lagakar, trader current market price se kam price pe market mein dakhil ho sakta hai, jo ke price badhne par potential profits ka bahaana ban sakta hai.

Jab buy limit order lagaya jata hai, ye sirf tab execute hoga jab currency pair ka market price specify ki gayi price ya usse kam ho jaye. Agar price specify kiye gaye level tak nahi pahunchti, to order pending rahega jab tak ya to expire ho jaye ya trader ise cancel na kare. Buy limit orders generally traders istemal karte hain jo market mein current price se behtar price pe dakhil hona chahte hain.

Buy Limit Orders ke Faide

Buy limit orders istemal karne ka ek faida ye hai ke traders currency pair ko current market price se kam price pe khareed sakte hain. Ye traders ko trade mein potential profits ko maximize karne mein madad kar sakta hai kyunki wo ek behtar price level pe dakhil ho rahe hain. Buy limit orders traders ko pehle se specific entry points set karne ki anumati dete hain, jo unhe apni trades ko zyada effectively plan karne mein madad karte hain.

Buy limit orders ka ek aur faida ye hai ke ye traders ko emotional decision-making se bacha sakte hain. Ek specific price level pe buy limit order set karke, traders apne trading plan ko follow kar sakte hain aur market ke fluctuations par adharit impulsive decisions se bach sakte hain. Ye traders ko apne trading objectives par focused aur disciplined rehne mein madad karta hai.

Buy Limit Orders ke Nuksan

Inke faiday ke bawajood, buy limit orders ke kuch nuksan bhi hote hain jo traders ko maloom hone chahiye. Ek potential downside ye hai ke market price kabhi-kabhi specify ki gayi price level tak nahi pahunchti. Is case mein, order pending rahega jab tak expire na ho jaye ya trader ise cancel na kare, jisse capital bandhak ho sakta hai aur trading opportunities par rok lagegi.

Ek aur nuksan ye hai ke agar market price jaldi badh jati hai aur specify ki gayi price level ko cross kar deti hai, to buy limit orders desired price pe fill nahi ho sakte, jisse trading opportunities miss ho sakti hain. Traders ko buy limit orders istemal karte waqt in nuksano ko madhya mein rakhte hue apni trading strategies ko adjust karna chahiye.

Kab Buy Limit Orders Istemal Karein

Buy limit orders typically uss situation mein istemal hote hain jab traders maante hain ke currency pair ki price ek certain level tak girne ke baad phir se badhne lagegi. Traders buy limit orders ka istemal karke market mein ek behtar price level pe dakhil ho sakte hain aur apni trades mein potential profits ko maximize kar sakte hain. Buy limit orders ka istemal karne mein madadgar hota hai traders ke liye jo pehle se specific entry points set karna chahte hain aur emotional decision-making se bachna chahte hain.

Sell Limit Order

Sell limit order ek aisa order hai jisme trader currency pair ko ek specify ki gayi price ya usse zyada price pe bechne ka iraada rakhta hai. Ye traders istemal karte hain jo maante hain ke currency pair ki price ek certain level tak badhegi, phir se girne lagegi. Sell limit order lagakar, trader current market price se zyada price pe market mein dakhil ho sakta hai, jo ke price girne par potential profits ka bahaana ban sakta hai.

Jab sell limit order lagaya jata hai, ye sirf tab execute hoga jab currency pair ka market price specify ki gayi price ya usse zyada ho jaye. Agar price specify ki gaye level tak nahi pahunchti, to order pending rahega jab tak ya to expire ho jaye ya trader ise cancel na kare. Sell limit orders generally traders istemal karte hain jo market mein current price se behtar price pe currency pair bechna chahte hain.

Sell Limit Orders ke Faide

Sell limit orders istemal karne ka ek faida ye hai ke traders currency pair ko current market price se zyada price pe bech sakte hain. Ye traders ko trade mein potential profits ko maximize karne mein madad kar sakta hai kyunki wo ek behtar price level pe dakhil ho rahe hain. Sell limit orders traders ko pehle se specific entry points set karne ki anumati dete hain, jo unhe apni trades ko zyada effectively plan karne mein madad karte hain.

Sell limit orders ka ek aur faida ye hai ke ye traders ko emotional decision-making se bacha sakte hain. Ek specific price level pe sell limit order set karke, traders apne trading plan ko follow kar sakte hain aur market ke fluctuations par adharit impulsive decisions se bach sakte hain. Ye traders ko apne trading objectives par focused aur disciplined rehne mein madad karta hai.

Sell Limit Orders ke Nuksan

Inke faiday ke bawajood, sell limit orders ke kuch nuksan bhi hote hain jo traders ko maloom hone chahiye. Ek potential downside ye hai ke market price kabhi-kabhi specify ki gayi price level tak nahi pahunchti. Is case mein, order pending rahega jab tak expire na ho jaye ya trader ise cancel na kare, jisse capital bandhak ho sakta hai aur trading opportunities par rok lagegi.

Ek aur nuksan ye hai ke agar market price jaldi gir jati hai aur specify ki gayi price level ko cross kar deti hai, to sell limit orders desired price pe fill nahi ho sakte, jisse trading opportunities miss ho sakti hain. Traders ko sell limit orders istemal karte waqt in nuksano ko madhya mein rakhte hue apni trading strategies ko adjust karna chahiye.

Kab Sell Limit Orders Istemal Karein

Sell limit orders typically uss situation mein istemal hote hain jab traders maante hain ke currency pair ki price ek certain level tak badhegi, phir se girne ke baad. Traders sell limit orders ka istemal karke market mein ek behtar price level pe currency pair bech sakte hain aur apni trades mein potential profits ko maximize kar sakte hain. Sell limit orders ka istemal karne mein madadgar hota hai traders ke liye jo pehle se specific entry points set karna chahte hain aur emotional decision-making se bachna chahte hain.

Buy limit aur sell limit orders forex market mein trades mein dakhil hone aur nikalne ke liye ahem tools hain. Buy limit orders ka istemal ek specify ki gayi price ya usse kam price pe currency pair khareedne ke liye hota hai, jabke sell limit orders ka istemal ek specify ki gayi price ya usse zyada price pe currency pair bechne ke liye hota hai. Dono types ke orders apne apne faiday aur nuksan rakhte hain, aur traders ko in factors ko dhyan mein rakh kar inka istemal apni trading strategies mein karna chahiye.

Buy limit orders traders ko market mein current price se behtar price pe dakhil hone mein madad kar sakte hain aur emotional decision-making se bacha sakte hain. Sell limit orders, doosri taraf, traders ko currency pair ko zyada price pe bechne aur trade mein potential profits ko maximize karne mein madad kar sakte hain. Buy limit aur sell limit orders ka sahi se istemal karke, traders apni trading strategies ko behtar bana sakte hain aur forex market mein behter faislay kar sakte hain

Buy Limit Order

Buy limit order ek aisa order hai jisme trader currency pair ko ek specify ki gayi price ya usse kam price pe kharidna chahta hai. Ye traders istemal karte hain jo maante hain ke currency pair ki price ek certain level tak giray gi, phir se badhne lagegi. Buy limit order lagakar, trader current market price se kam price pe market mein dakhil ho sakta hai, jo ke price badhne par potential profits ka bahaana ban sakta hai.

Jab buy limit order lagaya jata hai, ye sirf tab execute hoga jab currency pair ka market price specify ki gayi price ya usse kam ho jaye. Agar price specify kiye gaye level tak nahi pahunchti, to order pending rahega jab tak ya to expire ho jaye ya trader ise cancel na kare. Buy limit orders generally traders istemal karte hain jo market mein current price se behtar price pe dakhil hona chahte hain.

Buy Limit Orders ke Faide

Buy limit orders istemal karne ka ek faida ye hai ke traders currency pair ko current market price se kam price pe khareed sakte hain. Ye traders ko trade mein potential profits ko maximize karne mein madad kar sakta hai kyunki wo ek behtar price level pe dakhil ho rahe hain. Buy limit orders traders ko pehle se specific entry points set karne ki anumati dete hain, jo unhe apni trades ko zyada effectively plan karne mein madad karte hain.

Buy limit orders ka ek aur faida ye hai ke ye traders ko emotional decision-making se bacha sakte hain. Ek specific price level pe buy limit order set karke, traders apne trading plan ko follow kar sakte hain aur market ke fluctuations par adharit impulsive decisions se bach sakte hain. Ye traders ko apne trading objectives par focused aur disciplined rehne mein madad karta hai.

Buy Limit Orders ke Nuksan

Inke faiday ke bawajood, buy limit orders ke kuch nuksan bhi hote hain jo traders ko maloom hone chahiye. Ek potential downside ye hai ke market price kabhi-kabhi specify ki gayi price level tak nahi pahunchti. Is case mein, order pending rahega jab tak expire na ho jaye ya trader ise cancel na kare, jisse capital bandhak ho sakta hai aur trading opportunities par rok lagegi.

Ek aur nuksan ye hai ke agar market price jaldi badh jati hai aur specify ki gayi price level ko cross kar deti hai, to buy limit orders desired price pe fill nahi ho sakte, jisse trading opportunities miss ho sakti hain. Traders ko buy limit orders istemal karte waqt in nuksano ko madhya mein rakhte hue apni trading strategies ko adjust karna chahiye.

Kab Buy Limit Orders Istemal Karein

Buy limit orders typically uss situation mein istemal hote hain jab traders maante hain ke currency pair ki price ek certain level tak girne ke baad phir se badhne lagegi. Traders buy limit orders ka istemal karke market mein ek behtar price level pe dakhil ho sakte hain aur apni trades mein potential profits ko maximize kar sakte hain. Buy limit orders ka istemal karne mein madadgar hota hai traders ke liye jo pehle se specific entry points set karna chahte hain aur emotional decision-making se bachna chahte hain.

Sell Limit Order

Sell limit order ek aisa order hai jisme trader currency pair ko ek specify ki gayi price ya usse zyada price pe bechne ka iraada rakhta hai. Ye traders istemal karte hain jo maante hain ke currency pair ki price ek certain level tak badhegi, phir se girne lagegi. Sell limit order lagakar, trader current market price se zyada price pe market mein dakhil ho sakta hai, jo ke price girne par potential profits ka bahaana ban sakta hai.

Jab sell limit order lagaya jata hai, ye sirf tab execute hoga jab currency pair ka market price specify ki gayi price ya usse zyada ho jaye. Agar price specify ki gaye level tak nahi pahunchti, to order pending rahega jab tak ya to expire ho jaye ya trader ise cancel na kare. Sell limit orders generally traders istemal karte hain jo market mein current price se behtar price pe currency pair bechna chahte hain.

Sell Limit Orders ke Faide

Sell limit orders istemal karne ka ek faida ye hai ke traders currency pair ko current market price se zyada price pe bech sakte hain. Ye traders ko trade mein potential profits ko maximize karne mein madad kar sakta hai kyunki wo ek behtar price level pe dakhil ho rahe hain. Sell limit orders traders ko pehle se specific entry points set karne ki anumati dete hain, jo unhe apni trades ko zyada effectively plan karne mein madad karte hain.

Sell limit orders ka ek aur faida ye hai ke ye traders ko emotional decision-making se bacha sakte hain. Ek specific price level pe sell limit order set karke, traders apne trading plan ko follow kar sakte hain aur market ke fluctuations par adharit impulsive decisions se bach sakte hain. Ye traders ko apne trading objectives par focused aur disciplined rehne mein madad karta hai.

Sell Limit Orders ke Nuksan

Inke faiday ke bawajood, sell limit orders ke kuch nuksan bhi hote hain jo traders ko maloom hone chahiye. Ek potential downside ye hai ke market price kabhi-kabhi specify ki gayi price level tak nahi pahunchti. Is case mein, order pending rahega jab tak expire na ho jaye ya trader ise cancel na kare, jisse capital bandhak ho sakta hai aur trading opportunities par rok lagegi.

Ek aur nuksan ye hai ke agar market price jaldi gir jati hai aur specify ki gayi price level ko cross kar deti hai, to sell limit orders desired price pe fill nahi ho sakte, jisse trading opportunities miss ho sakti hain. Traders ko sell limit orders istemal karte waqt in nuksano ko madhya mein rakhte hue apni trading strategies ko adjust karna chahiye.

Kab Sell Limit Orders Istemal Karein

Sell limit orders typically uss situation mein istemal hote hain jab traders maante hain ke currency pair ki price ek certain level tak badhegi, phir se girne ke baad. Traders sell limit orders ka istemal karke market mein ek behtar price level pe currency pair bech sakte hain aur apni trades mein potential profits ko maximize kar sakte hain. Sell limit orders ka istemal karne mein madadgar hota hai traders ke liye jo pehle se specific entry points set karna chahte hain aur emotional decision-making se bachna chahte hain.

Buy limit aur sell limit orders forex market mein trades mein dakhil hone aur nikalne ke liye ahem tools hain. Buy limit orders ka istemal ek specify ki gayi price ya usse kam price pe currency pair khareedne ke liye hota hai, jabke sell limit orders ka istemal ek specify ki gayi price ya usse zyada price pe currency pair bechne ke liye hota hai. Dono types ke orders apne apne faiday aur nuksan rakhte hain, aur traders ko in factors ko dhyan mein rakh kar inka istemal apni trading strategies mein karna chahiye.

Buy limit orders traders ko market mein current price se behtar price pe dakhil hone mein madad kar sakte hain aur emotional decision-making se bacha sakte hain. Sell limit orders, doosri taraf, traders ko currency pair ko zyada price pe bechne aur trade mein potential profits ko maximize karne mein madad kar sakte hain. Buy limit aur sell limit orders ka sahi se istemal karke, traders apni trading strategies ko behtar bana sakte hain aur forex market mein behter faislay kar sakte hain

تبصرہ

Расширенный режим Обычный режим